This version of the form is not currently in use and is provided for reference only. Download this version of

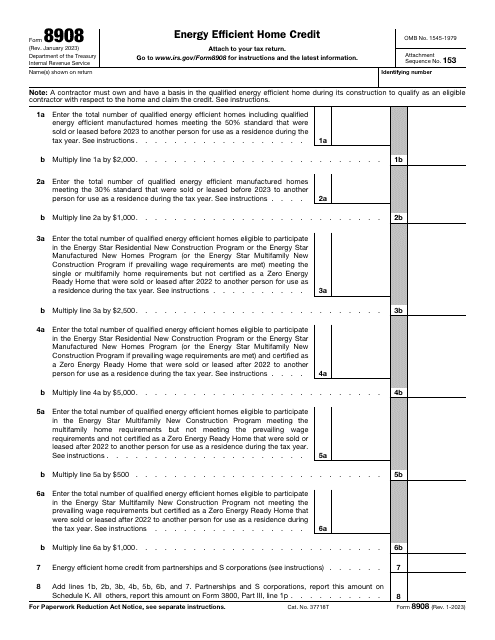

IRS Form 8908

for the current year.

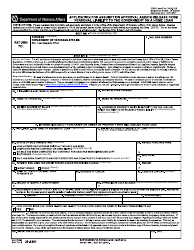

IRS Form 8908 Energy Efficient Home Credit

What Is IRS Form 8908?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on January 1, 2023. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8908?

A: IRS Form 8908 is a tax form used to claim the Energy Efficient Home Credit.

Q: What is the Energy Efficient Home Credit?

A: The Energy Efficient Home Credit is a tax credit for homeowners who make qualified energy-efficient improvements to their homes.

Q: Who is eligible for the Energy Efficient Home Credit?

A: Homeowners who make qualified energy-efficient improvements to their main residences and meet specific criteria are eligible for the credit.

Q: What types of improvements qualify for the Energy Efficient Home Credit?

A: Improvements such as installing energy-efficient windows, doors, insulation, and certain heating and cooling systems may qualify for the credit.

Q: How much is the Energy Efficient Home Credit?

A: The credit is equal to 30% of the cost of qualifying improvements, up to a maximum of $1,500.

Q: How do I claim the Energy Efficient Home Credit?

A: To claim the credit, you need to complete and file IRS Form 8908 along with your federal income tax return.

Q: What documentation do I need to support my claim for the Energy Efficient Home Credit?

A: You may need to keep receipts and other records to support your claim for the credit. Consult IRS guidelines or a tax professional for specific requirements.

Q: Is the Energy Efficient Home Credit still available?

A: No, the Energy Efficient Home Credit expired at the end of 2017 and is no longer available for new installations. However, it may still be applicable for certain installations made before that date.

Q: Are there any other tax credits available for energy-efficient home improvements?

A: Yes, there may be other tax credits available for certain energy-efficient home improvements. Consult IRS guidelines or a tax professional for information on current credits.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8908 through the link below or browse more documents in our library of IRS Forms.