This version of the form is not currently in use and is provided for reference only. Download this version of

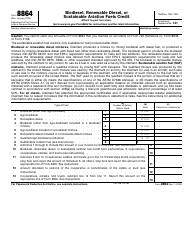

Instructions for IRS Form 8835

for the current year.

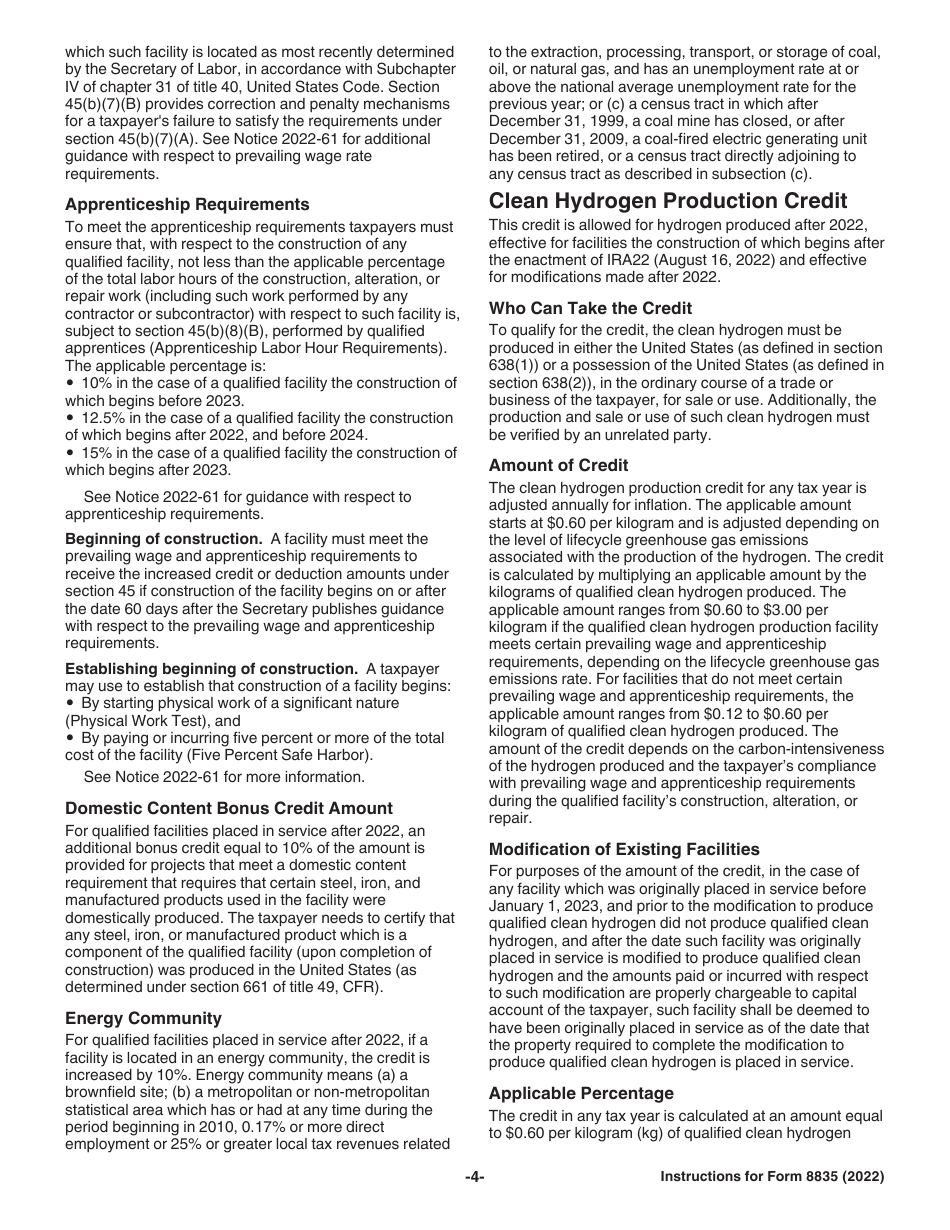

Instructions for IRS Form 8835 Renewable Electricity Production Credit

This document contains official instructions for IRS Form 8835 , Renewable Electricity Production Credit - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8835 is available for download through this link.

FAQ

Q: What is IRS Form 8835?

A: IRS Form 8835 is a form used to claim the Renewable Electricity Production Credit.

Q: What is the Renewable Electricity Production Credit?

A: The Renewable Electricity Production Credit is a tax credit offered to individuals and businesses for the production of electricity from renewable resources.

Q: Who can claim the Renewable Electricity Production Credit?

A: Individuals, partnerships, corporations, estates, and trusts engaged in the production of electricity from renewable resources can claim this credit.

