This version of the form is not currently in use and is provided for reference only. Download this version of

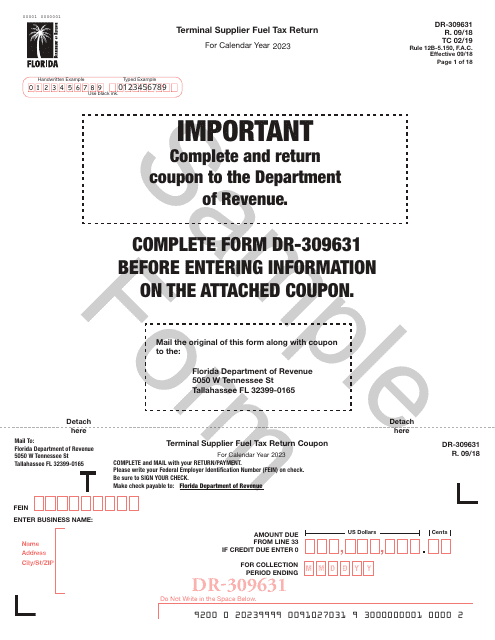

Form DR-309631

for the current year.

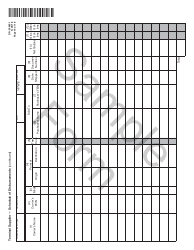

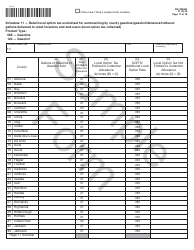

