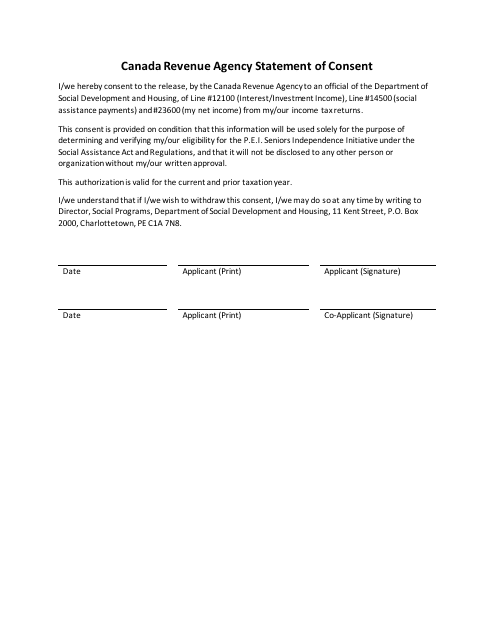

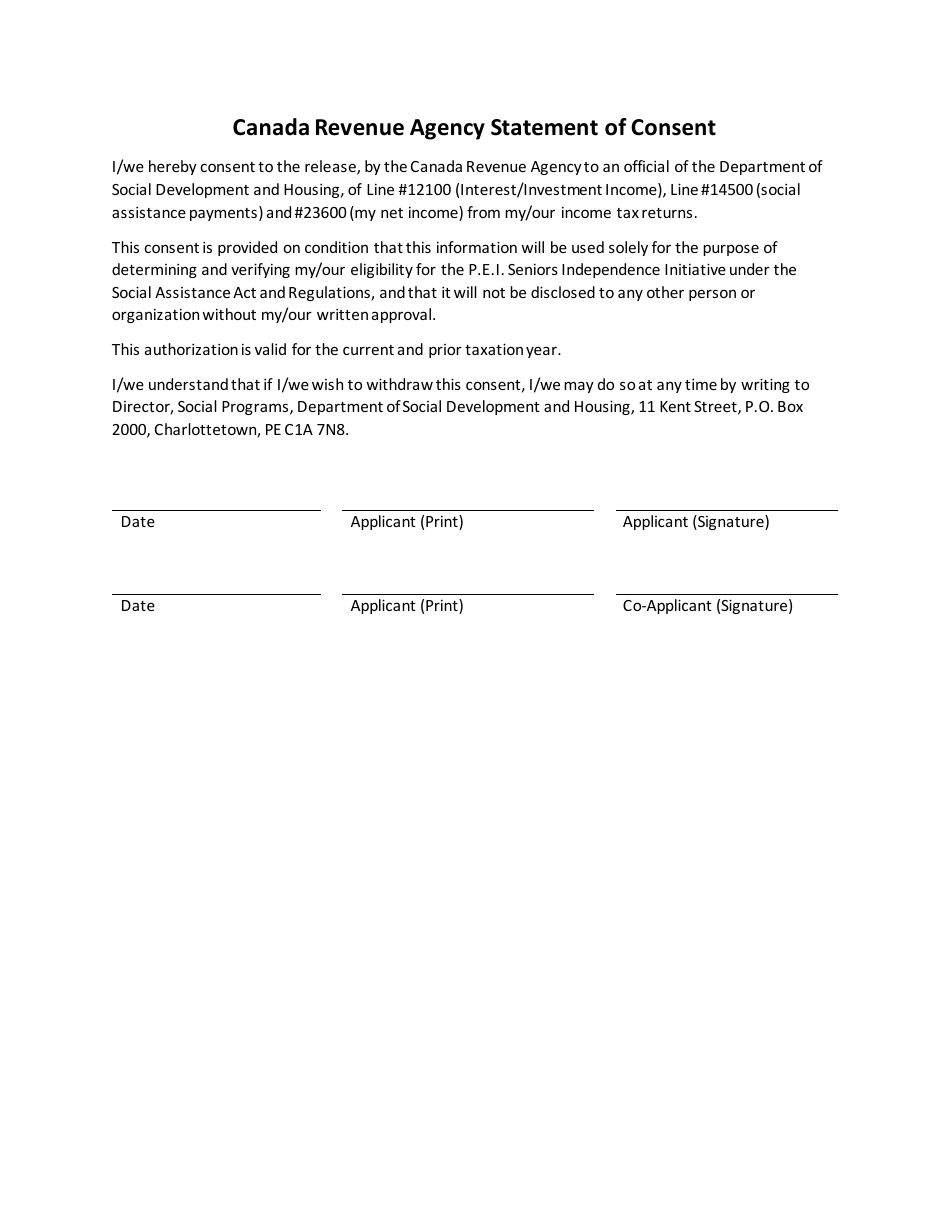

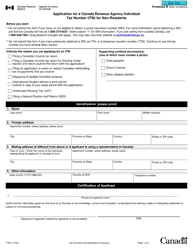

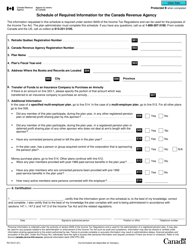

Canada Revenue Agency Statement of Consent - Prince Edward Island, Canada

The Canada Revenue Agency Statement of Consent is a document specific to Prince Edward Island, Canada. It is used to grant consent for the Canada Revenue Agency (CRA) to disclose tax-related information to a third party, as authorized by the individual taxpayer. This document allows the CRA to communicate with the designated third party about tax matters on behalf of the taxpayer.

The Canada Revenue Agency Statement of Consent is filed by individuals or businesses in Prince Edward Island, Canada who need to provide consent for the release of their tax information to a third party.

FAQ

Q: What is the Canada Revenue Agency Statement of Consent?

A: The Canada Revenue Agency Statement of Consent is a document used in Prince Edward Island, Canada.

Q: What is the purpose of the Statement of Consent?

A: The purpose of the Statement of Consent is to provide consent for the Canada Revenue Agency to disclose tax information to a third party.

Q: Who needs to complete the Statement of Consent?

A: Any individual or business that wishes to authorize the Canada Revenue Agency to disclose their tax information to a third party needs to complete the Statement of Consent.

Q: Are there any fees associated with the Statement of Consent?

A: No, there are no fees associated with obtaining or submitting the Statement of Consent.