This version of the form is not currently in use and is provided for reference only. Download this version of

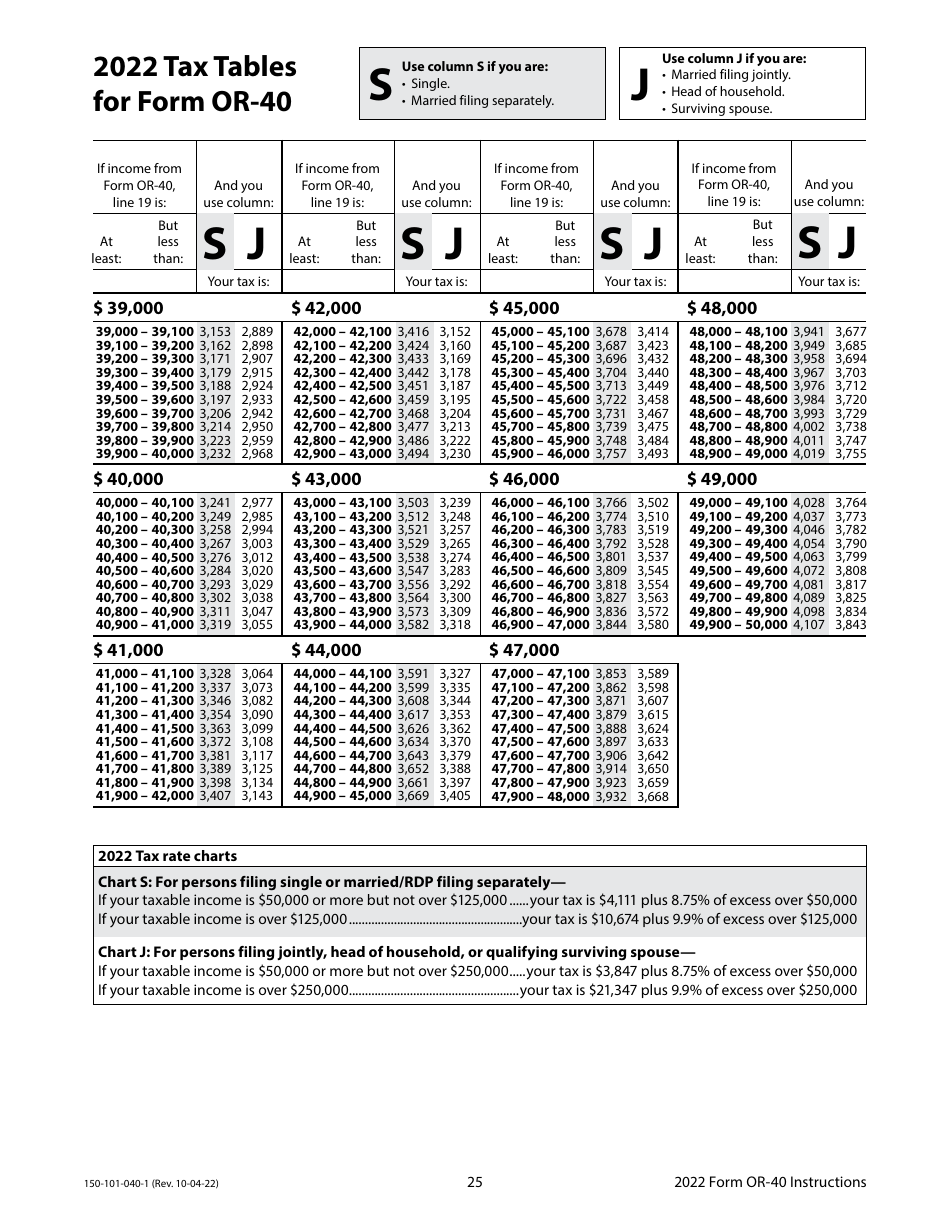

Instructions for Form OR-40, 150-101-040

for the current year.