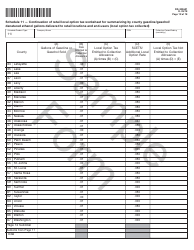

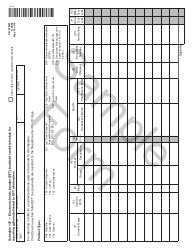

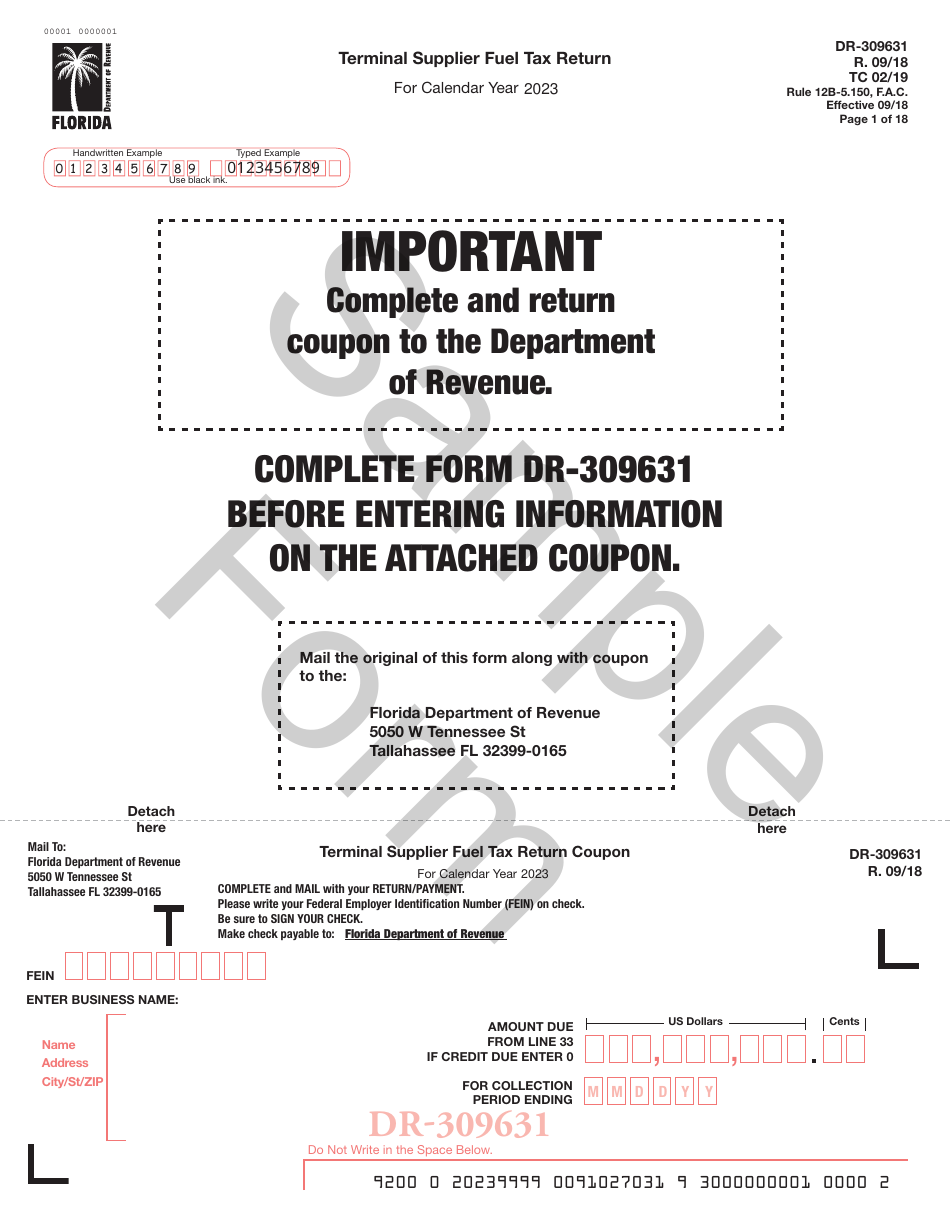

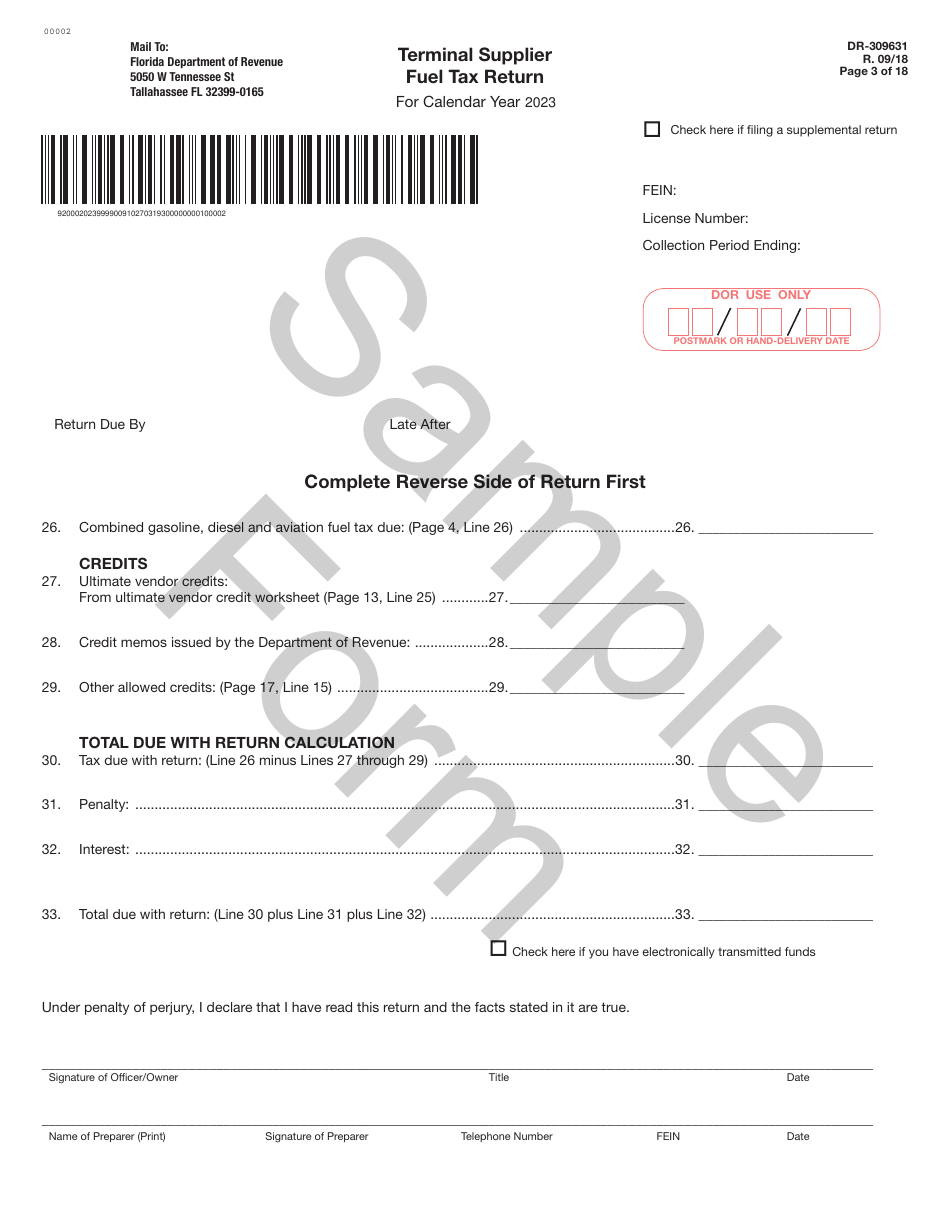

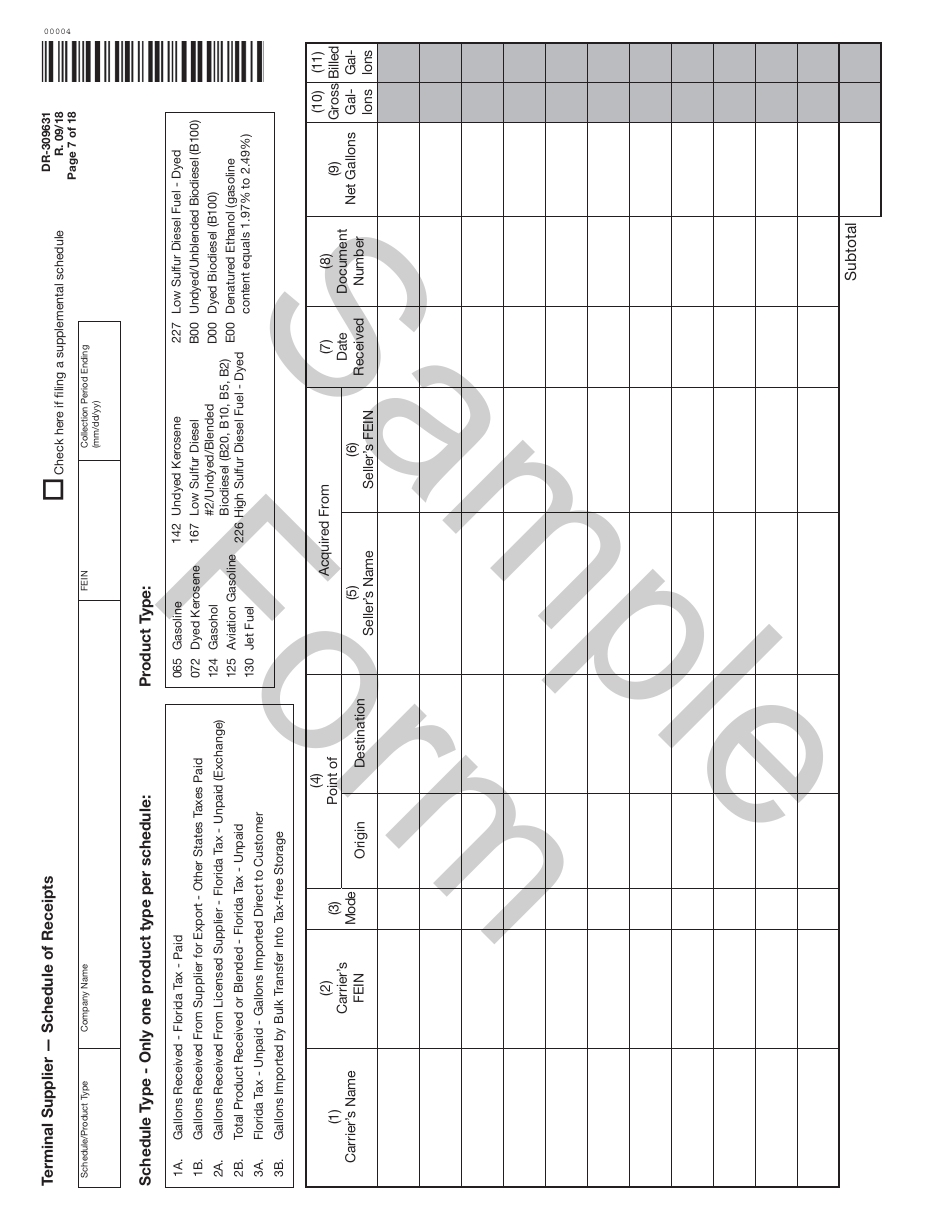

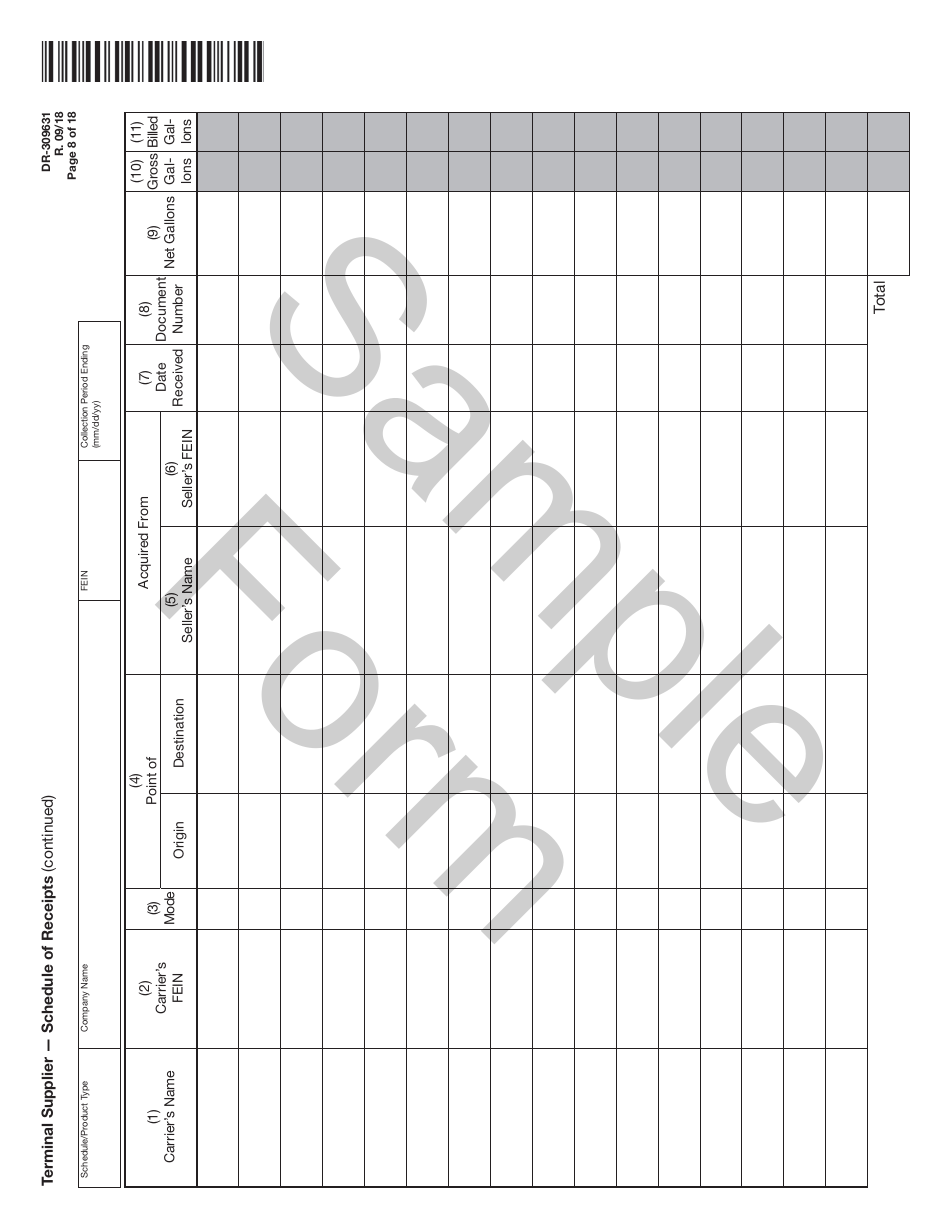