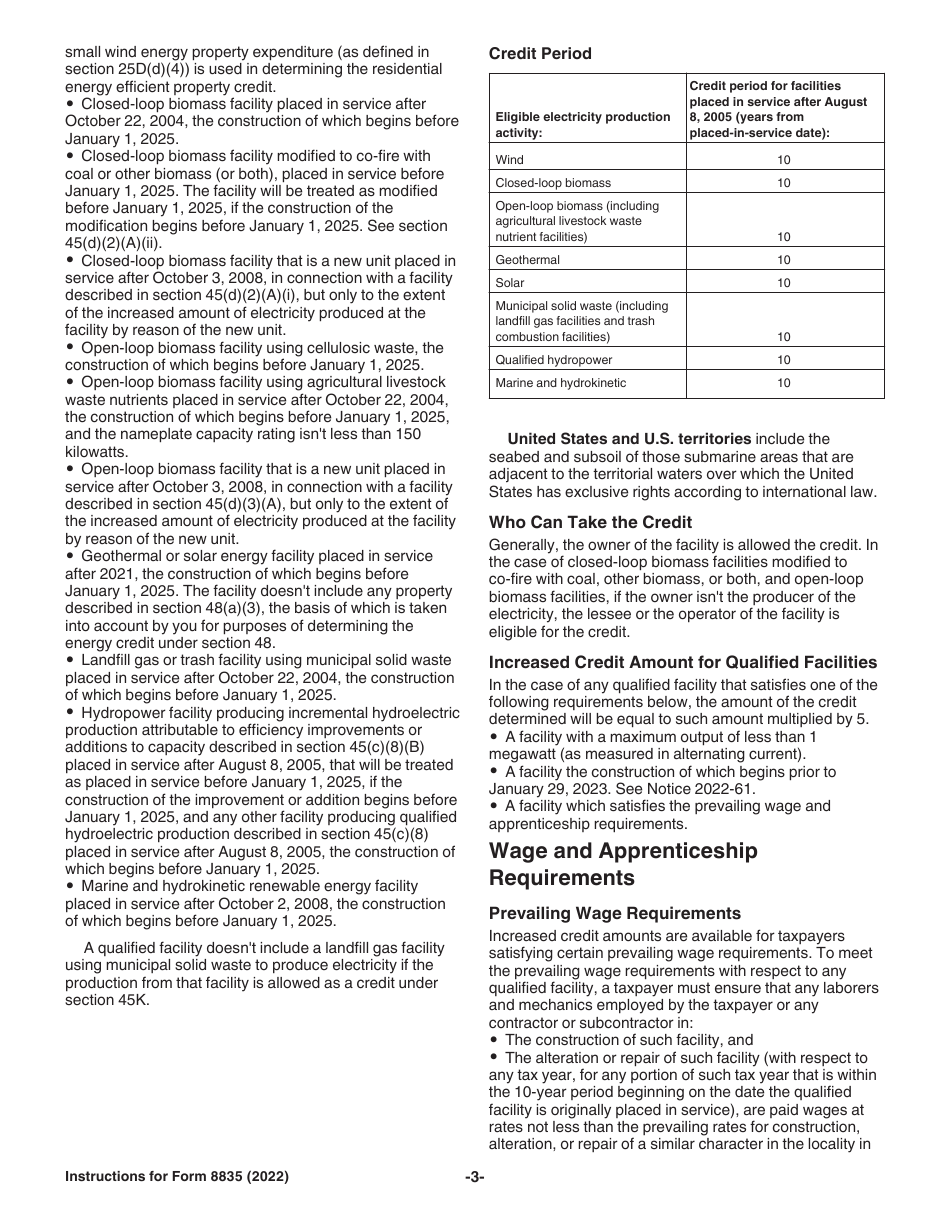

Q: What are considered renewable resources for this credit?

A: Renewable resources include wind, closed-loop biomass, open-loop biomass, geothermal energy, municipal solid waste, qualified hydropower production, and marine and hydrokinetic renewable energy.

Q: How much is the credit?

A: The credit is 2.4 cents per kilowatt-hour (kWh) of electricity produced from qualified energy sources.

Q: Are there any limitations on claiming the credit?

A: Yes, there are various limitations and requirements that must be met in order to claim the credit. These include specific deadlines for starting construction, ownership requirements, and capacity limitations.

Q: Are there any other forms or documents required to claim the credit?

A: Yes, additional forms and documentation may be required depending on the specific circumstances of the taxpayer. These may include Form 3468, Form 3800, and various supporting documents.

Q: Is there a deadline for claiming the credit?

A: Yes, the renewable electricity production credit must be claimed on the taxpayer's annual federal income tax return. The specific deadline for filing the return and claiming the credit is usually April 15th of the following year, unless an extension has been requested.

Q: Can I carry forward any unused credit?

A: Yes, any unused credit can generally be carried forward for up to 20 years.

Instruction Details:

- This 7-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.