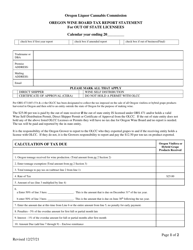

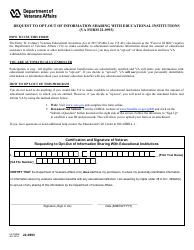

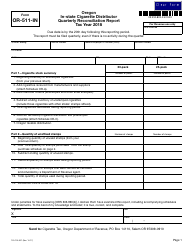

This version of the form is not currently in use and is provided for reference only. Download this version of

Form OR-511-OUT (150-105-057)

for the current year.

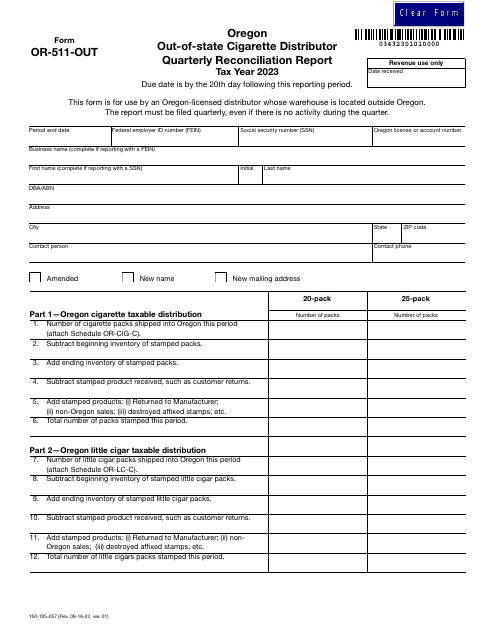

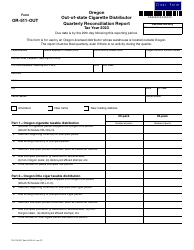

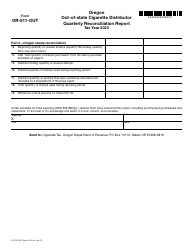

