This version of the form is not currently in use and is provided for reference only. Download this version of

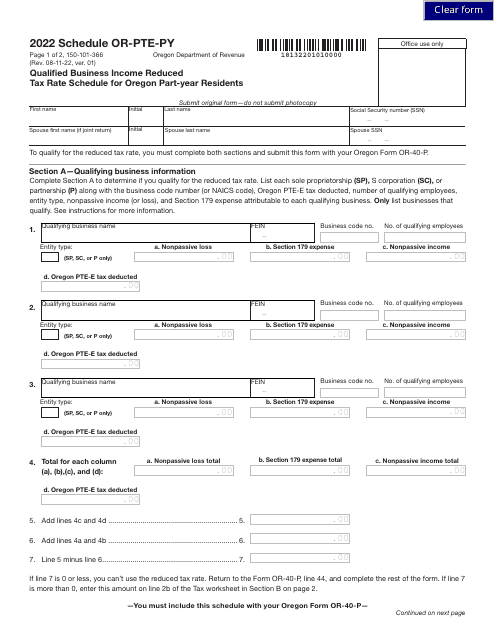

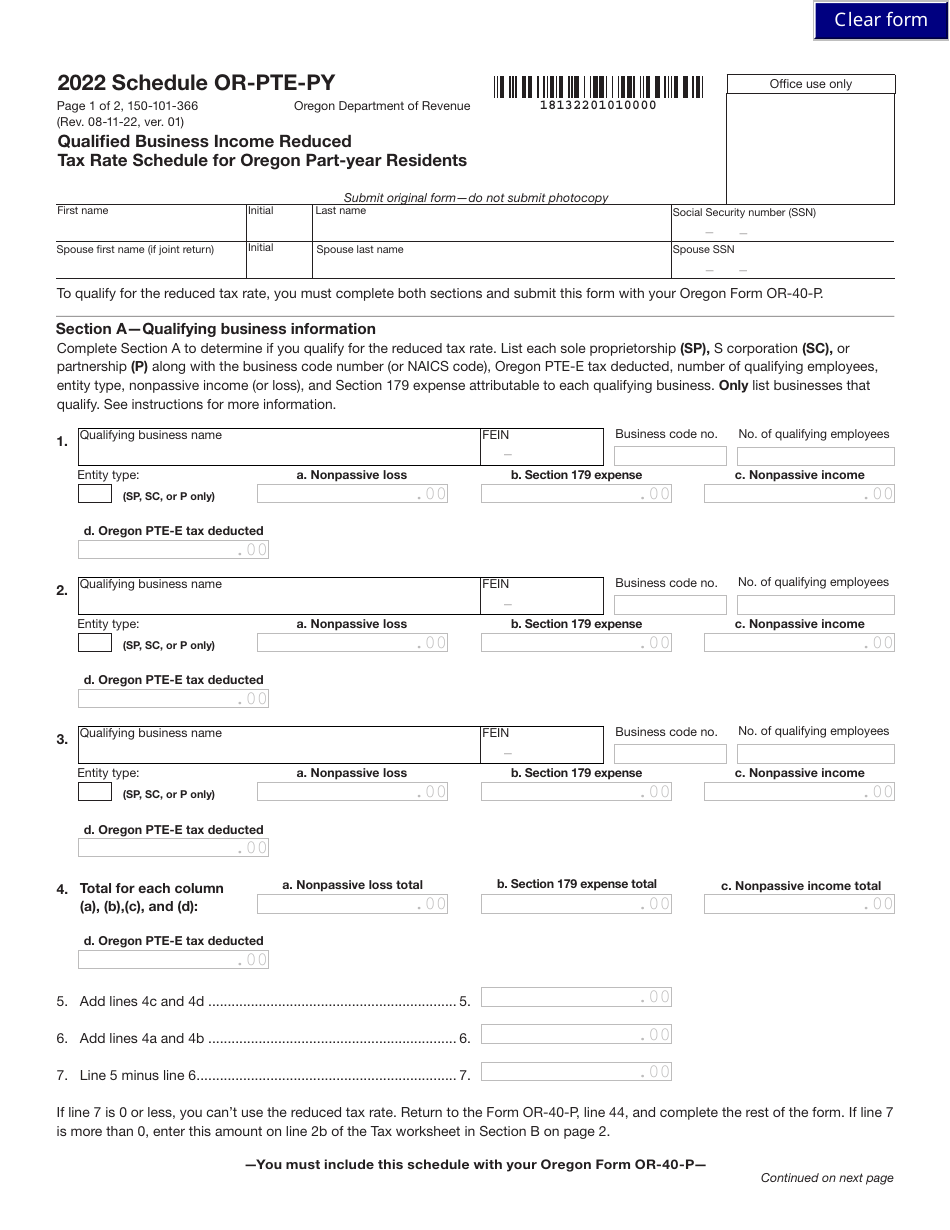

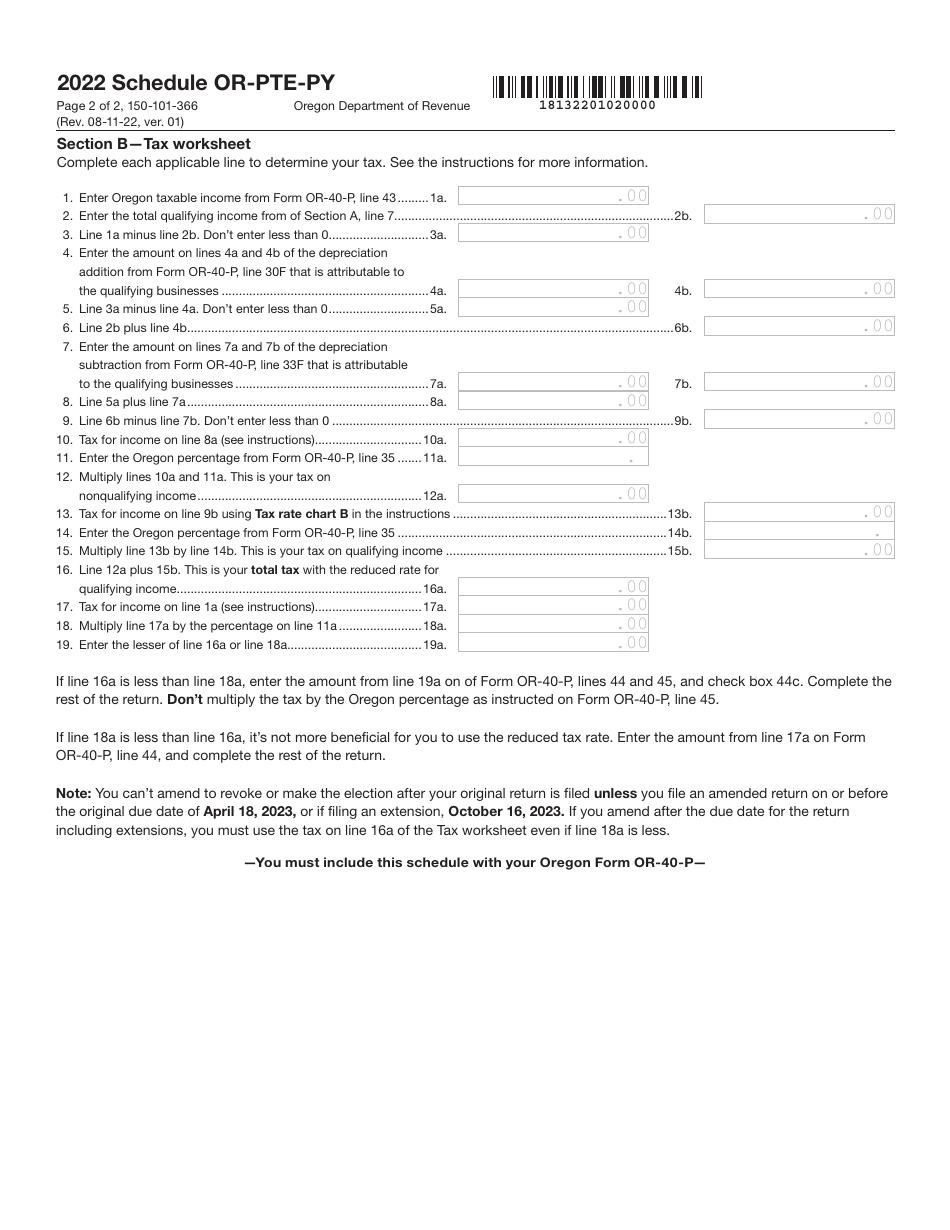

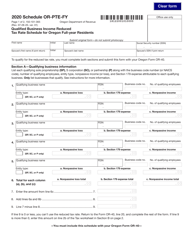

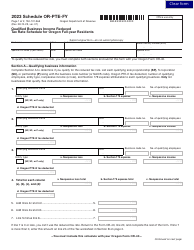

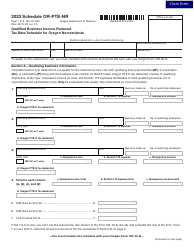

Form 150-101-366 Schedule OR-PTE-PY

for the current year.

Form 150-101-366 Schedule OR-PTE-PY Qualified Business Income Reduced Tax Rate Schedule for Oregon Part-Year Residents - Oregon

What Is Form 150-101-366 Schedule OR-PTE-PY?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 150-101-366 Schedule OR-PTE-PY?

A: Form 150-101-366 Schedule OR-PTE-PY is a schedule used by Oregon part-year residents to calculate the qualified business income reduced tax rate.

Q: Who should use Form 150-101-366 Schedule OR-PTE-PY?

A: Oregon part-year residents should use Form 150-101-366 Schedule OR-PTE-PY.

Q: What is the purpose of Form 150-101-366 Schedule OR-PTE-PY?

A: The purpose of Form 150-101-366 Schedule OR-PTE-PY is to calculate the reduced tax rate for qualified business income for Oregon part-year residents.

Q: What is qualified business income?

A: Qualified business income is the net income from a qualified trade or business.

Q: What is the reduced tax rate for qualified business income?

A: The reduced tax rate for qualified business income is a lower tax rate that applies to certain types of income from a qualified trade or business.

Q: What do Oregon part-year residents need to include in Form 150-101-366 Schedule OR-PTE-PY?

A: Oregon part-year residents need to include their qualified business income and other required information in Form 150-101-366 Schedule OR-PTE-PY.

Form Details:

- Released on August 11, 2022;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-101-366 Schedule OR-PTE-PY by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.