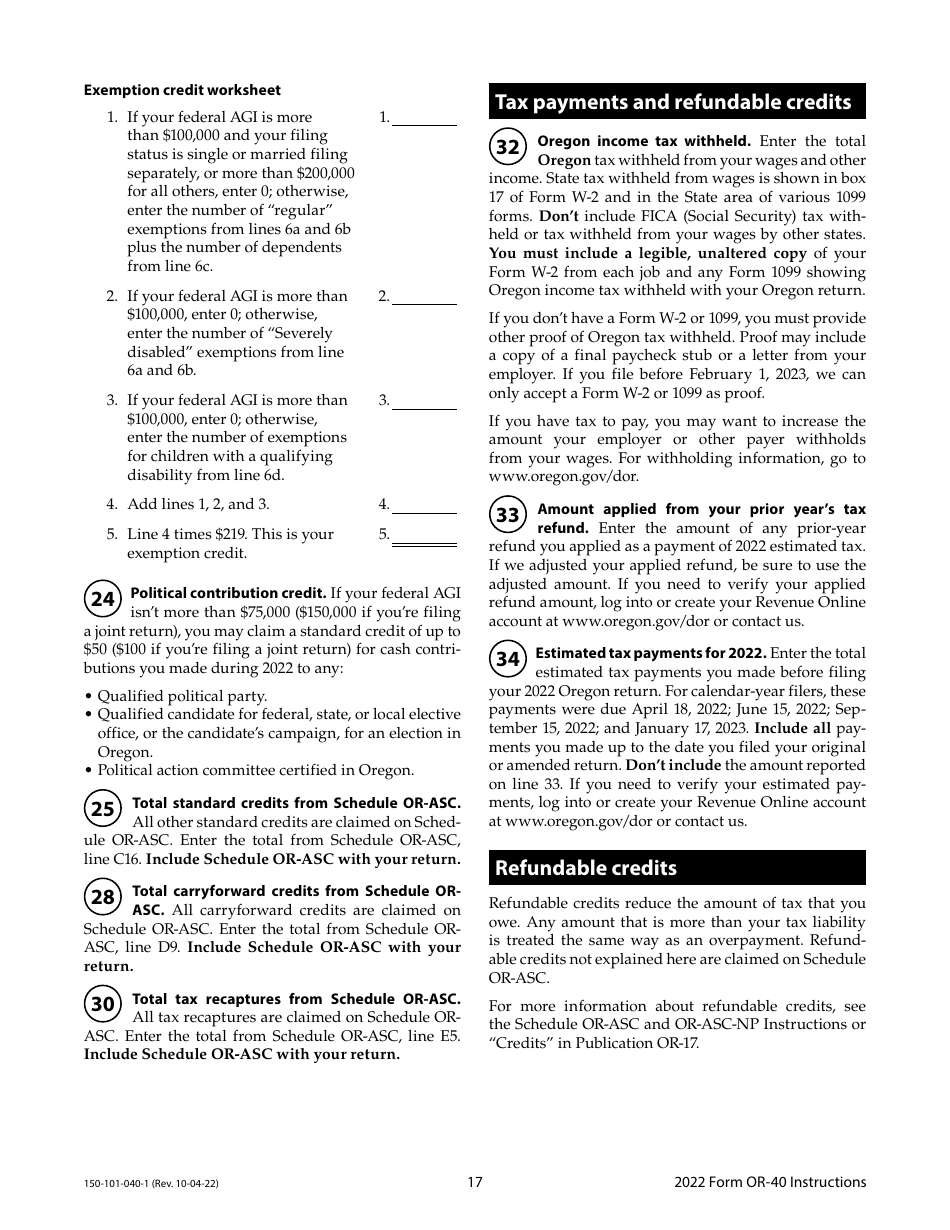

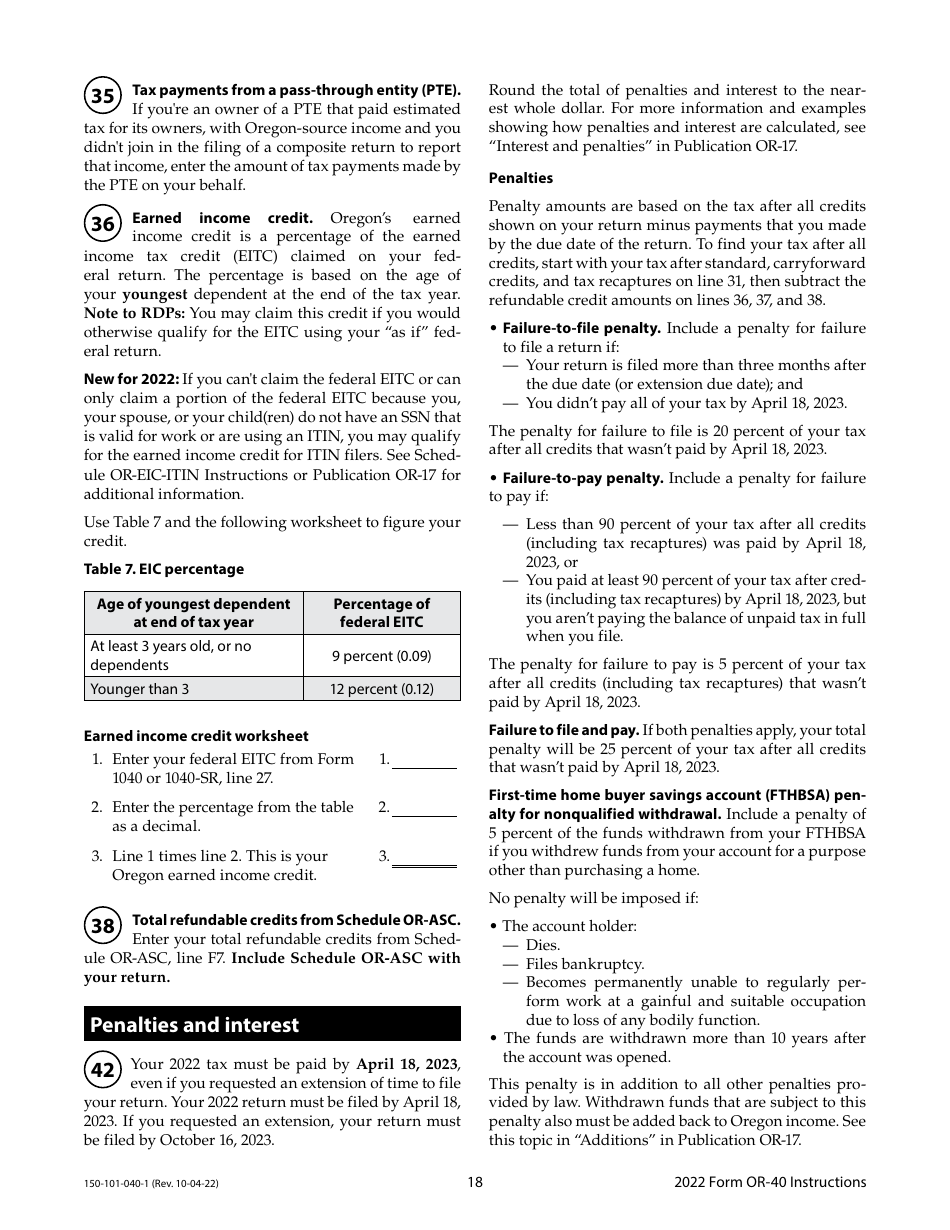

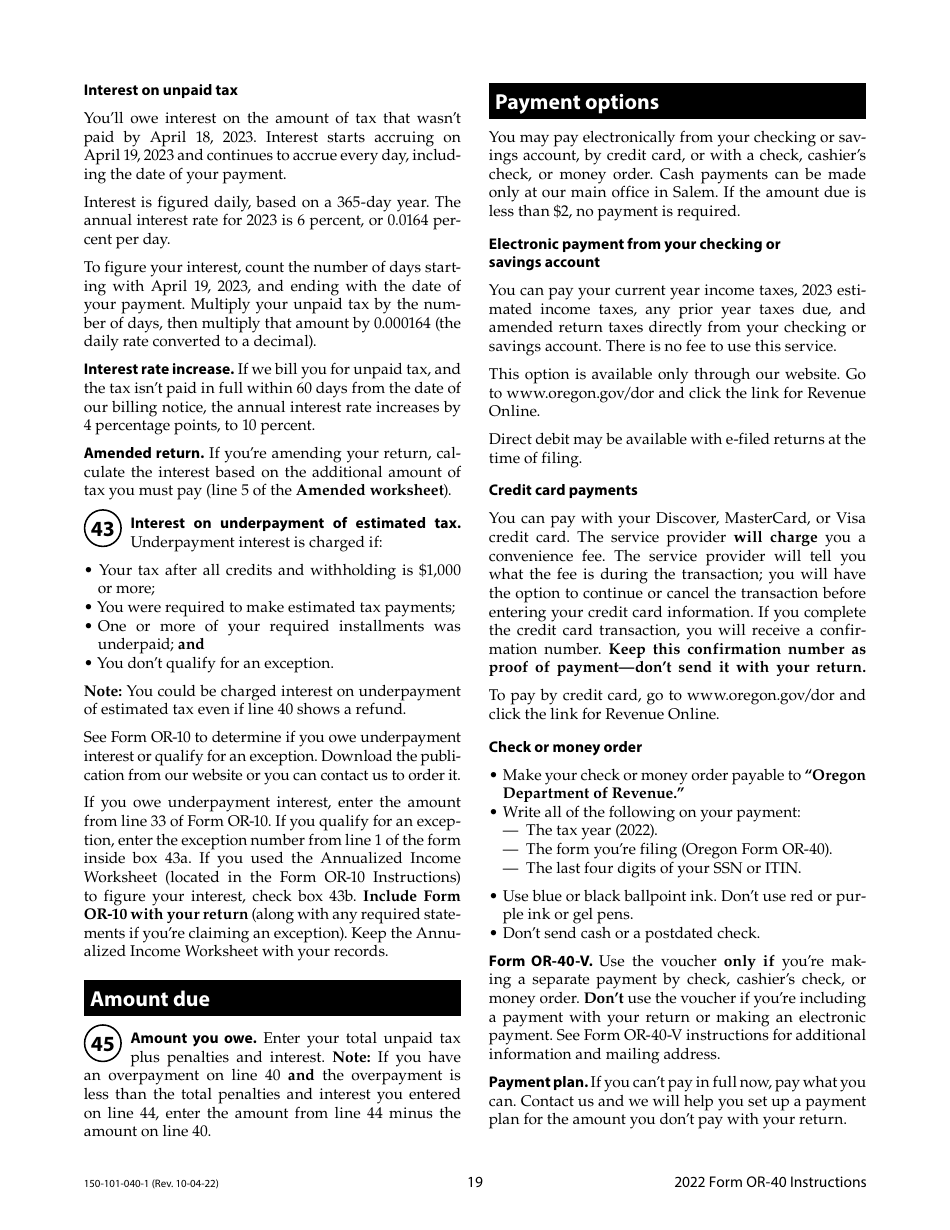

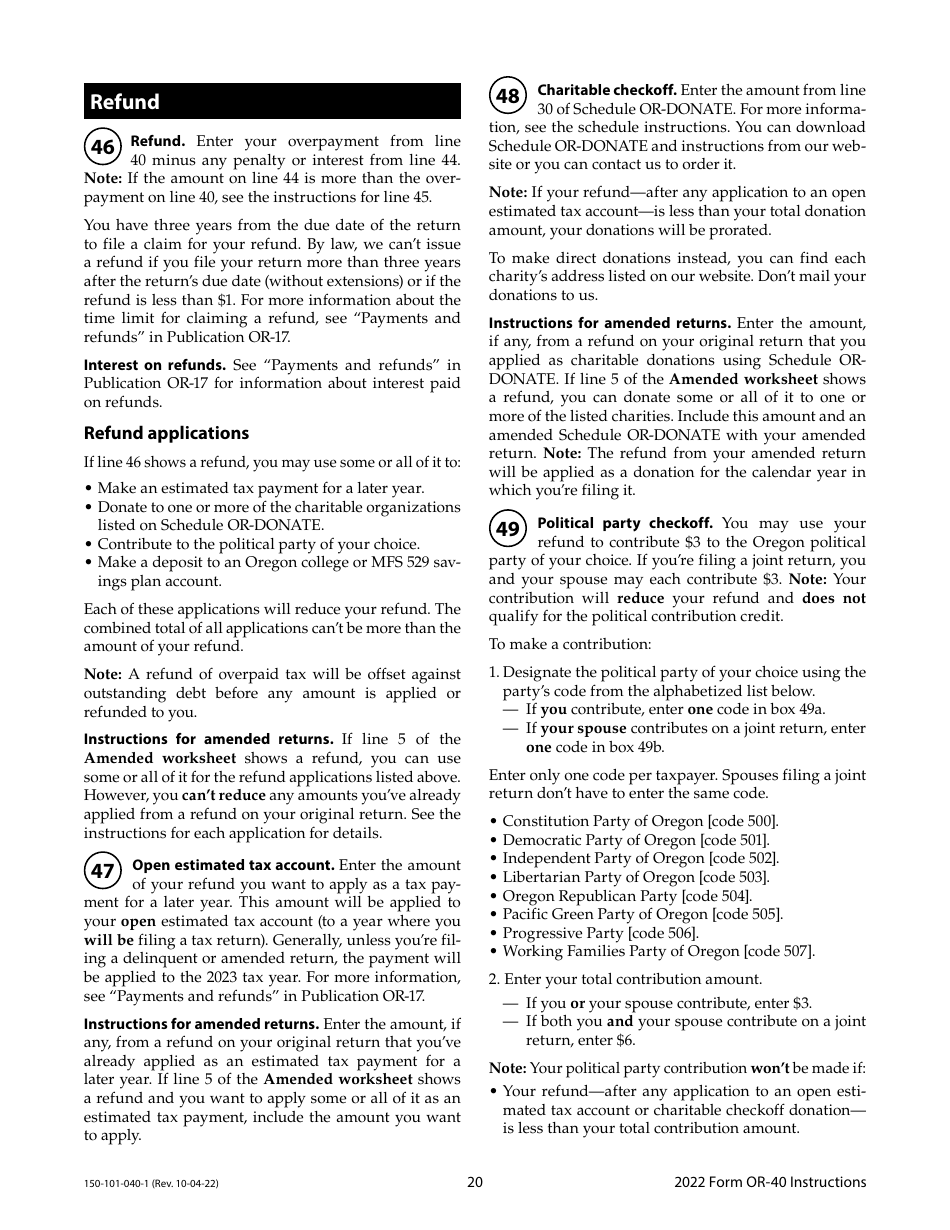

Instructions for Form OR-40, 150-101-040 Oregon Individual Income Tax Return for Full-Year Residents - Oregon

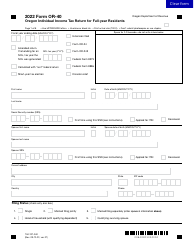

This document contains official instructions for Form OR-40 , and Form 150-101-040 . Both forms are released and collected by the Oregon Department of Revenue. An up-to-date fillable Form OR-40 (150-101-040) is available for download through this link.

FAQ

Q: What is Form OR-40?