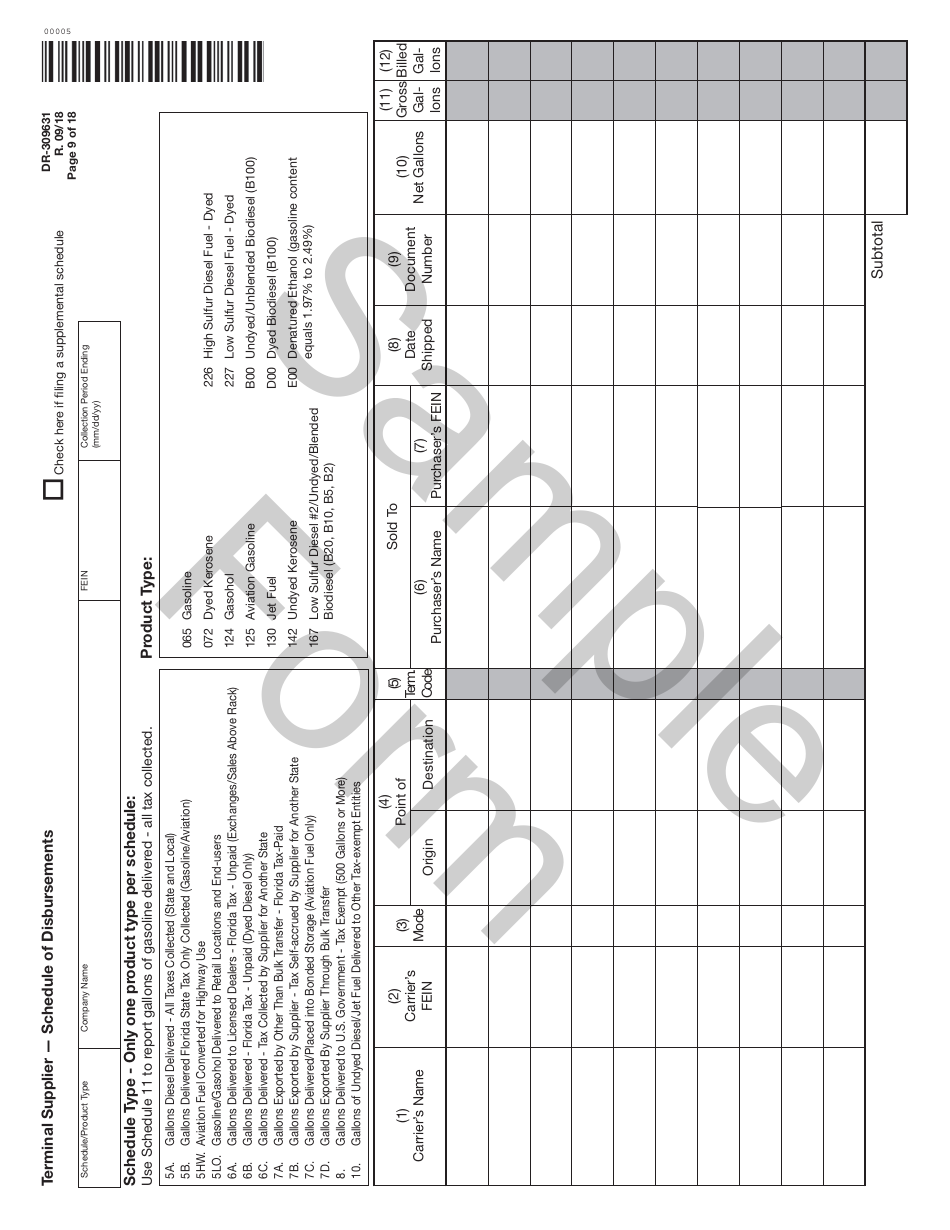

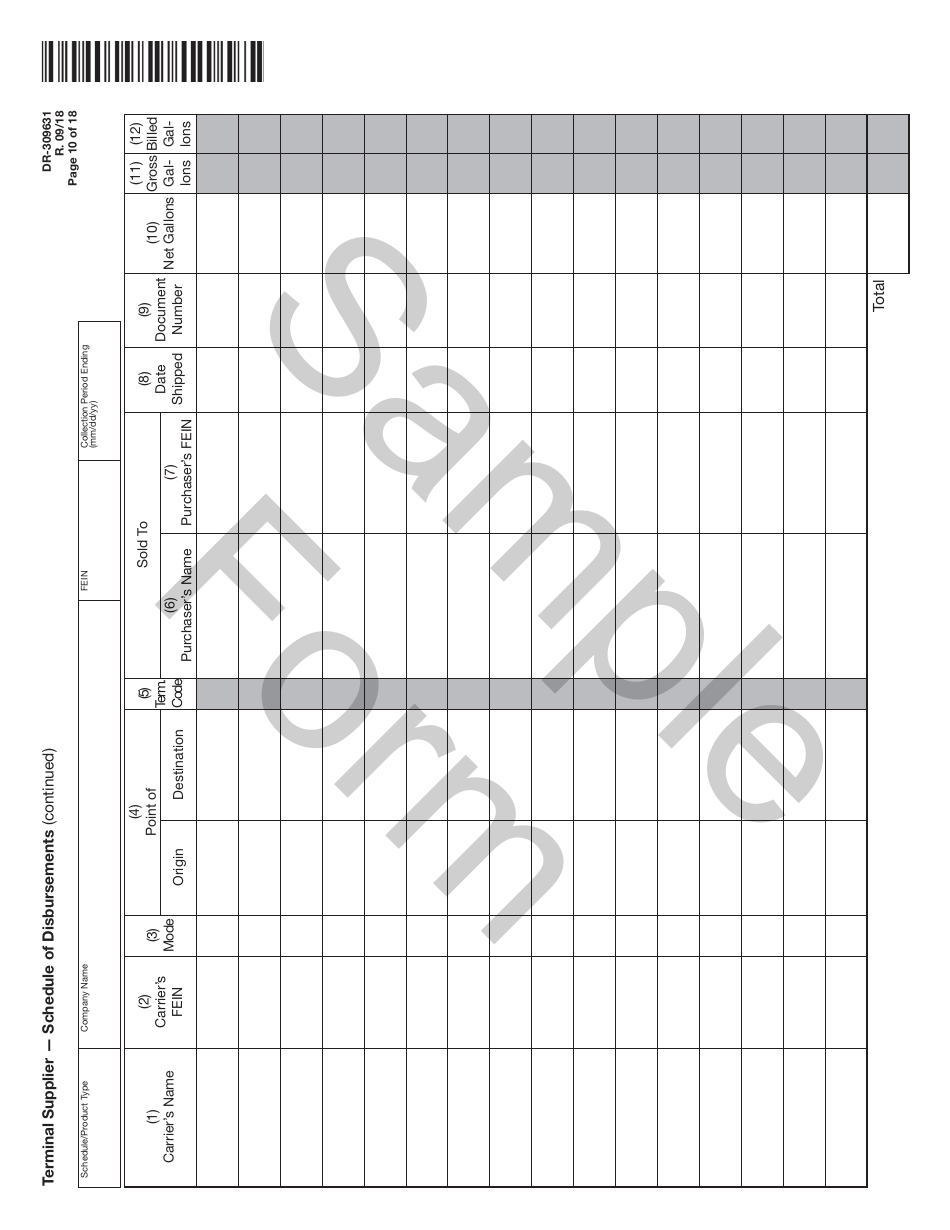

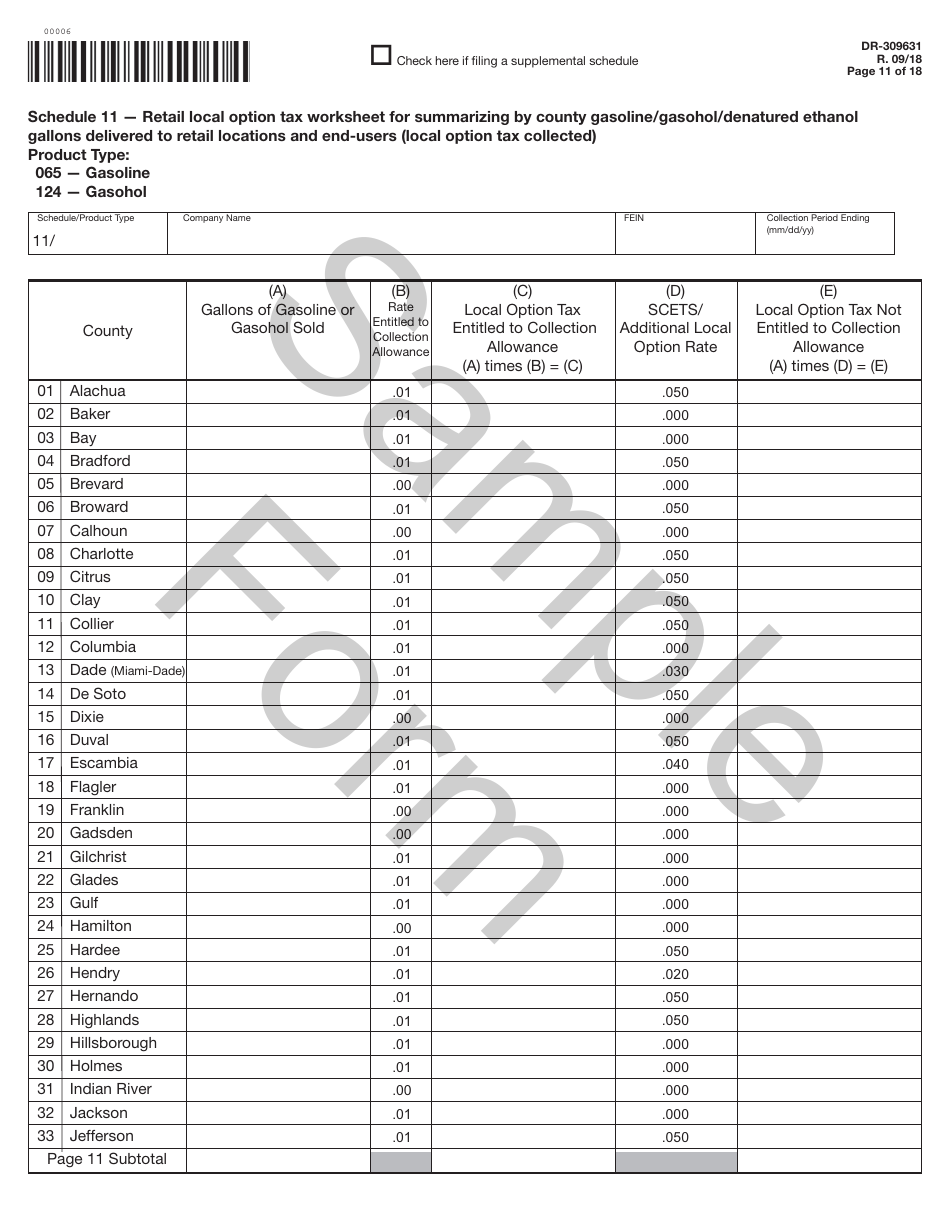

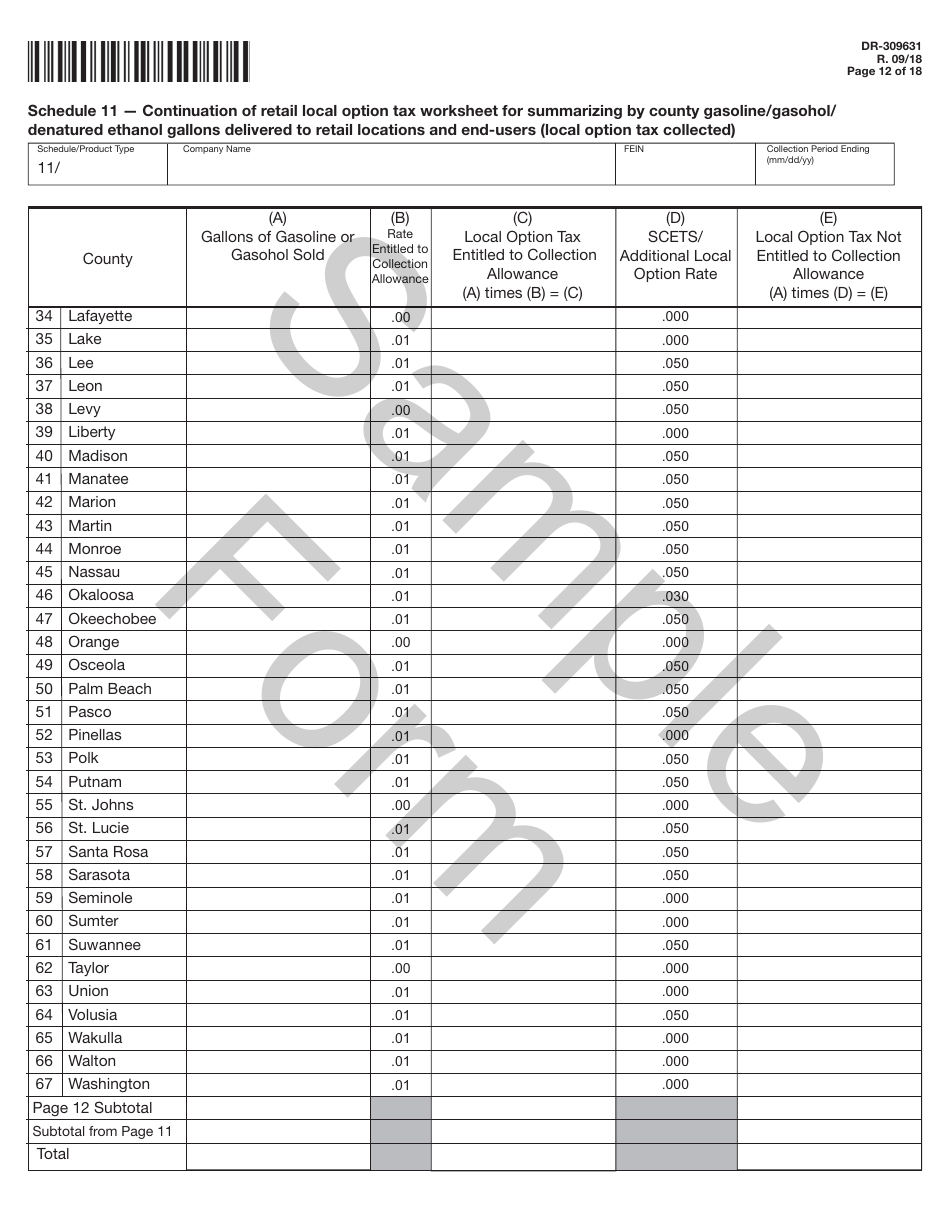

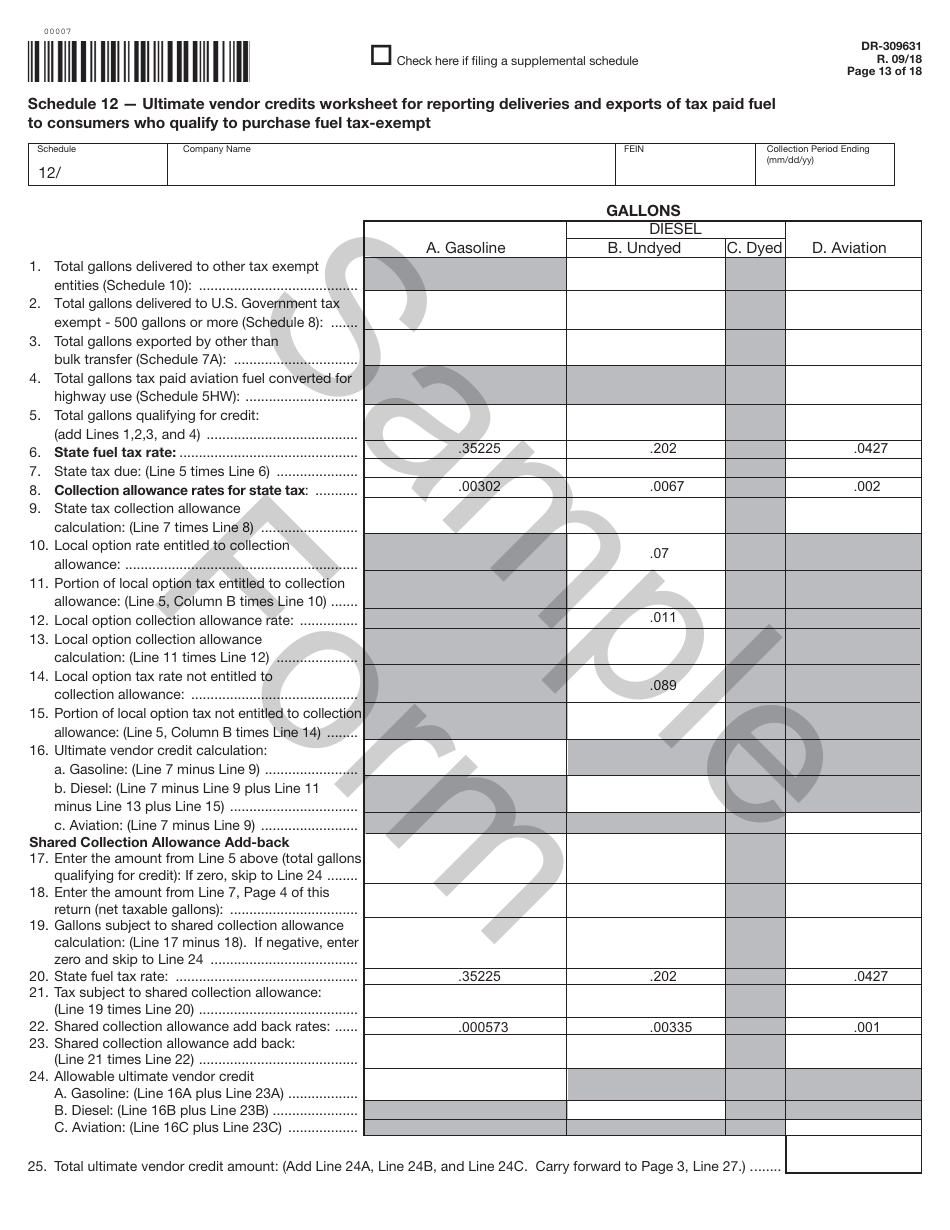

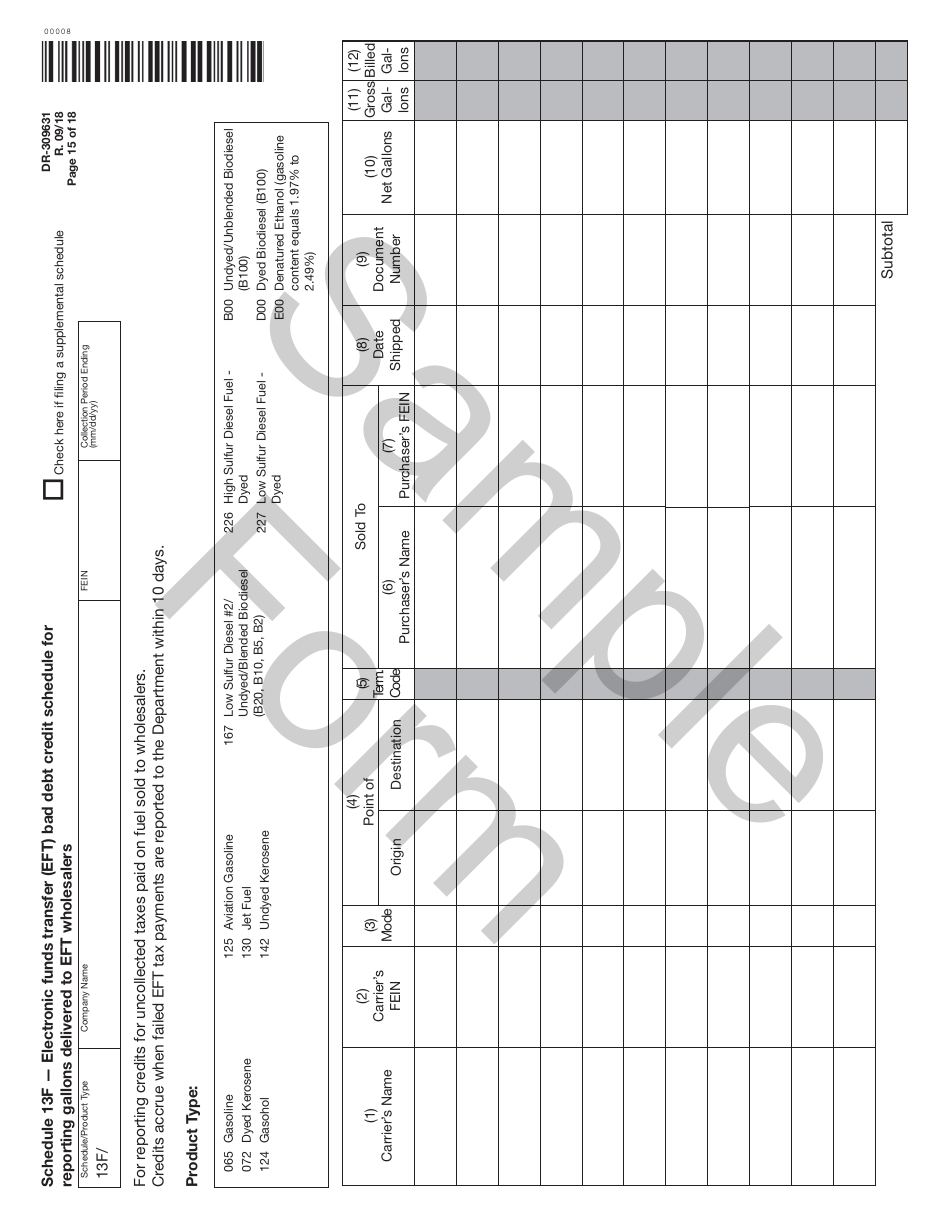

