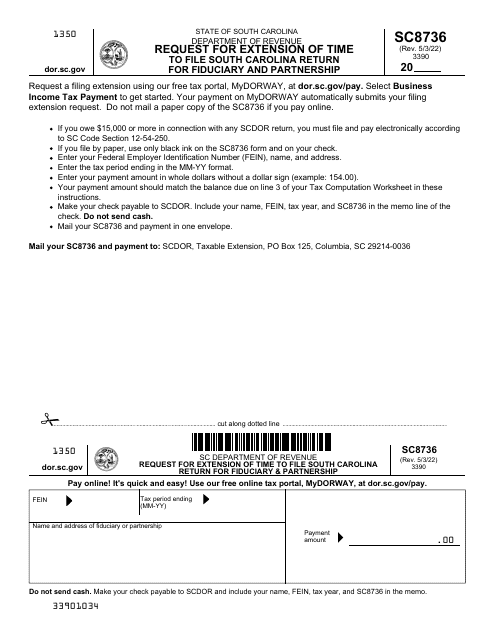

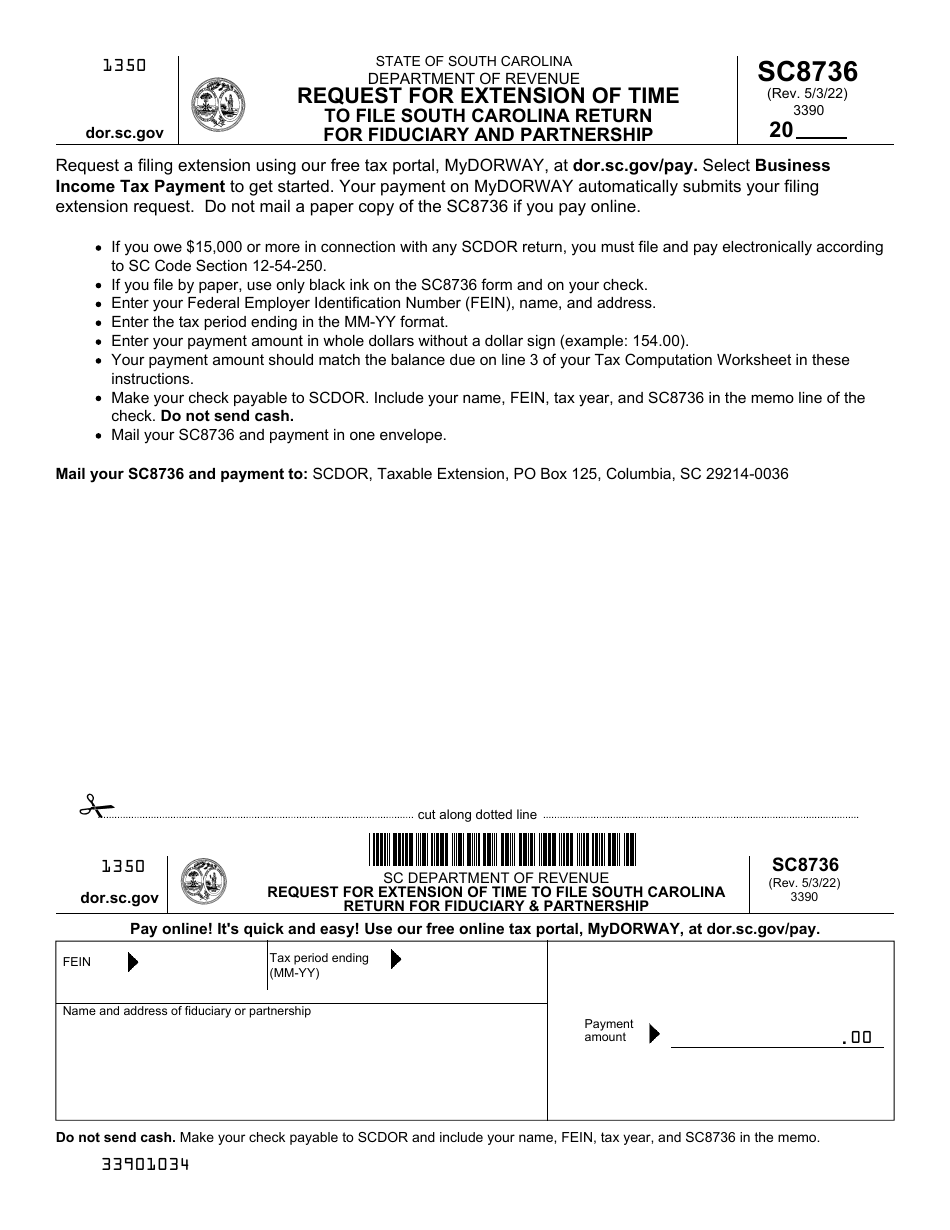

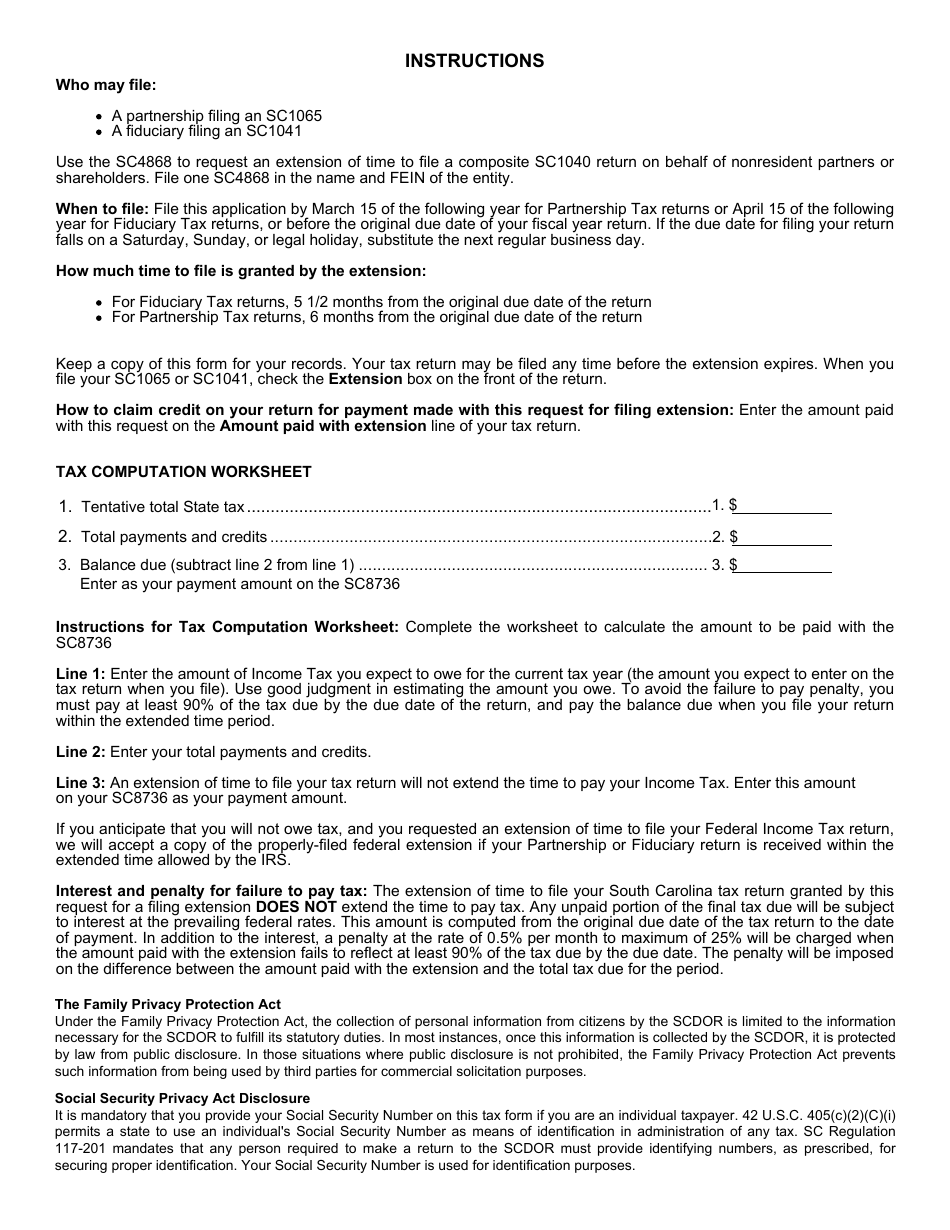

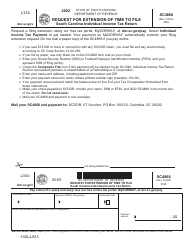

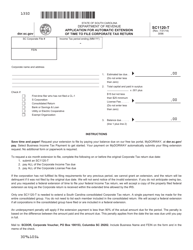

Form SC8736 Request for Extension of Time to File South Carolina Return for Fiduciary and Partnership - South Carolina

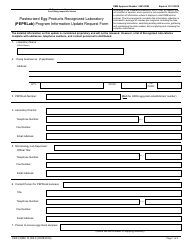

What Is Form SC8736?

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SC8736?

A: Form SC8736 is a request for an extension of time to file a South Carolina tax return for fiduciaries and partnerships in South Carolina.

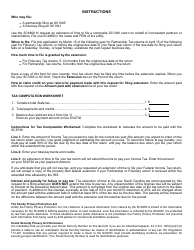

Q: Who can use Form SC8736?

A: Fiduciaries and partnerships in South Carolina can use Form SC8736 to request an extension of time to file their state tax return.

Q: Why would I need to file for an extension?

A: You may need to file for an extension if you are unable to file your South Carolina tax return by the original due date.

Q: When is the deadline to file Form SC8736?

A: Form SC8736 must be filed by the original due date of your South Carolina tax return, which is typically April 15th.

Q: How long is the extension period?

A: If approved, the extension period for filing your South Carolina tax return will be 6 months.

Q: Is there a penalty for filing for an extension?

A: There is no penalty for filing for an extension, as long as you pay any tax owed by the original due date.

Q: What if I don't file for an extension and miss the deadline?

A: If you don't file for an extension and miss the deadline, you may be subject to penalties and interest for late filing.

Q: Can I request an additional extension if I need more time?

A: No, South Carolina does not grant additional extensions beyond the initial 6-month extension period.

Form Details:

- Released on May 3, 2022;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form SC8736 by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.