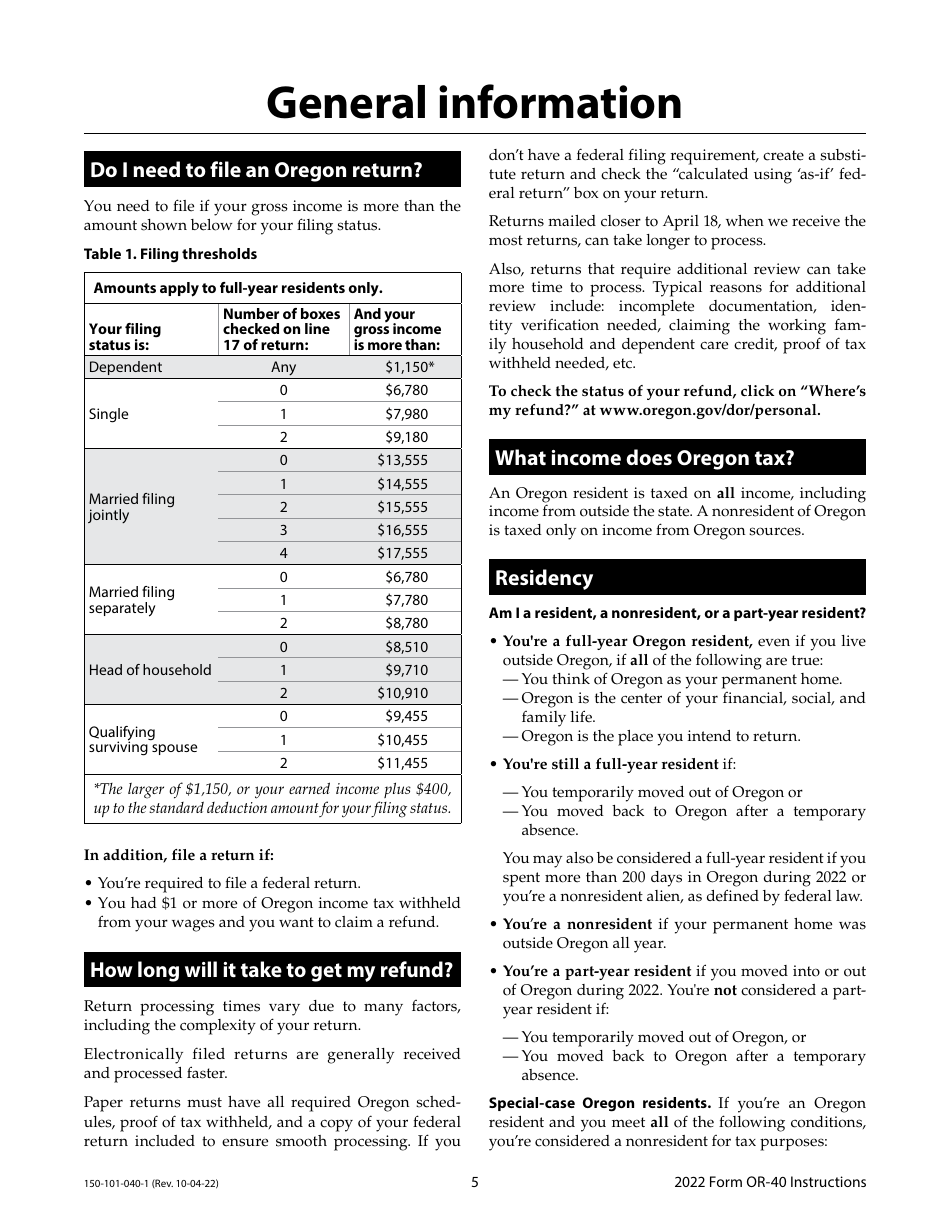

A: Form OR-40 is the Oregon Individual Income Tax Return for full-year residents of Oregon.

Q: Who should file Form OR-40?

A: Any full-year resident of Oregon who earned income during the tax year should file Form OR-40.

Q: What information is required to complete Form OR-40?

A: You will need to provide your personal information, including your name, Social Security number, and address. You will also need to report your income, deductions, and any tax credits you may be eligible for.

Q: When is the deadline to file Form OR-40?

A: The deadline to file Form OR-40 is generally April 15th, but it may vary depending on the tax year.

Q: Can I file Form OR-40 electronically?

A: Yes, you can file Form OR-40 electronically using the Oregon e-file system or through approved software providers.

Q: What if I can't afford to pay the taxes I owe?

A: If you are unable to pay the full amount of taxes owed, you can contact the Oregon Department of Revenue to discuss payment options, such as an installment agreement or an offer in compromise.

Q: What if I need an extension to file Form OR-40?

A: If you need more time to file Form OR-40, you can request an extension by filling out Form OR-40-V.

Q: Are there any penalties for filing Form OR-40 late?

A: Yes, if you file Form OR-40 late without an approved extension, you may be subject to late filing penalties and interest charges on the unpaid taxes.

