This version of the form is not currently in use and is provided for reference only. Download this version of

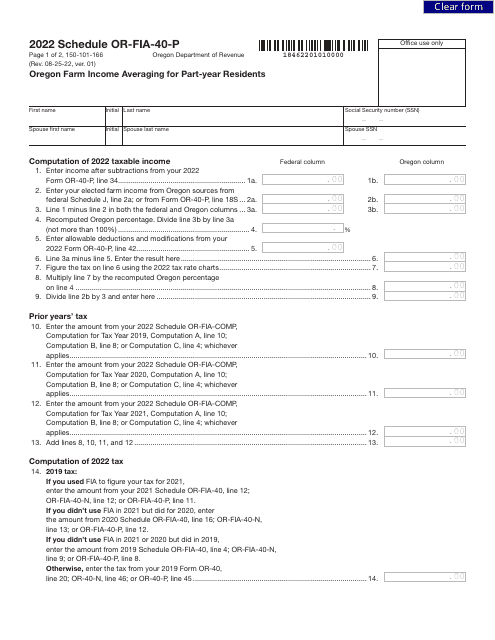

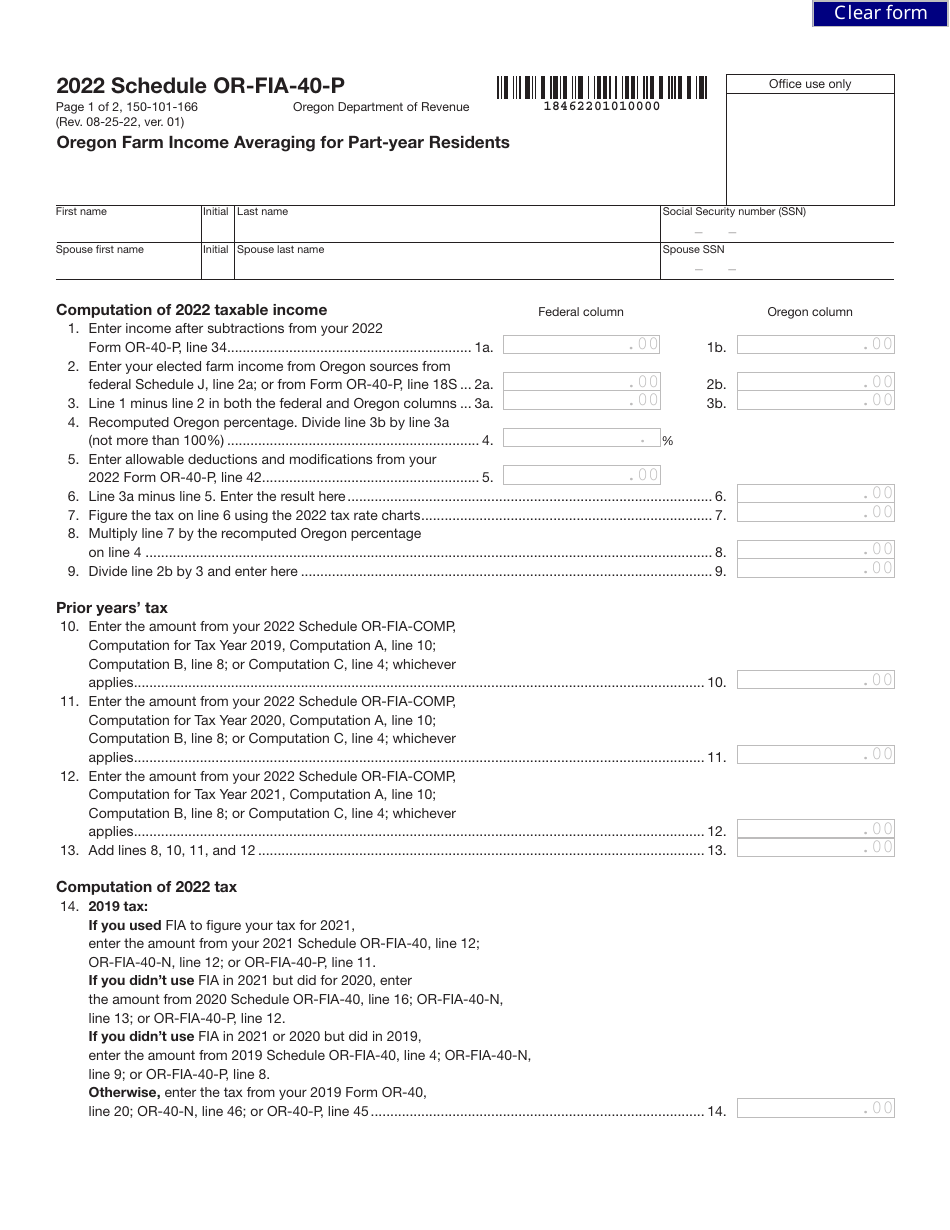

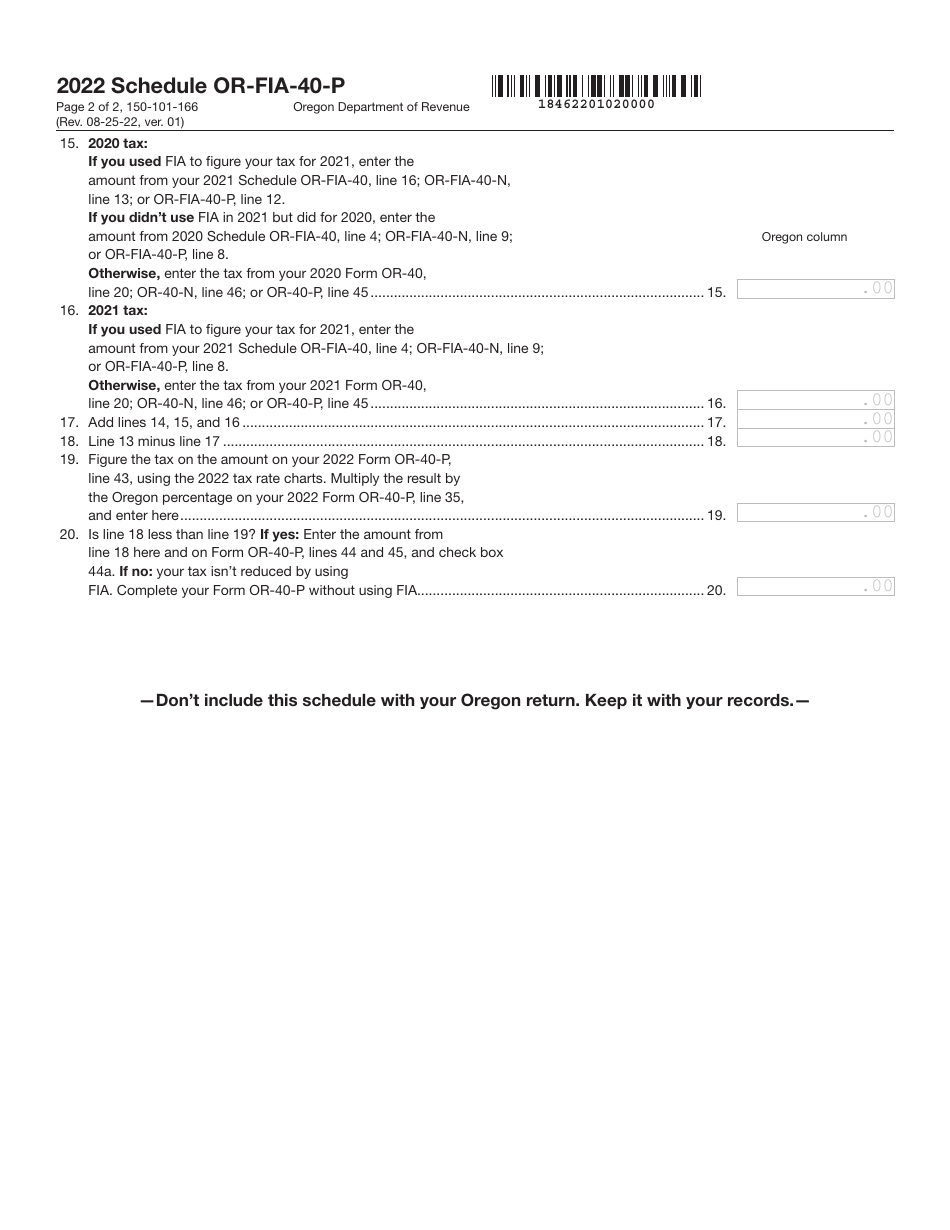

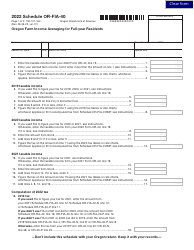

Form 150-101-166 Schedule OR-FIA-40-P

for the current year.

Form 150-101-166 Schedule OR-FIA-40-P Oregon Farm Income Averaging for Part-Year Residents - Oregon

What Is Form 150-101-166 Schedule OR-FIA-40-P?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 150-101-166?

A: Form 150-101-166 is the Schedule OR-FIA-40-P for Oregon Farm Income Averaging for Part-Year Residents in Oregon.

Q: What is the purpose of Form 150-101-166?

A: The purpose of Form 150-101-166 is to allow part-year residents of Oregon who have farm income to average their income over a period of years.

Q: Who should use Form 150-101-166?

A: Part-year residents of Oregon who have farm income should use Form 150-101-166.

Q: What is farm income averaging?

A: Farm income averaging is a tax benefit that allows farmers to average their income over a period of years, reducing the impact of fluctuating income.

Q: How does Form 150-101-166 work?

A: Form 150-101-166 allows part-year residents of Oregon to calculate their farm income average by combining their income from Oregon sources with their farm income from all sources.

Q: What are the eligibility criteria for using Form 150-101-166?

A: To be eligible to use Form 150-101-166, you must have farm income and be a part-year resident of Oregon.

Q: When is Form 150-101-166 due?

A: Form 150-101-166 is due on April 15th of the tax year, or the next business day if April 15th falls on a weekend or holiday.

Q: Are there any tips for filling out Form 150-101-166?

A: Some tips for filling out Form 150-101-166 include carefully reviewing the instructions, gathering all the necessary documents and information, and double-checking your calculations before submitting the form.

Form Details:

- Released on August 25, 2022;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-101-166 Schedule OR-FIA-40-P by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.