This version of the form is not currently in use and is provided for reference only. Download this version of

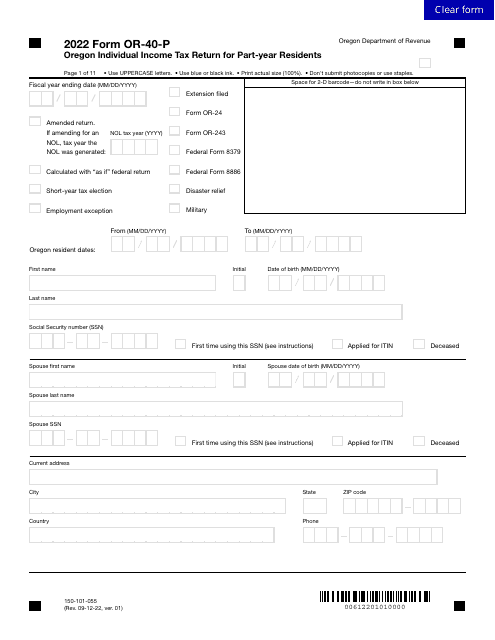

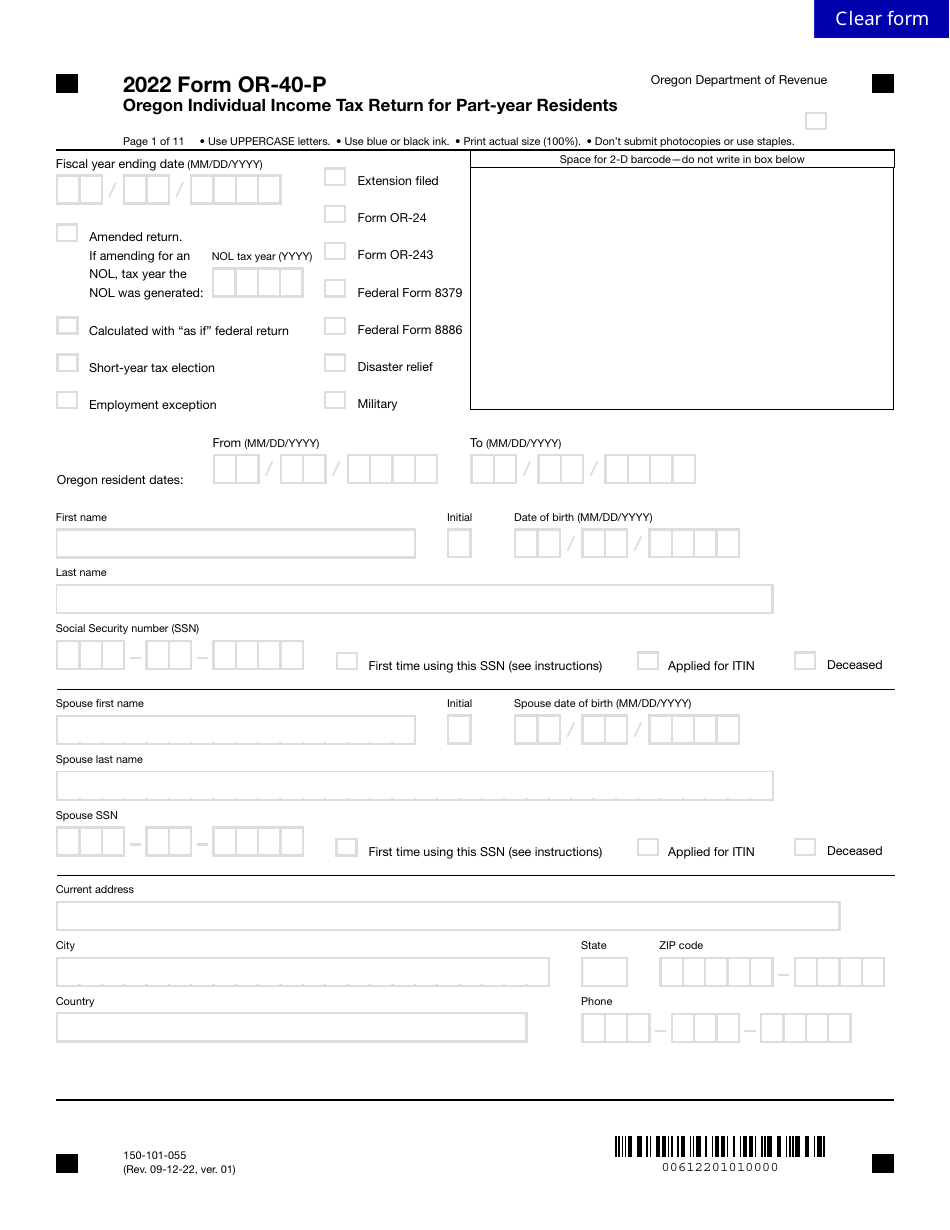

Form OR-40-P (150-101-055)

for the current year.

