This version of the form is not currently in use and is provided for reference only. Download this version of

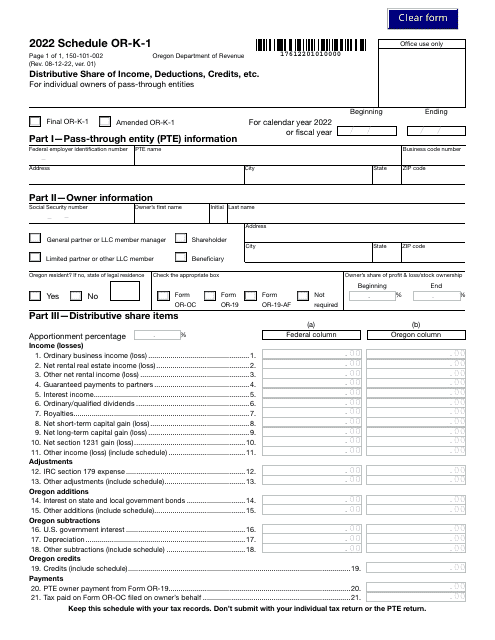

Form 150-101-002 Schedule OR-K-1

for the current year.

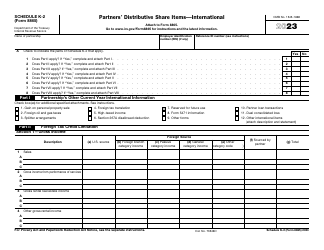

Form 150-101-002 Schedule OR-K-1 Distributive Share of Income, Deductions, Credits, Etc. for Individual Owners of Pass-Through Entities - Oregon

What Is Form 150-101-002 Schedule OR-K-1?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 150-101-002 Schedule OR-K-1?

A: Form 150-101-002 Schedule OR-K-1 is a tax form used by individual owners of pass-through entities in Oregon to report their distributive share of income, deductions, credits, etc.

Q: Who needs to file Form 150-101-002 Schedule OR-K-1?

A: Individual owners of pass-through entities in Oregon need to file Form 150-101-002 Schedule OR-K-1.

Q: What information does Form 150-101-002 Schedule OR-K-1 require?

A: Form 150-101-002 Schedule OR-K-1 requires information about the individual owner's share of income, deductions, credits, etc. from the pass-through entity.

Q: When is the deadline to file Form 150-101-002 Schedule OR-K-1?

A: The deadline to file Form 150-101-002 Schedule OR-K-1 is usually April 15th, but it may vary depending on the tax year and any extensions granted.

Form Details:

- Released on August 12, 2022;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-101-002 Schedule OR-K-1 by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.