This version of the form is not currently in use and is provided for reference only. Download this version of

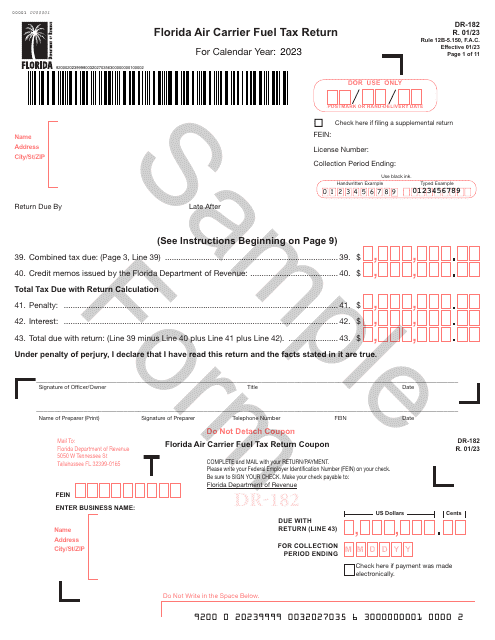

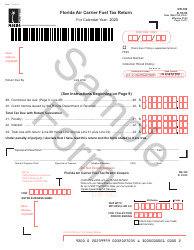

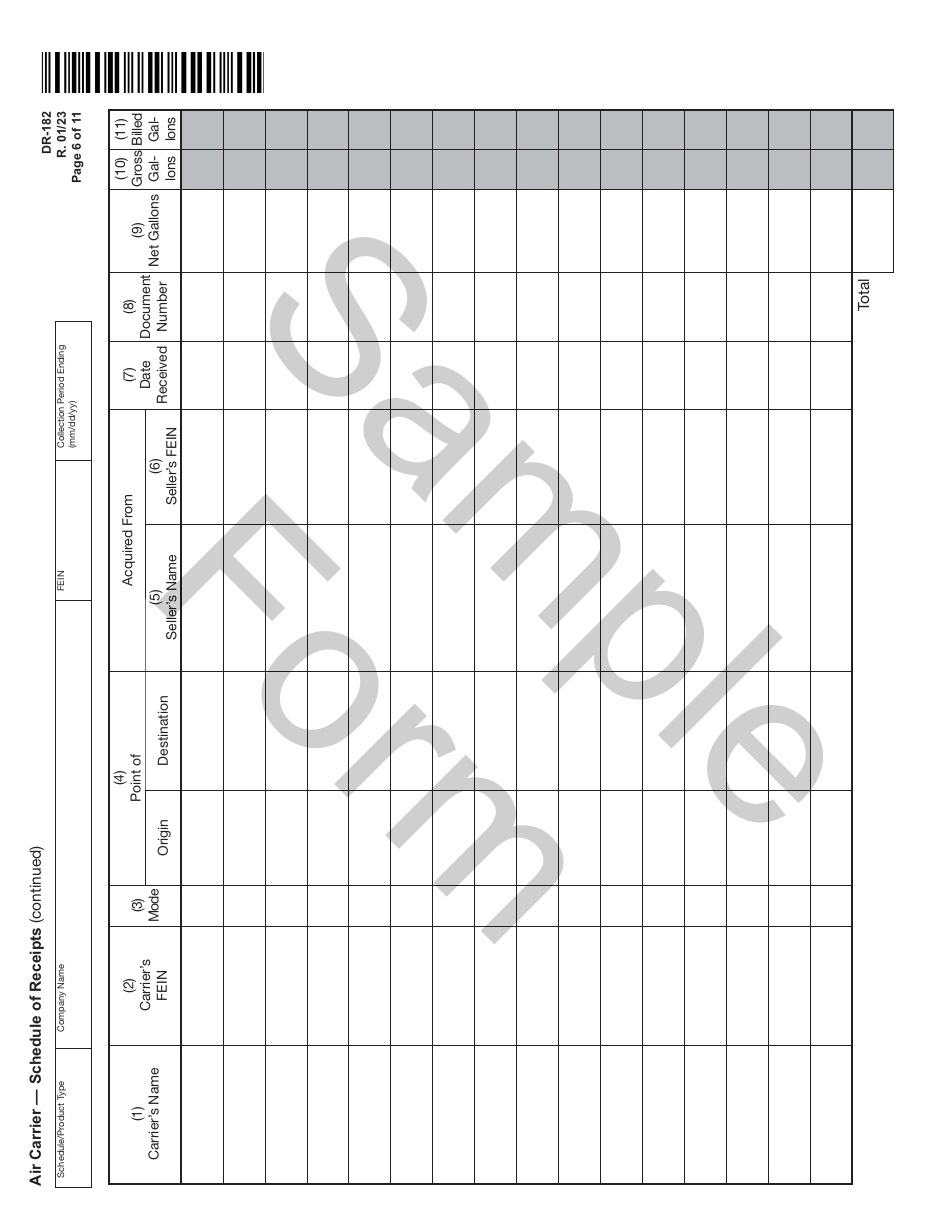

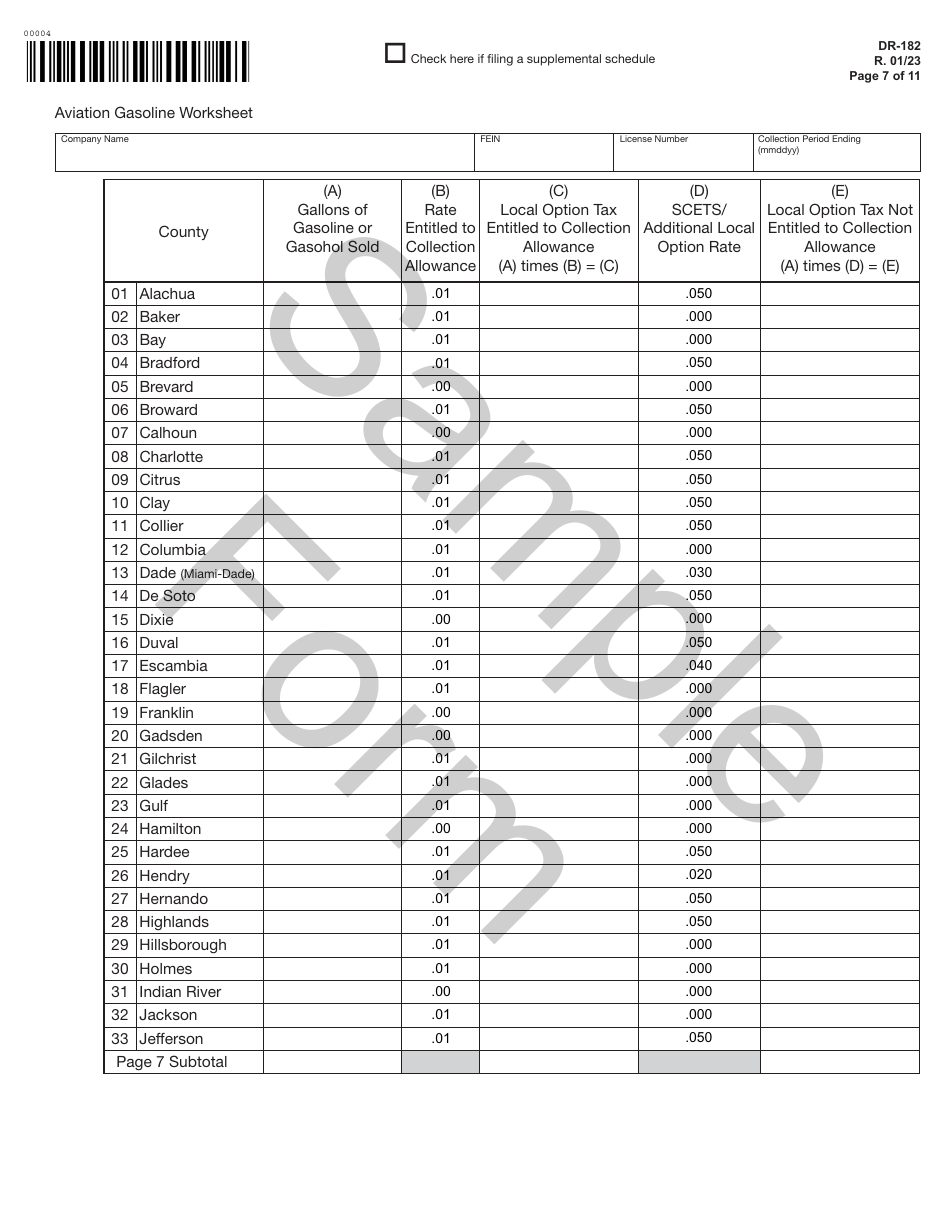

