This version of the form is not currently in use and is provided for reference only. Download this version of

Form OR-531 (150-605-006)

for the current year.

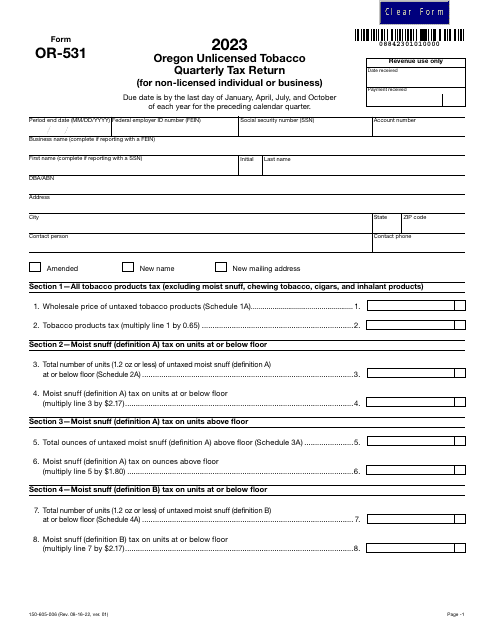

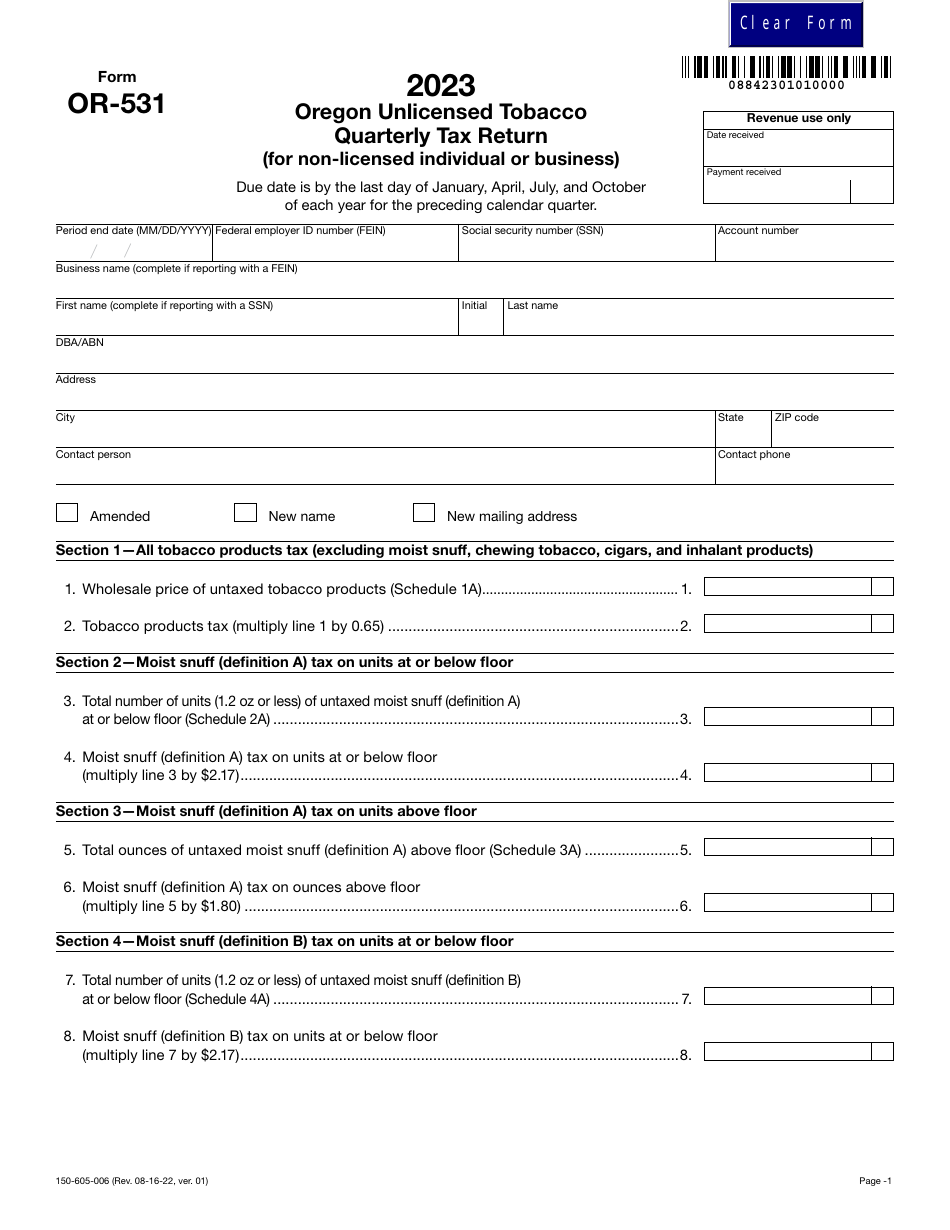

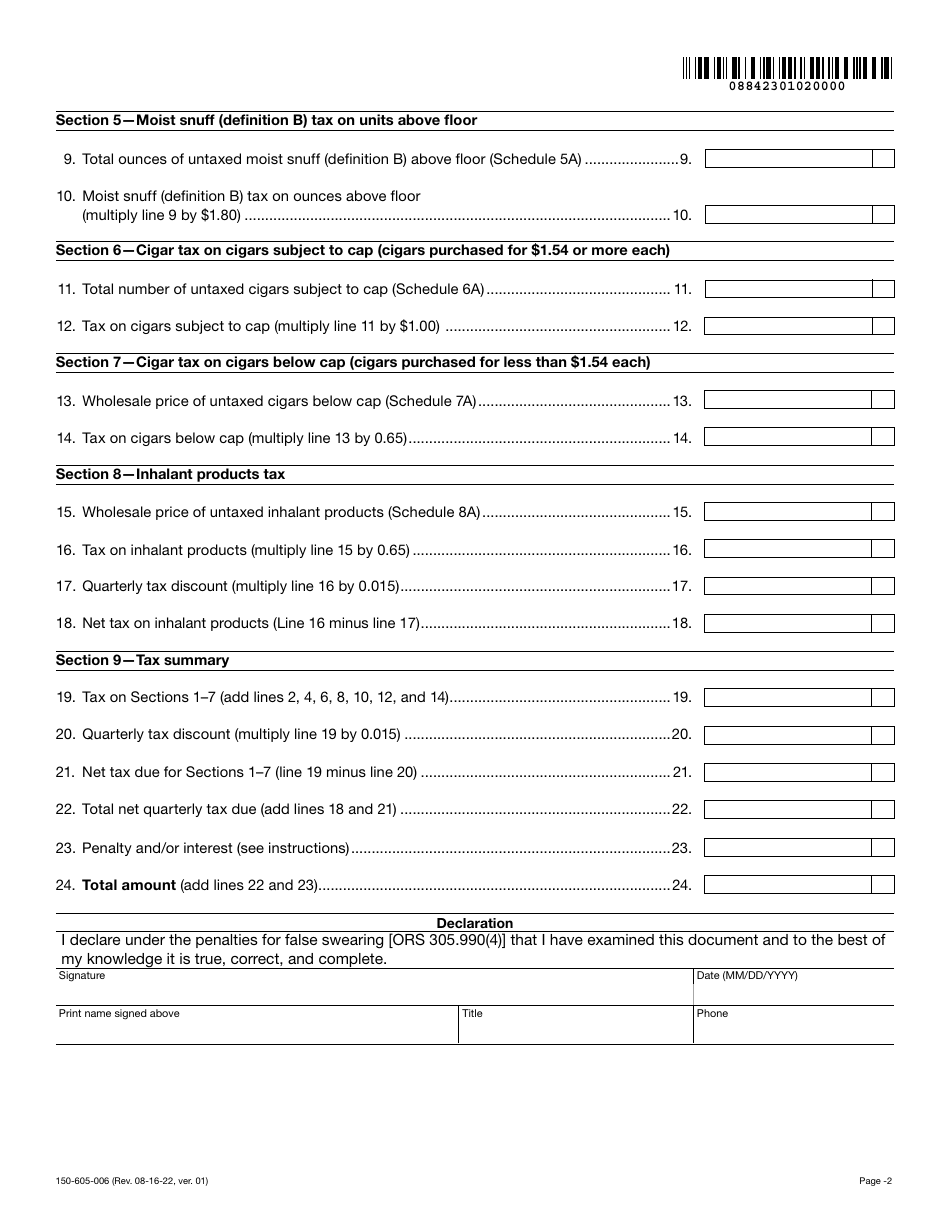

Form OR-531 (150-605-006) Oregon Unlicensed Tobacco Quarterly Tax Return (For Non-licensed Individual or Business) - Oregon

What Is Form OR-531 (150-605-006)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form OR-531?

A: Form OR-531 is the Oregon Unlicensed Tobacco Quarterly Tax Return for non-licensed individuals or businesses.

Q: Who needs to file Form OR-531?

A: Non-licensed individuals or businesses in Oregon who engage in the sale of tobacco products need to file Form OR-531.

Q: What is the purpose of Form OR-531?

A: Form OR-531 is used to report and pay the quarterly tax on tobacco products sold by non-licensed individuals or businesses in Oregon.

Q: When is Form OR-531 due?

A: Form OR-531 is due on a quarterly basis, with the due dates being April 30, July 31, October 31, and January 31.

Q: How do I fill out Form OR-531?

A: You will need to enter the required information such as your contact details, the total sales of tobacco products, and calculate the amount of tax due.

Q: Are there any penalties for not filing Form OR-531?

A: Yes, failure to file Form OR-531 or pay the tax due can result in penalties and interest being assessed by the Oregon Department of Revenue.

Q: Can I file Form OR-531 if I am a licensed tobacco seller?

A: No, Form OR-531 is specifically for non-licensed individuals or businesses. Licensed sellers should file the appropriate tax forms for licensed tobacco sales.

Q: What other taxes may apply to tobacco sales in Oregon?

A: In addition to the quarterly tax reported on Form OR-531, licensed tobacco sellers may also be subject to the Oregon Tobacco Tax and other applicable taxes.

Form Details:

- Released on August 16, 2022;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-531 (150-605-006) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.