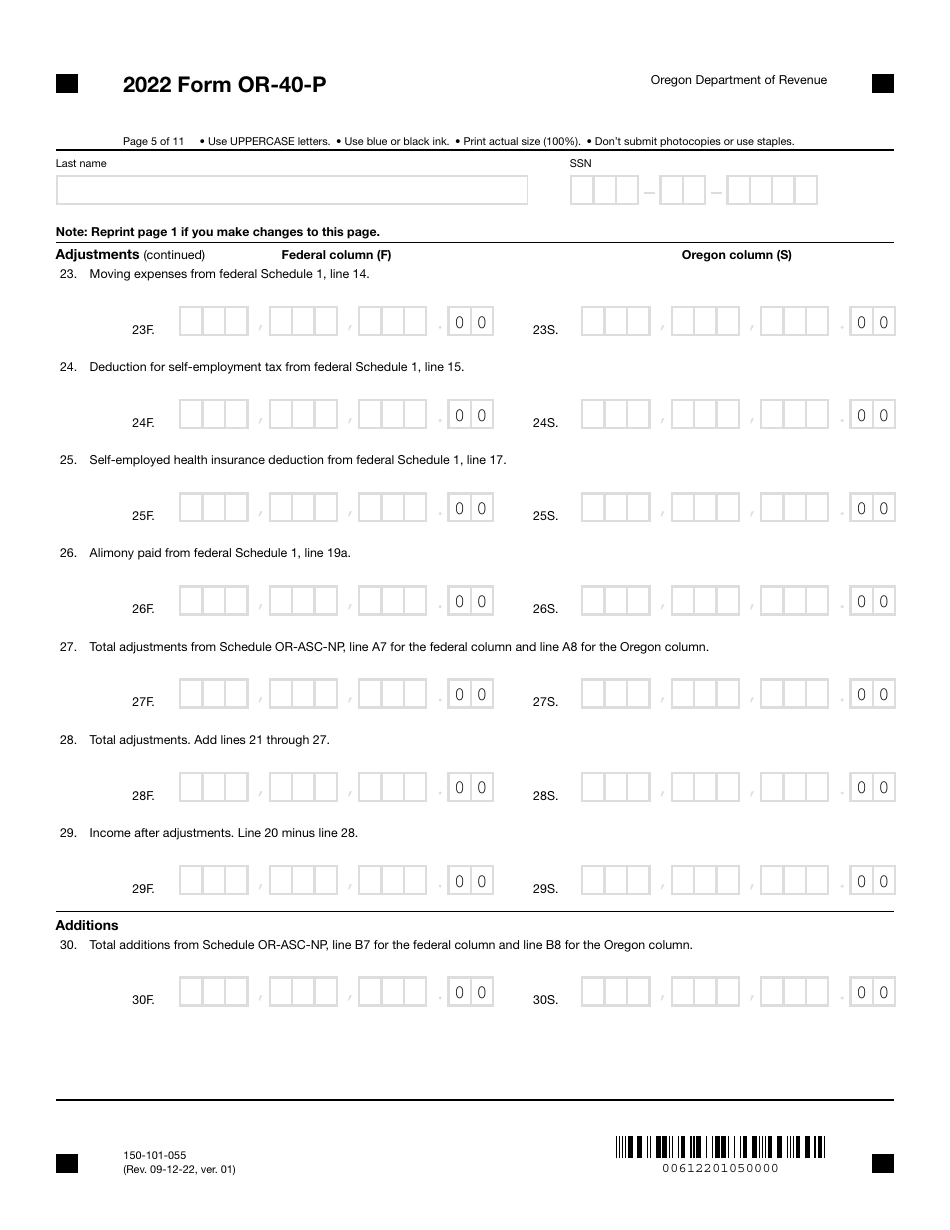

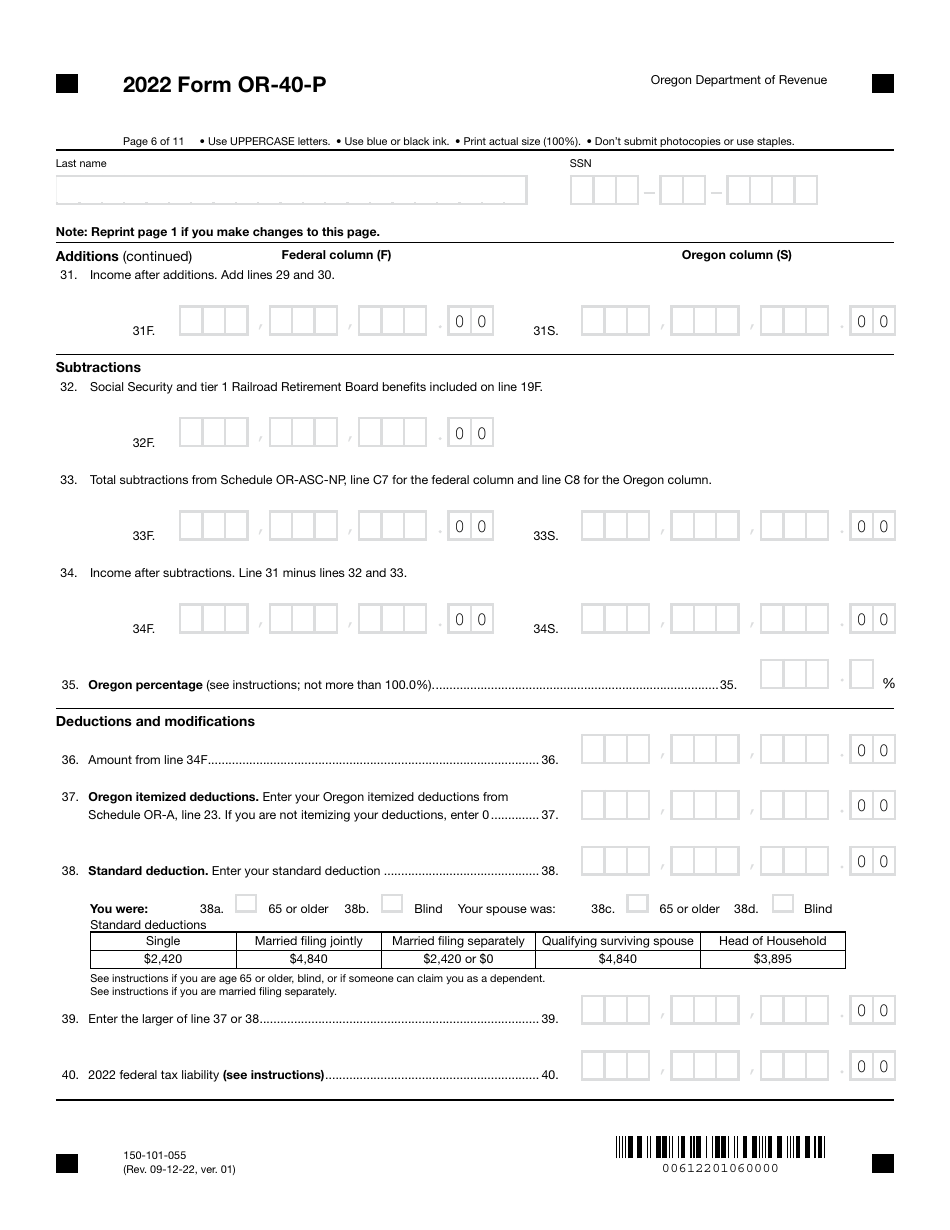

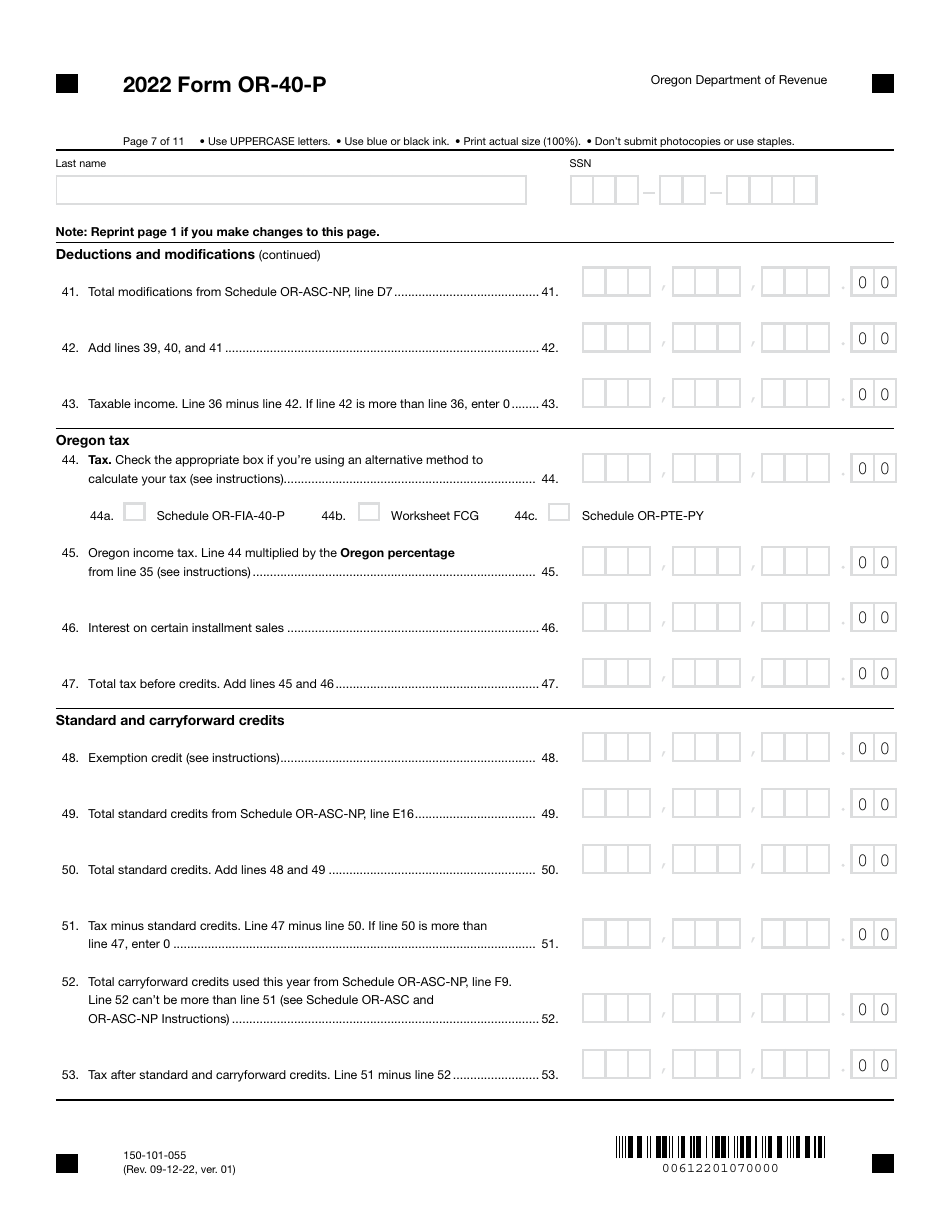

