This version of the form is not currently in use and is provided for reference only. Download this version of

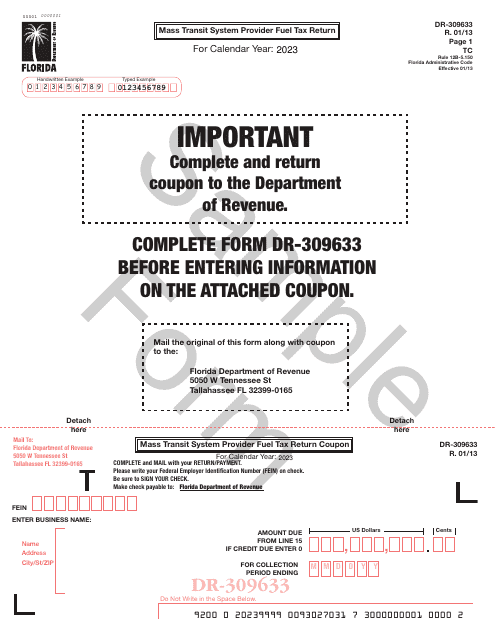

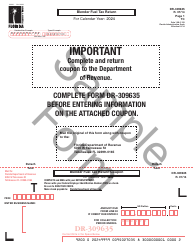

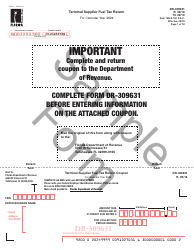

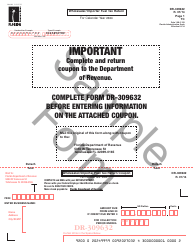

Form DR-309633

for the current year.