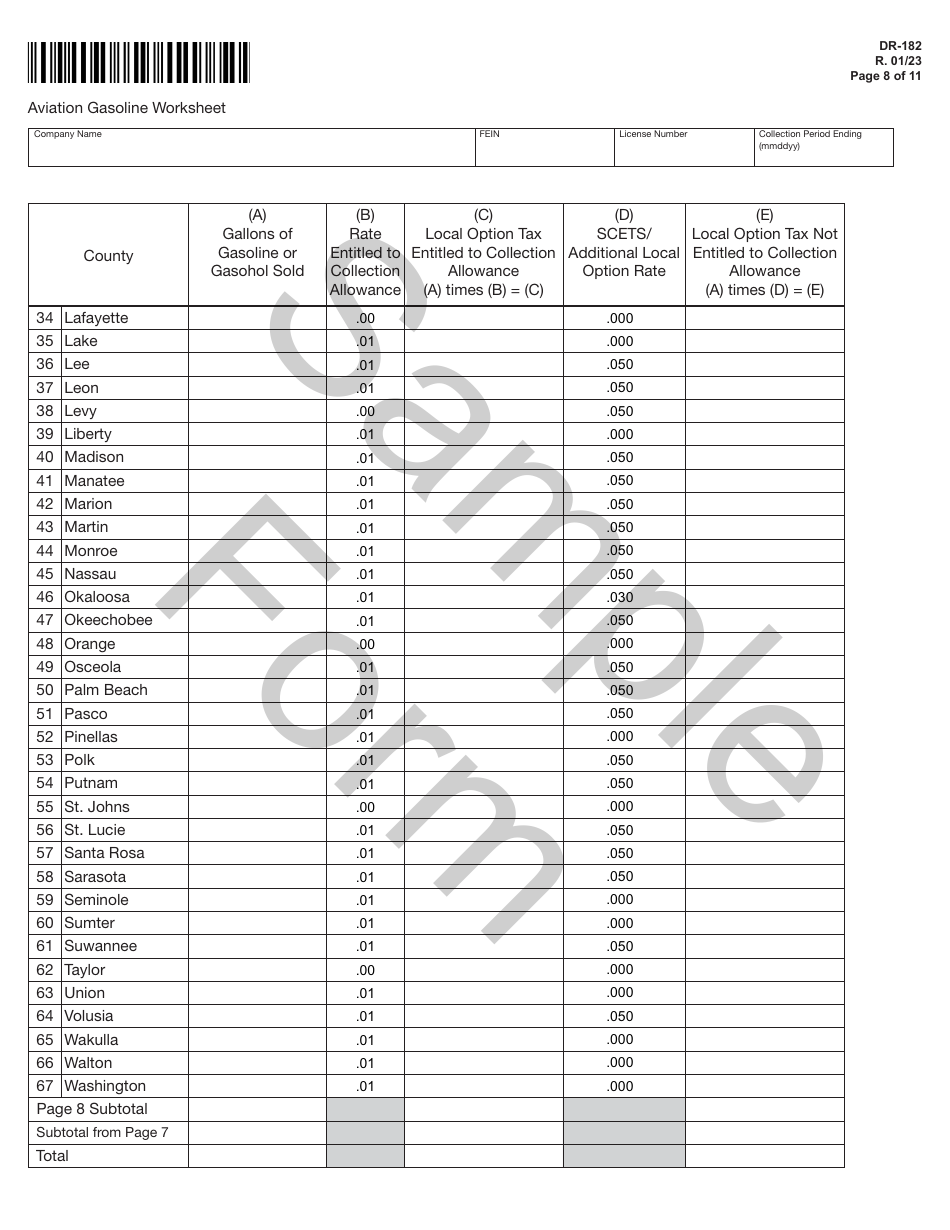

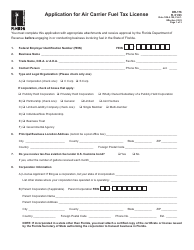

Form DR-182

for the current year.

