This version of the form is not currently in use and is provided for reference only. Download this version of

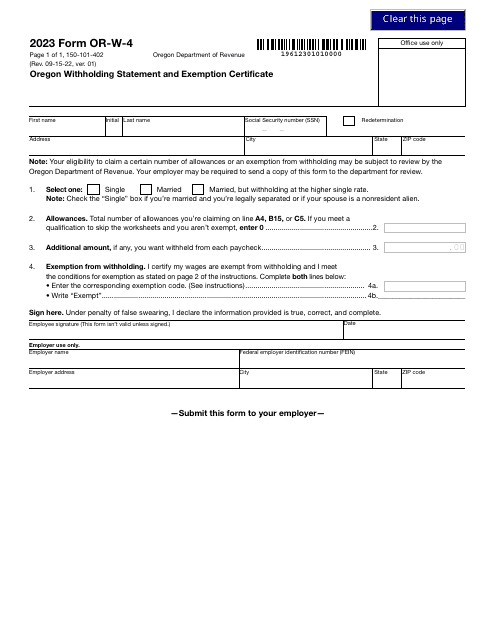

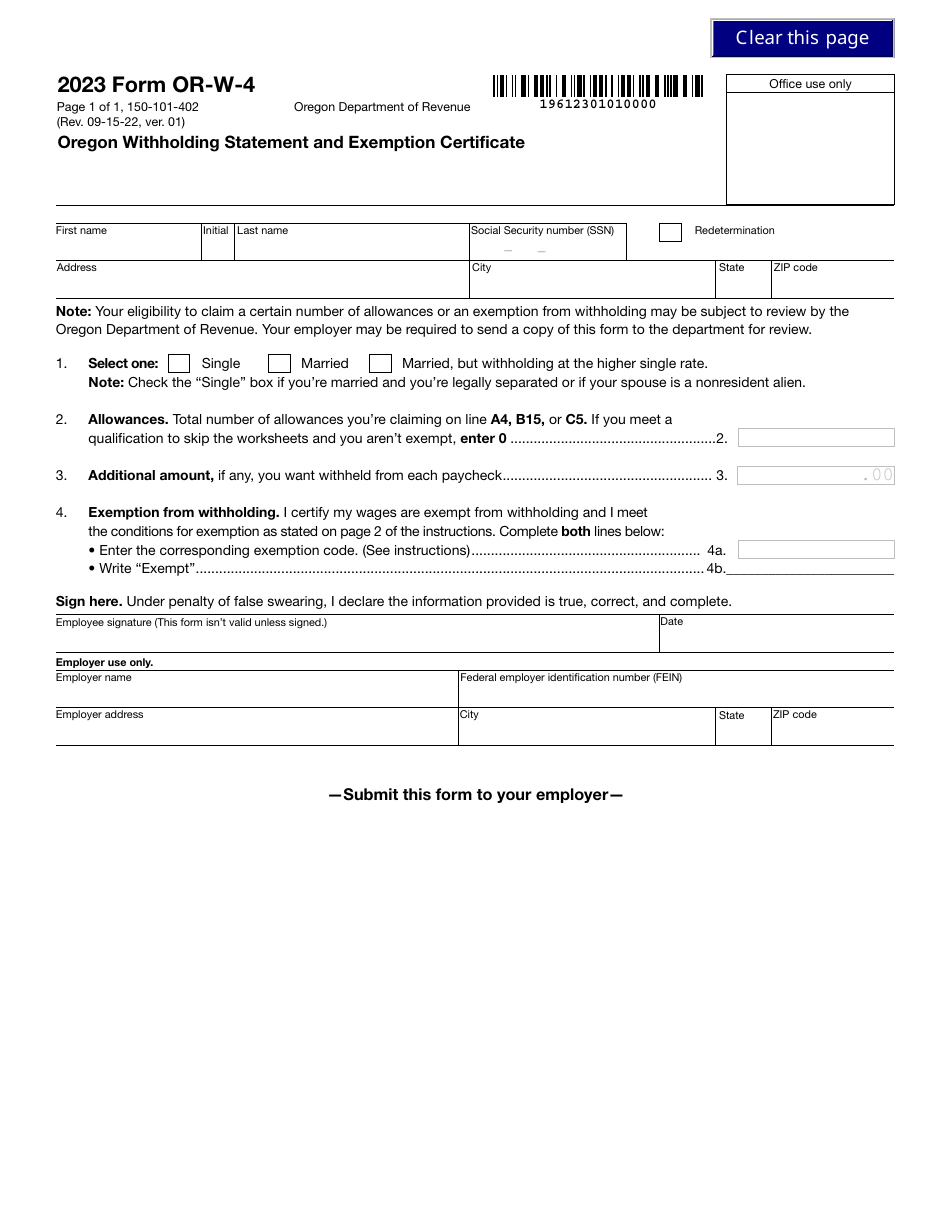

Form OR-W-4 (150-101-402)

for the current year.

Form OR-W-4 (150-101-402) Oregon Withholding Statement and Exemption Certificate - Oregon

What Is Form OR-W-4 (150-101-402)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form OR-W-4?

A: Form OR-W-4 is the Oregon Withholding Statement and Exemption Certificate.

Q: What is the purpose of Form OR-W-4?

A: The purpose of Form OR-W-4 is to determine the amount of state income tax to be withheld from an employee's wages in Oregon.

Q: Who needs to fill out Form OR-W-4?

A: Employees who work in Oregon and want to adjust the amount of state income tax withheld from their wages need to fill out Form OR-W-4.

Q: What information is required on Form OR-W-4?

A: Form OR-W-4 requires the employee's personal information, exemption status, and any additional withholding amount.

Q: Is Form OR-W-4 for Oregon residents only?

A: No, Form OR-W-4 is for anyone who earns income in Oregon, regardless of their residency status.

Q: When should I submit Form OR-W-4?

A: You should submit Form OR-W-4 to your employer as soon as you start or change your employment in Oregon.

Q: Can I claim exemptions on Form OR-W-4?

A: Yes, you can claim exemptions on Form OR-W-4 if you meet the requirements set by the Oregon Department of Revenue.

Q: How often should I update Form OR-W-4?

A: You should update Form OR-W-4 whenever there are changes in your personal or financial situation that affect your tax withholding in Oregon.

Q: What happens if I don't fill out Form OR-W-4?

A: If you don't fill out Form OR-W-4, your employer will withhold state income tax based on the default withholding rate for your income.

Form Details:

- Released on September 15, 2022;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-W-4 (150-101-402) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.