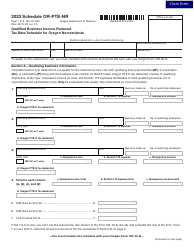

This version of the form is not currently in use and is provided for reference only. Download this version of

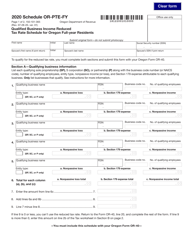

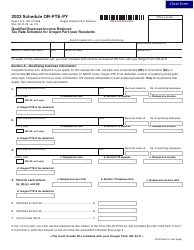

Form 150-101-365 Schedule OR-PTE-FY

for the current year.

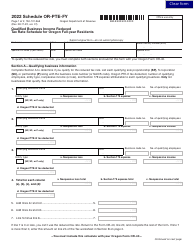

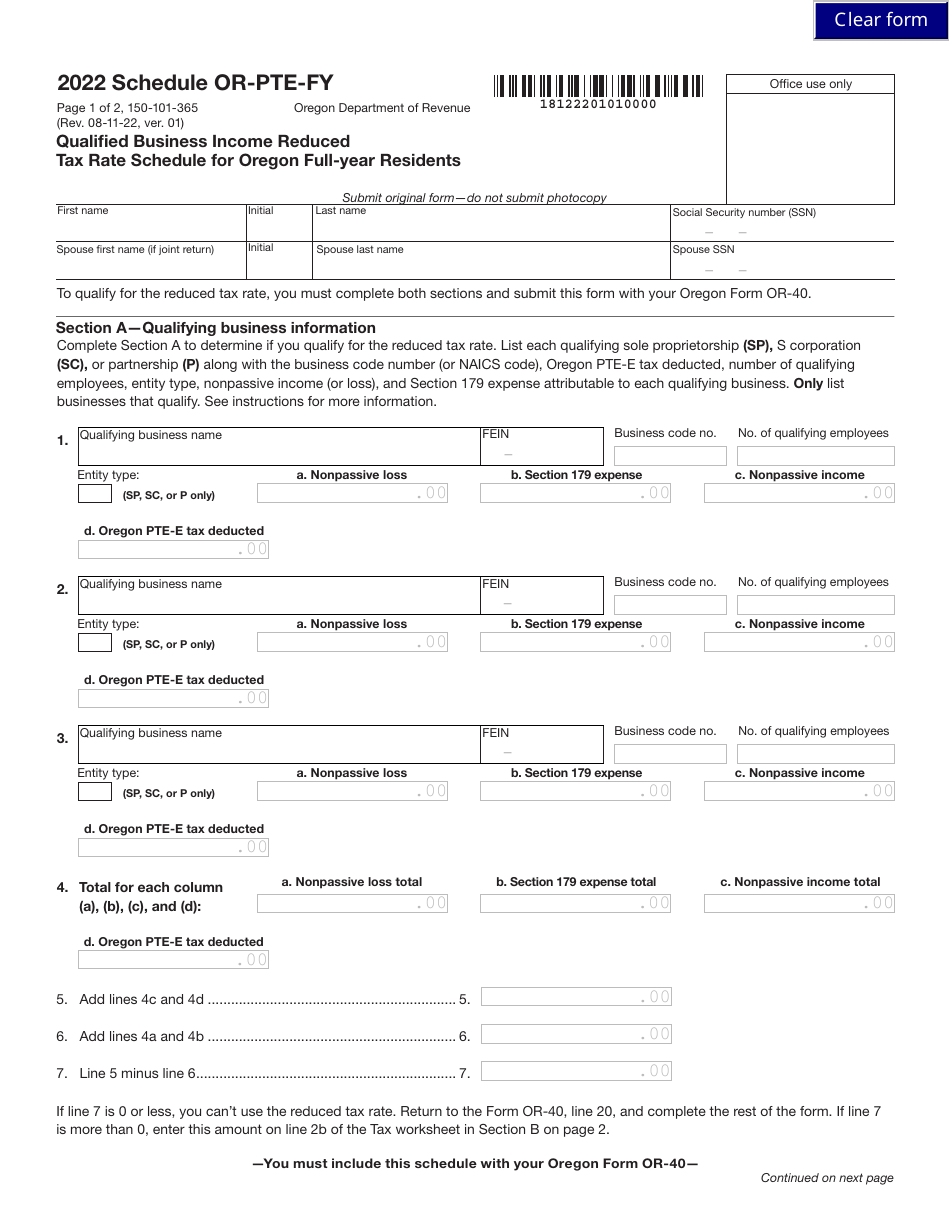

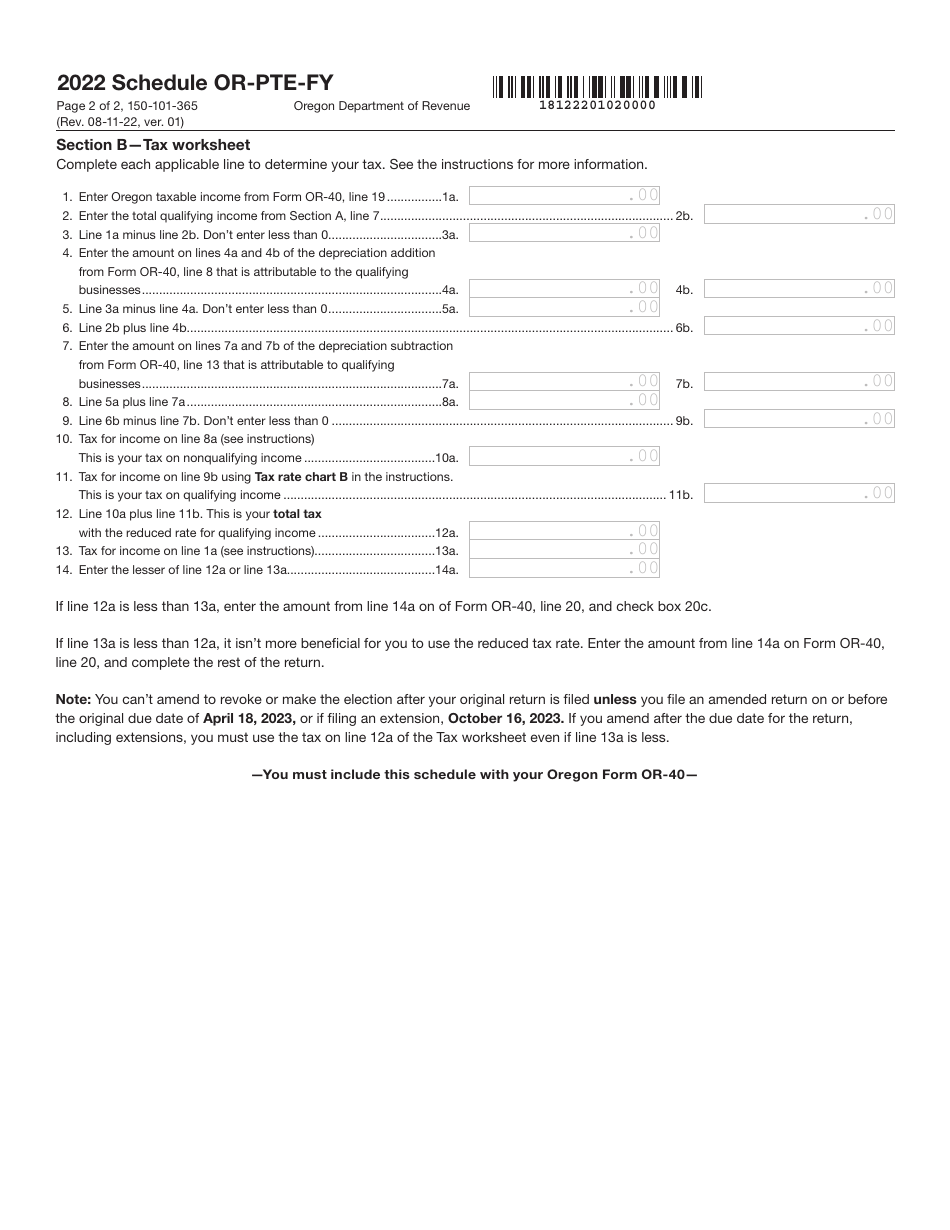

Form 150-101-365 Schedule OR-PTE-FY Qualified Business Income Reduced Tax Rate Schedule for Oregon Full-Year Residents - Oregon

What Is Form 150-101-365 Schedule OR-PTE-FY?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 150-101-365?

A: Form 150-101-365 is the Schedule OR-PTE-FY Qualified Business IncomeReduced Tax Rate Schedule for Oregon Full-Year Residents.

Q: Who should use Form 150-101-365?

A: Oregon full-year residents who have qualified business income and want to calculate their reduced tax rate should use Form 150-101-365.

Q: What is the purpose of Form 150-101-365?

A: The purpose of Form 150-101-365 is to determine the reduced tax rate for qualified business income for Oregon full-year residents.

Q: What is the reduced tax rate for qualified business income?

A: The reduced tax rate for qualified business income is 3.5% for Oregon full-year residents.

Q: Are there any eligibility requirements to use Form 150-101-365?

A: Yes, there are eligibility requirements to use Form 150-101-365. You must be an Oregon full-year resident and have qualified business income.

Q: Can I e-file Form 150-101-365?

A: No, you cannot e-file Form 150-101-365. It must be filed by mail with the Oregon Department of Revenue.

Q: When is the deadline to file Form 150-101-365?

A: The deadline to file Form 150-101-365 is the same as the deadline for filing your Oregon state income tax return, which is usually April 15th.

Q: Do I need to include Form 150-101-365 with my federal tax return?

A: No, Form 150-101-365 is specific to Oregon state taxes and should not be included with your federal tax return.

Q: Is there a penalty for late filing of Form 150-101-365?

A: Yes, there may be penalties for late filing of Form 150-101-365. It is important to file your taxes on time to avoid any penalties or interest charges.

Form Details:

- Released on August 11, 2022;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-101-365 Schedule OR-PTE-FY by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.