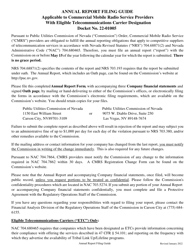

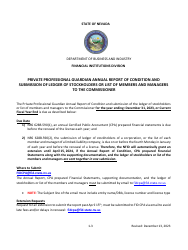

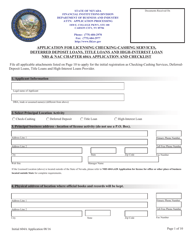

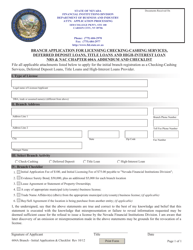

Annual Report of Conditions to the Commissioner - Deferred Deposit Loans, High Interest Loans, Title Loans, and / or Check Cashing Services - Nevada

Annual Report of Conditions to the Commissioner - Deferred Deposit Loans, High Interest Loans, Check Cashing Services is a legal document that was released by the Nevada Department of Business and Industry - a government authority operating within Nevada.

FAQ

Q: What is an Annual Report of Conditions to the Commissioner?

A: The Annual Report of Conditions is a report that provides information about the operations and financial condition of entities offering deferred deposit loans, high interest loans, title loans, and/or check cashing services in Nevada.

Q: What are deferred deposit loans?

A: Deferred deposit loans, also known as payday loans, are short-term loans with high interest rates that are typically due on the borrower's next payday.

Q: What are high interest loans?

A: High interest loans are loans with interest rates that are significantly higher than the average market rate.

Q: What are title loans?

A: Title loans are secured loans where borrowers use their vehicle title as collateral.

Q: What are check cashing services?

A: Check cashing services are businesses that cash checks for a fee.

Q: Who is the Commissioner?

A: The Commissioner refers to the Commissioner of the Financial Institutions Division, the regulatory authority responsible for overseeing financial institutions in Nevada.

Q: Why is the Annual Report of Conditions important?

A: The Annual Report of Conditions provides transparency and accountability by allowing the Commissioner to monitor the operations and financial health of entities offering these types of services.

Q: Who needs to file the Annual Report of Conditions?

A: Entities offering deferred deposit loans, high interest loans, title loans, and/or check cashing services in Nevada are required to file the Annual Report of Conditions.

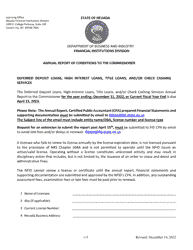

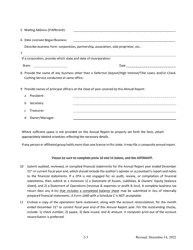

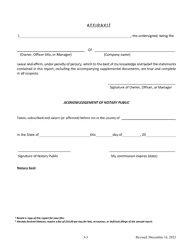

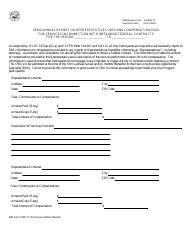

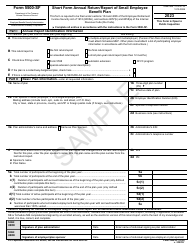

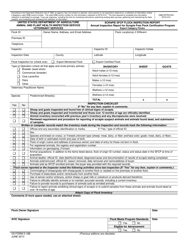

Q: What information is required in the Annual Report of Conditions?

A: The Annual Report of Conditions requires entities to provide detailed information about their operations, financial condition, loan volume, interest rates, loan defaults, and other relevant data.

Form Details:

- Released on December 14, 2022;

- The latest edition currently provided by the Nevada Department of Business and Industry;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Nevada Department of Business and Industry.