This version of the form is not currently in use and is provided for reference only. Download this version of

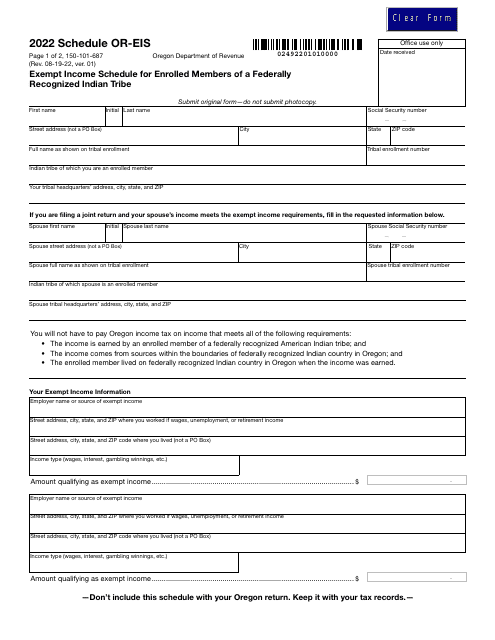

Form 150-101-687 Schedule OR-EIS

for the current year.

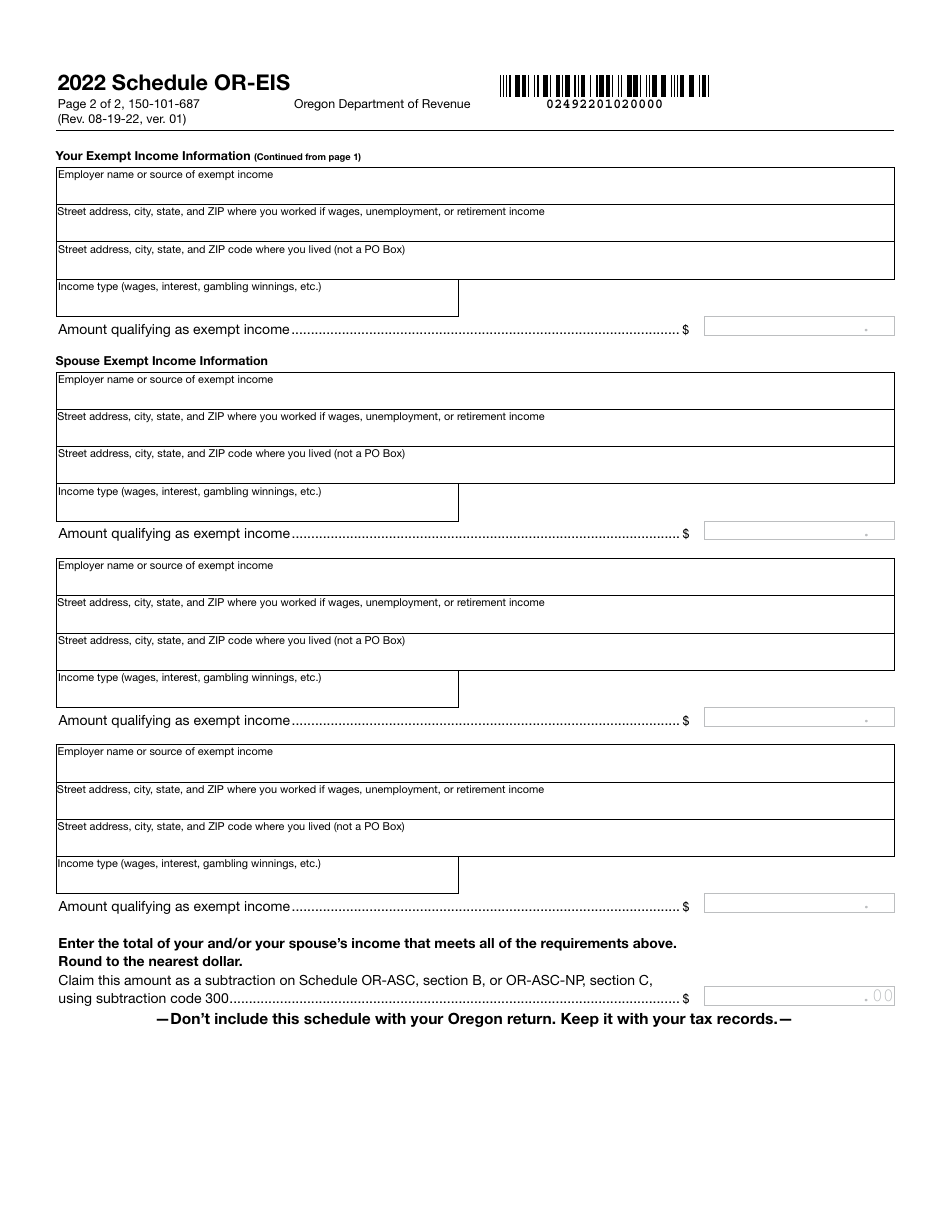

Form 150-101-687 Schedule OR-EIS Exempt Income Schedule for Enrolled Members of a Federally Recognized Indian Tribe - Oregon

What Is Form 150-101-687 Schedule OR-EIS?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-101-687?

A: Form 150-101-687 is the Schedule OR-EIS Exempt Income Schedule for Enrolled Members of a Federally Recognized Indian Tribe in Oregon.

Q: Who needs to file Form 150-101-687?

A: Enrolled Members of a Federally Recognized Indian Tribe in Oregon who have exempt income need to file Form 150-101-687.

Q: What is the purpose of Form 150-101-687?

A: The purpose of Form 150-101-687 is to report exempt income for enrolled members of a federally recognized Indian tribe in Oregon.

