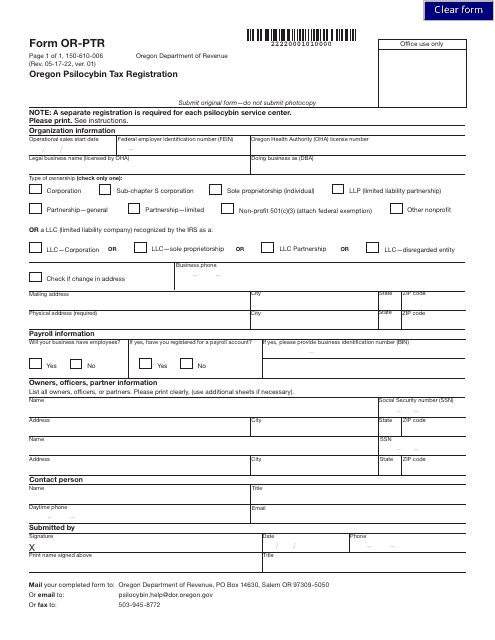

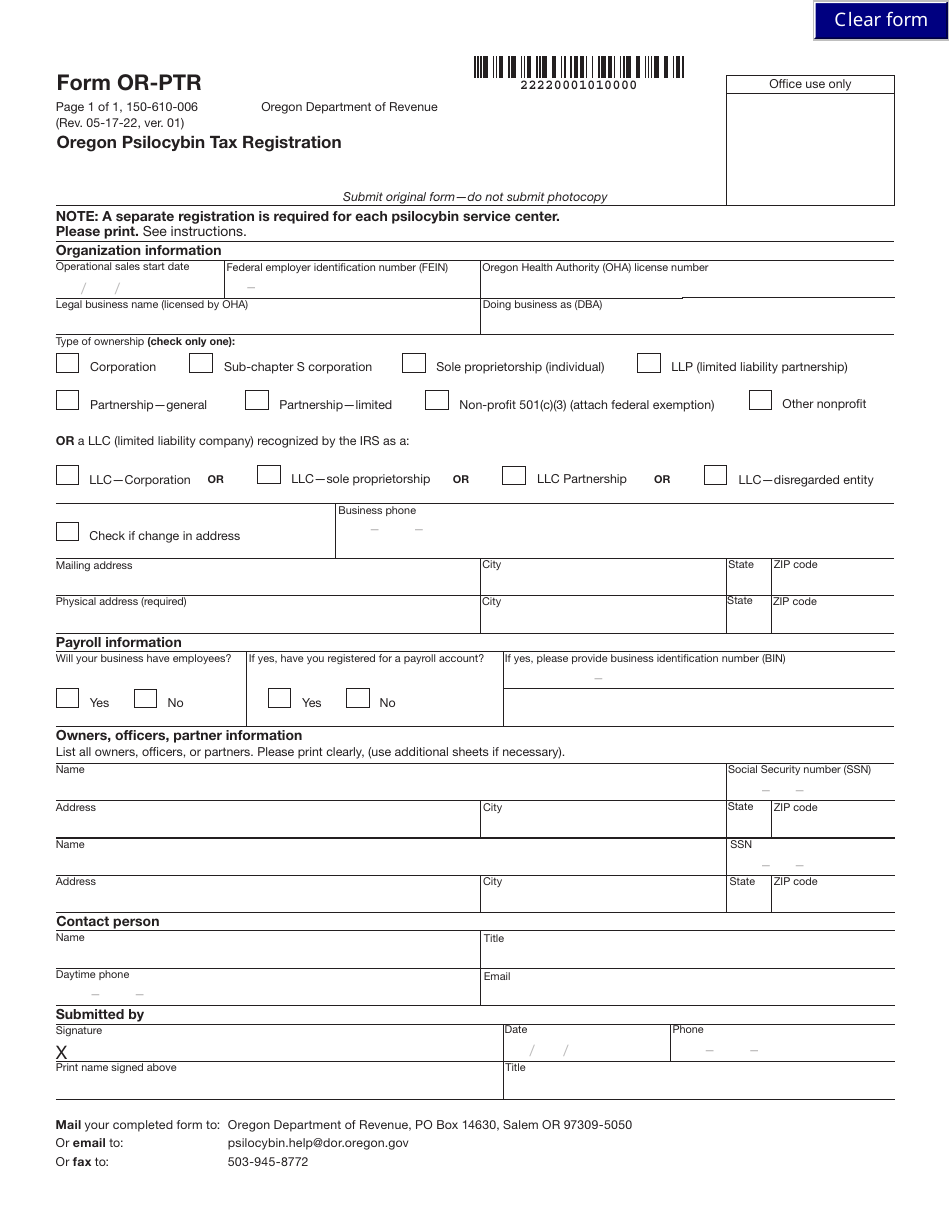

Form OR-PTR (150-610-006) Oregon Psilocybin Tax Registration - Oregon

What Is Form OR-PTR (150-610-006)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the OR-PTR (150-610-006) form?

A: The OR-PTR (150-610-006) form is the Oregon Psilocybin Tax Registration form.

Q: What is the purpose of the OR-PTR (150-610-006) form?

A: The purpose of the OR-PTR (150-610-006) form is to register for the Oregon Psilocybin Tax.

Q: Who needs to fill out the OR-PTR (150-610-006) form?

A: Anyone who is involved in the sale or production of psilocybin in Oregon needs to fill out the OR-PTR (150-610-006) form.

Q: What is the Oregon Psilocybin Tax?

A: The Oregon Psilocybin Tax is a tax specifically for the sale or production of psilocybin in Oregon.

Q: Are there any fees associated with the OR-PTR (150-610-006) form?

A: Yes, there is a fee of $250 for the initial registration and an annual renewal fee of $100 for subsequent years.

Q: When is the OR-PTR (150-610-006) form due?

A: The OR-PTR (150-610-006) form is due on or before the last day of the month following the end of the calendar quarter.

Q: What happens if I don't fill out the OR-PTR (150-610-006) form?

A: Failure to fill out the OR-PTR (150-610-006) form or pay the required taxes can result in penalties and fines.

Q: Can I get a refund for the Oregon Psilocybin Tax?

A: No, the Oregon Psilocybin Tax is non-refundable.

Form Details:

- Released on May 17, 2022;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-PTR (150-610-006) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.