This version of the form is not currently in use and is provided for reference only. Download this version of

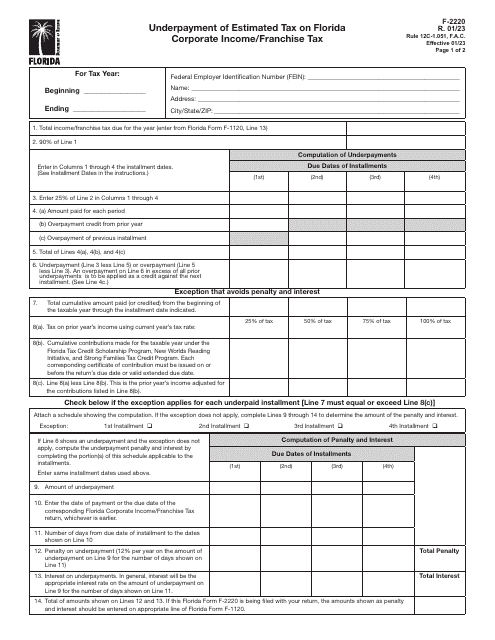

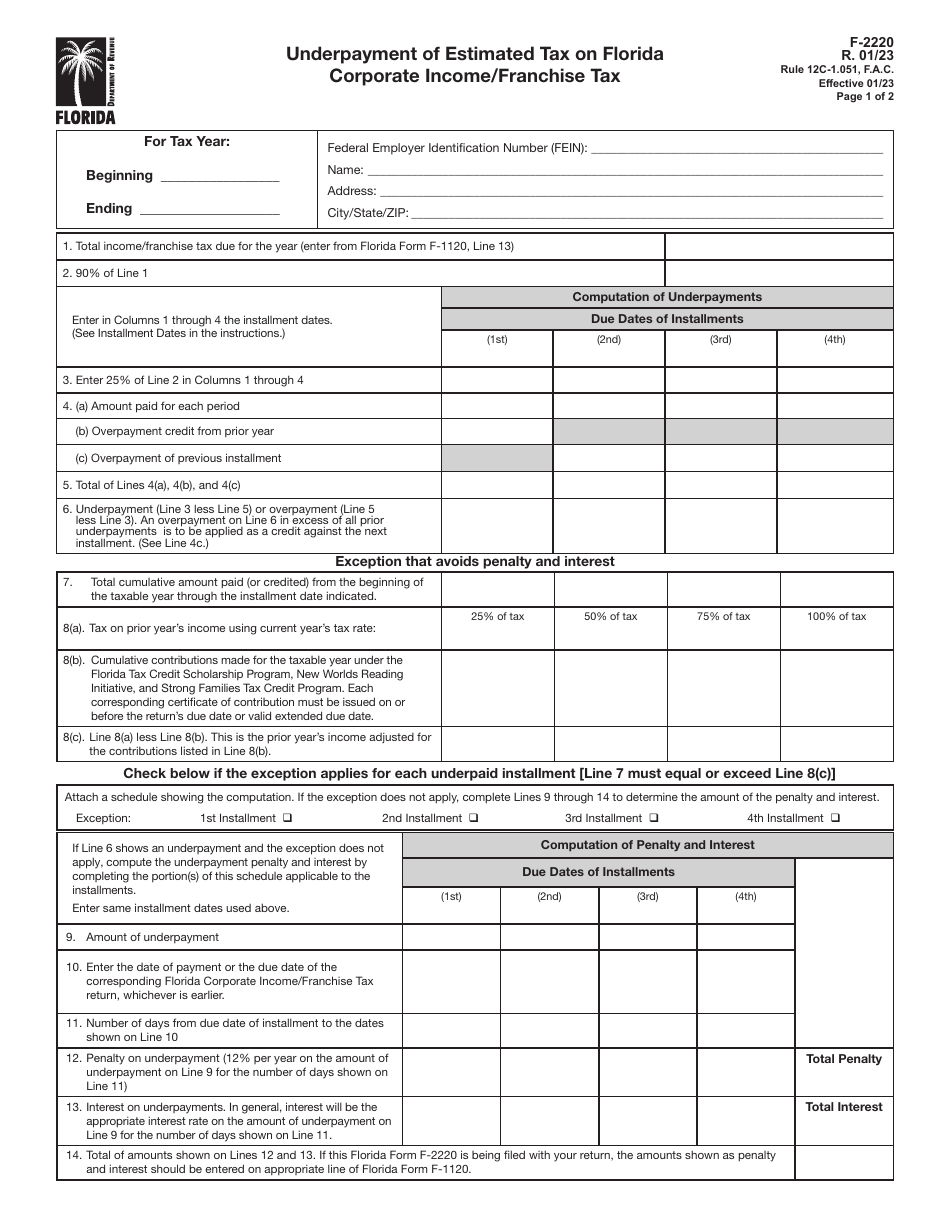

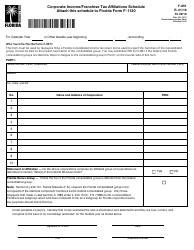

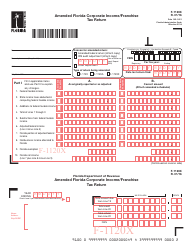

Form F-2220

for the current year.

