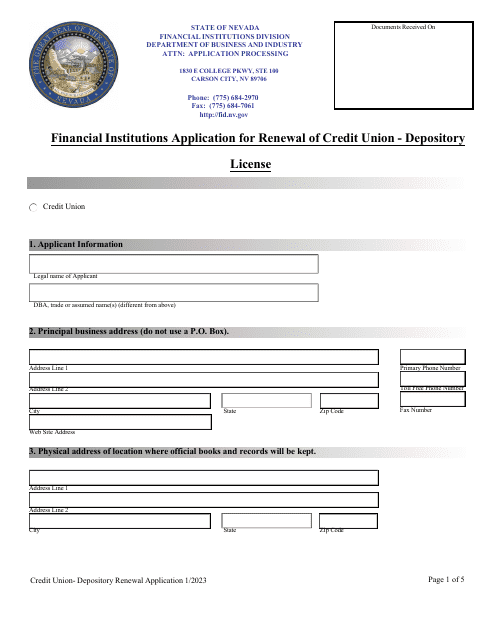

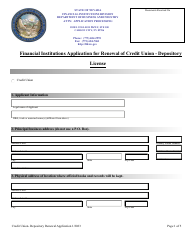

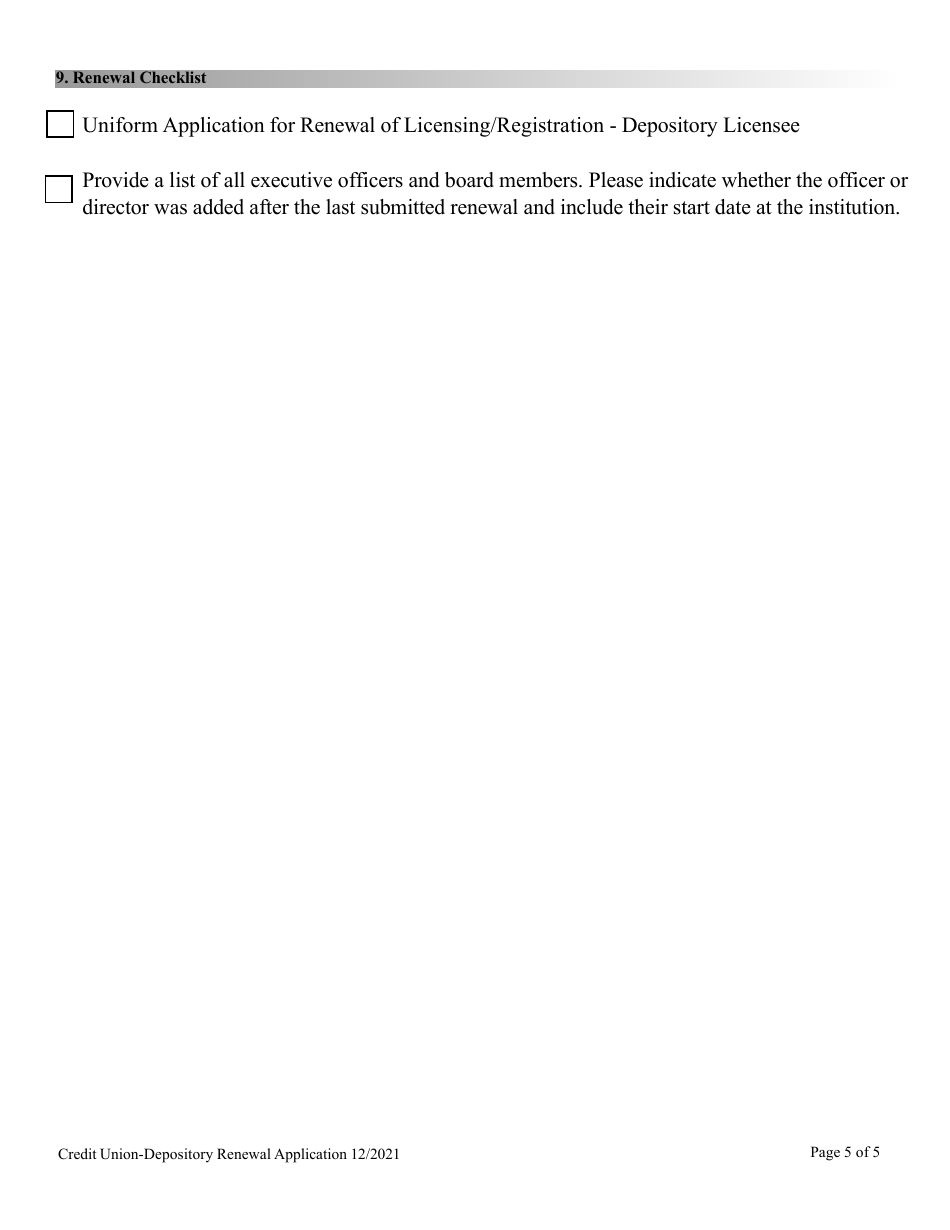

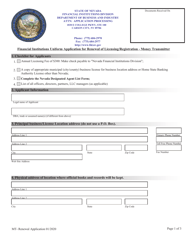

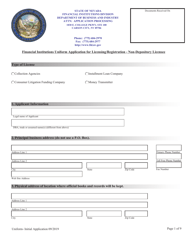

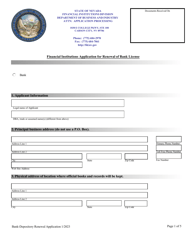

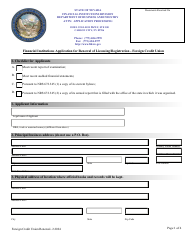

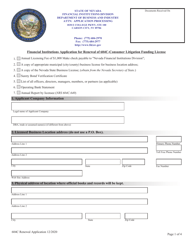

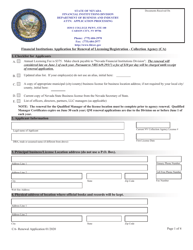

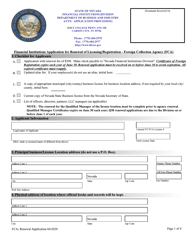

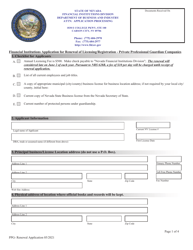

Financial Institutions Application for Renewal of Credit Union - Depository License - Nevada

Financial Institutions Application for Renewal of Credit Union - Depository License is a legal document that was released by the Nevada Department of Business and Industry - a government authority operating within Nevada.

FAQ

Q: What is the application for renewal of a credit union depository license in Nevada?

A: The application for renewal of a credit union depository license in Nevada is a process by which a credit union must apply to the state regulatory authority for permission to continue operating as a depository institution.

Q: Who is required to apply for the renewal of a credit union depository license in Nevada?

A: Any credit union operating as a depository institution in Nevada is required to apply for the renewal of their license.

Q: What is the purpose of the renewal process for a credit union depository license in Nevada?

A: The purpose of the renewal process is to ensure that credit unions continue to meet the regulatory requirements and maintain financial stability to operate as a depository institution.

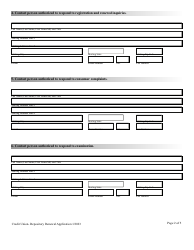

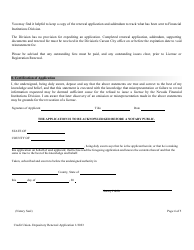

Q: What are the regulatory requirements for the renewal of a credit union depository license in Nevada?

A: The regulatory requirements for renewal include financial statements, business plan, compliance with state and federal laws, and other documentation requested by the regulatory authority.

Q: How often does a credit union in Nevada need to renew its depository license?

A: The renewal of a credit union depository license in Nevada typically occurs every one to three years, depending on the specific requirements of the regulatory authority.

Q: What happens if a credit union fails to renew its depository license in Nevada?

A: If a credit union fails to renew its depository license, it may face penalties or be required to cease its operations as a depository institution.

Form Details:

- Released on January 1, 2023;

- The latest edition currently provided by the Nevada Department of Business and Industry;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Nevada Department of Business and Industry.