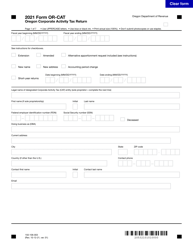

This version of the form is not currently in use and is provided for reference only. Download this version of

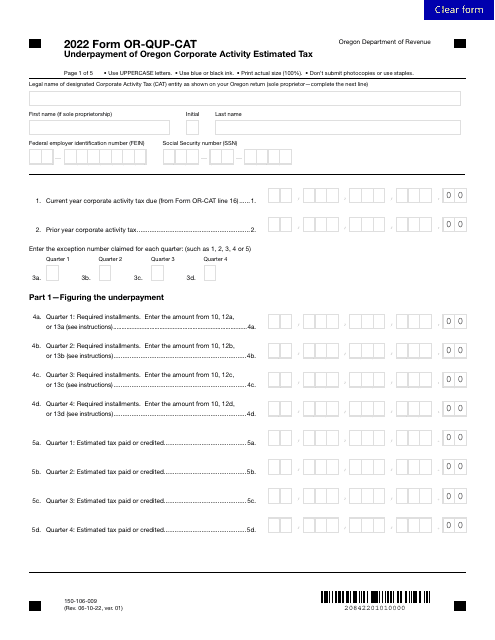

Form OR-QUP-CAT (150-106-009)

for the current year.