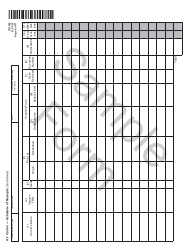

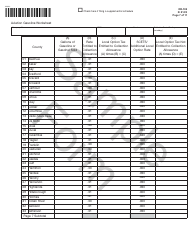

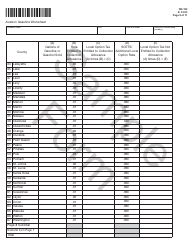

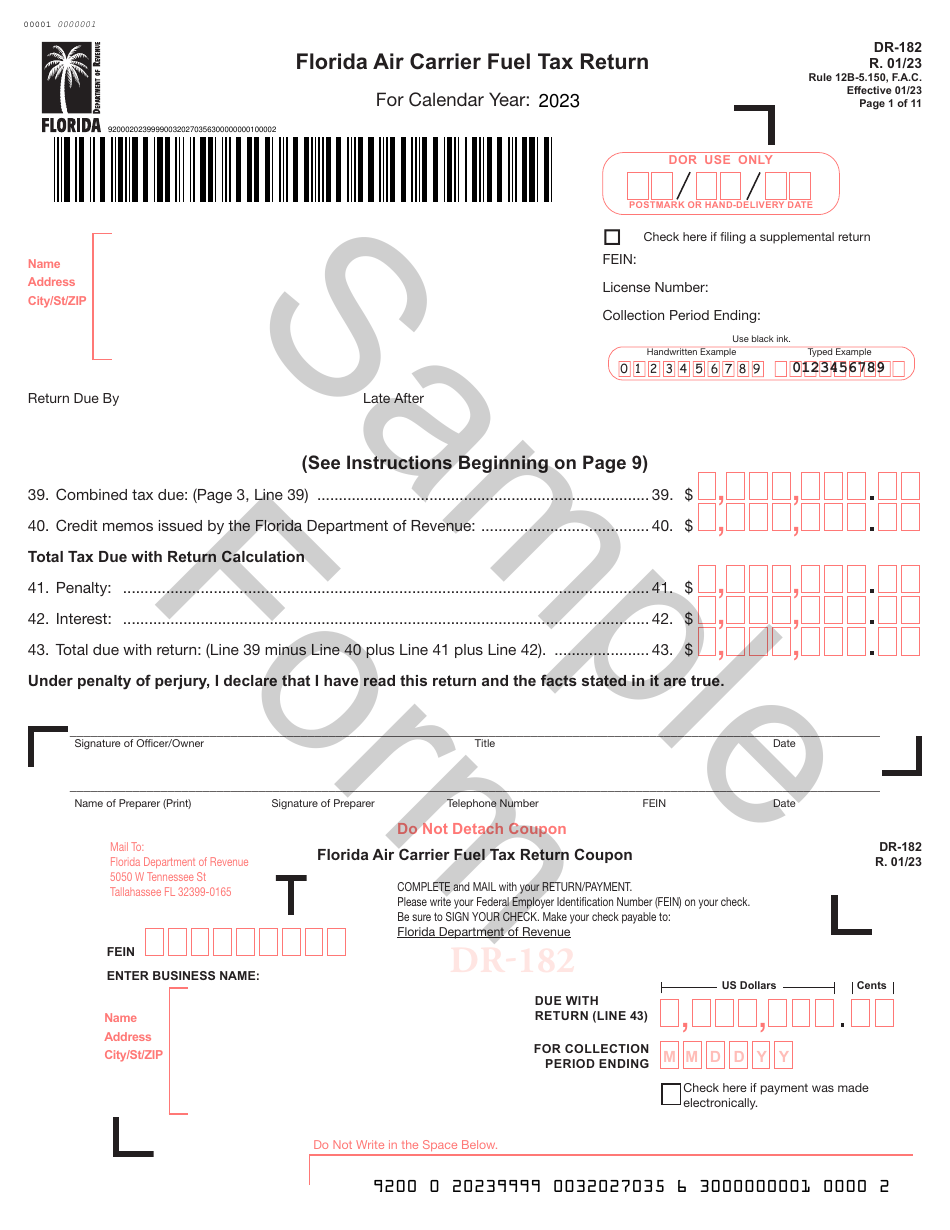

