This version of the form is not currently in use and is provided for reference only. Download this version of

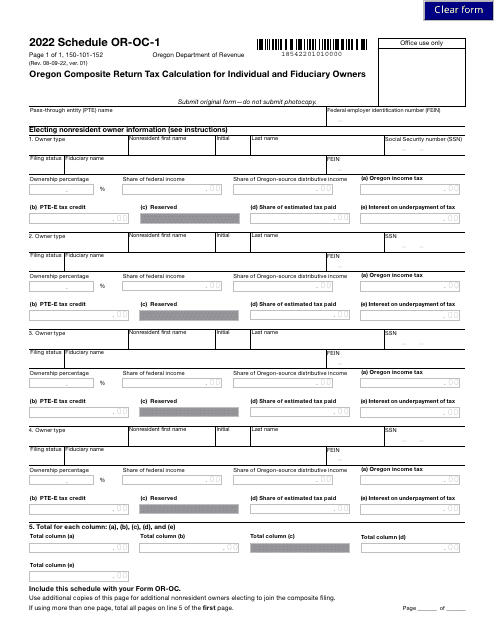

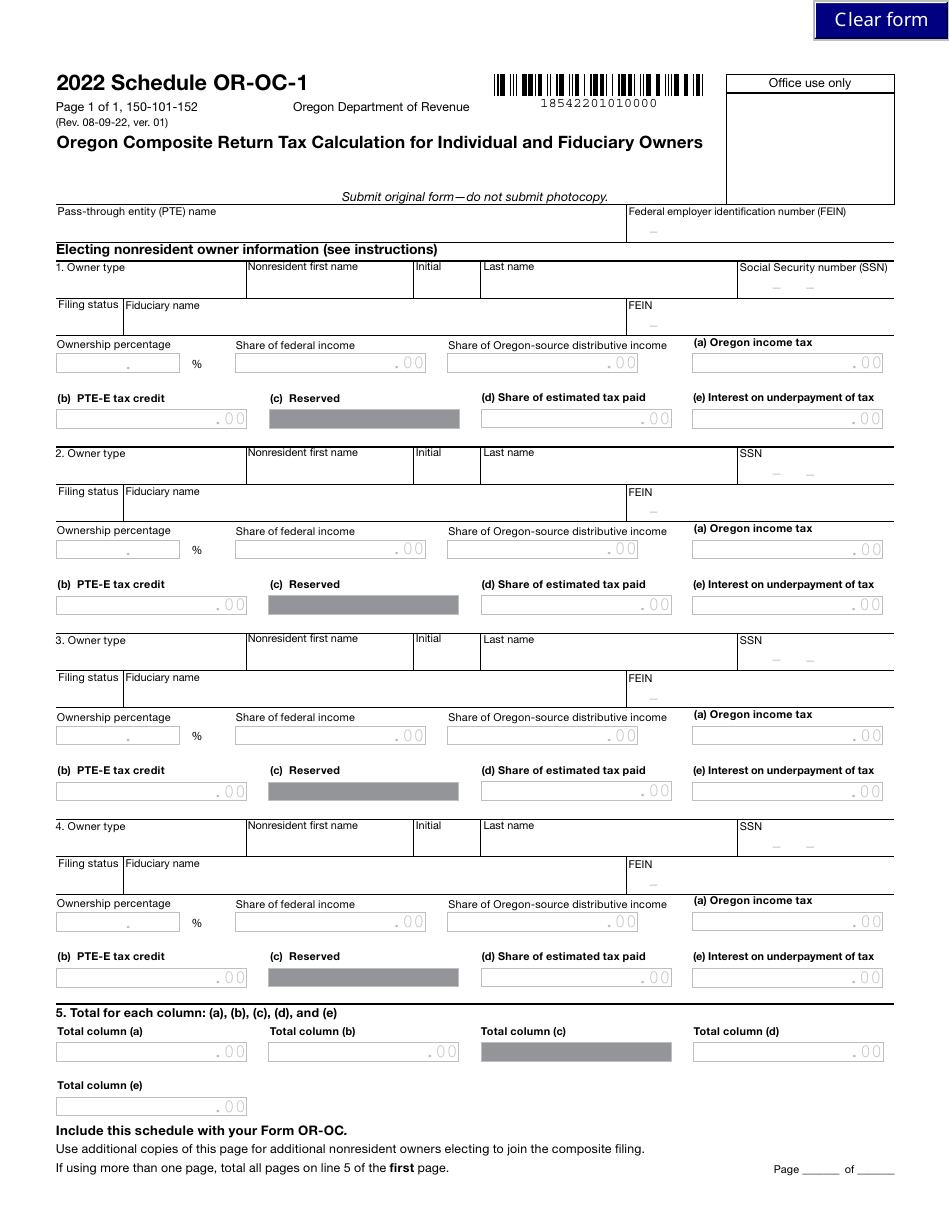

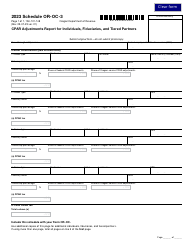

Form 150-101-152 Schedule OR-OC-1

for the current year.

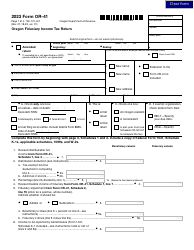

Form 150-101-152 Schedule OR-OC-1 Oregon Composite Return Tax Calculation for Individual and Fiduciary Owners - Oregon

What Is Form 150-101-152 Schedule OR-OC-1?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-101-152?

A: Form 150-101-152 is the Schedule OR-OC-1 for Oregon Composite Return Tax Calculation for Individual and Fiduciary Owners.

Q: What is the purpose of Schedule OR-OC-1?

A: The purpose of Schedule OR-OC-1 is to calculate the Oregon Composite Return Tax for Individual and Fiduciary Owners.

Q: Who needs to file Schedule OR-OC-1?

A: Individual and fiduciary owners who want to file a composite return for Oregon need to file Schedule OR-OC-1.

Q: What information is required on Schedule OR-OC-1?

A: Schedule OR-OC-1 requires information about the individual and fiduciary owners, their income, deductions, and credits.

Q: Is there a deadline for filing Schedule OR-OC-1?

A: Yes, Schedule OR-OC-1 must be filed by the due date of the Oregon composite return, which is generally April 15th.

Q: Are there any penalties for late filing of Schedule OR-OC-1?

A: Yes, there may be penalties for late filing of Schedule OR-OC-1. It is advisable to file the form on time to avoid any penalties.

Q: Do I need to include any supporting documents with Schedule OR-OC-1?

A: Yes, you may need to include supporting documents such as W-2 forms, 1099 forms, and other relevant tax documents with Schedule OR-OC-1.

Q: Can I amend Schedule OR-OC-1 if I made a mistake?

A: Yes, you can amend Schedule OR-OC-1 if you made a mistake. You will need to file an amended return using Form 150-101-047.

Form Details:

- Released on August 9, 2022;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-101-152 Schedule OR-OC-1 by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.