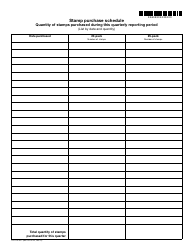

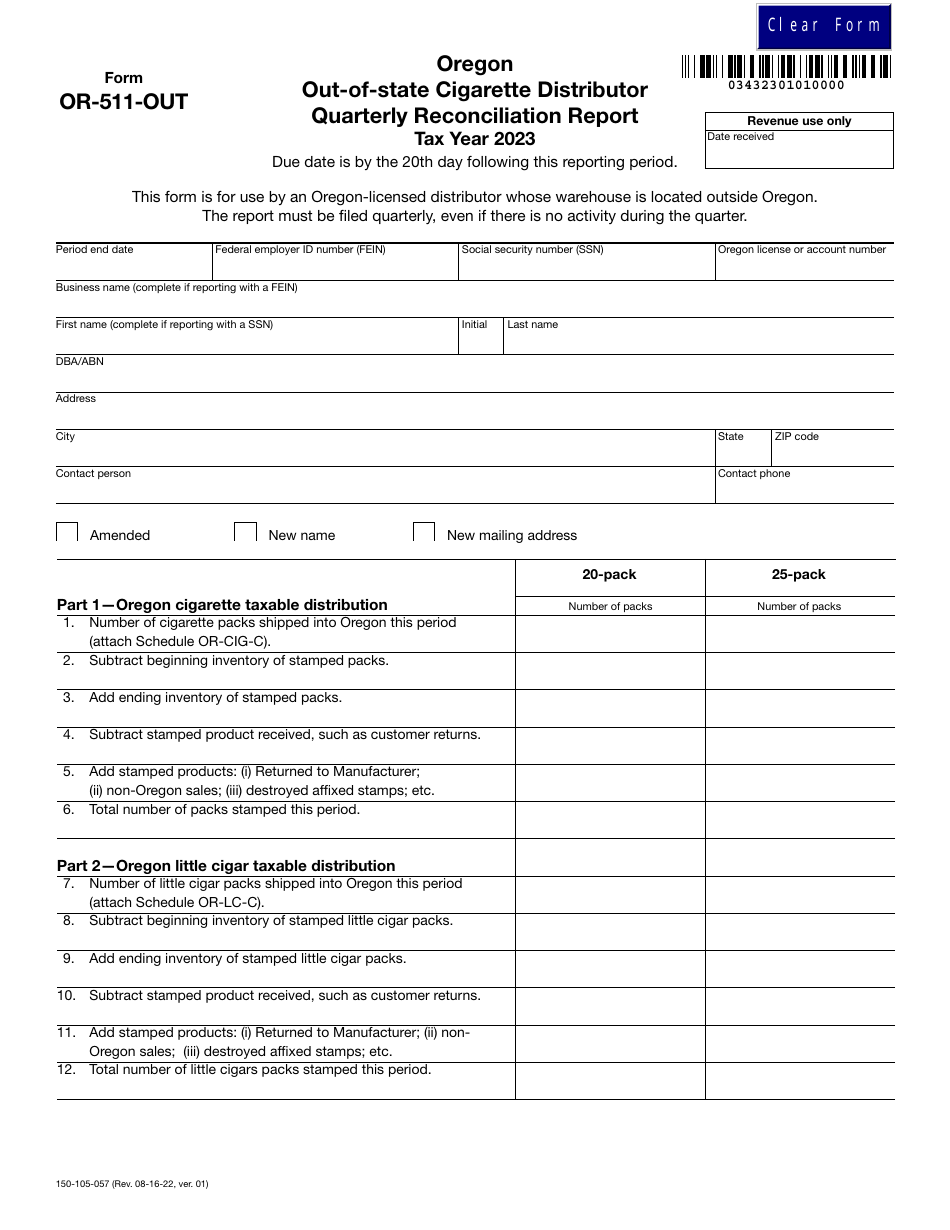

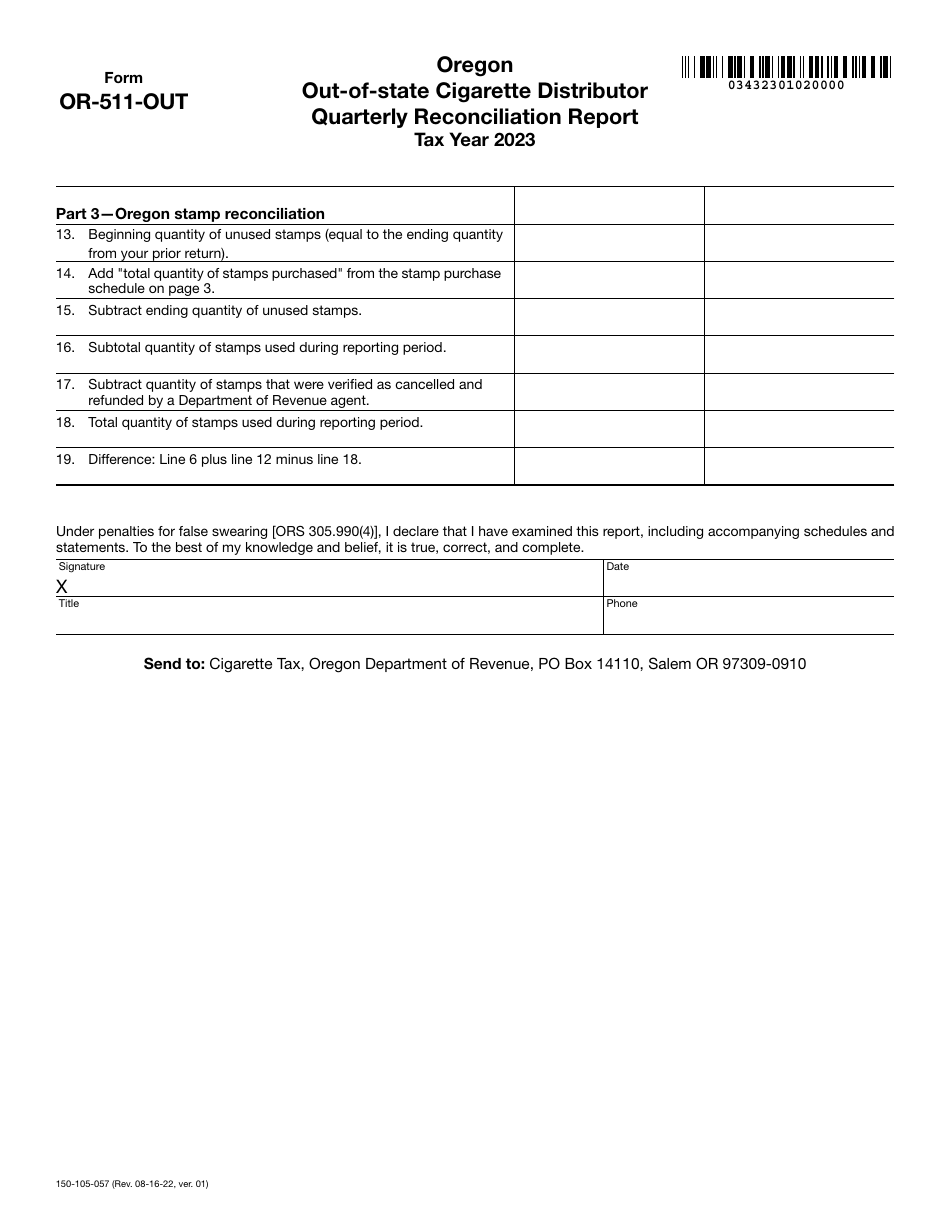

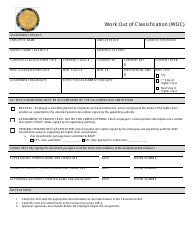

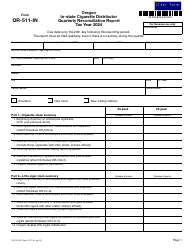

Form OR-511-OUT (150-105-057) Oregon Out-of-State Cigarette Distributor Quarterly Reconciliation Report - Oregon

What Is Form OR-511-OUT (150-105-057)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form OR-511-OUT?