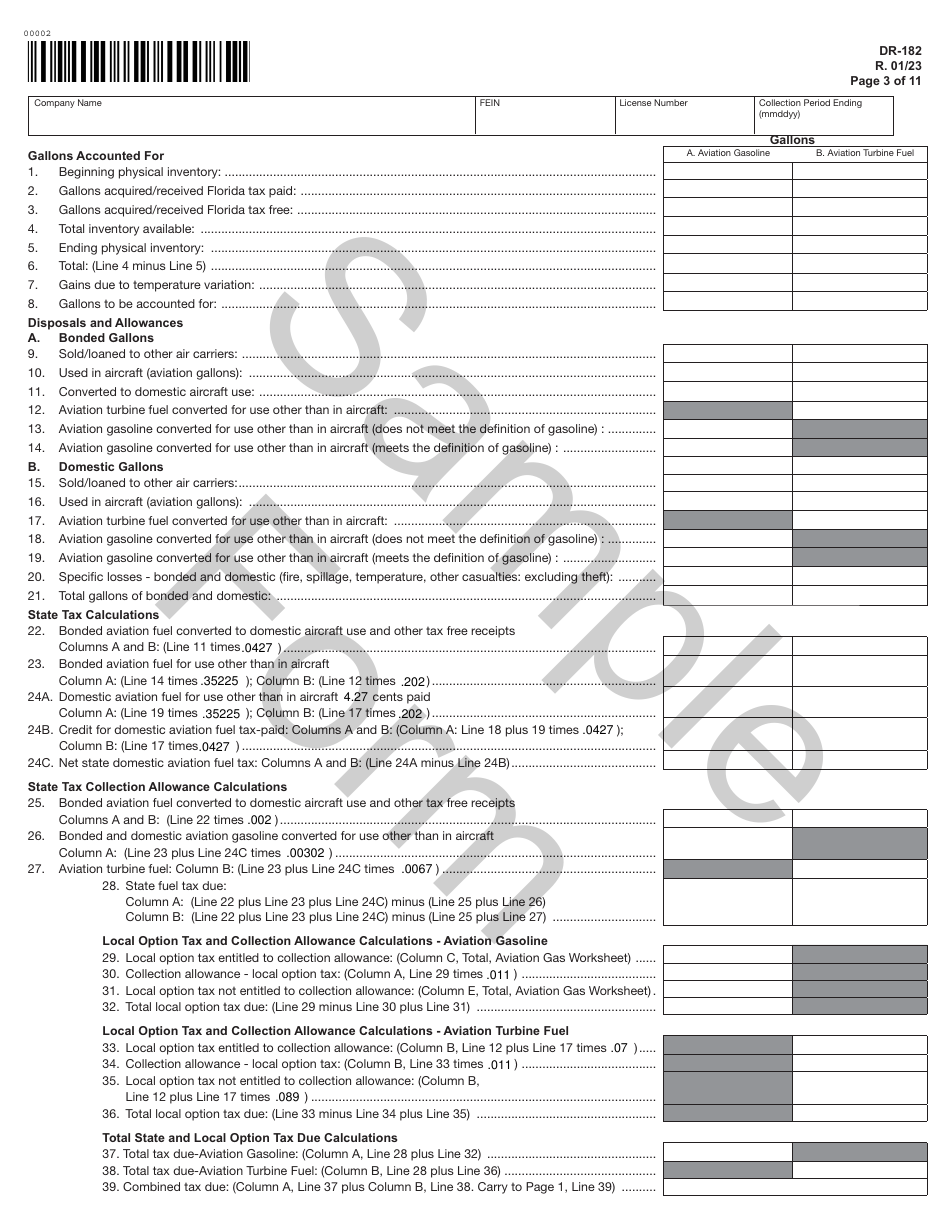

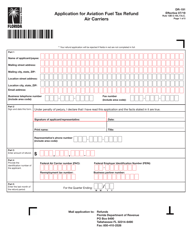

Form DR-182 Florida Air Carrier Fuel Tax Return - Sample - Florida

What Is Form DR-182?