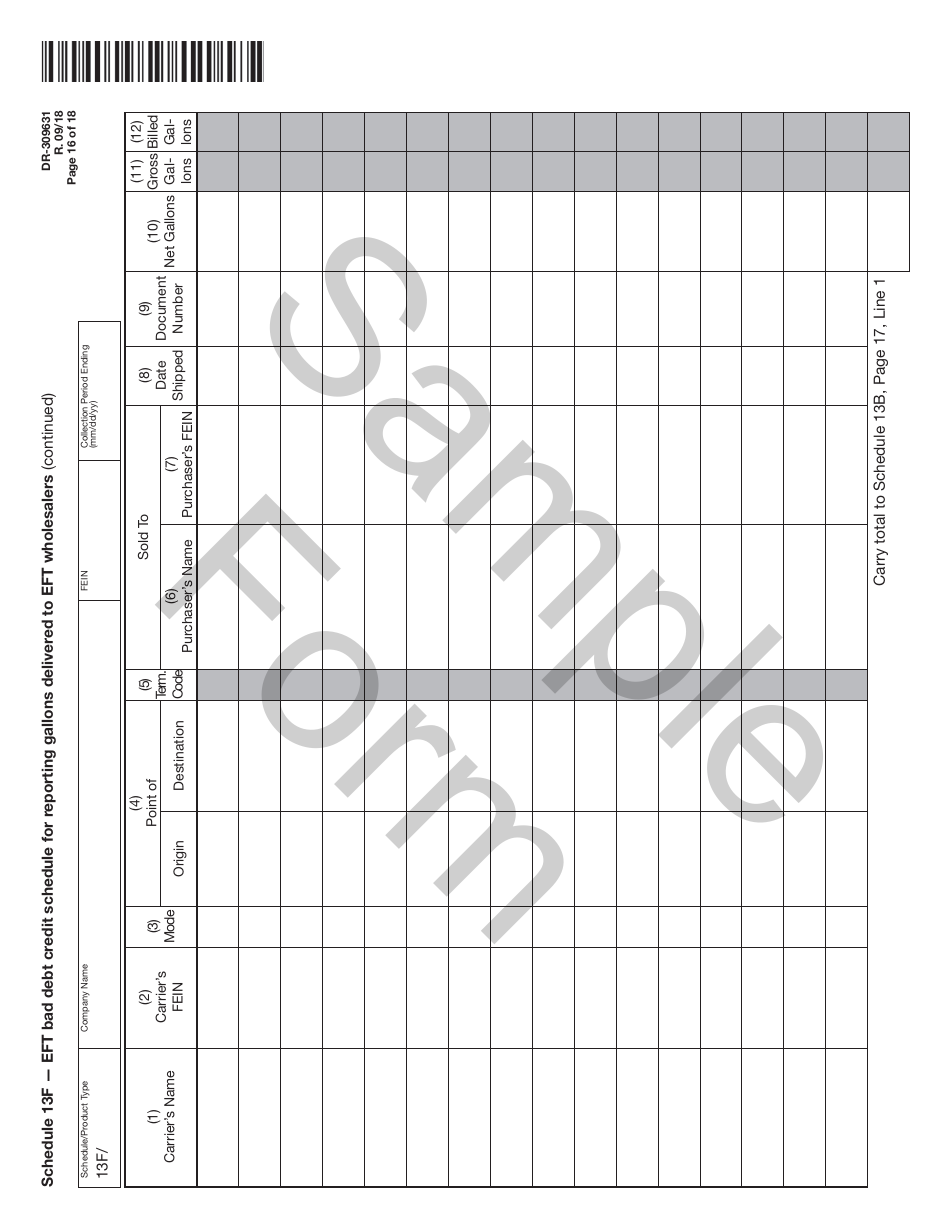

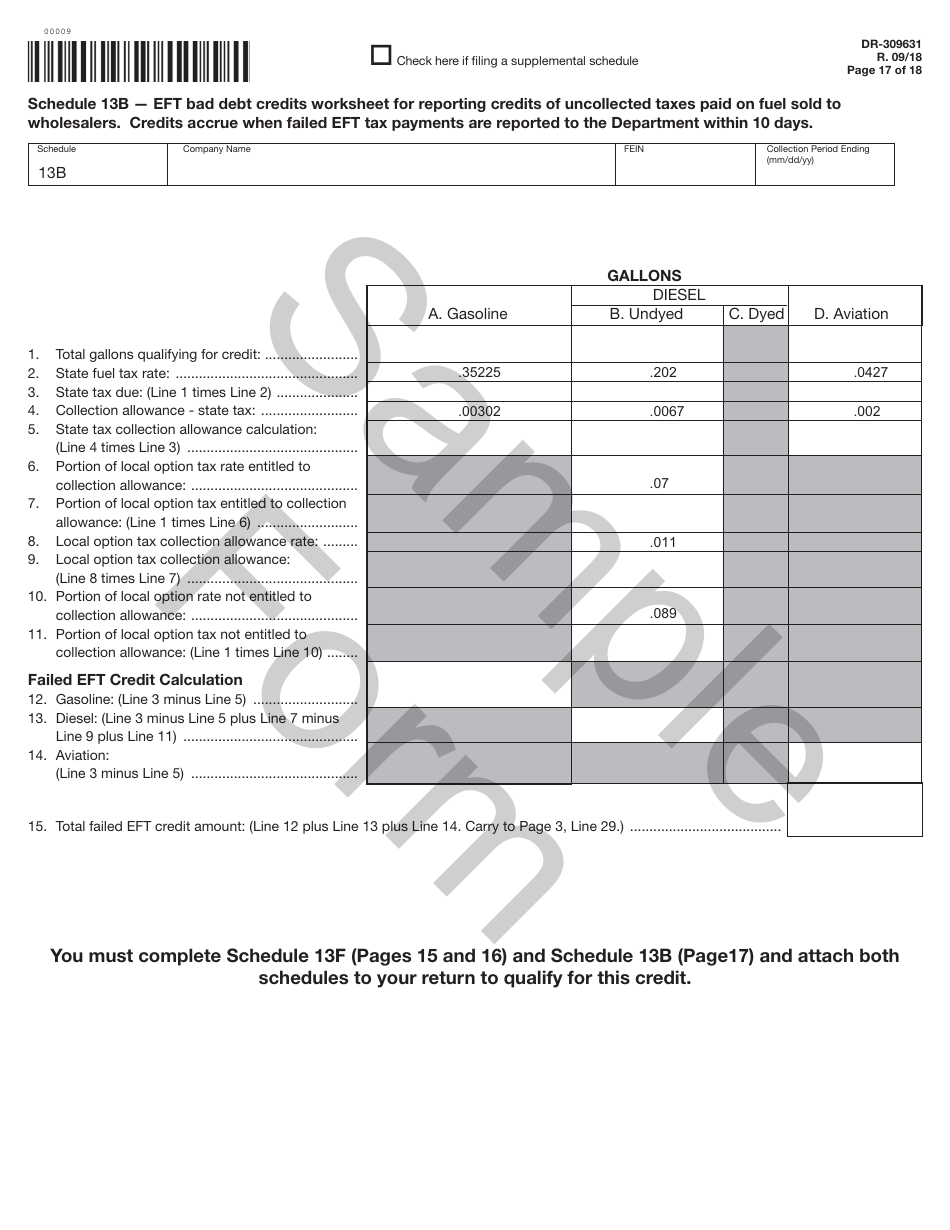

Form DR-309631 Terminal Supplier Fuel Tax Return - Sample - Florida

What Is Form DR-309631?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. Check the official instructions before completing and submitting the form.

FAQ

Q: What is the Form DR-309631 Terminal Supplier Fuel Tax Return?

A: The Form DR-309631 is a tax return form used by terminal suppliers to report and pay fuel taxes in Florida.

Q: Who needs to file the Form DR-309631 Terminal Supplier Fuel Tax Return?

A: Terminal suppliers, which are businesses that distribute fuel to retailers or users, must file this form to report and pay fuel taxes in Florida.

Q: How often do I need to file the Form DR-309631 Terminal Supplier Fuel Tax Return?

A: The frequency of filing depends on your fuel sales volume. Terminal suppliers with high sales volume may need to file the return on a monthly basis, while those with lower sales volume may file quarterly.

