This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form 150-101-500 Schedule OR-EIC-ITIN

for the current year.

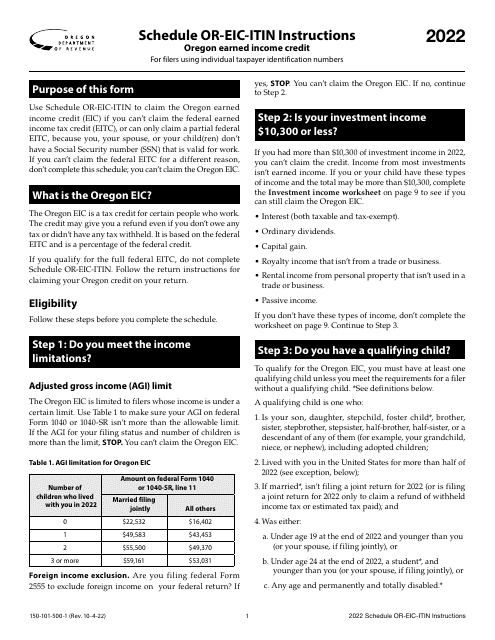

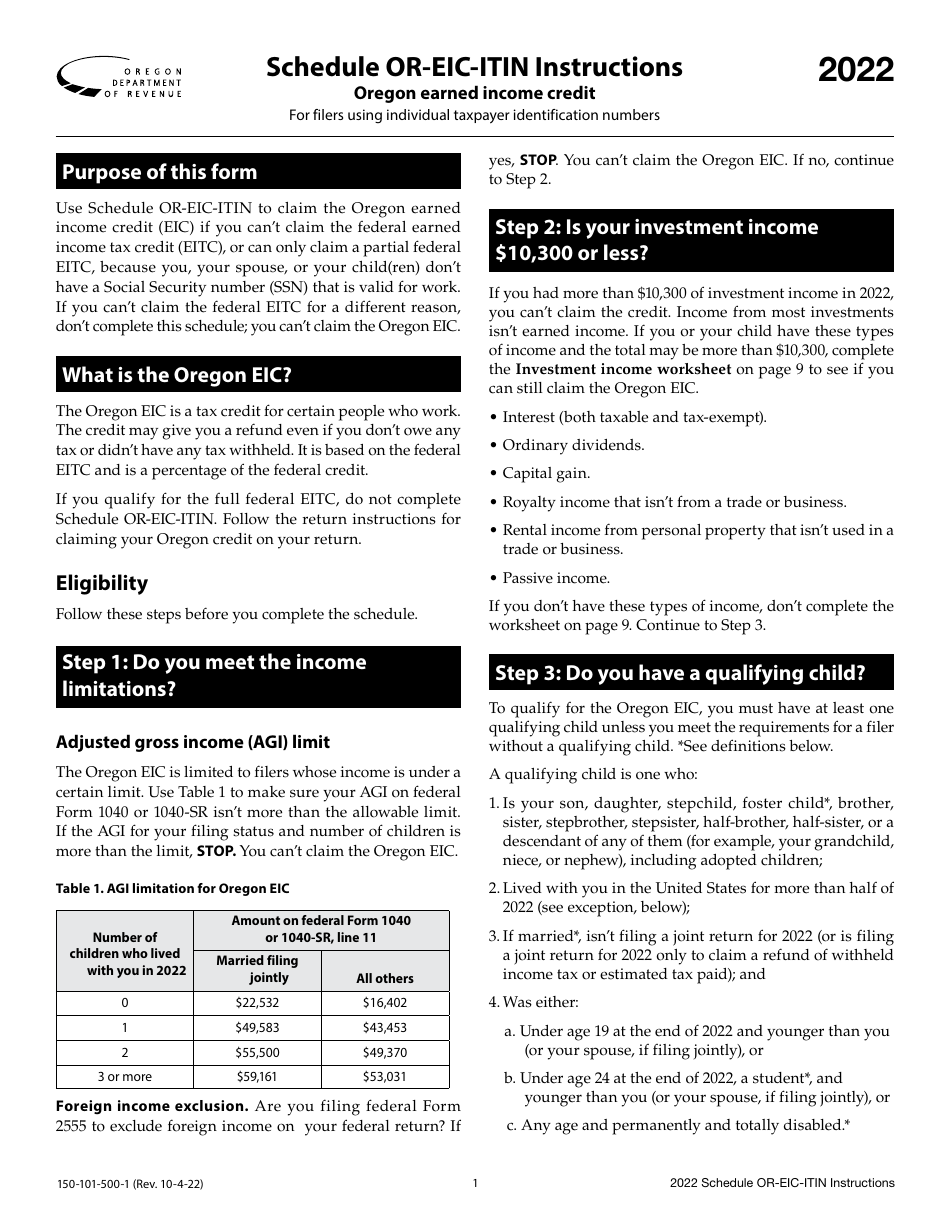

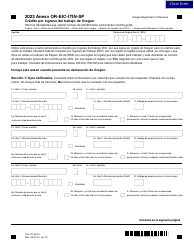

Instructions for Form 150-101-500 Schedule OR-EIC-ITIN Oregon Earned Income Credit for Filers Using Individual Taxpayer Identification Numbers - Oregon

This document contains official instructions for Form 150-101-500 Schedule OR-EIC-ITIN, Oregon Earned Income Credit for Filers Using Individual Taxpayer Identification Numbers - a form released and collected by the Oregon Department of Revenue. An up-to-date fillable Form 150-101-500 Schedule OR-EIC-ITIN is available for download through this link.

FAQ

Q: What is Form 150-101-500?

A: Form 150-101-500 is a tax form used in Oregon to claim the Earned Income Credit for filers who have Individual Taxpayer Identification Numbers (ITINs).

Q: What is the Oregon Earned Income Credit?

A: The Oregon Earned Income Credit is a refundable tax credit designed to help low-income working individuals and families in Oregon.

Q: Who can use Form 150-101-500?

A: Form 150-101-500 is specifically for filers who have Individual Taxpayer Identification Numbers (ITINs) and want to claim the Oregon Earned Income Credit.

Q: How do I qualify for the Oregon Earned Income Credit?

A: To qualify for the Oregon Earned Income Credit, you must meet certain income requirements and have earned income from employment.

Q: When is the deadline to file Form 150-101-500?

A: The deadline to file Form 150-101-500 is typically the same as the deadline for filing your Oregon state tax return, which is usually April 15th each year.

Q: Is the Oregon Earned Income Credit refundable?

A: Yes, the Oregon Earned Income Credit is a refundable tax credit, which means that if the credit exceeds your tax liability, you can receive a refund for the difference.

Q: Can I claim the Oregon Earned Income Credit if I have a Social Security Number?

A: No, Form 150-101-500 is specifically for filers who have Individual Taxpayer Identification Numbers (ITINs). If you have a Social Security Number, you should use a different form to claim the Earned Income Credit in Oregon.

Q: What other tax credits are available in Oregon?

A: There are various tax credits available in Oregon, including the Child and Dependent Care Credit, the Residential Energy Credit, and the Elderly and Disabled Credit. You may be eligible for these credits depending on your circumstances.

Q: Can I e-file Form 150-101-500?

A: Yes, you can e-file Form 150-101-500 using approved tax software or through a tax professional.

Instruction Details:

- This 10-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Oregon Department of Revenue.