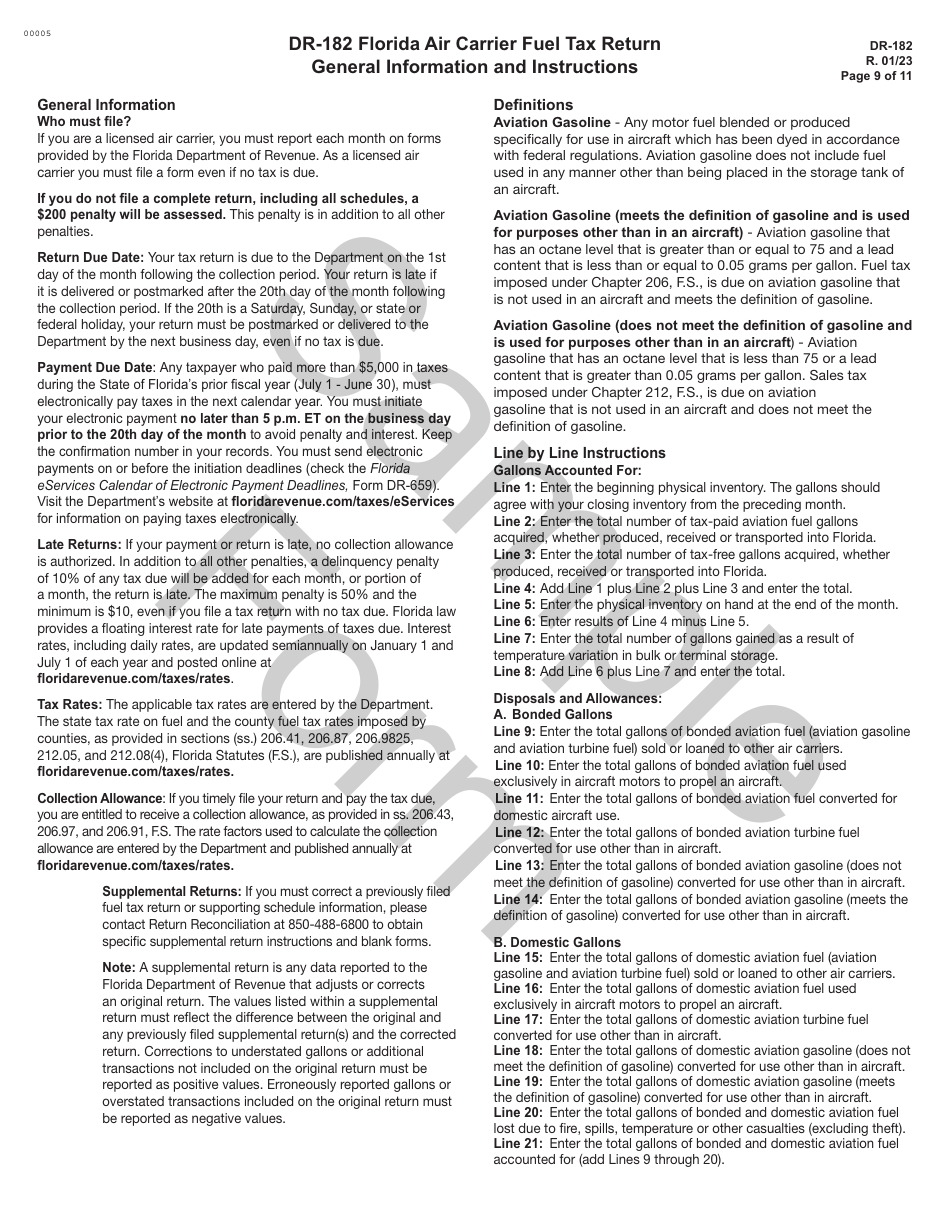

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR-182?

A: Form DR-182 is the Florida Air Carrier Fuel Tax Return.

Q: Who needs to file Form DR-182?

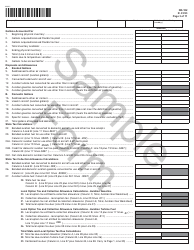

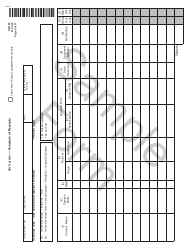

A: Air carriers operating in Florida must file Form DR-182.

Q: What is the purpose of Form DR-182?

A: Form DR-182 is used to report and remit the air carrier fuel tax in Florida.

Q: How often is Form DR-182 filed?

A: Form DR-182 is filed on a quarterly basis.

Q: Are there any exemptions to the air carrier fuel tax?

A: Yes, certain noncommercial flights and certain military flights are exempt from the air carrier fuel tax.