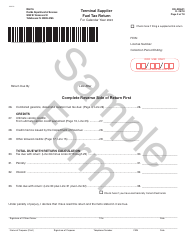

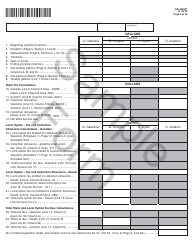

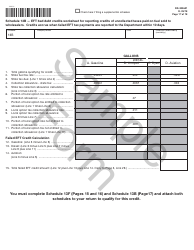

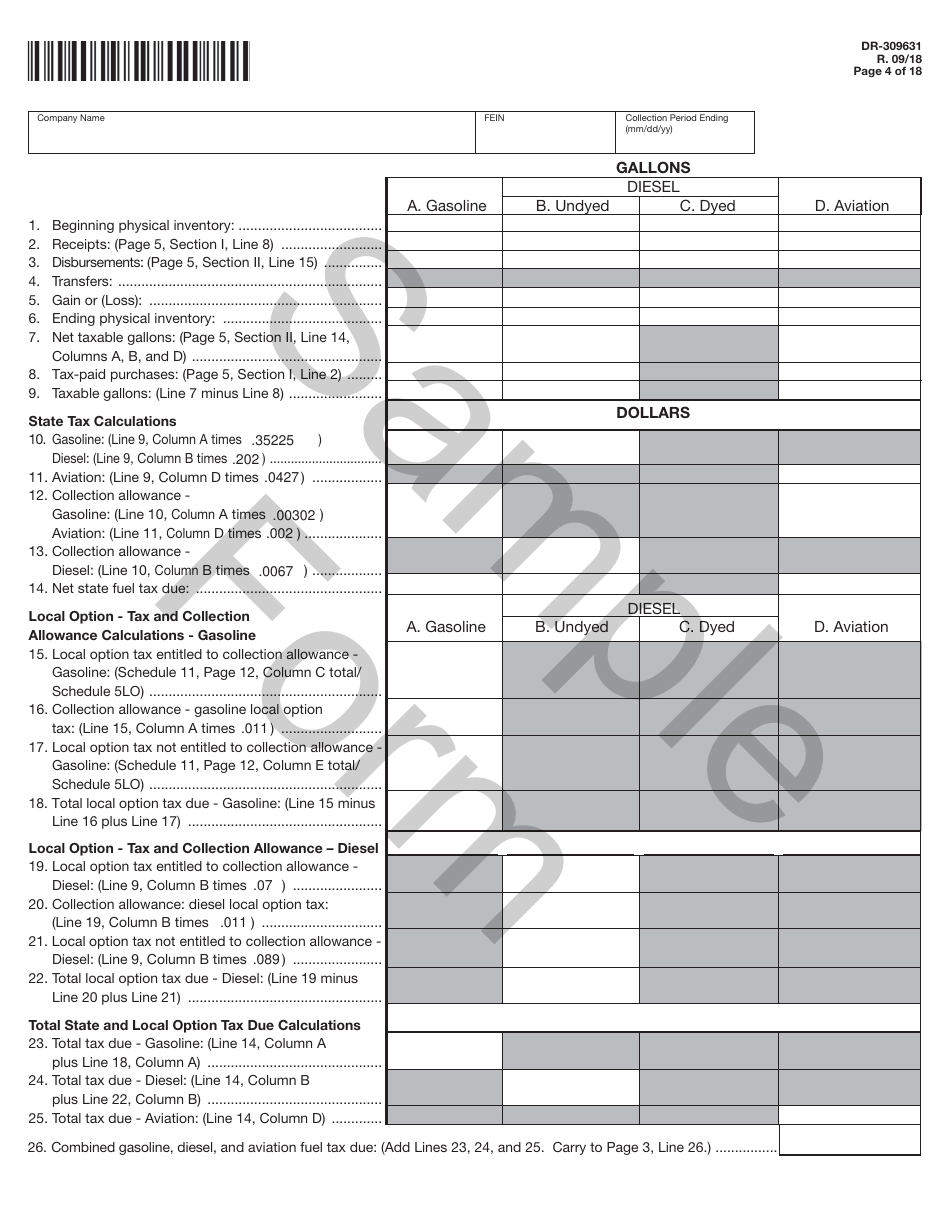

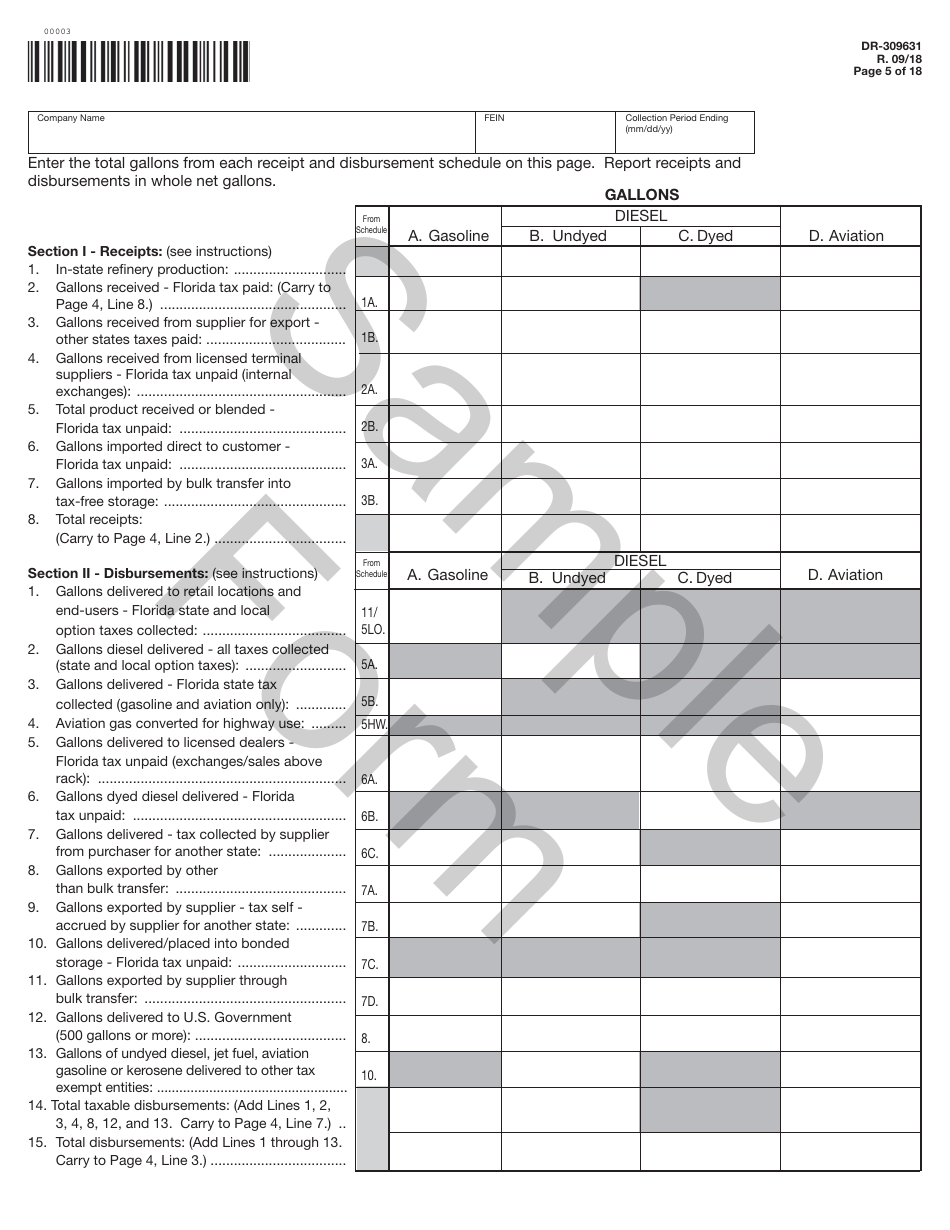

Q: What information is required on the Form DR-309631 Terminal Supplier Fuel Tax Return?

A: The form requires you to provide information on fuel sales and gallons sold, tax rates, fuel types, and other relevant details for calculating and reporting fuel taxes.

Q: What happens if I don't file the Form DR-309631 Terminal Supplier Fuel Tax Return?

A: Failure to file the tax return or pay the required fuel taxes can result in penalties and interest charges imposed by the Florida Department of Revenue.

Form Details:

- Released on February 1, 2019;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DR-309631 by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.