This version of the form is not currently in use and is provided for reference only. Download this version of

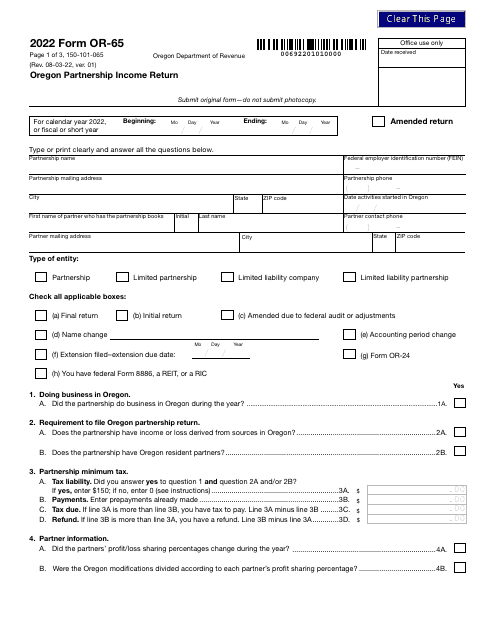

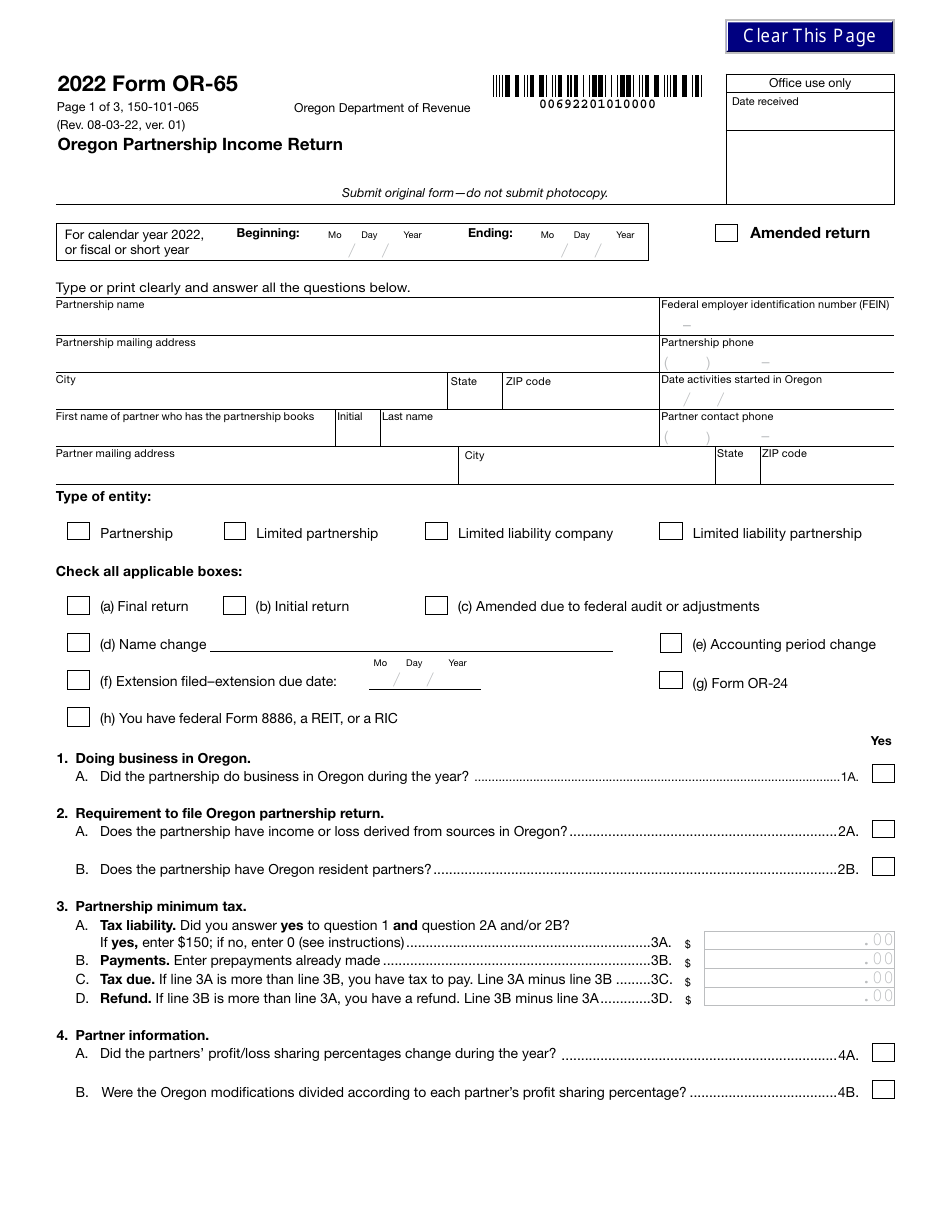

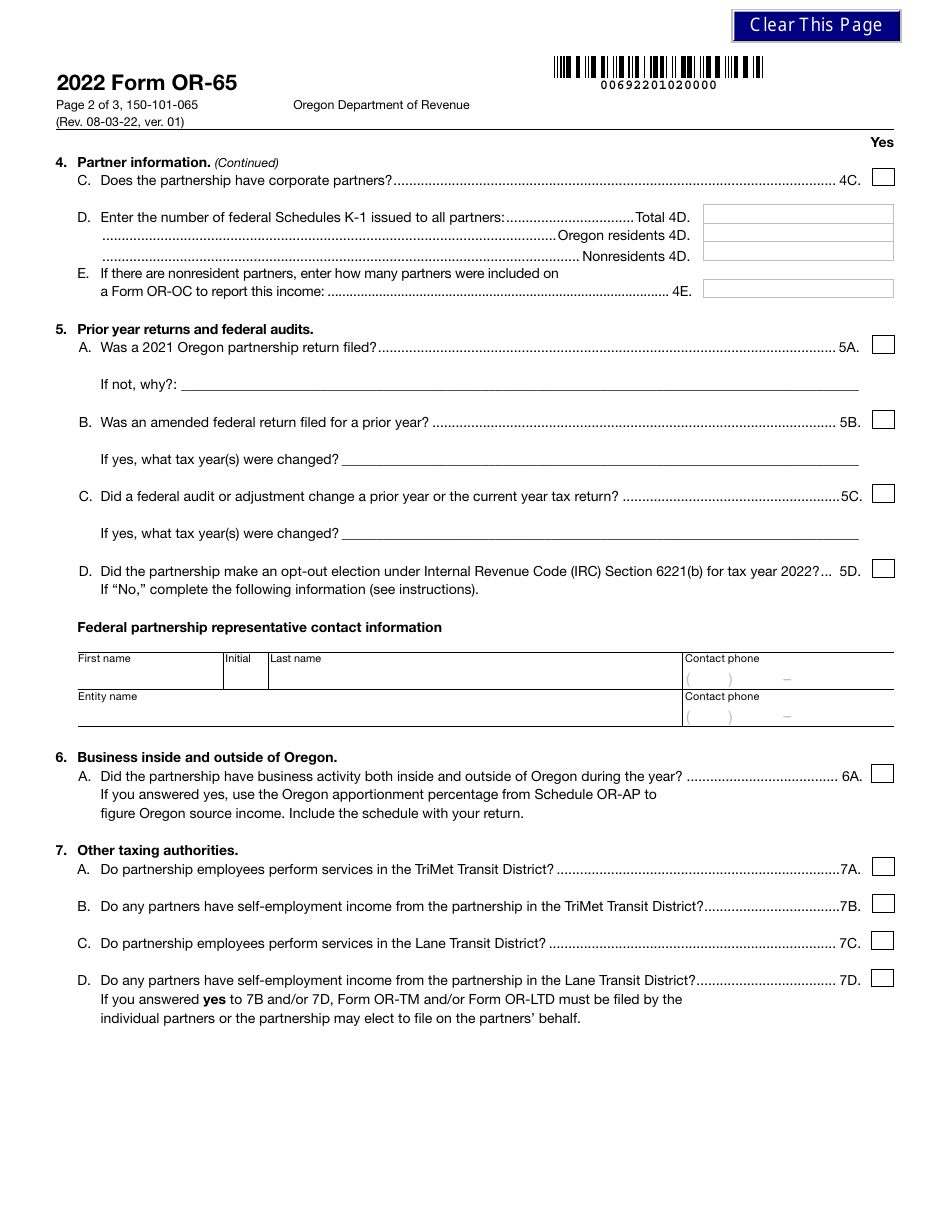

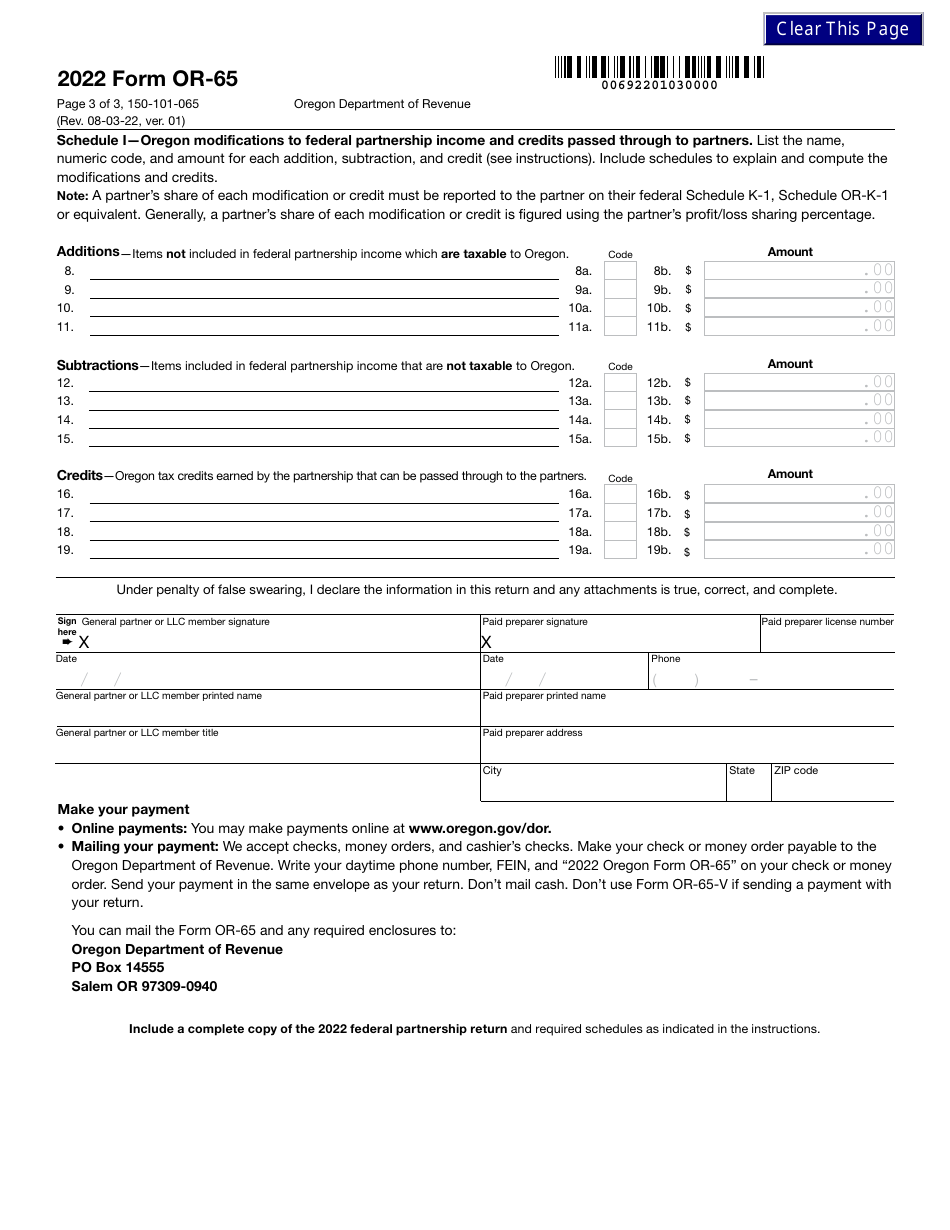

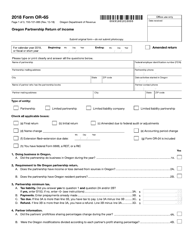

Form OR-65 (150-101-065)

for the current year.

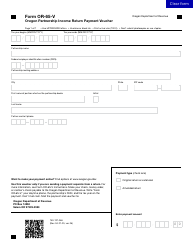

Form OR-65 (150-101-065) Oregon Partnership Income Return - Oregon

What Is Form OR-65 (150-101-065)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form OR-65?

A: Form OR-65 is the Oregon Partnership Income Return.

Q: Who needs to file Form OR-65?

A: Partnerships that have income derived from Oregon sources or have Oregon partners need to file Form OR-65.

Q: What is the purpose of Form OR-65?

A: The purpose of Form OR-65 is to report the income, deductions, and credits of a partnership in Oregon.

Q: When is Form OR-65 due?

A: Form OR-65 is due on the 15th day of the third month following the close of the partnership's tax year.

Q: Are there any requirements for filing Form OR-65?

A: Yes, partnerships must also provide copies of Schedule K-1 to each partner and maintain records supporting the information reported on the form.

Q: Is there a penalty for late filing of Form OR-65?

A: Yes, there may be a penalty for late filing or failure to file Form OR-65.

Q: Can Form OR-65 be filed electronically?

A: Yes, Form OR-65 can be filed electronically using approved tax preparation software or through a certified electronic filing provider.

Q: Are there any other forms that need to be filed with Form OR-65?

A: Partnerships may also need to file Schedule OR-ASC and Schedule OR-A.

Q: Is there a fee for filing Form OR-65?

A: No, there is no fee for filing Form OR-65.

Form Details:

- Released on August 3, 2022;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-65 (150-101-065) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.