Q: Are there any penalties for late filing or non-payment of the air carrier fuel tax?

A: Yes, penalties and interest may be imposed for late filing or non-payment of the air carrier fuel tax.

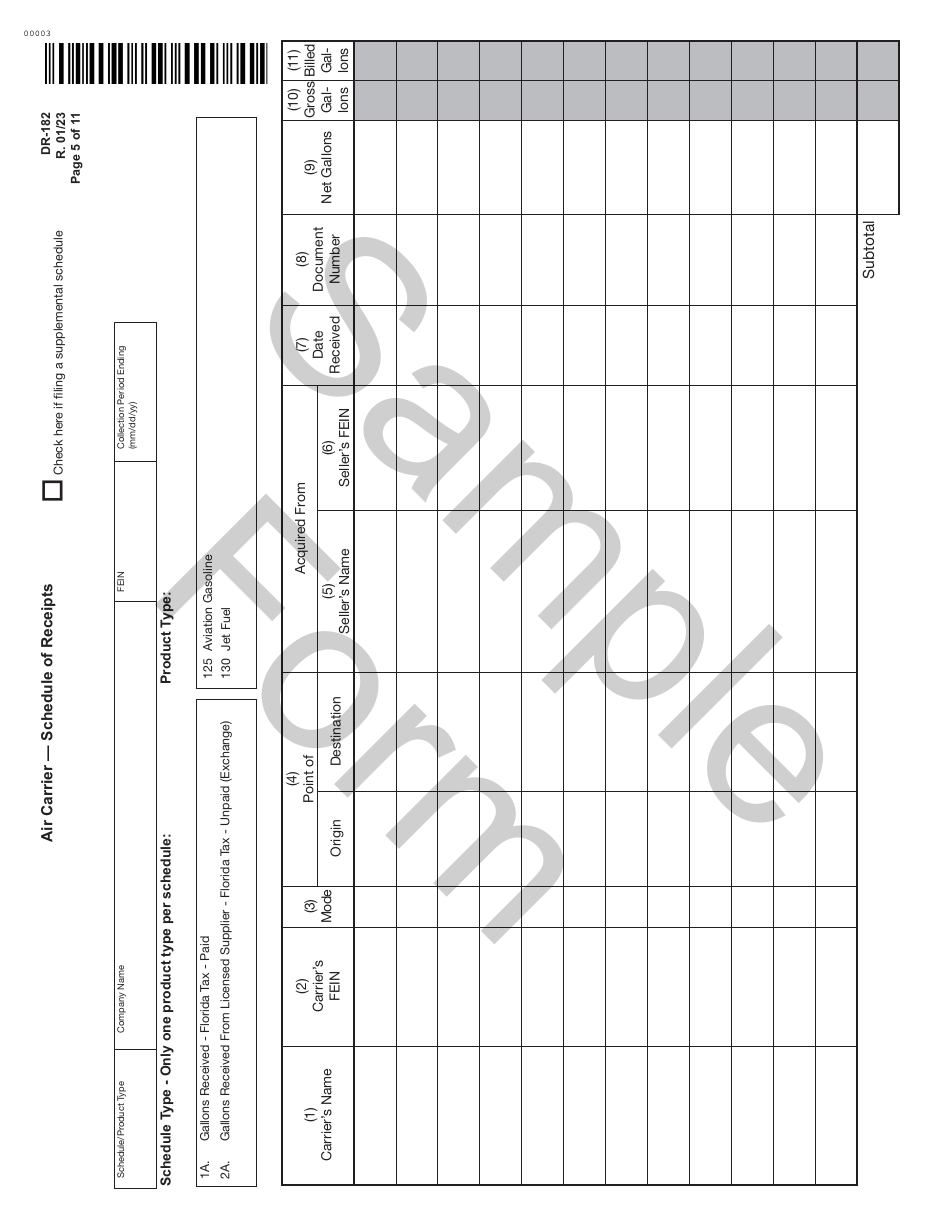

Q: What supporting documentation is required to be submitted with Form DR-182?

A: Generally, you must submit copies of fuel receipts or invoices with Form DR-182.

Q: What is the due date for filing Form DR-182?

A: Form DR-182 is due on or before the 20th day of the month following the end of the quarter.

Form Details:

- Released on January 1, 2023;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DR-182 by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.