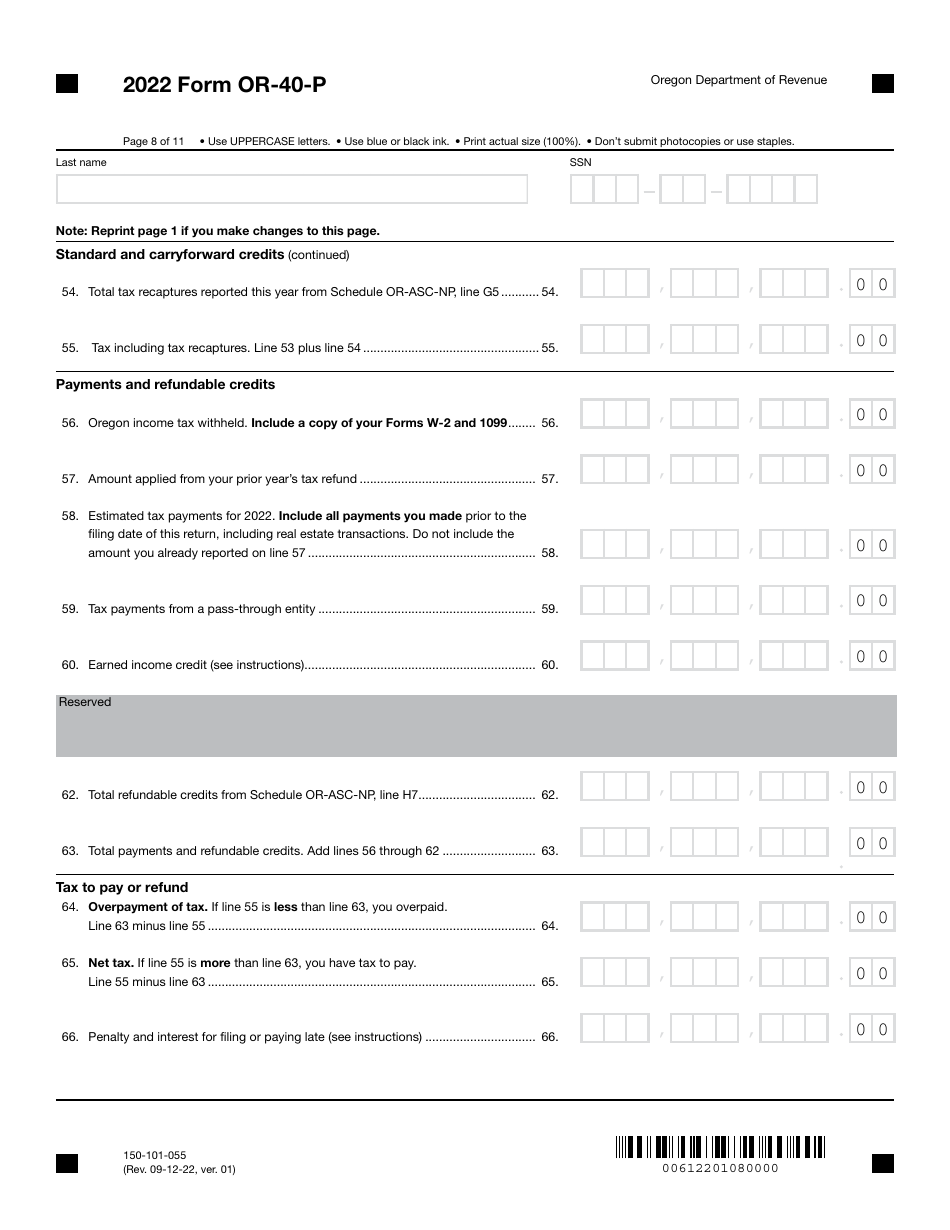

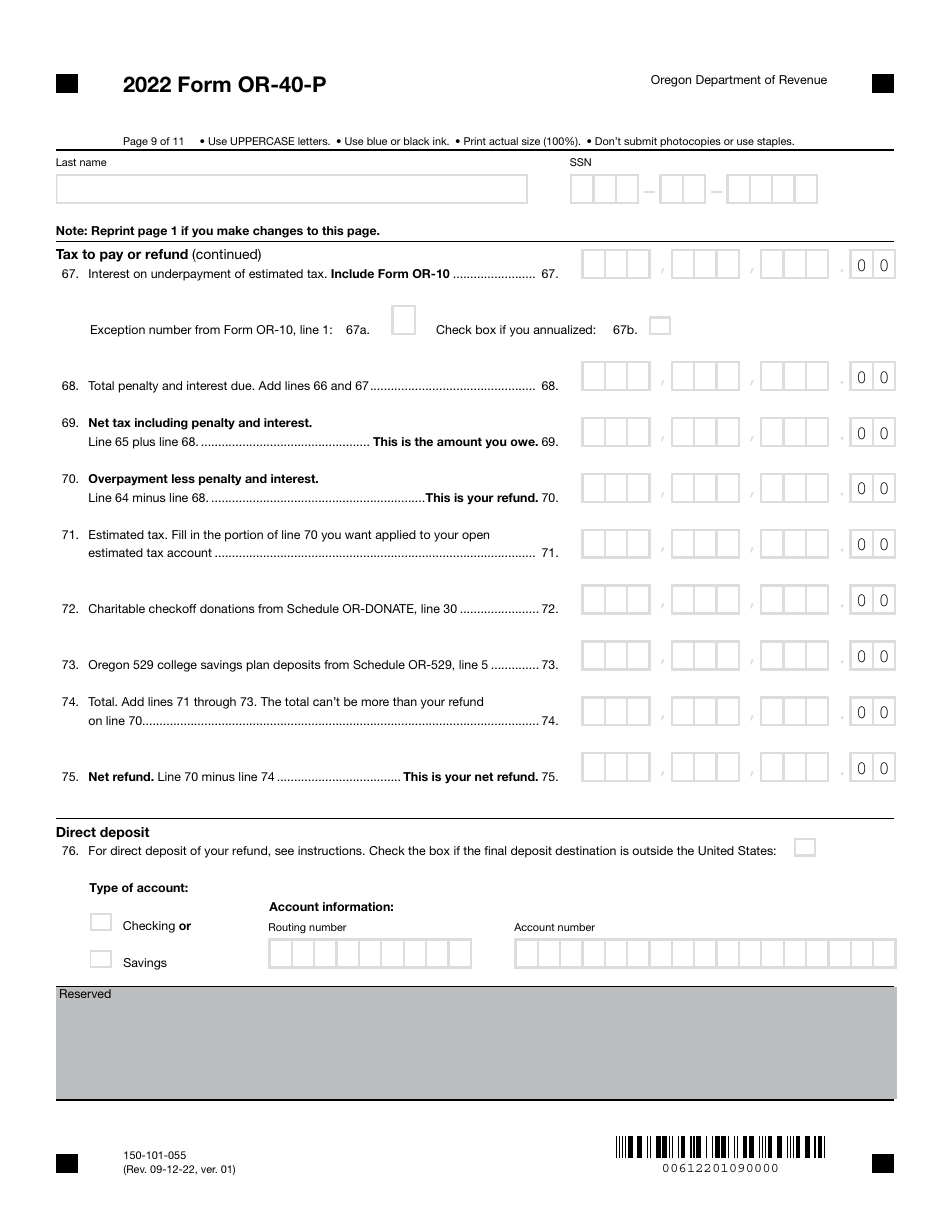

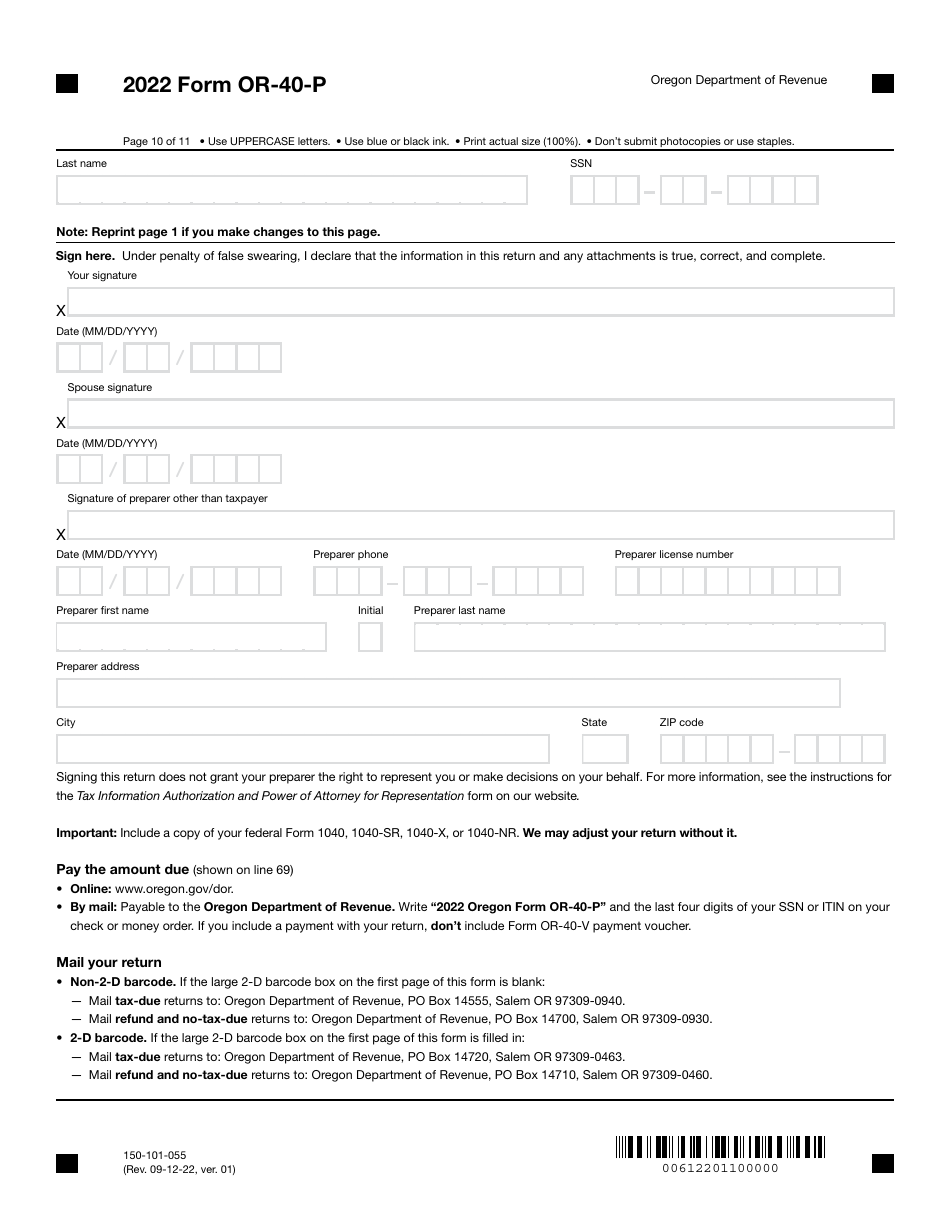

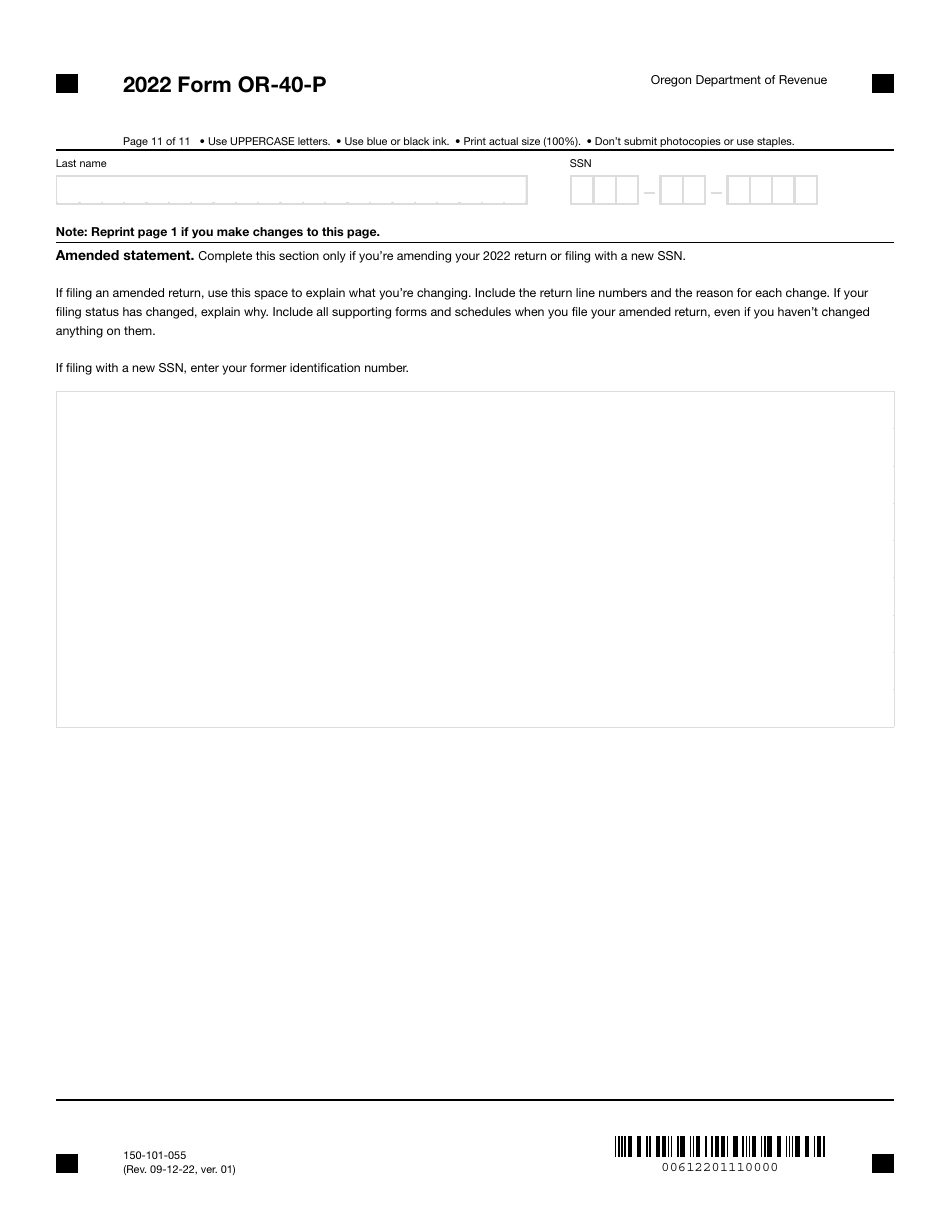

Form OR-40-P (150-101-055) Oregon Individual Income Tax Return for Part-Year Residents - Oregon

What Is Form OR-40-P (150-101-055)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form OR-40-P?

A: Form OR-40-P is the Oregon Individual Income Tax Return for Part-Year Residents.

Q: Who uses Form OR-40-P?

A: Form OR-40-P is used by individuals who were residents of Oregon for only part of the tax year.