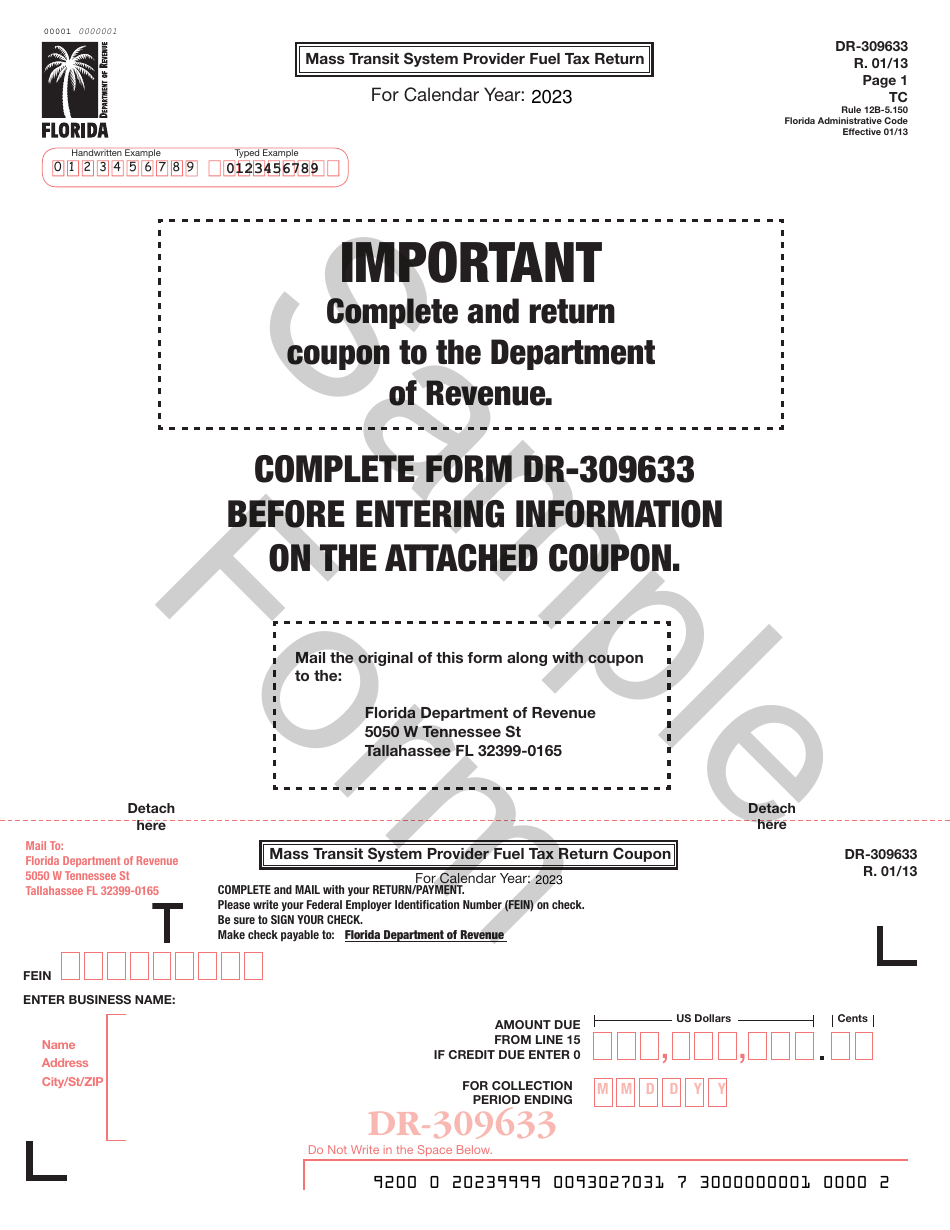

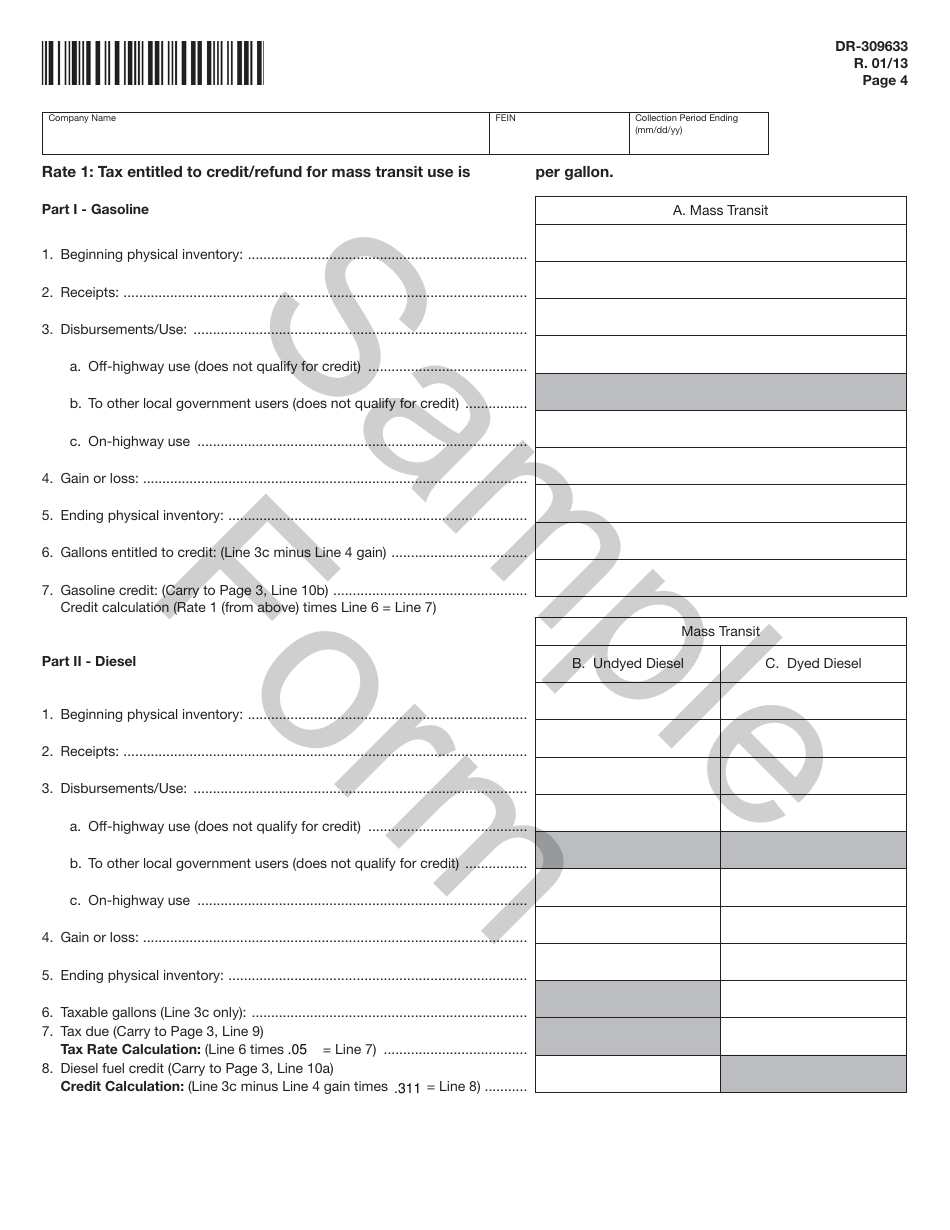

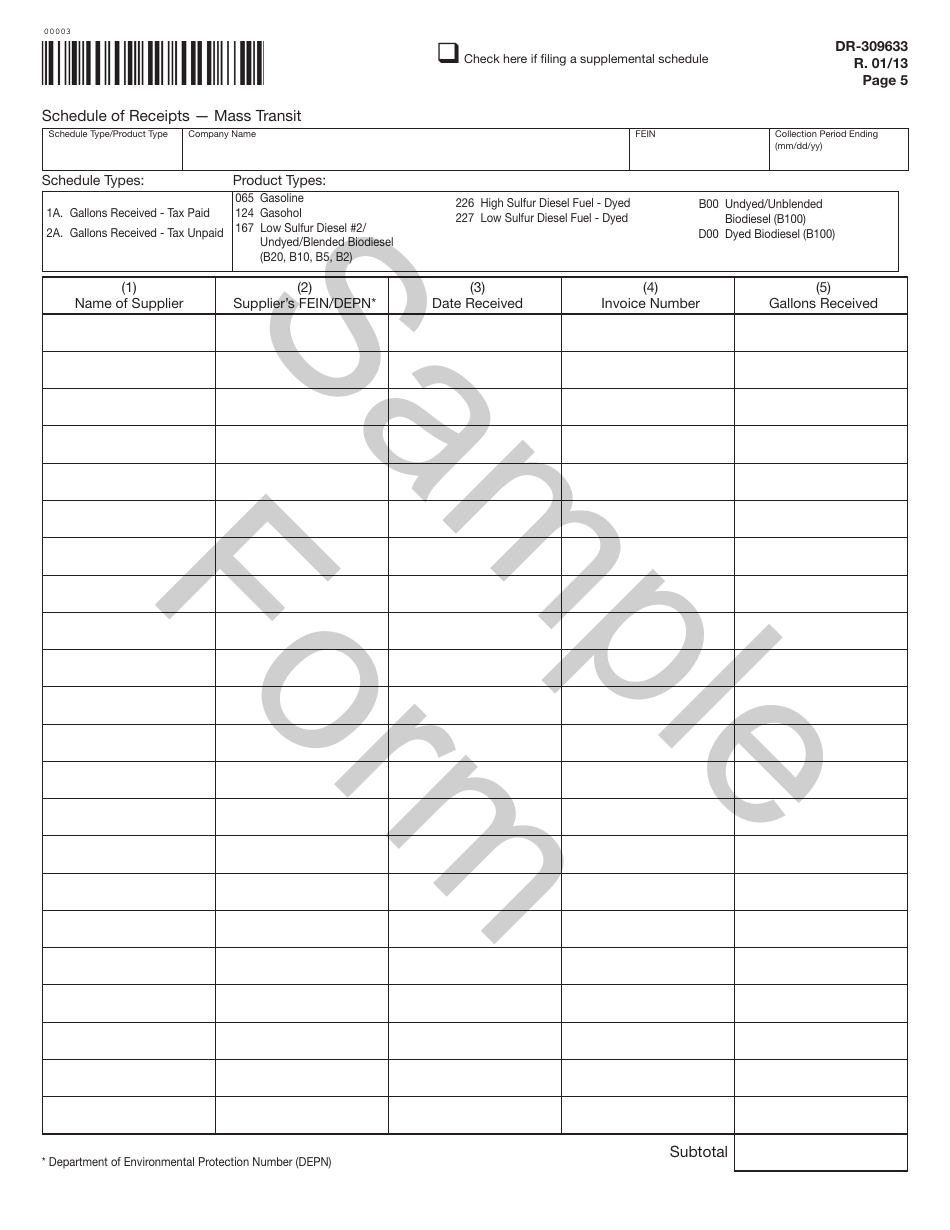

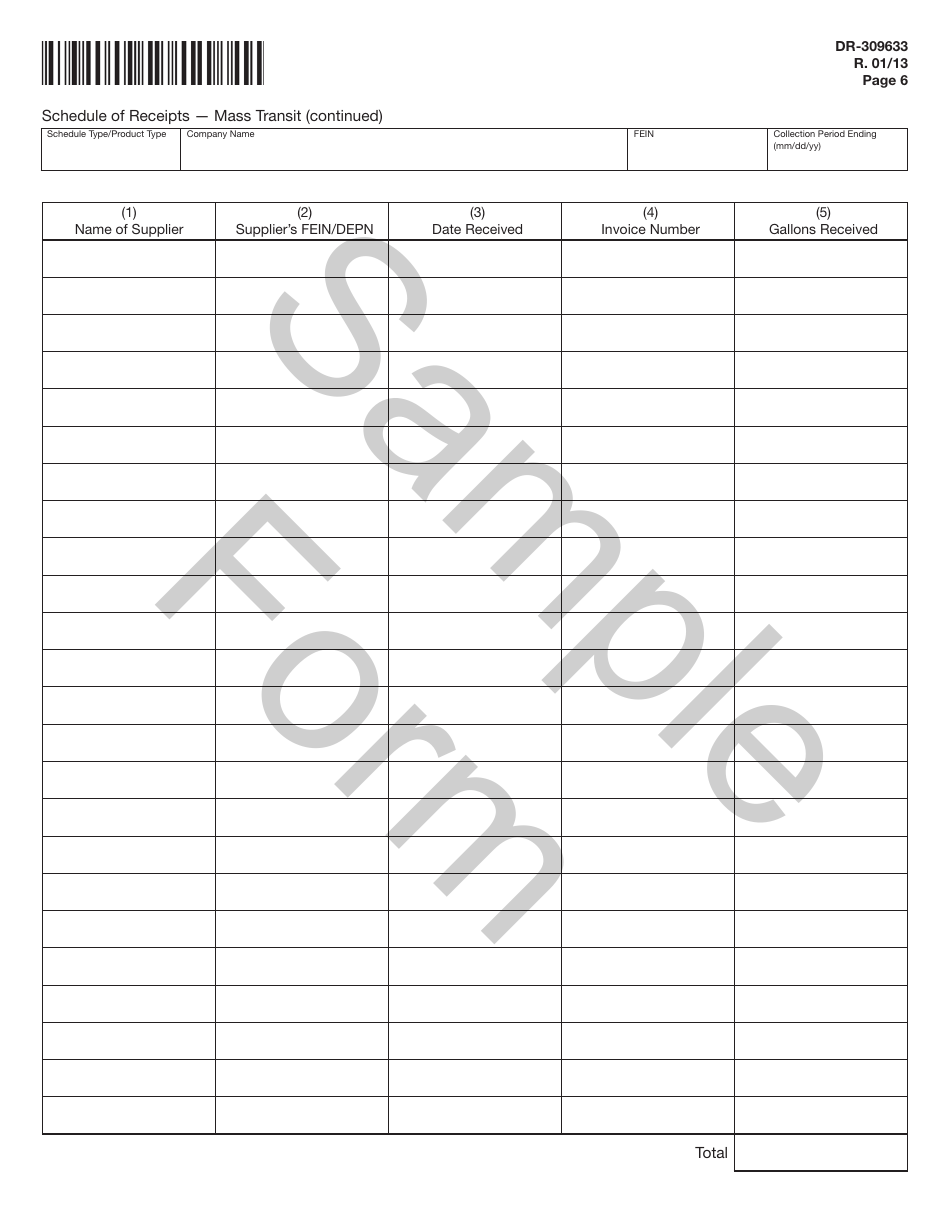

Form DR-309633 Mass Transit System Provider Fuel Tax Return - Sample - Florida

What Is Form DR-309633?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form DR-309633?

A: Form DR-309633 is the Mass Transit System Provider Fuel Tax Return.

Q: Who should file Form DR-309633?

A: Mass Transit System Providers in Florida should file Form DR-309633.

Q: What is the purpose of Form DR-309633?

A: The purpose of Form DR-309633 is to report and pay fuel taxes for mass transit systems.

Q: Is Form DR-309633 specific to Florida?

A: Yes, Form DR-309633 is specific to the state of Florida.

Q: How often should Form DR-309633 be filed?

A: Form DR-309633 should be filed on a monthly basis.

