This version of the form is not currently in use and is provided for reference only. Download this version of

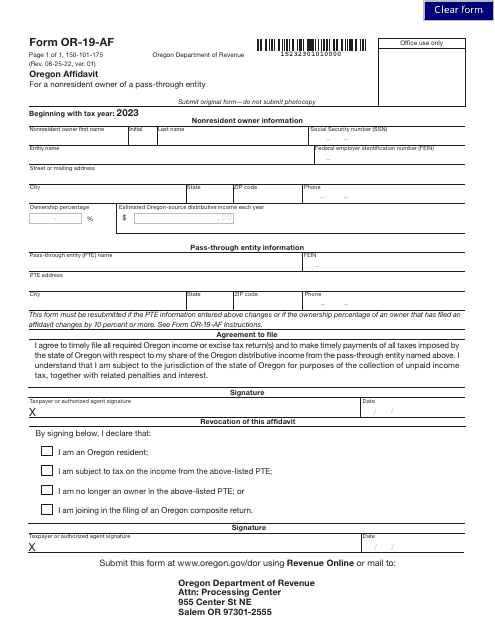

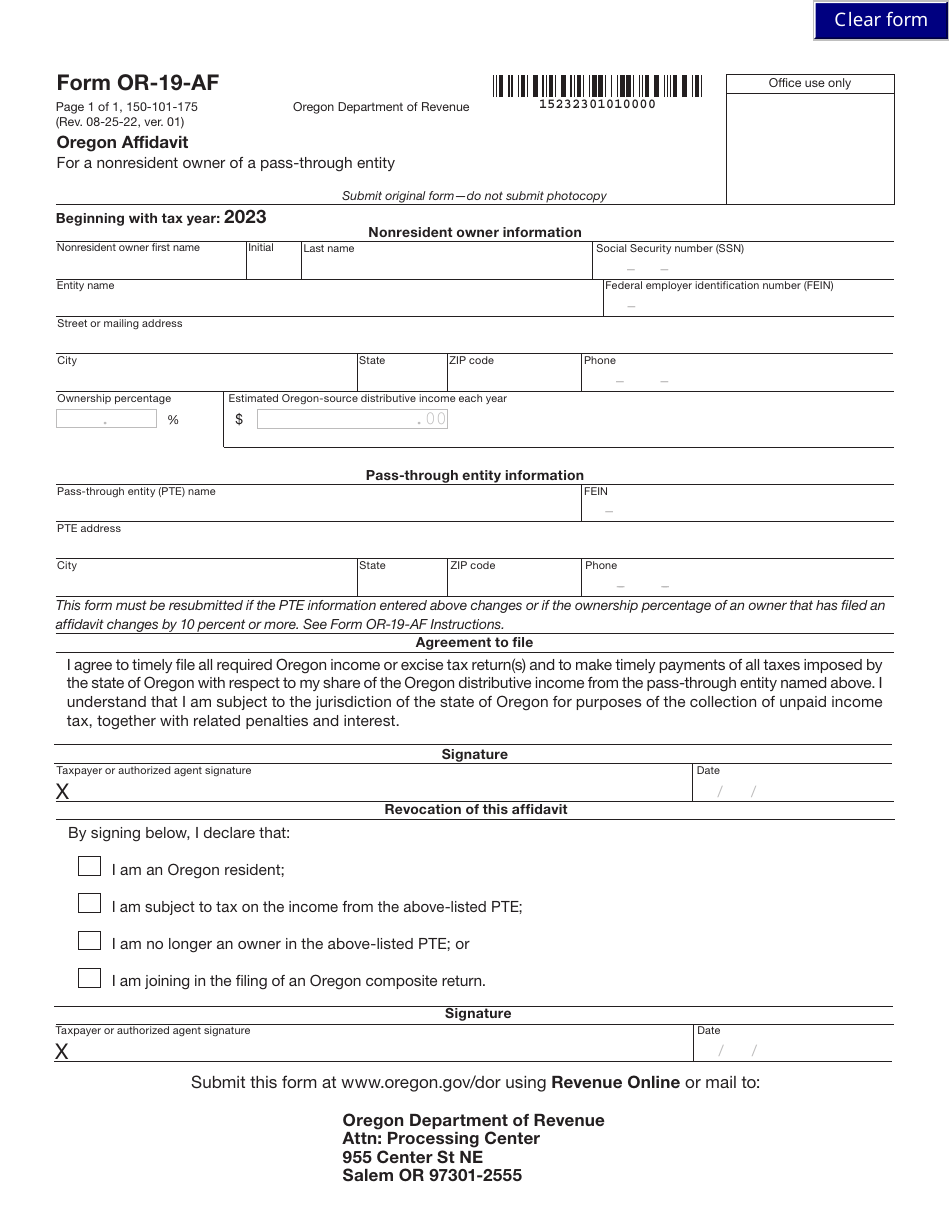

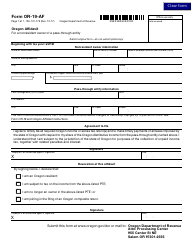

Form OR-19-AF (150-101-175)

for the current year.

Form OR-19-AF (150-101-175) Oregon Affidavit for a Nonresident Owner of a Pass-Through Entity - Oregon

What Is Form OR-19-AF (150-101-175)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form OR-19-AF?

A: Form OR-19-AF is the Oregon Affidavit for a Nonresident Owner of a Pass-Through Entity.

Q: Who should use Form OR-19-AF?

A: Form OR-19-AF should be used by nonresident owners of pass-through entities in Oregon.

Q: What is a pass-through entity?

A: A pass-through entity is a business entity where the profits and losses are passed through to the owners for taxation.

Q: What is the purpose of Form OR-19-AF?

A: The purpose of Form OR-19-AF is to report income, deductions, and credits of nonresident owners from an Oregon pass-through entity.

Q: Are nonresident owners of pass-through entities required to file Form OR-19-AF?

A: Yes, nonresident owners of pass-through entities are required to file Form OR-19-AF if they have Oregon-source income.

Form Details:

- Released on August 25, 2022;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-19-AF (150-101-175) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.