This version of the form is not currently in use and is provided for reference only. Download this version of

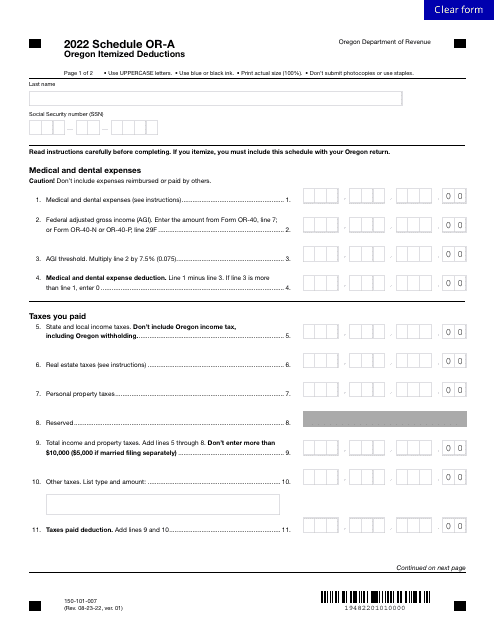

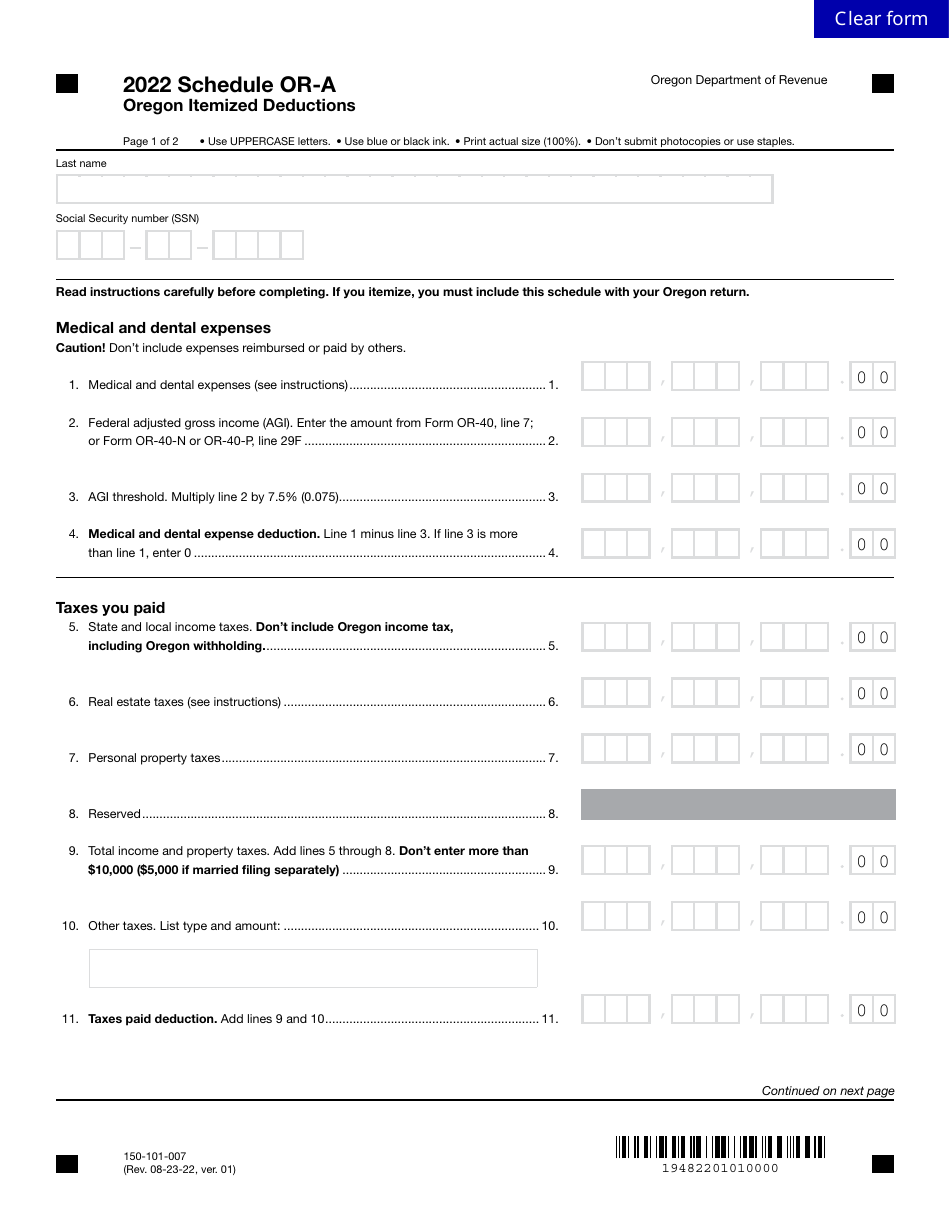

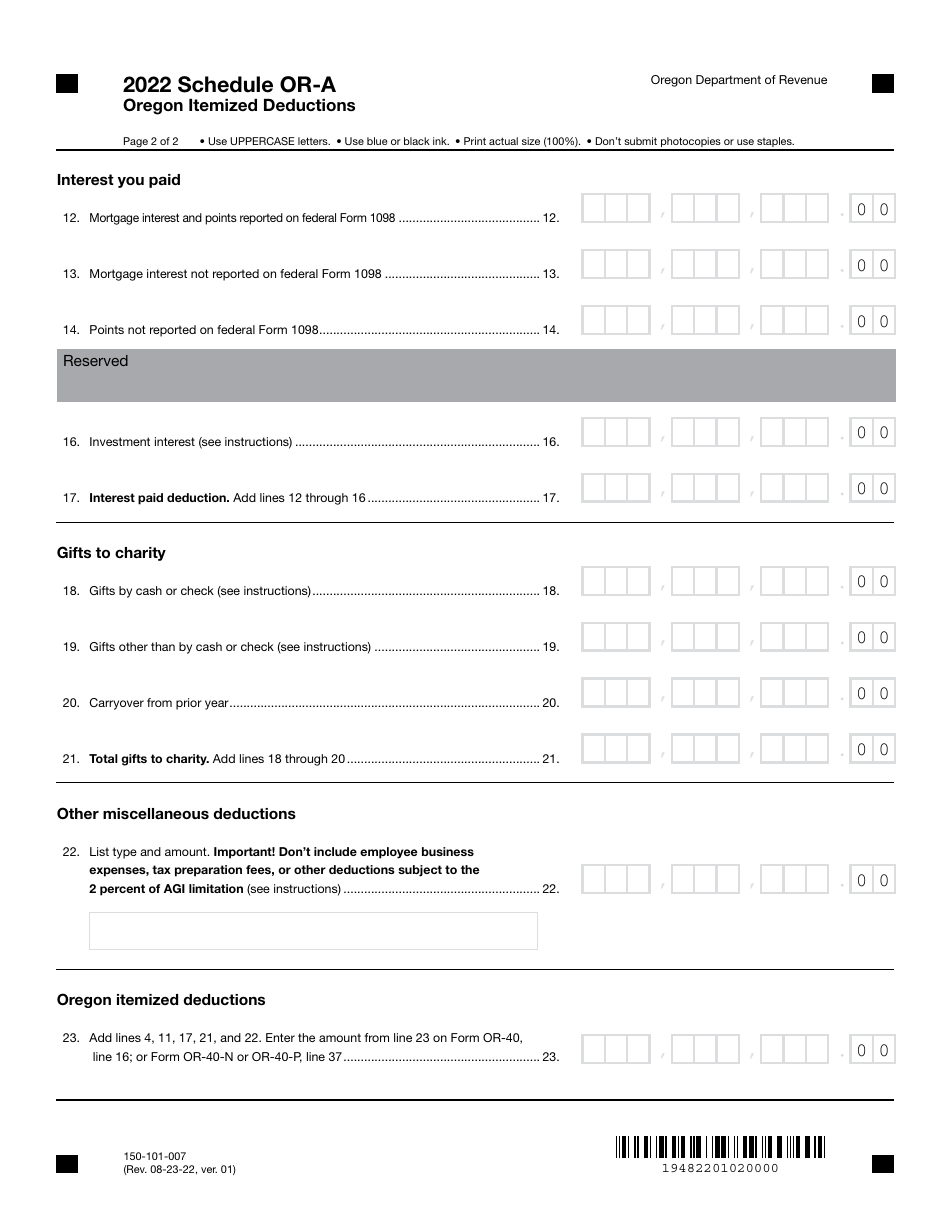

Form 150-101-007 Schedule OR-A

for the current year.

Form 150-101-007 Schedule OR-A Oregon Itemized Deductions - Oregon

What Is Form 150-101-007 Schedule OR-A?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 150-101-007 Schedule OR-A?

A: Form 150-101-007 Schedule OR-A is a tax form used by taxpayers in Oregon to claim itemized deductions.

Q: What are itemized deductions?

A: Itemized deductions are certain expenses that individuals can subtract from their adjusted gross income to reduce their taxable income.

Q: Who can use Form 150-101-007 Schedule OR-A?

A: Form 150-101-007 Schedule OR-A can be used by individuals who are filing their state taxes in Oregon and choose to itemize deductions.

Q: What expenses can be itemized on Form 150-101-007 Schedule OR-A?

A: Expenses that can be itemized on Form 150-101-007 Schedule OR-A include medical expenses, state and local taxes, mortgage interest, charitable contributions, and certain miscellaneous deductions.

Q: Is it better to take the standard deduction or itemize deductions?

A: It depends on your specific financial situation. In some cases, taking the standard deduction may be more beneficial, while in others, itemizing deductions can result in a larger tax savings. You should compare both options to determine which one is more advantageous for you.

Form Details:

- Released on August 23, 2022;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-101-007 Schedule OR-A by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.