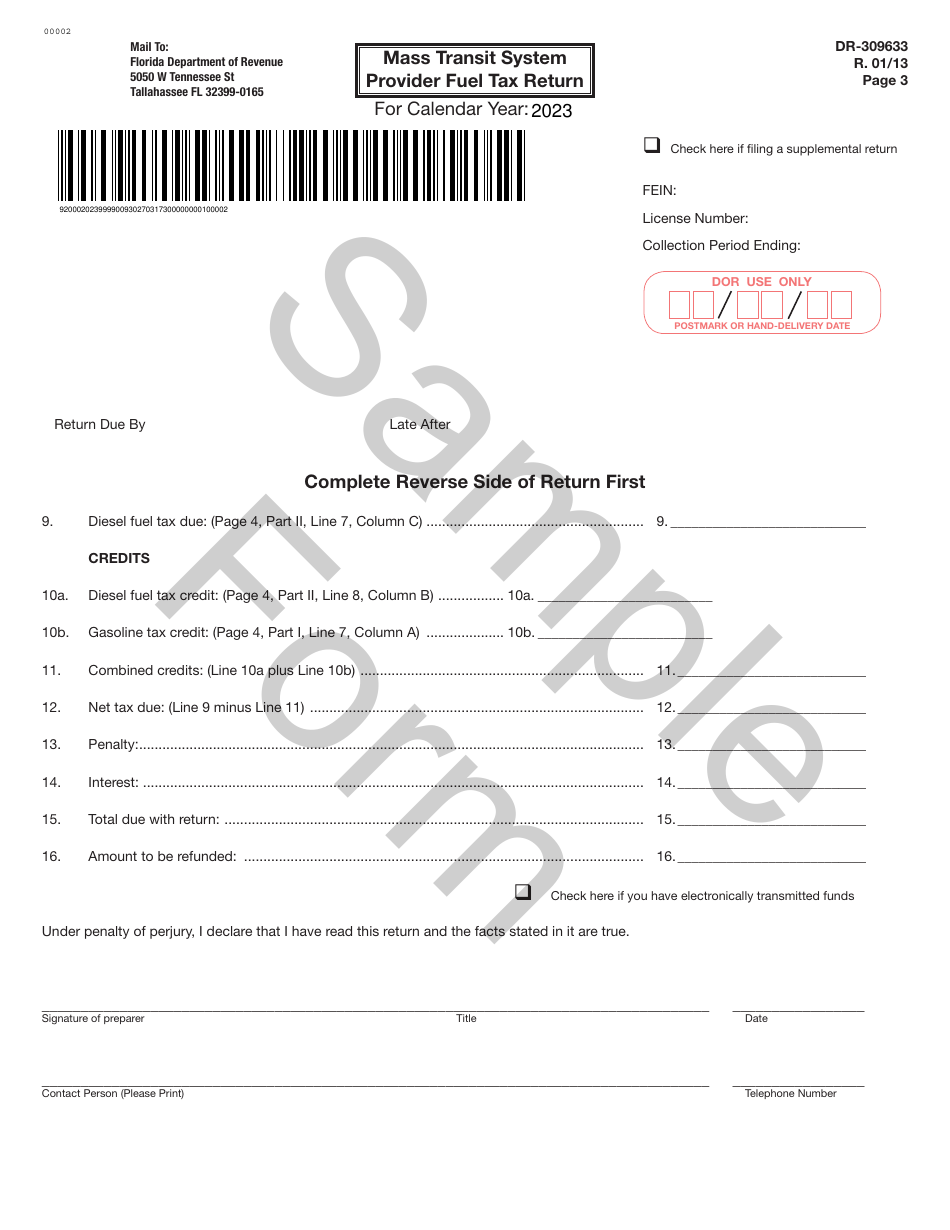

Q: Are there any penalties for not filing Form DR-309633?

A: Yes, there are penalties for not filing Form DR-309633, including interest on delinquent payments.

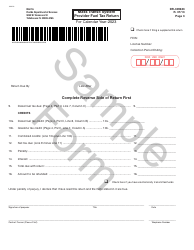

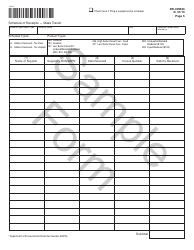

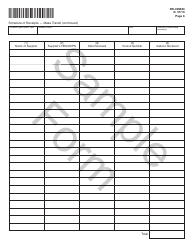

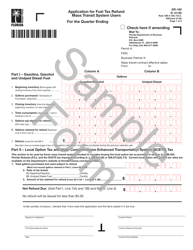

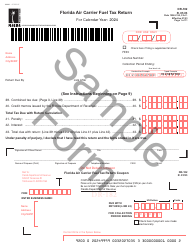

Q: What information is required on Form DR-309633?

A: Form DR-309633 requires information such as the amount of fuel purchased, fuel sales, and tax calculated.

Q: Can Form DR-309633 be filed electronically?

A: Yes, Form DR-309633 can be filed electronically through the Florida Department of Revenue's e-Services portal.

Q: Is there a due date for filing Form DR-309633?

A: Yes, Form DR-309633 is due on the 1st day of the month following the reporting period.

Form Details:

- Released on January 1, 2013;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DR-309633 by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.