This version of the form is not currently in use and is provided for reference only. Download this version of

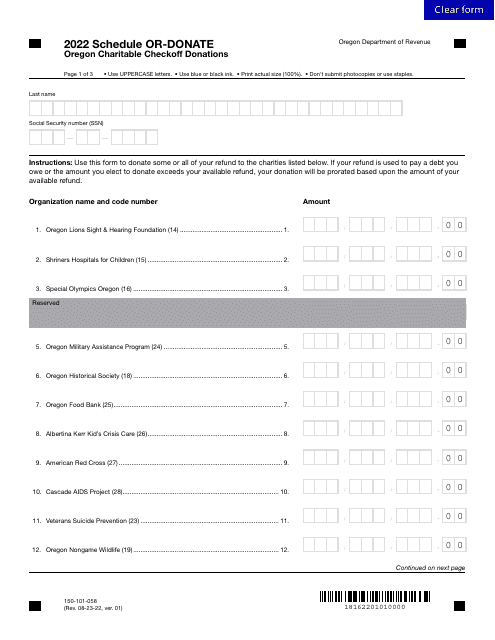

Form 150-101-058 Schedule OR-DONATE

for the current year.

Form 150-101-058 Schedule OR-DONATE Oregon Charitable Checkoff Donations - Oregon

What Is Form 150-101-058 Schedule OR-DONATE?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-101-058 Schedule OR-DONATE?

A: Form 150-101-058 Schedule OR-DONATE is a form used in Oregon to report charitable checkoff donations.

Q: What are charitable checkoff donations?

A: Charitable checkoff donations are voluntary contributions that individuals can make on their tax returns to support various charitable causes in Oregon.

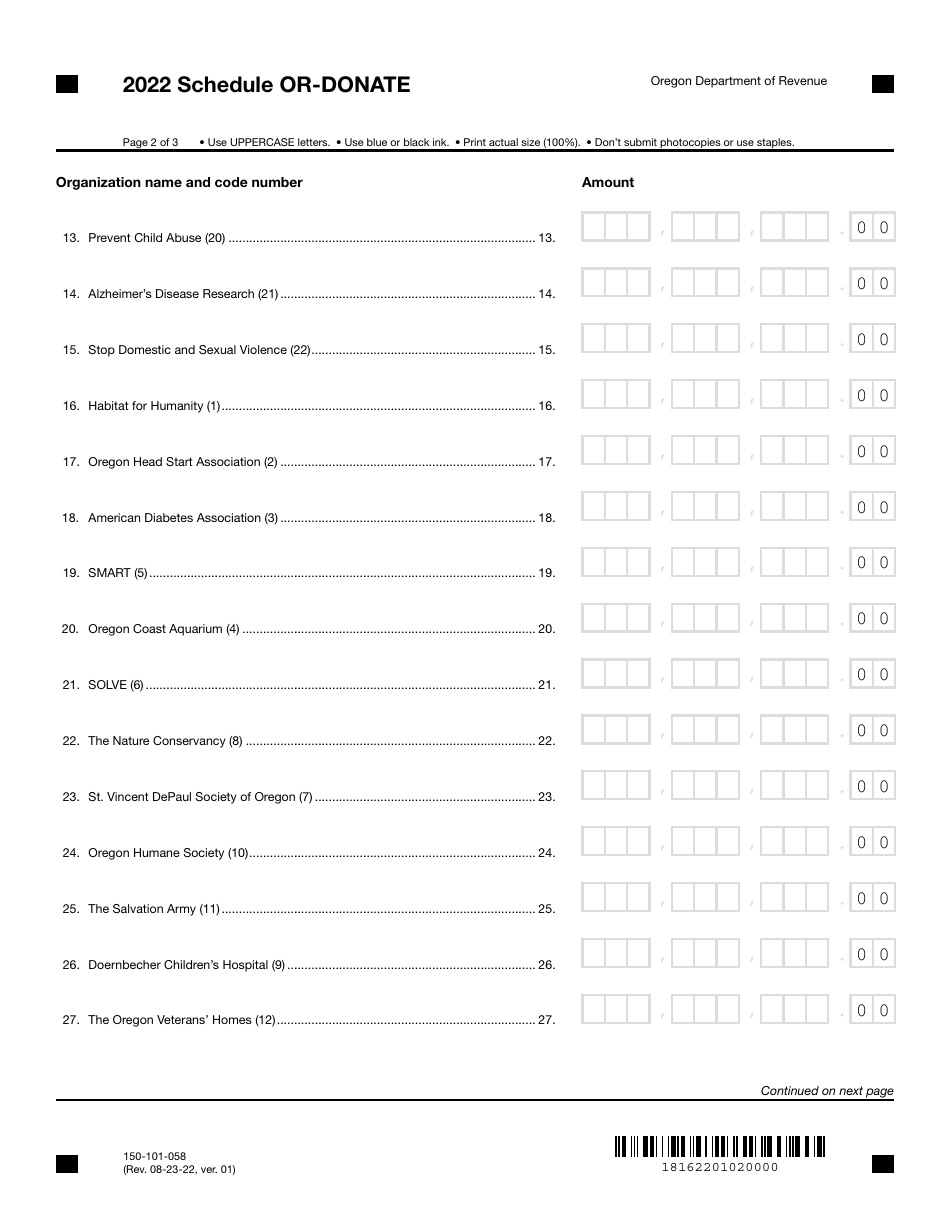

Q: How do I report charitable checkoff donations on my tax return?