Form F-2220 Underpayment of Estimated Tax on Florida Corporate Income / Franchise Tax - Florida

What Is Form F-2220?

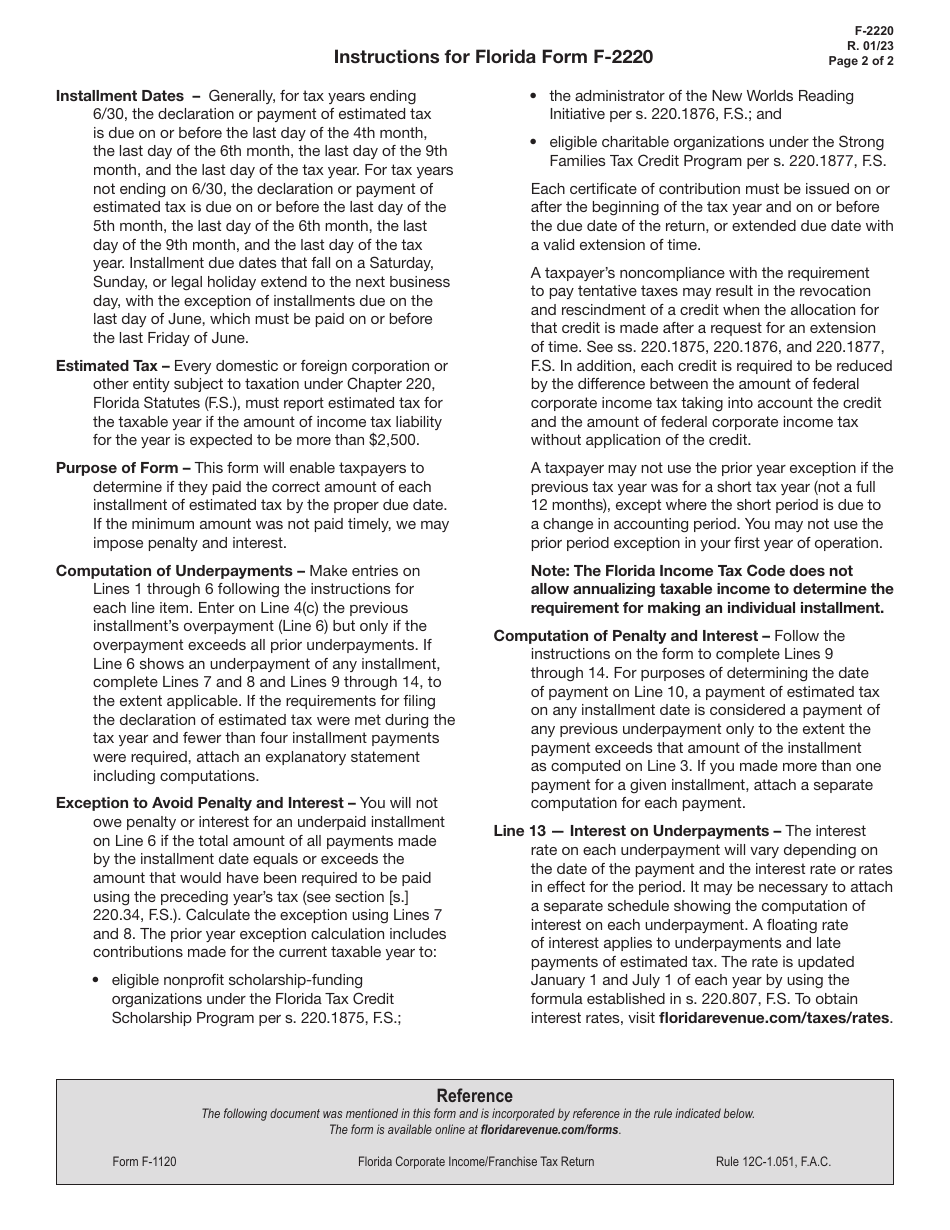

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form F-2220?

A: Form F-2220 is a form used to calculate the underpayment of estimated tax on Florida Corporate Income/Franchise Tax.

Q: What is the purpose of Form F-2220?

A: The purpose of Form F-2220 is to determine whether a corporation owes interest or penalties for underpaying estimated tax on Florida Corporate Income/Franchise Tax.

Q: Who needs to file Form F-2220?

A: Corporations that underpaid estimated tax on Florida Corporate Income/Franchise Tax may need to file Form F-2220.

Q: What happens if I don't file Form F-2220?

A: Failure to file Form F-2220 may result in interest or penalties for underpayment of estimated tax on Florida Corporate Income/Franchise Tax.

Form Details:

- Released on January 1, 2023;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form F-2220 by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.