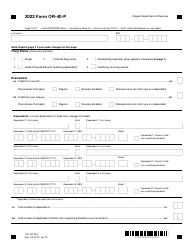

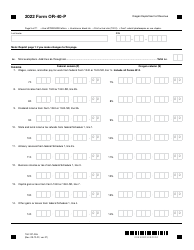

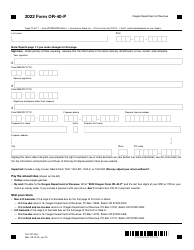

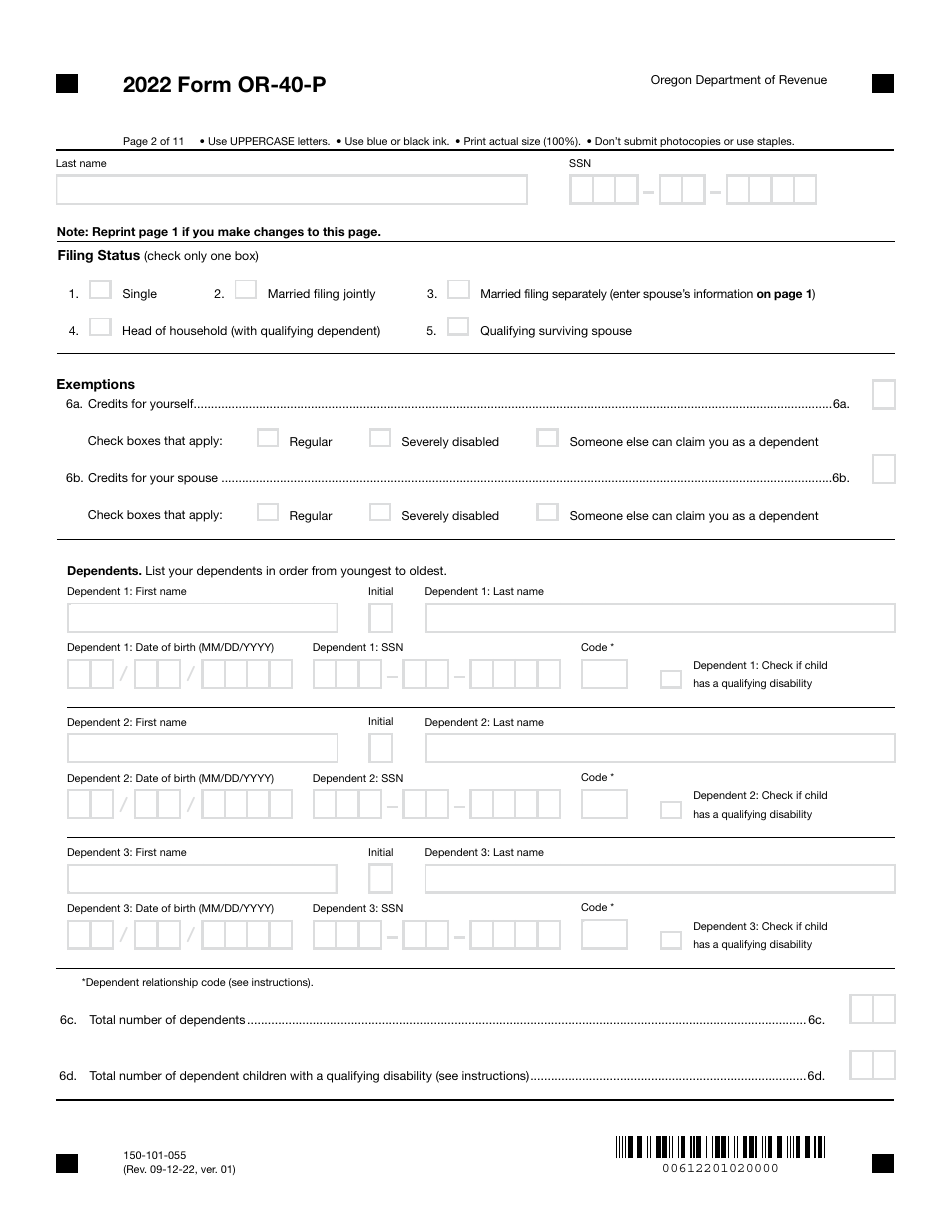

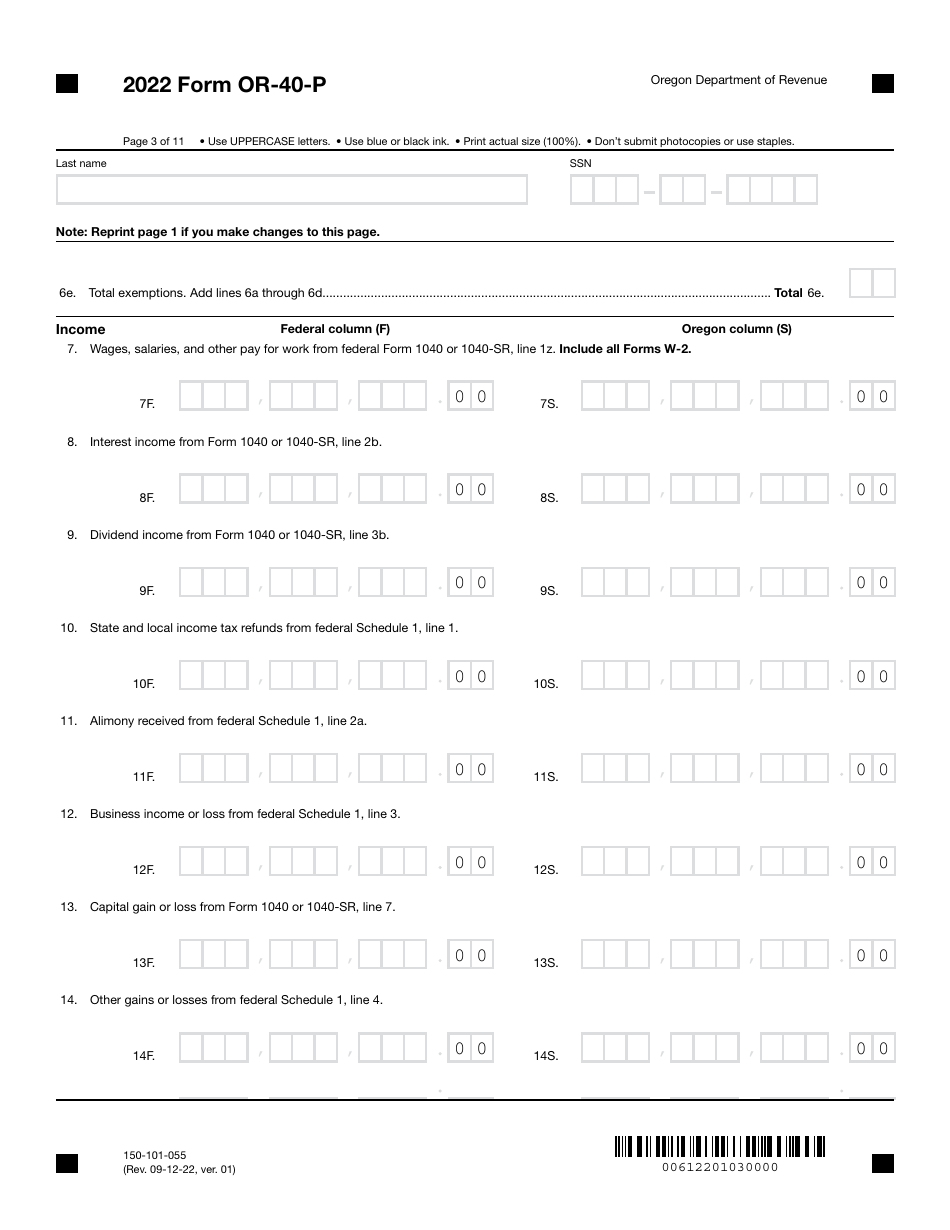

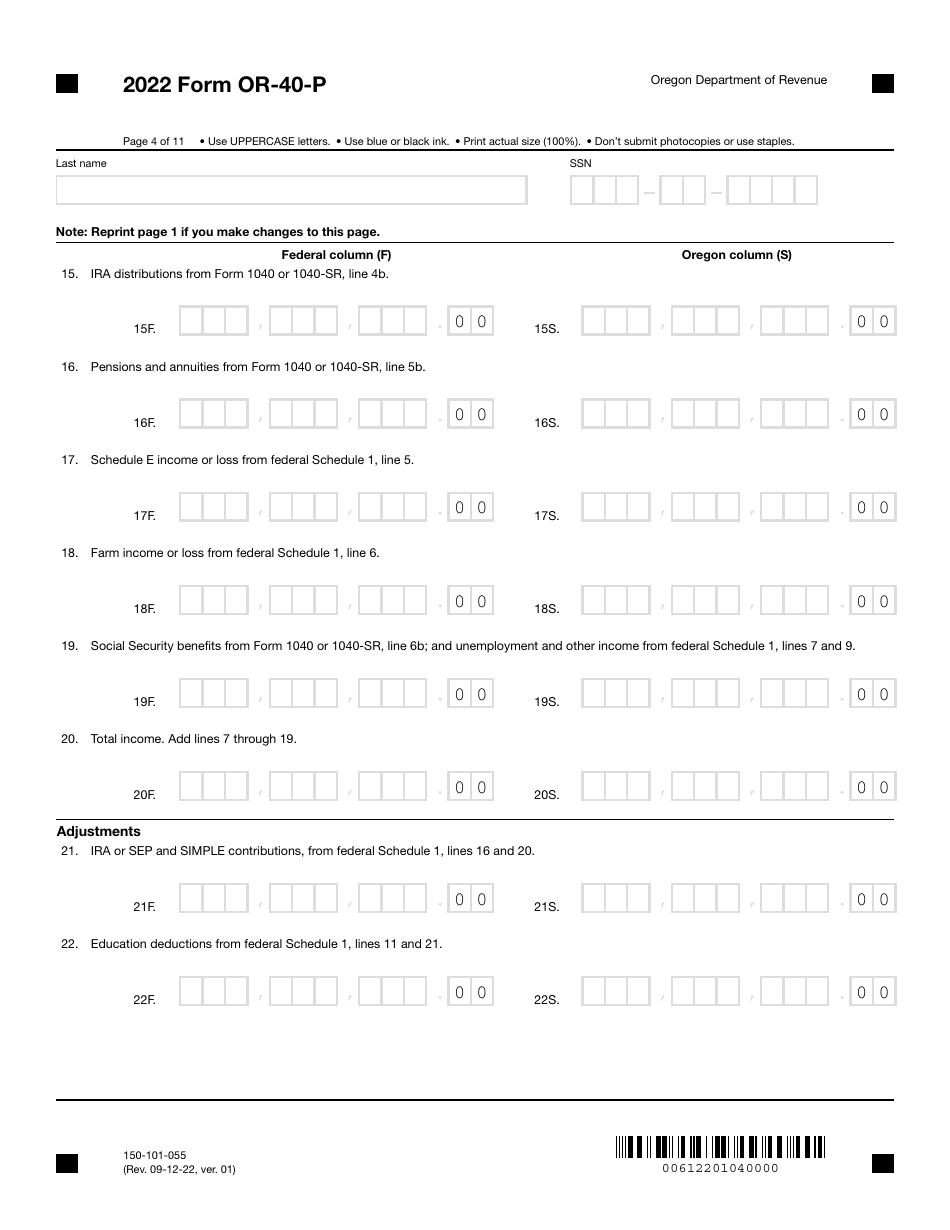

Q: What information do I need to fill out Form OR-40-P?

A: You will need to provide your personal information, income details, deductions, and credits for the part of the year you were an Oregon resident.

Q: When is Form OR-40-P due?

A: Form OR-40-P is due on April 15th of the following year, or the next business day if April 15th falls on a weekend or holiday.

Q: Can I file Form OR-40-P electronically?

A: Yes, you can file Form OR-40-P electronically using the Oregon eFile system.

Q: What should I do if I need an extension to file Form OR-40-P?

A: You can request an extension of time to file by submitting Form OR-40-V.

Q: Is there a penalty for late filing of Form OR-40-P?

A: Yes, there is a penalty for late filing, so it's important to file your return on time or request an extension if needed.

Form Details:

- Released on September 12, 2022;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-40-P (150-101-055) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.