This version of the form is not currently in use and is provided for reference only. Download this version of

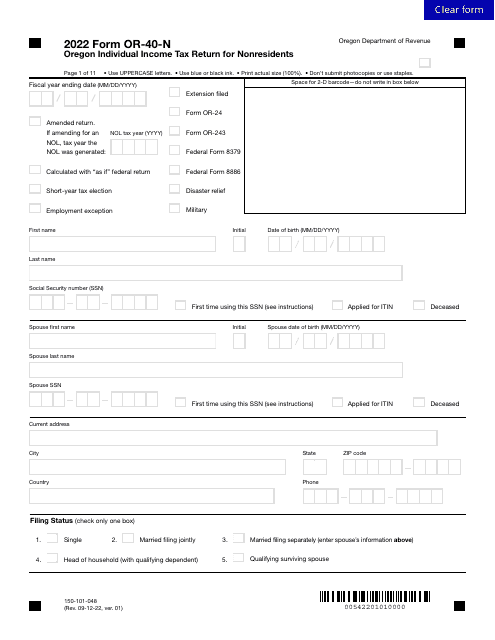

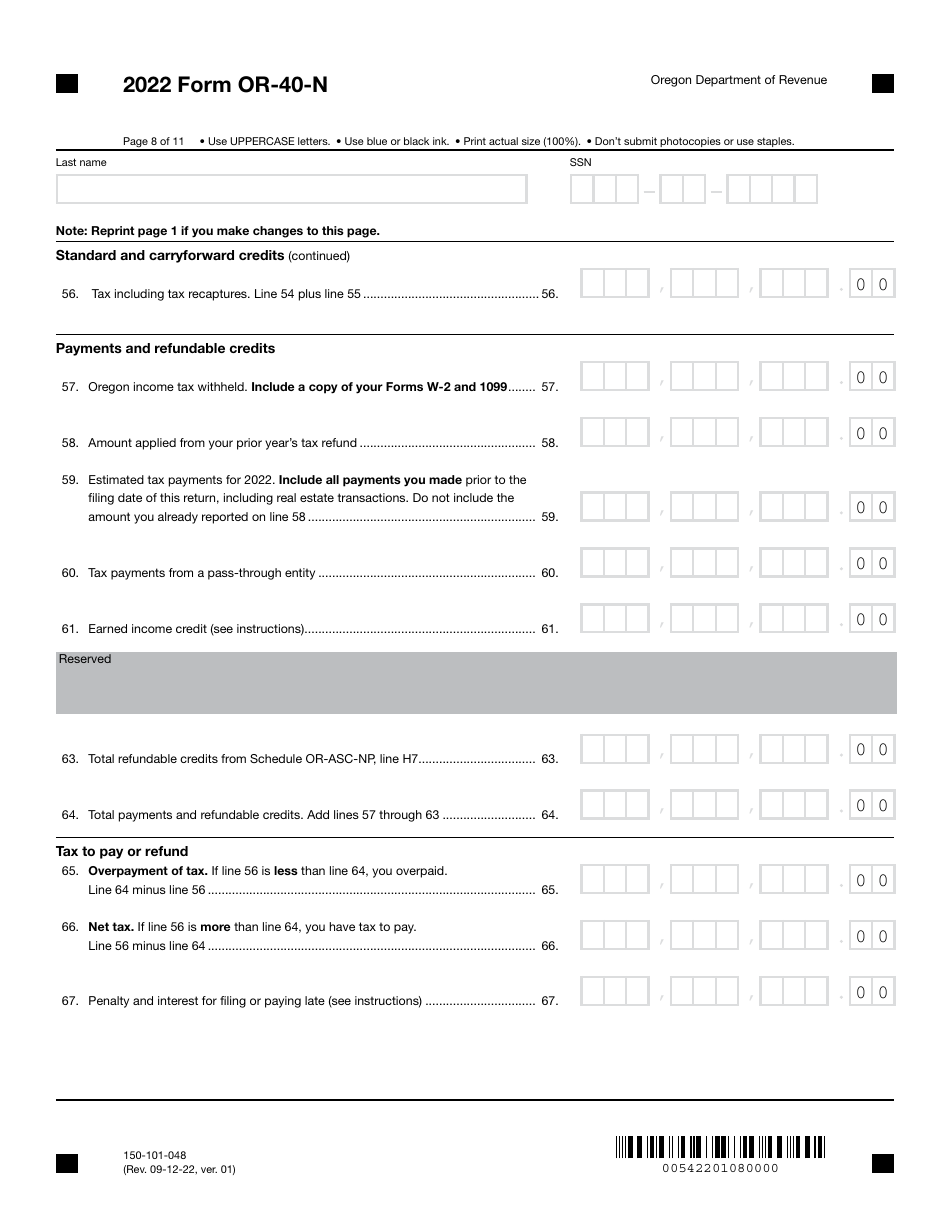

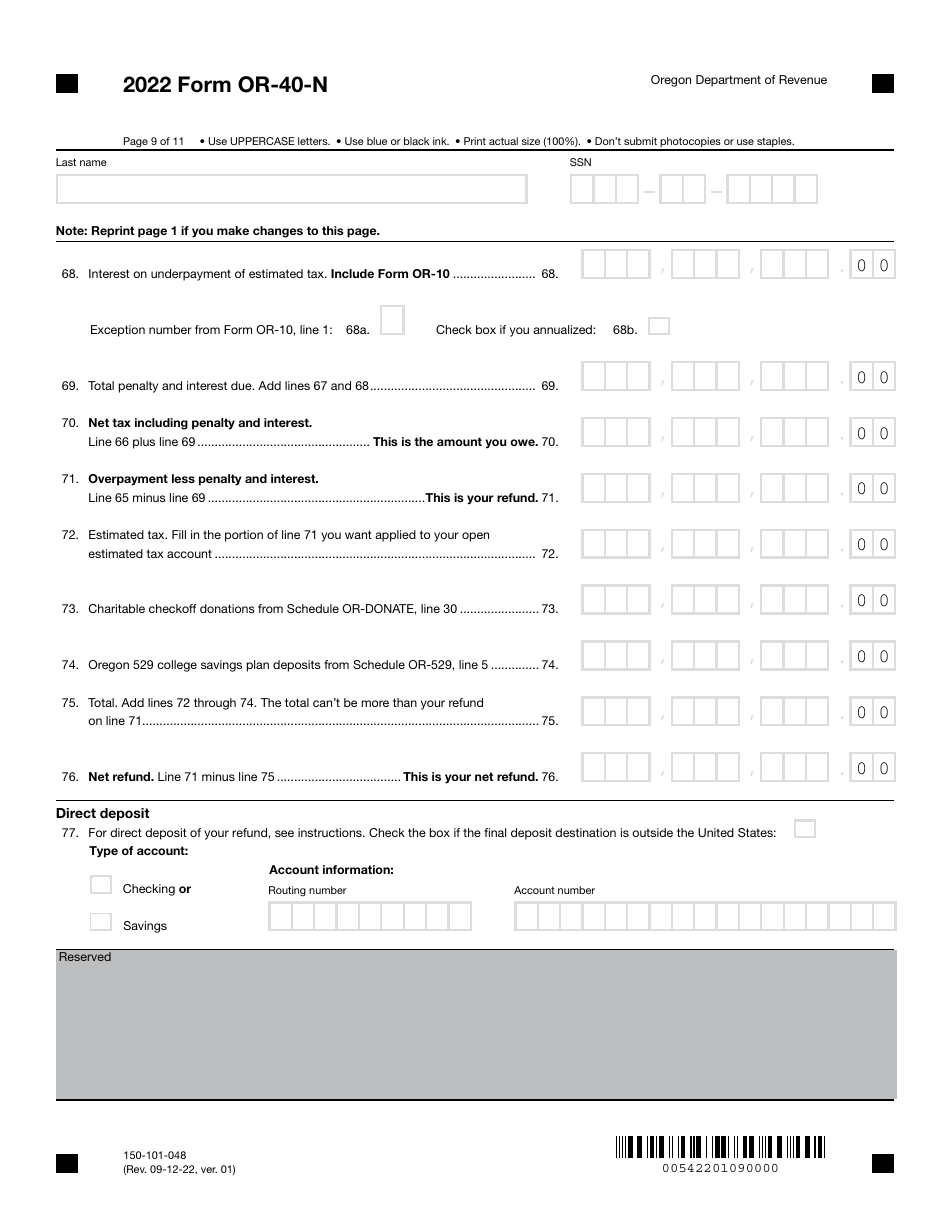