Q: Can I claim a refund if I overpaid my taxes?

A: Yes, if you overpaid your taxes, you can claim a refund on Form OR-40 and receive a refund check or direct deposit.

Instruction Details:

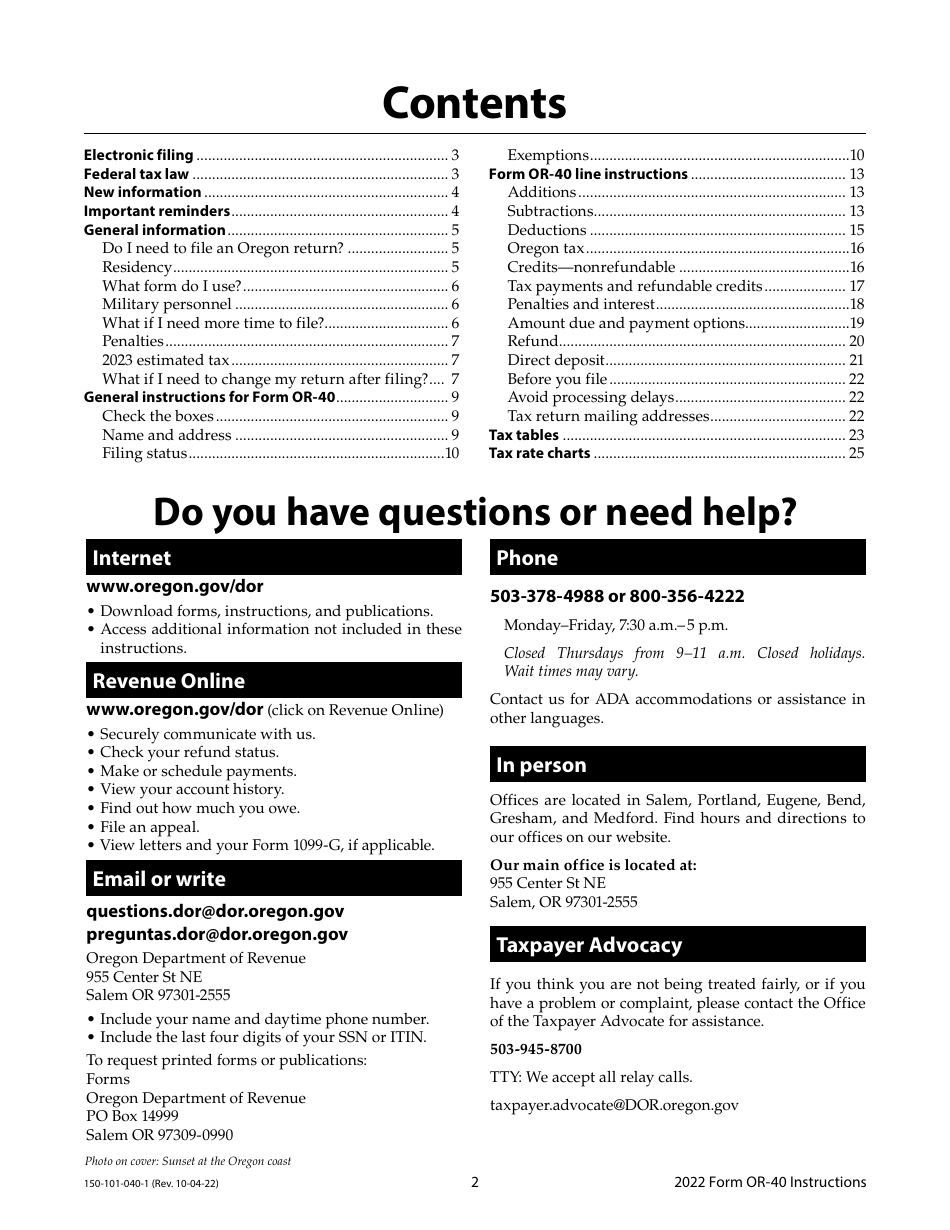

- This 25-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Oregon Department of Revenue.