This version of the form is not currently in use and is provided for reference only. Download this version of

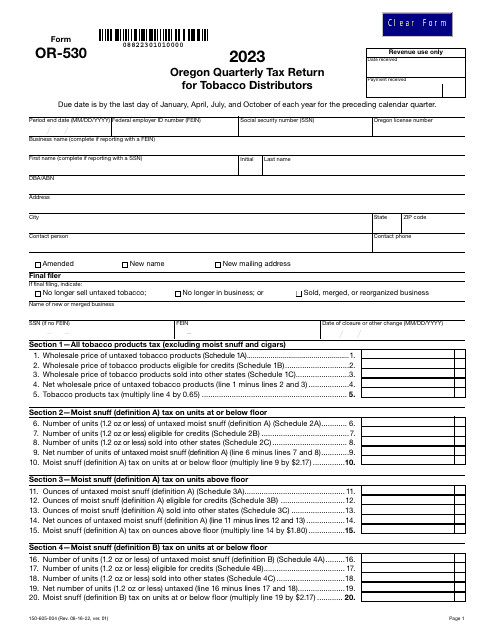

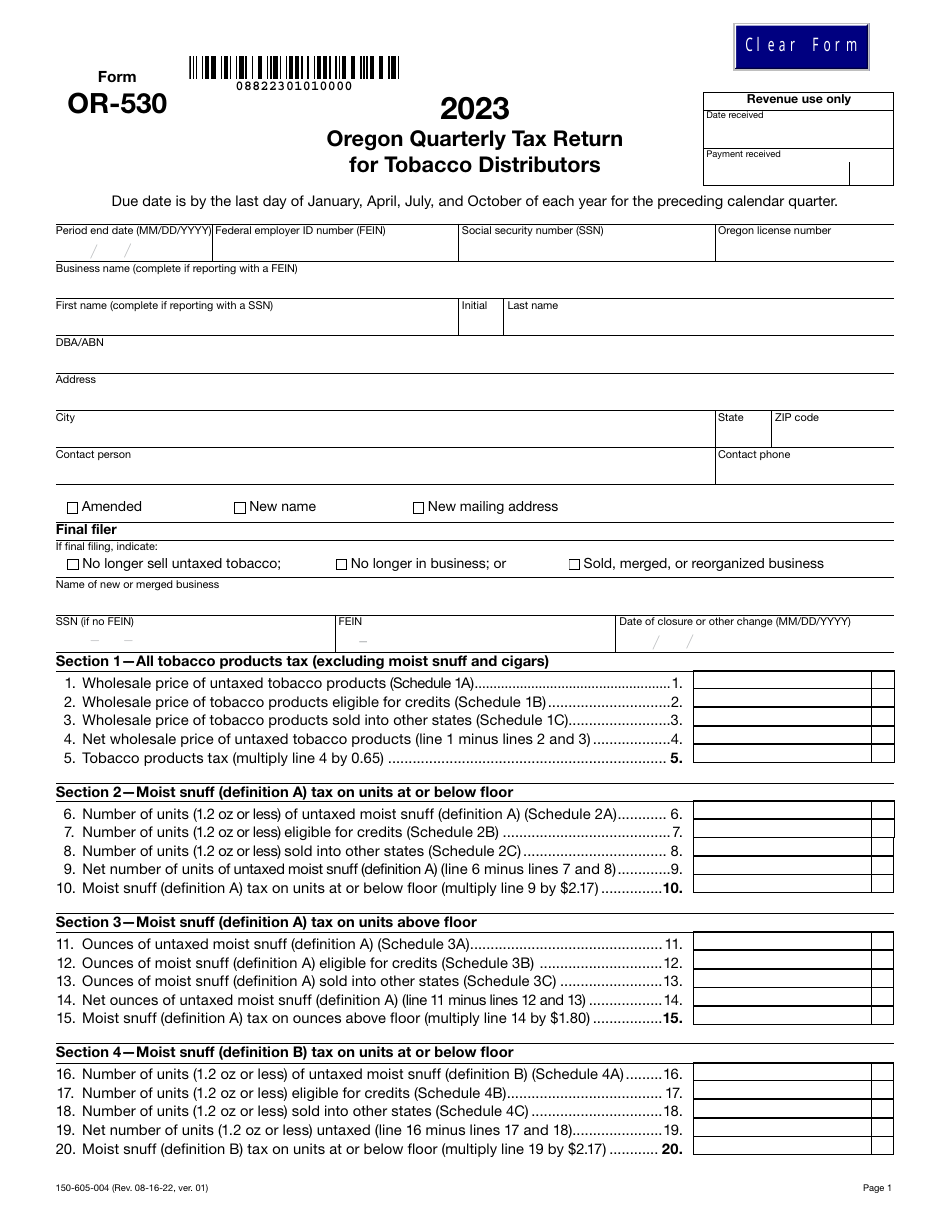

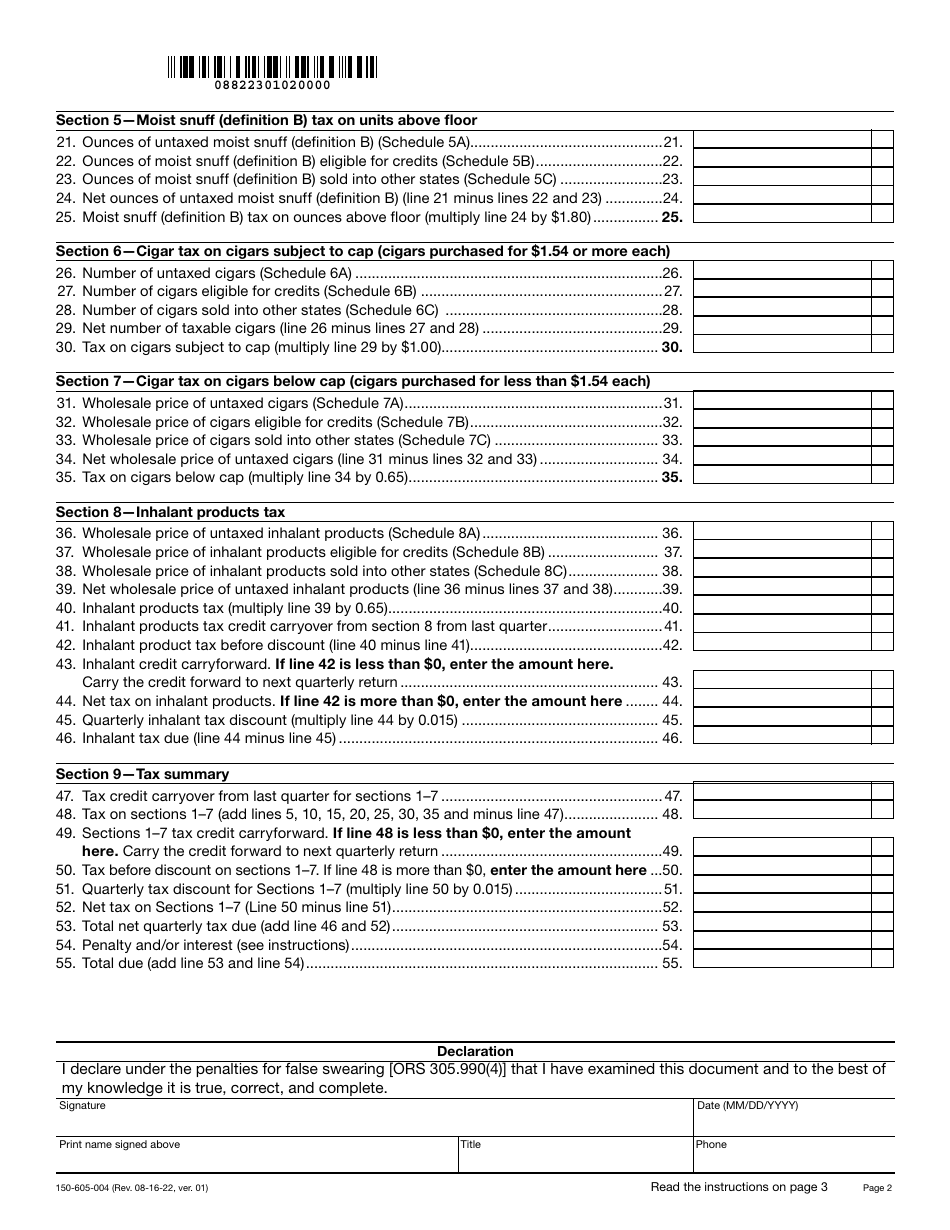

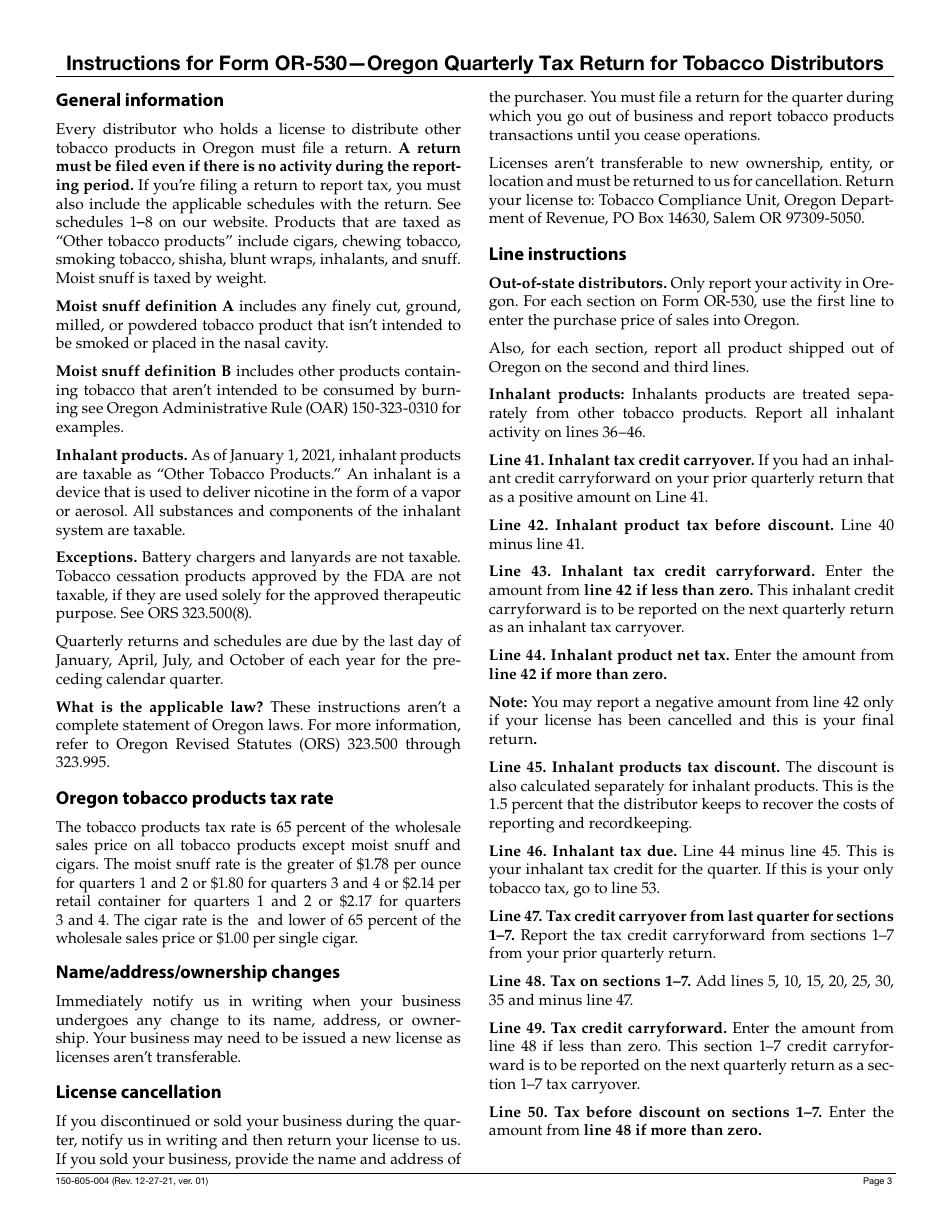

Form OR-530 (150-605-004)

for the current year.

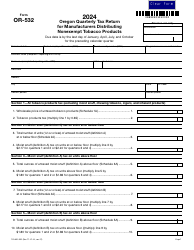

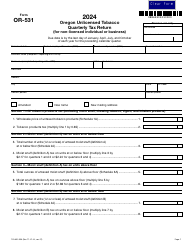

Form OR-530 (150-605-004) Oregon Quarterly Tax Return for Tobacco Distributors - Oregon

What Is Form OR-530 (150-605-004)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form OR-530?

A: Form OR-530 is the Oregon Quarterly Tax Return for Tobacco Distributors.

Q: Who needs to file Form OR-530?

A: Tobacco distributors in Oregon need to file Form OR-530.

Q: What is the purpose of Form OR-530?

A: The purpose of Form OR-530 is to report and pay tobacco taxes to the state of Oregon on a quarterly basis.

Q: What information do I need to complete Form OR-530?

A: You will need to provide information about your tobacco sales and calculate the amount of tax owed based on the rates provided on the form.

Q: Are there any penalties for not filing Form OR-530?

A: Yes, there are penalties for not filing Form OR-530 or for filing it late. It is important to submit the form on time to avoid penalties.

Form Details:

- Released on August 16, 2022;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-530 (150-605-004) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.