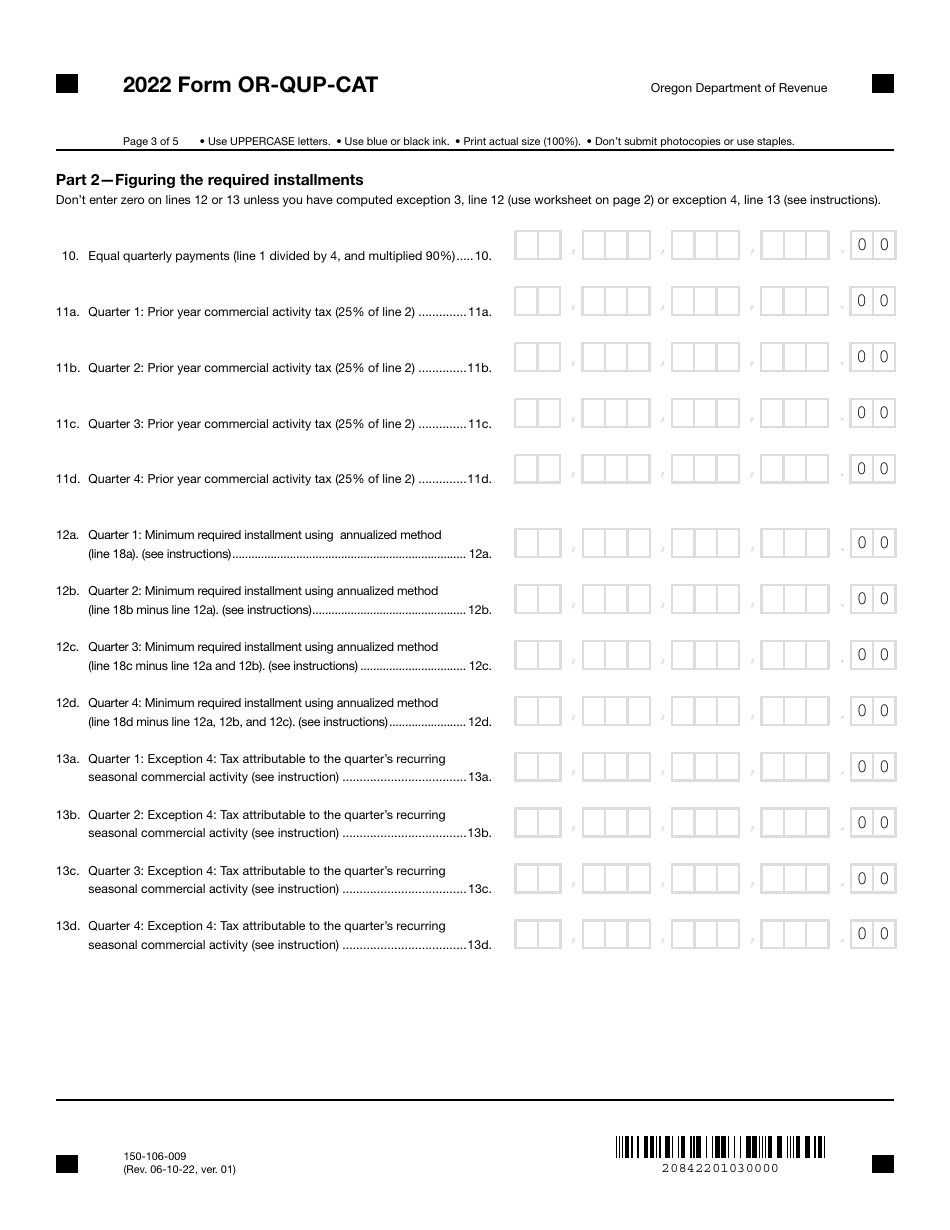

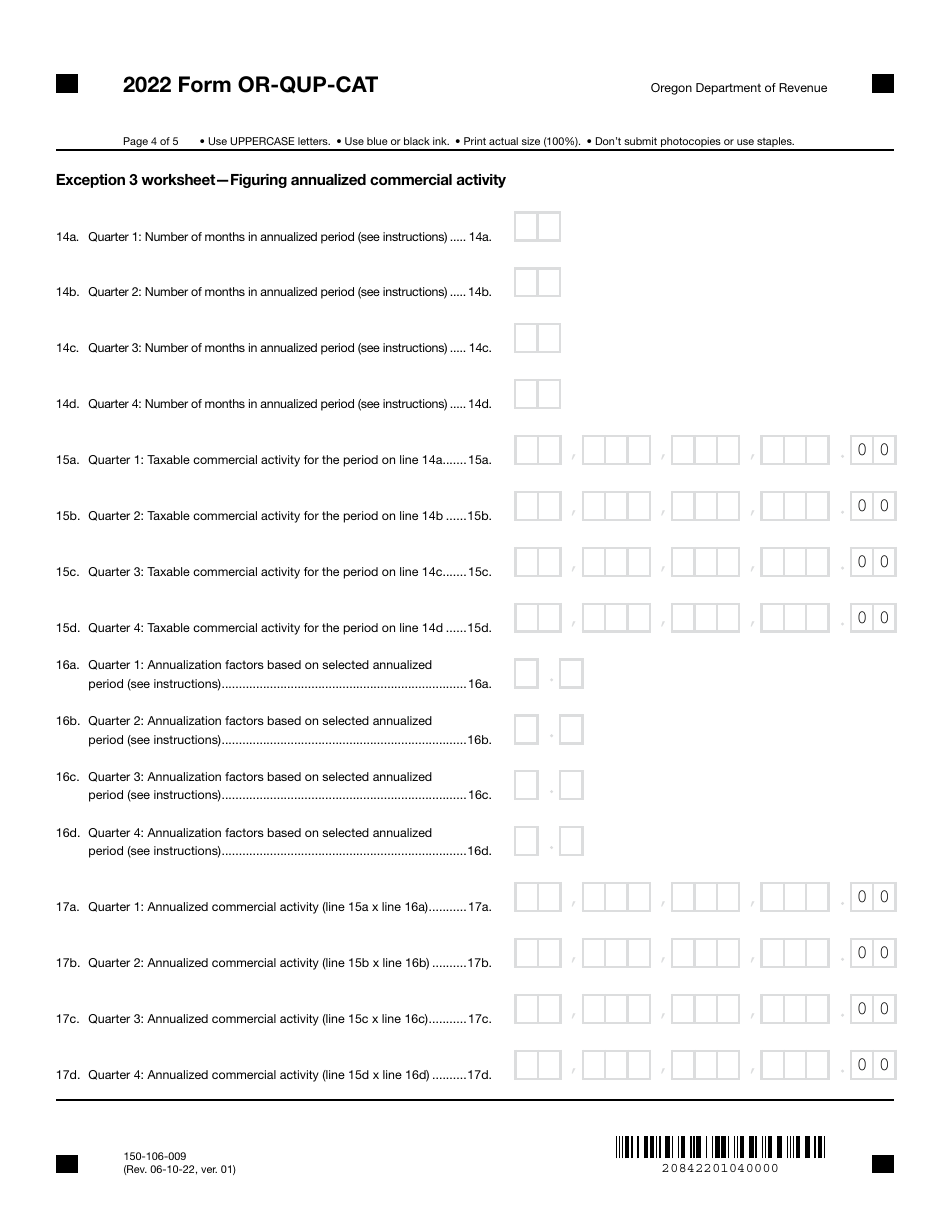

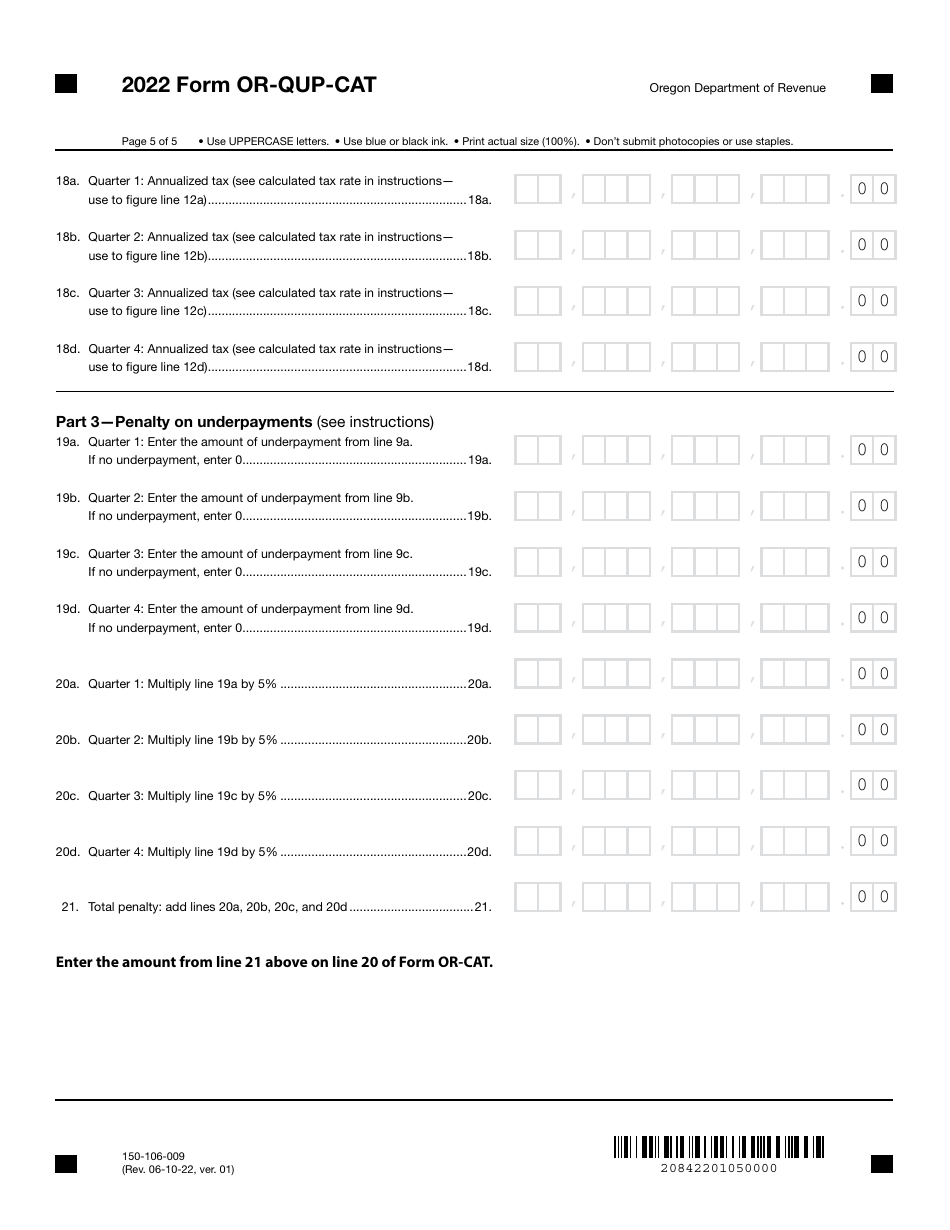

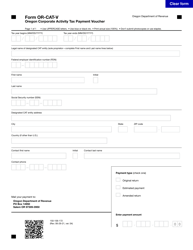

Form OR-QUP-CAT (150-106-009) Underpayment of Oregon Corporate Activity Estimated Tax - Oregon

What Is Form OR-QUP-CAT (150-106-009)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

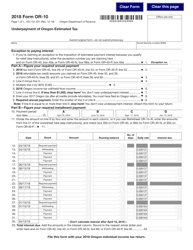

Q: What is Form OR-QUP-CAT?

A: Form OR-QUP-CAT is a form used to report underpayment of Oregon Corporate Activity Estimated Tax in Oregon.

Q: What is underpayment of Oregon Corporate Activity Estimated Tax?

A: Underpayment of Oregon Corporate Activity Estimated Tax occurs when a business fails to pay the full amount of estimated tax due in a tax year.

Q: Who needs to file Form OR-QUP-CAT?

A: Businesses that have underpaid their Oregon Corporate Activity Estimated Tax need to file Form OR-QUP-CAT.

Q: When is Form OR-QUP-CAT due?

A: Form OR-QUP-CAT is generally due on the same date as the Oregon Corporate Activity Tax return, which is on the 15th day of the month following the end of the quarter.

Q: What happens if I don't file Form OR-QUP-CAT?

A: If you don't file Form OR-QUP-CAT, you may be subject to penalties and interest on the underpaid amount.

Form Details:

- Released on June 10, 2022;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-QUP-CAT (150-106-009) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.