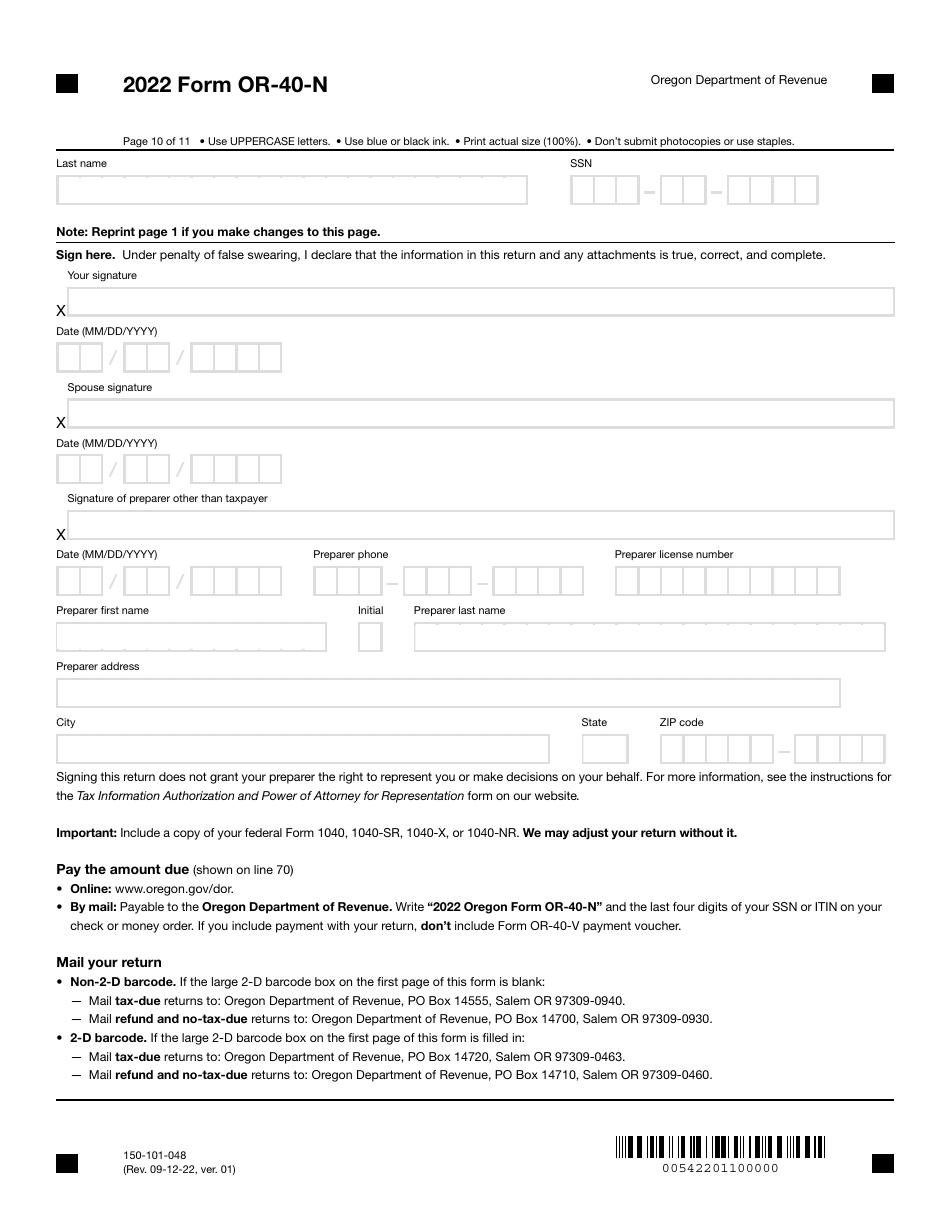

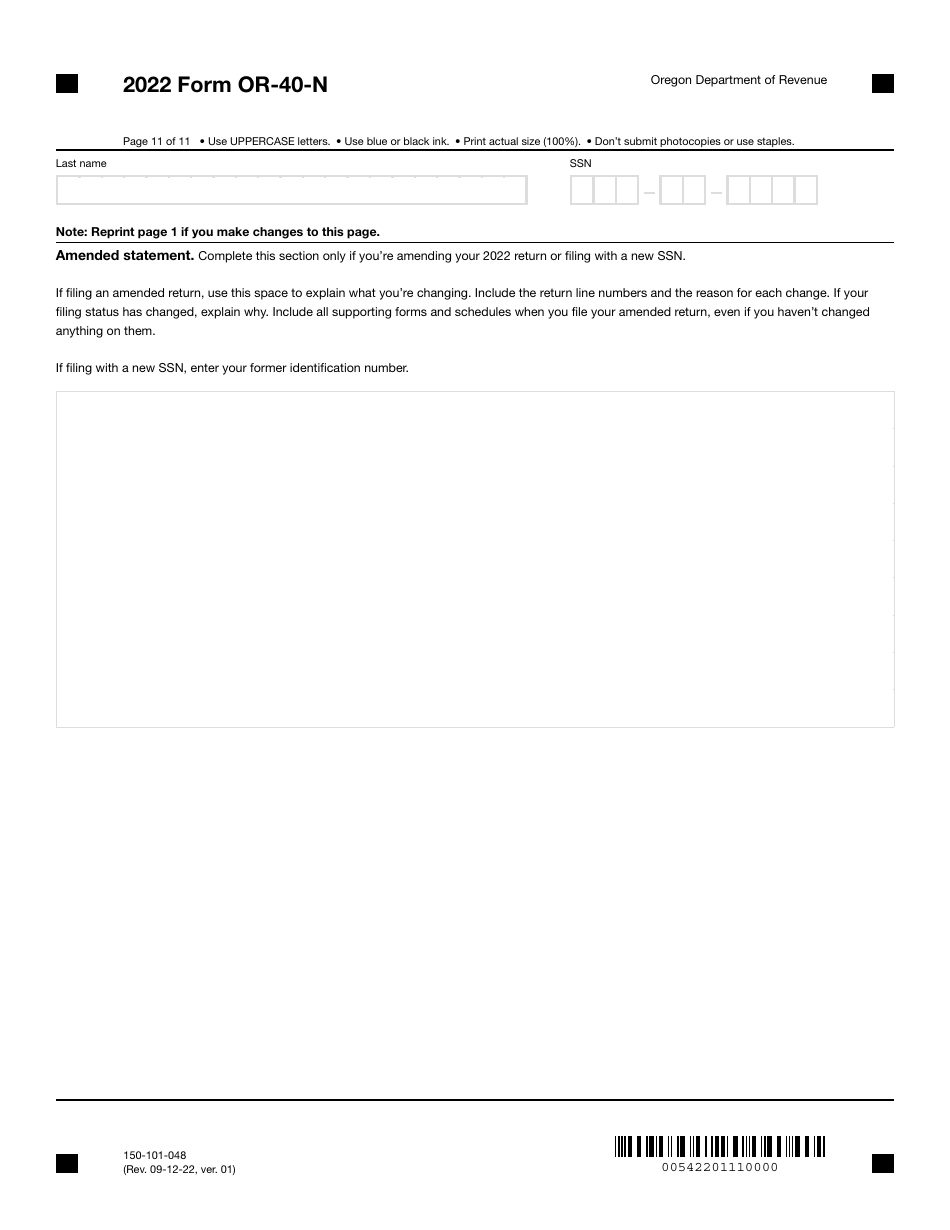

Form OR-40-N (150-101-048)

for the current year.