A: Form OR-511-OUT is the Oregon Out-of-State Cigarette Distributor Quarterly Reconciliation Report.

Q: Who needs to file Form OR-511-OUT?

A: Out-of-state cigarette distributors operating in Oregon need to file Form OR-511-OUT.

Q: What is the purpose of Form OR-511-OUT?

A: Form OR-511-OUT is used to report and reconcile the distribution of cigarettes in Oregon by out-of-state distributors.

Q: How often is Form OR-511-OUT filed?

A: Form OR-511-OUT is filed quarterly, meaning it is submitted four times a year.

Q: Are there any filing deadlines for Form OR-511-OUT?

A: Yes, Form OR-511-OUT must be filed by the last day of the month following the end of each quarter.

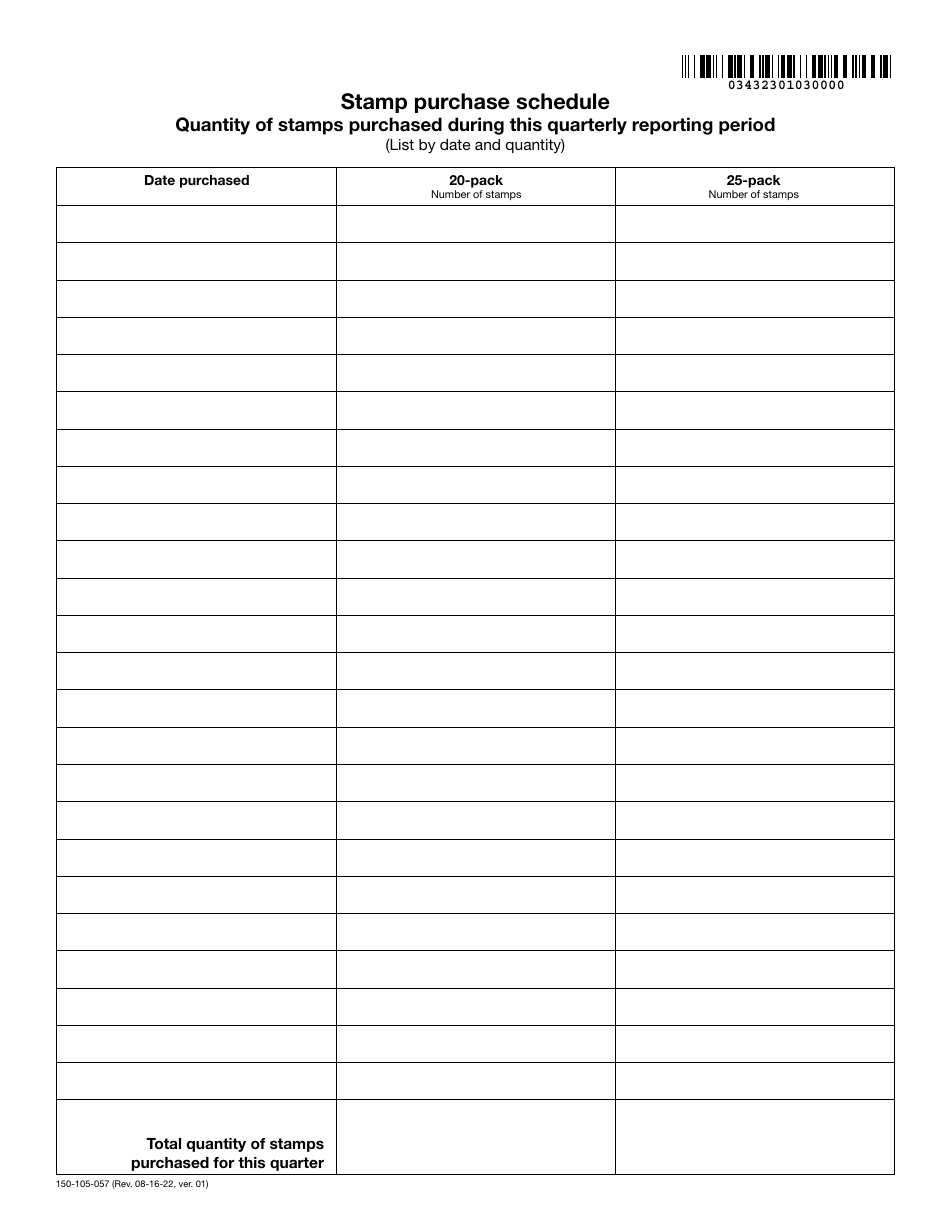

Q: What information is required on Form OR-511-OUT?

A: Form OR-511-OUT requires information such as the total amount of cigarettes distributed, the tax due, and any credits or deductions claimed.

Q: Are there any penalties for not filing Form OR-511-OUT?

A: Yes, failure to file Form OR-511-OUT or late filing can result in penalties and interest charges.

Q: Is there a fee for filing Form OR-511-OUT?

A: No, there is no fee for filing Form OR-511-OUT.

Form Details:

- Released on August 16, 2022;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-511-OUT (150-105-057) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.