A: You can report charitable checkoff donations on your tax return by completing Form 150-101-058 Schedule OR-DONATE and including it with your Oregon tax return.

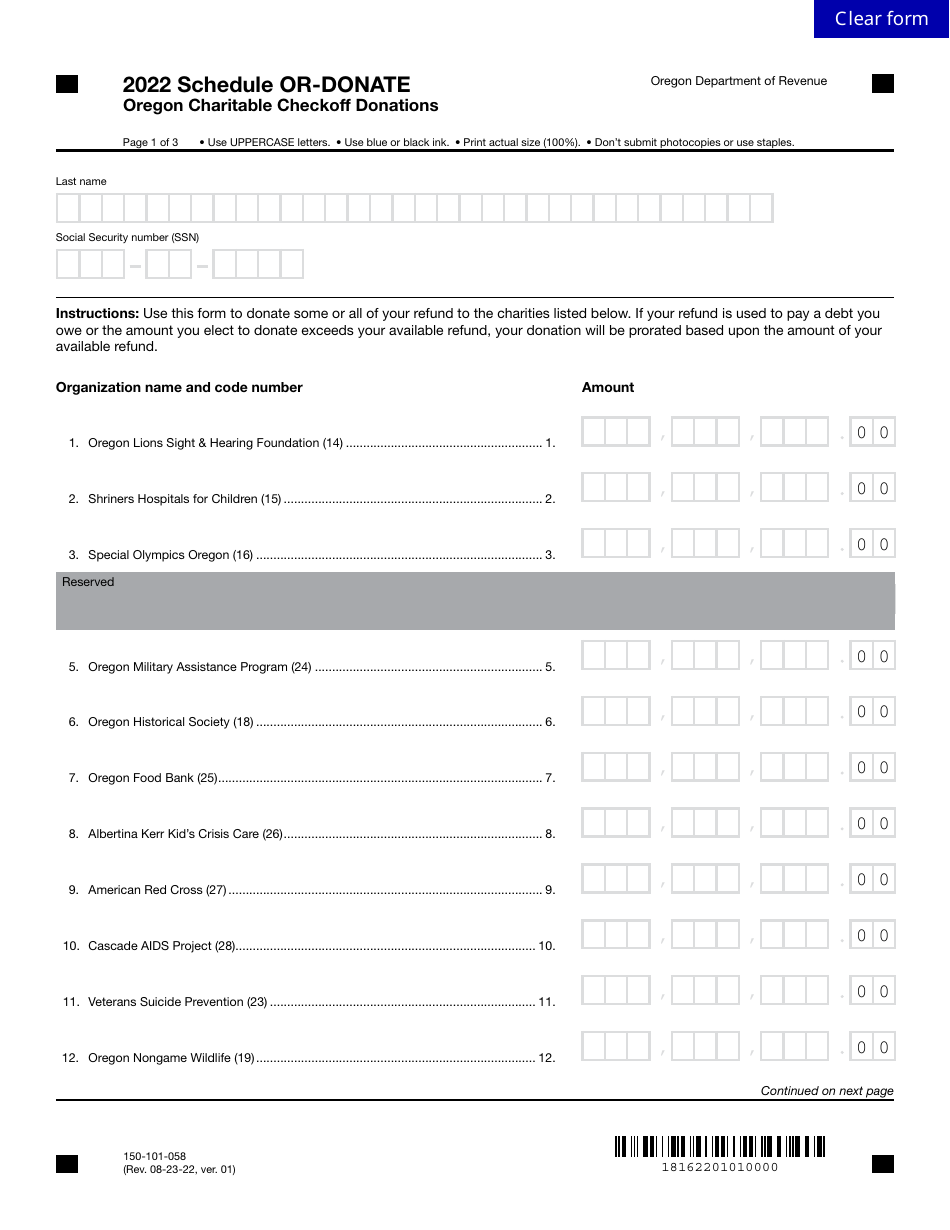

Q: What charitable causes can I support with checkoff donations in Oregon?

A: In Oregon, you can support causes such as the Oregon Veterans' Homes, the Oregon Opportunity Grant Fund, the Oregon Animal Health and Welfare Fund, and the Oregon State School Fund, among others.

Q: Are checkoff donations tax deductible?

A: Yes, checkoff donations are tax deductible on your Oregon state tax return.

Q: When is the deadline to make checkoff donations in Oregon?

A: The deadline to make checkoff donations in Oregon is generally April 15th, the same as the deadline to file your tax return.

Q: Can I make checkoff donations if I am not an Oregon resident?

A: No, checkoff donations can only be made by Oregon residents on their Oregon tax returns.

Form Details:

- Released on August 23, 2022;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-101-058 Schedule OR-DONATE by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.