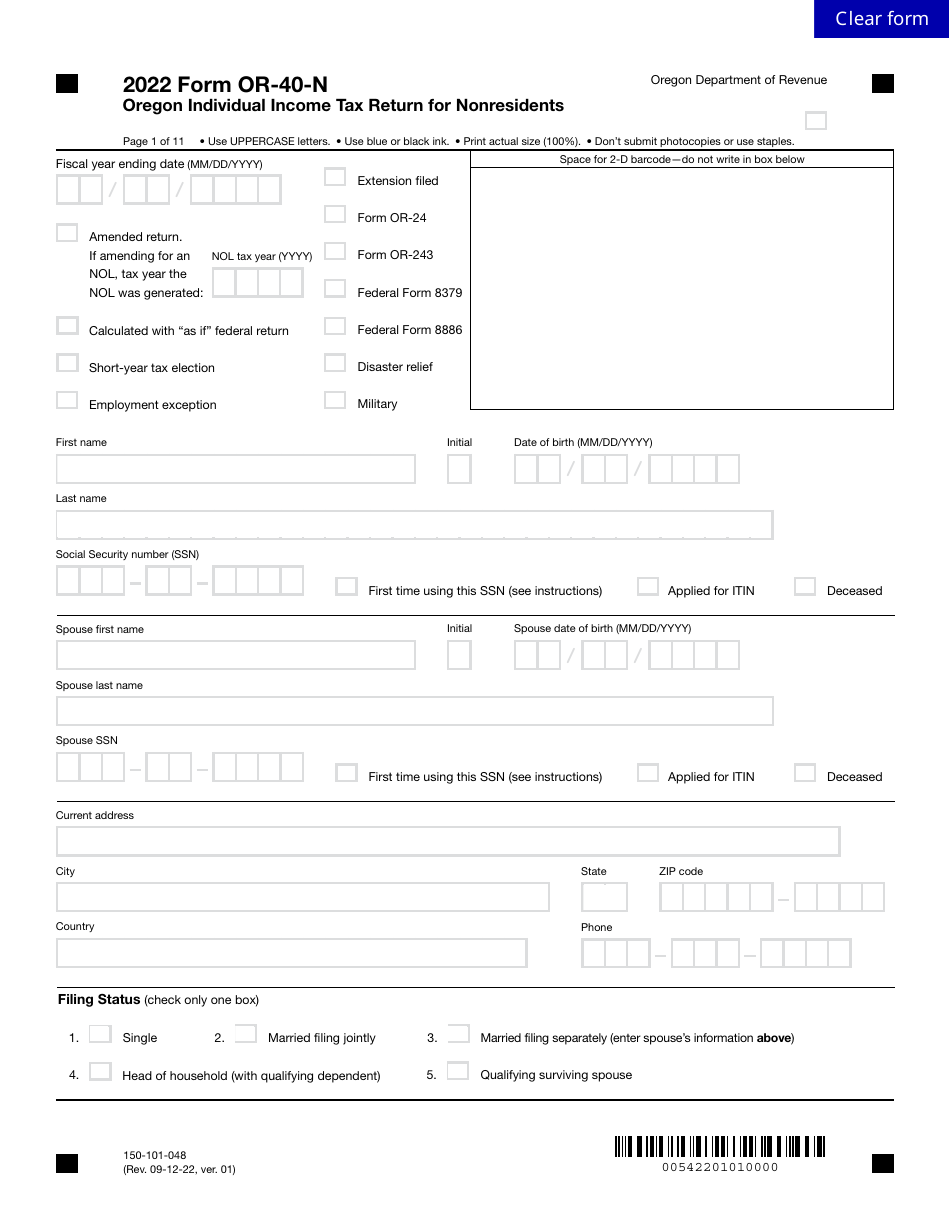

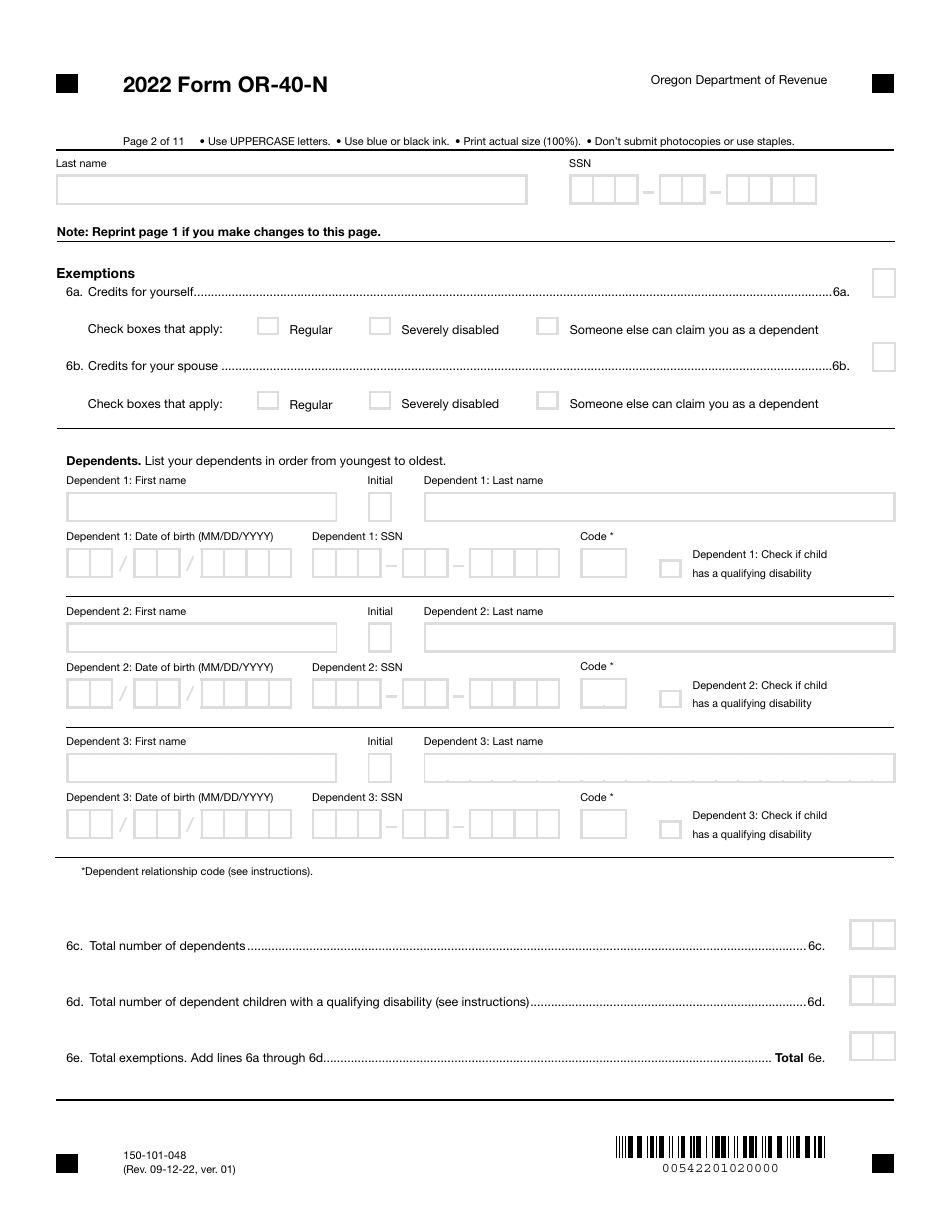

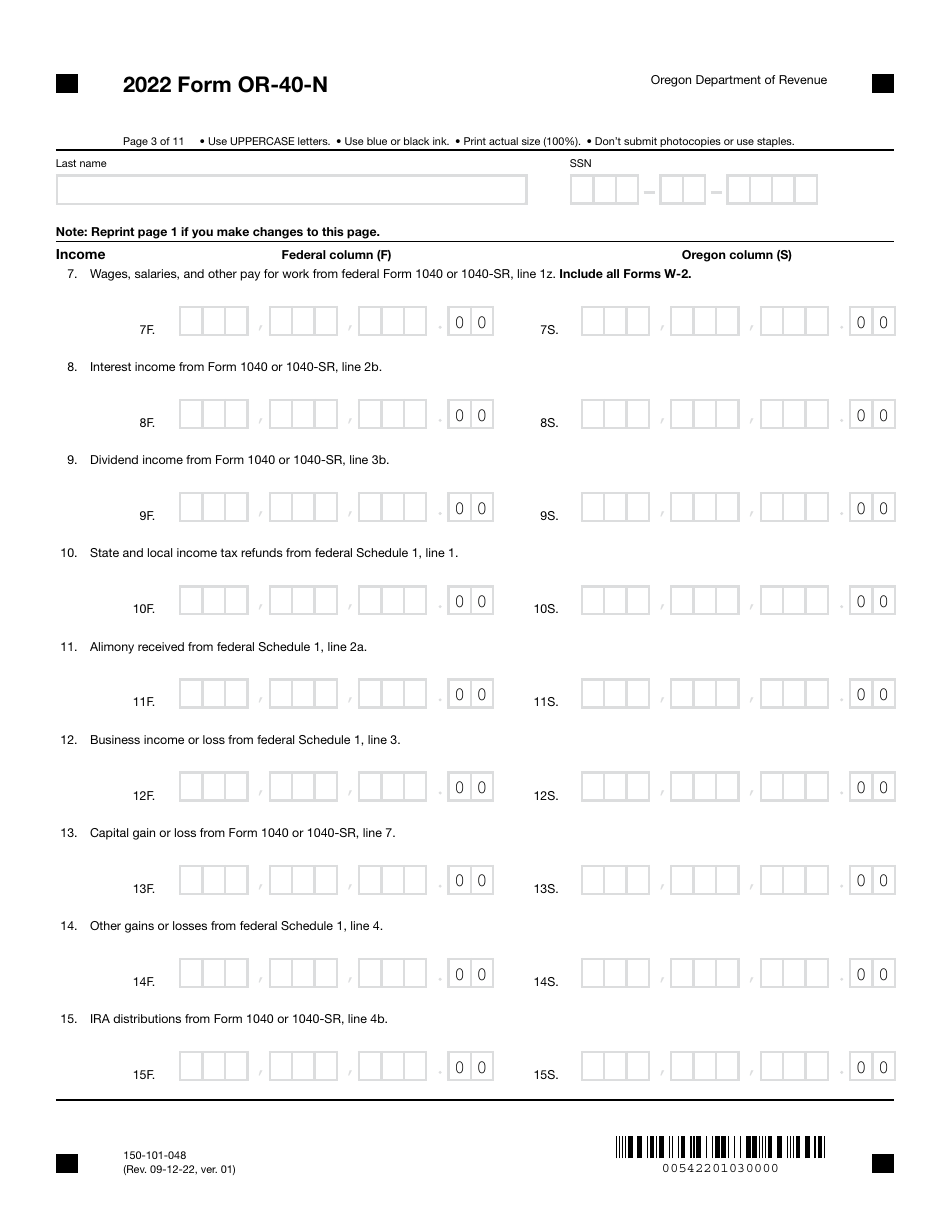

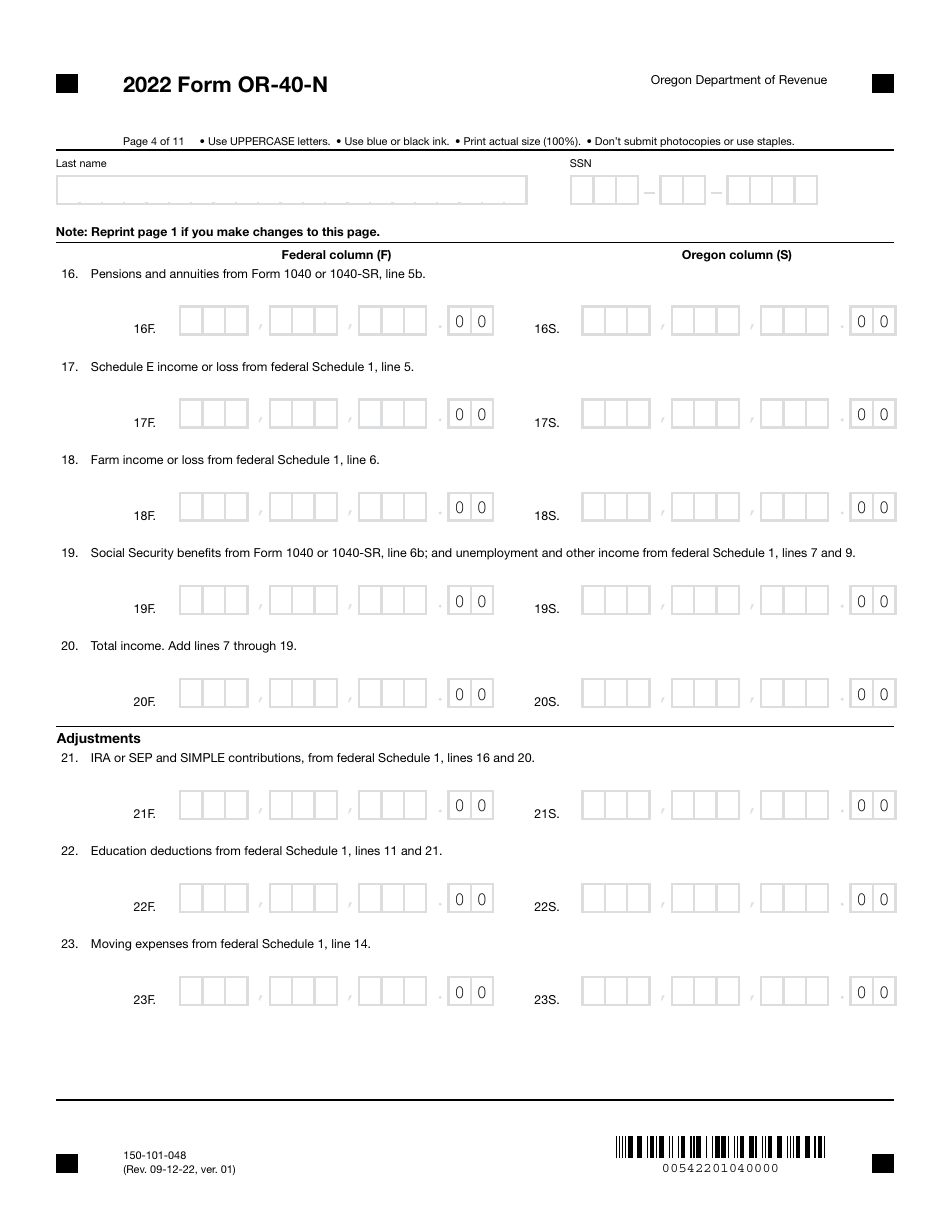

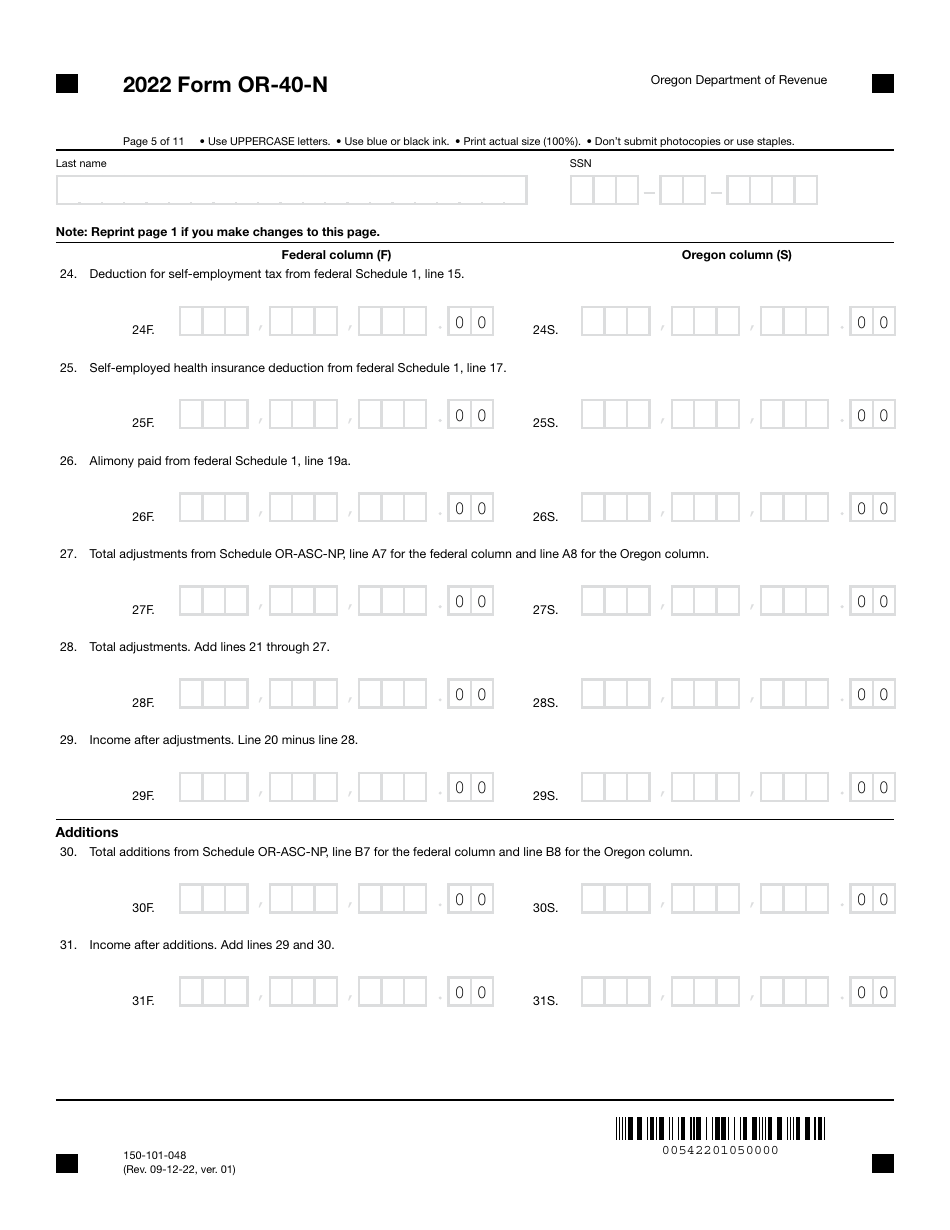

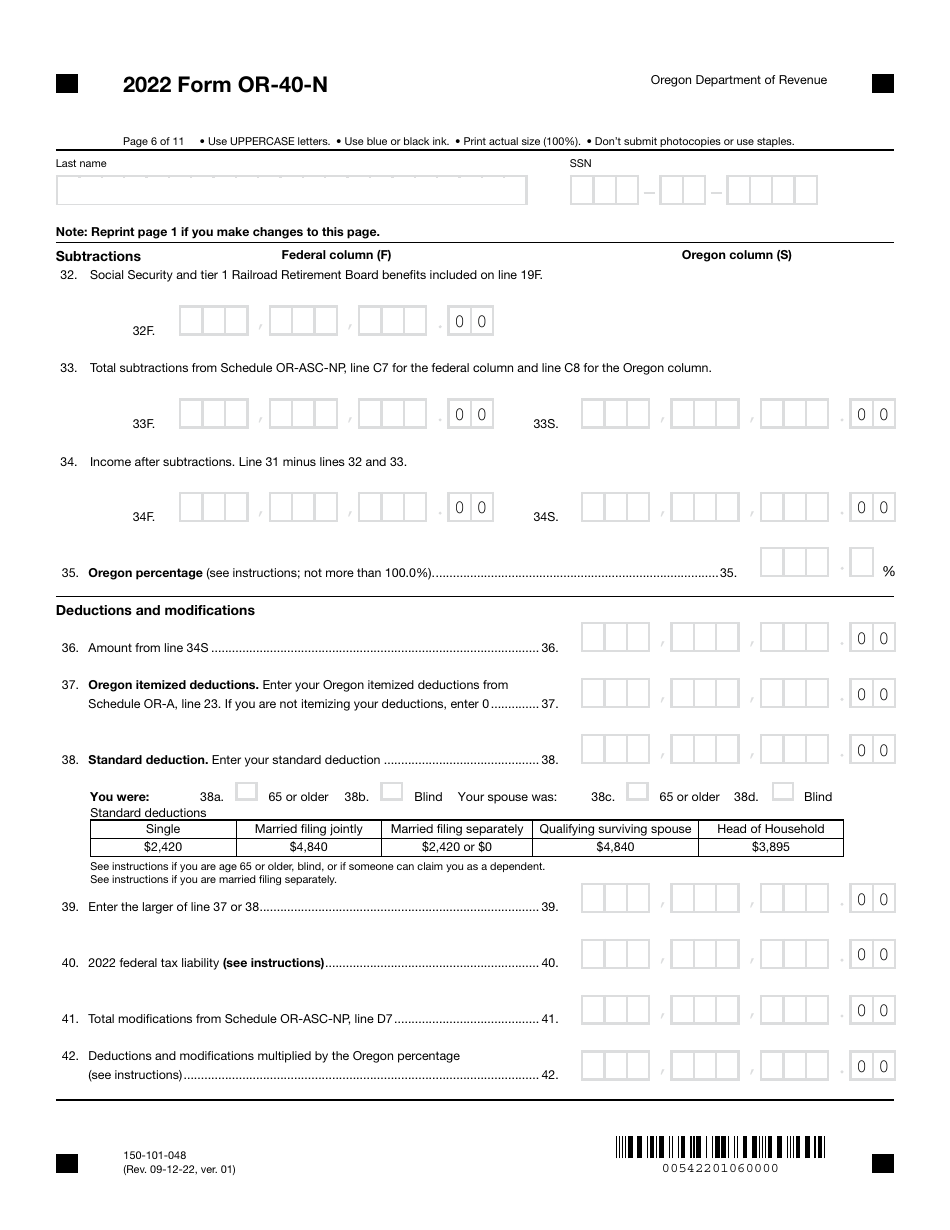

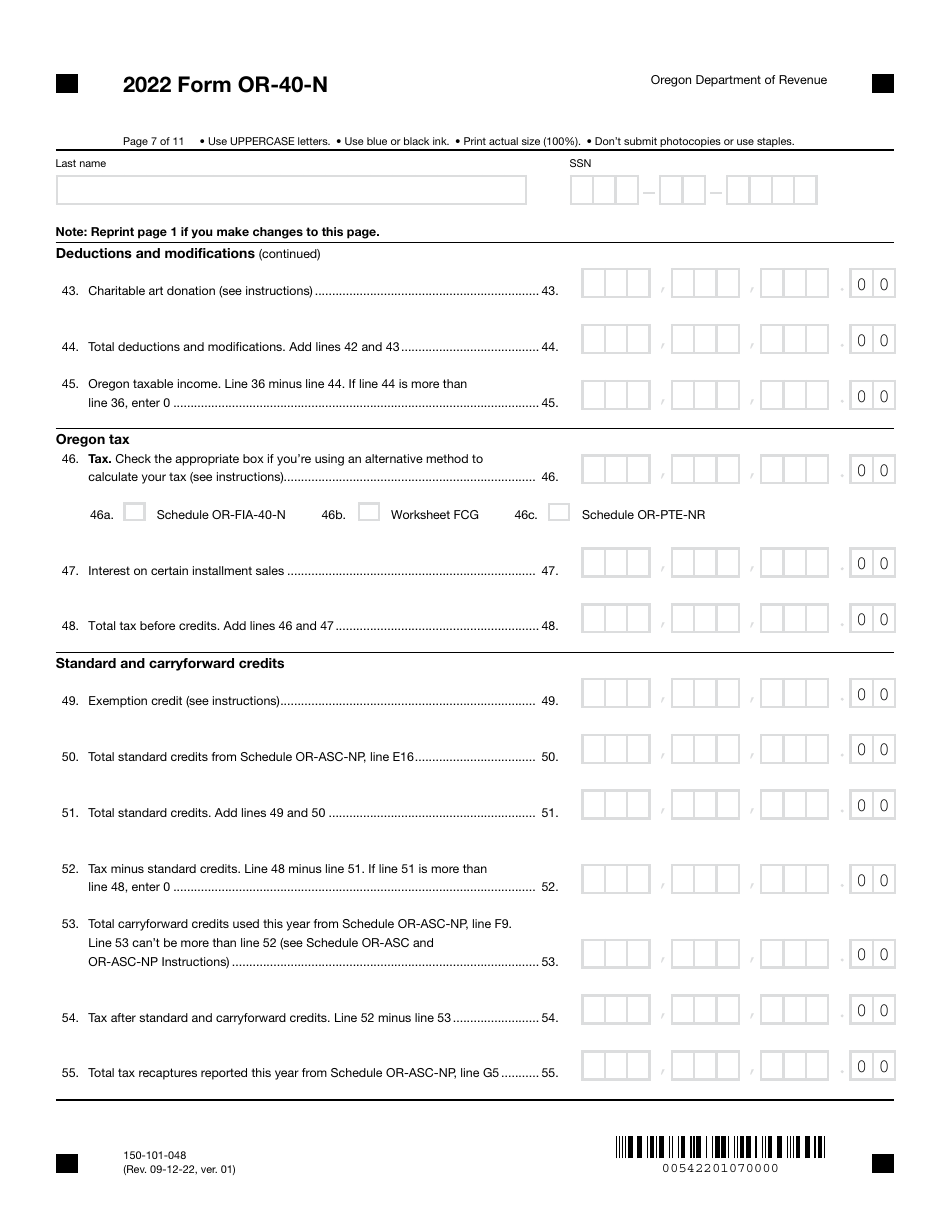

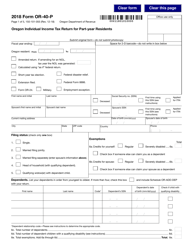

Form OR-40-N (150-101-048) Oregon Individual Income Tax Return for Nonresidents - Oregon

What Is Form OR-40-N (150-101-048)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form OR-40-N?

A: Form OR-40-N is the Oregon Individual Income Tax Return specifically for nonresidents.

Q: Who needs to file Form OR-40-N?

A: Nonresidents who earned income in Oregon need to file Form OR-40-N.

Q: What is the purpose of Form OR-40-N?

A: The purpose of Form OR-40-N is to report and pay income tax on earnings in Oregon for nonresidents.

Q: When is the deadline to file Form OR-40-N?

A: The deadline for filing Form OR-40-N is typically April 15th, unless it falls on a weekend or holiday.

Q: Are there any special instructions for completing Form OR-40-N?

A: Yes, nonresidents should refer to the instructions provided with the form for specific guidance on completing it.

Q: Do I need to include my federal tax return with Form OR-40-N?

A: No, you do not need to include your federal tax return with Form OR-40-N.

Q: What do I do if I have questions or need help with Form OR-40-N?

A: If you have questions or need help with Form OR-40-N, you can contact the Oregon Department of Revenue for assistance.

Form Details:

- Released on September 12, 2022;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-40-N (150-101-048) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.