Q: Is Form 150-101-687 specific to Oregon?

A: Yes, Form 150-101-687 is specific to enrolled members of federally recognized Indian tribes in Oregon.

Q: Is Form 150-101-687 for individuals or businesses?

A: Form 150-101-687 is for individuals who are enrolled members of federally recognized Indian tribes in Oregon.

Q: What does exempt income mean?

A: Exempt income refers to income that is not subject to taxation. Enrolled members of federally recognized Indian tribes may have certain types of income that are exempt from state taxes.

Q: Are all enrolled members of federally recognized Indian tribes exempt from state taxes?

A: No, not all income earned by enrolled members of federally recognized Indian tribes is exempt from state taxes. Form 150-101-687 is specifically for reporting exempt income.

Q: What happens after I file Form 150-101-687?

A: After filing Form 150-101-687, the Oregon Department of Revenue will review your information and determine if you are eligible for exemptions.

Q: Are there any deadlines for filing Form 150-101-687?

A: Yes, Form 150-101-687 must be filed by the due date for your Oregon tax return. The specific deadline can vary, so it's important to check with the Oregon Department of Revenue.

Q: Can I file Form 150-101-687 electronically?

A: Yes, you can file Form 150-101-687 electronically if you are filing your Oregon tax return electronically.

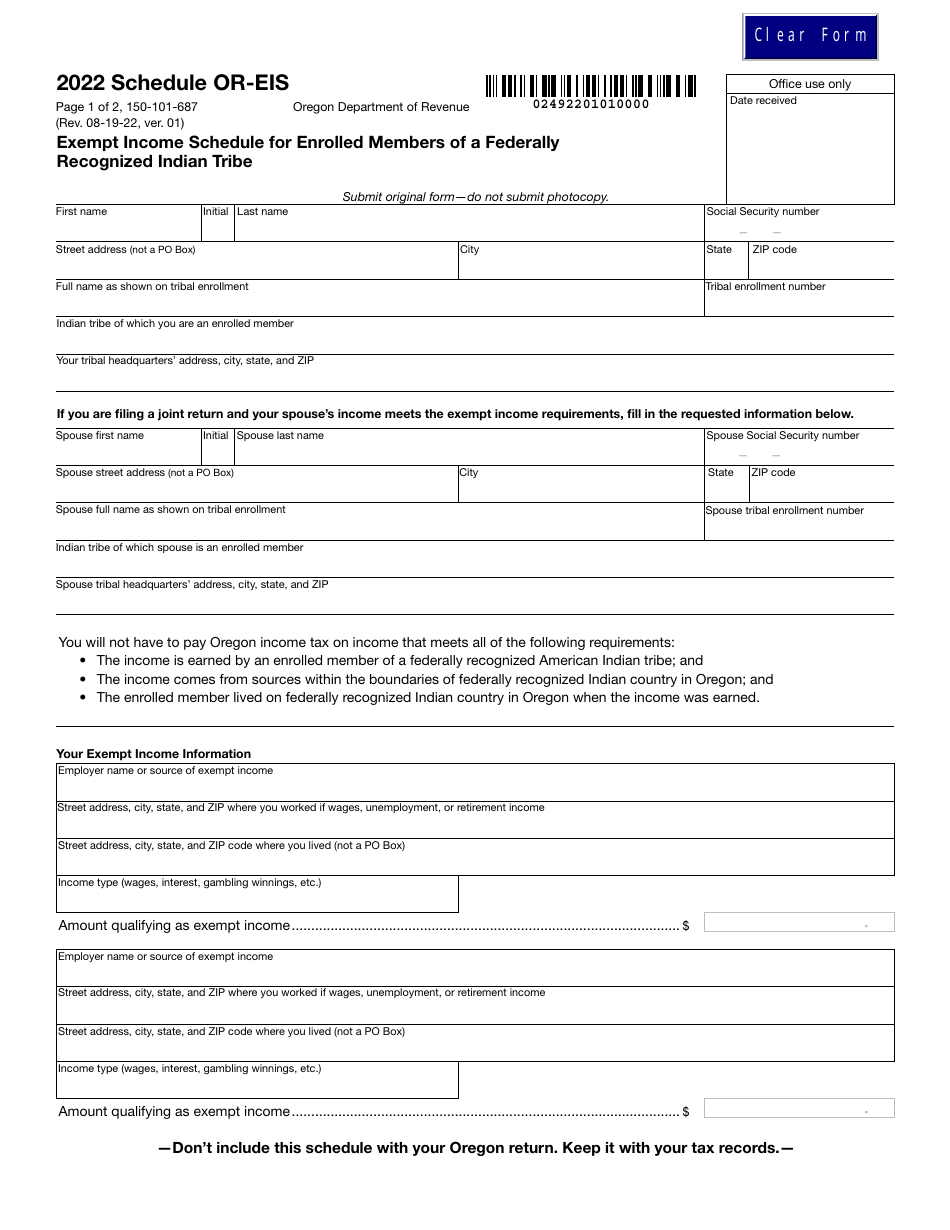

Q: Can I claim multiple types of exempt income on Form 150-101-687?

A: Yes, you can claim multiple types of exempt income on Form 150-101-687. The form includes sections for different types of exempt income.

Q: Do I need any supporting documents when filing Form 150-101-687?

A: It is recommended to keep records of your exempt income, but you may not need to submit supporting documents with Form 150-101-687. However, you should have the necessary documentation available in case it is requested by the Oregon Department of Revenue.

Q: What should I do if I have questions about Form 150-101-687?

A: If you have questions about Form 150-101-687, you can contact the Oregon Department of Revenue for assistance.

Form Details:

- Released on August 19, 2022;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-101-687 Schedule OR-EIS by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.