This version of the form is not currently in use and is provided for reference only. Download this version of

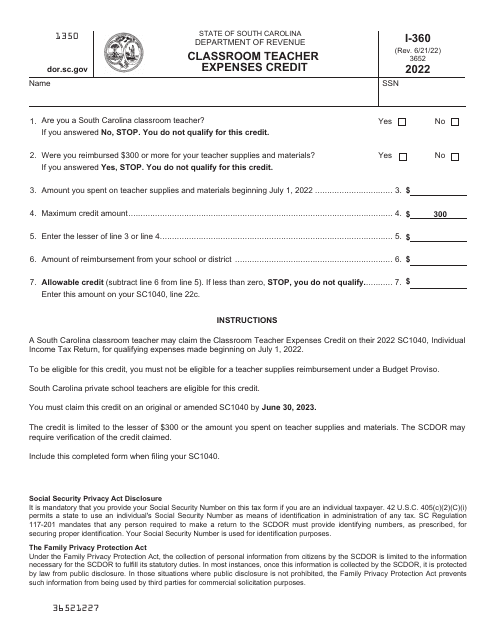

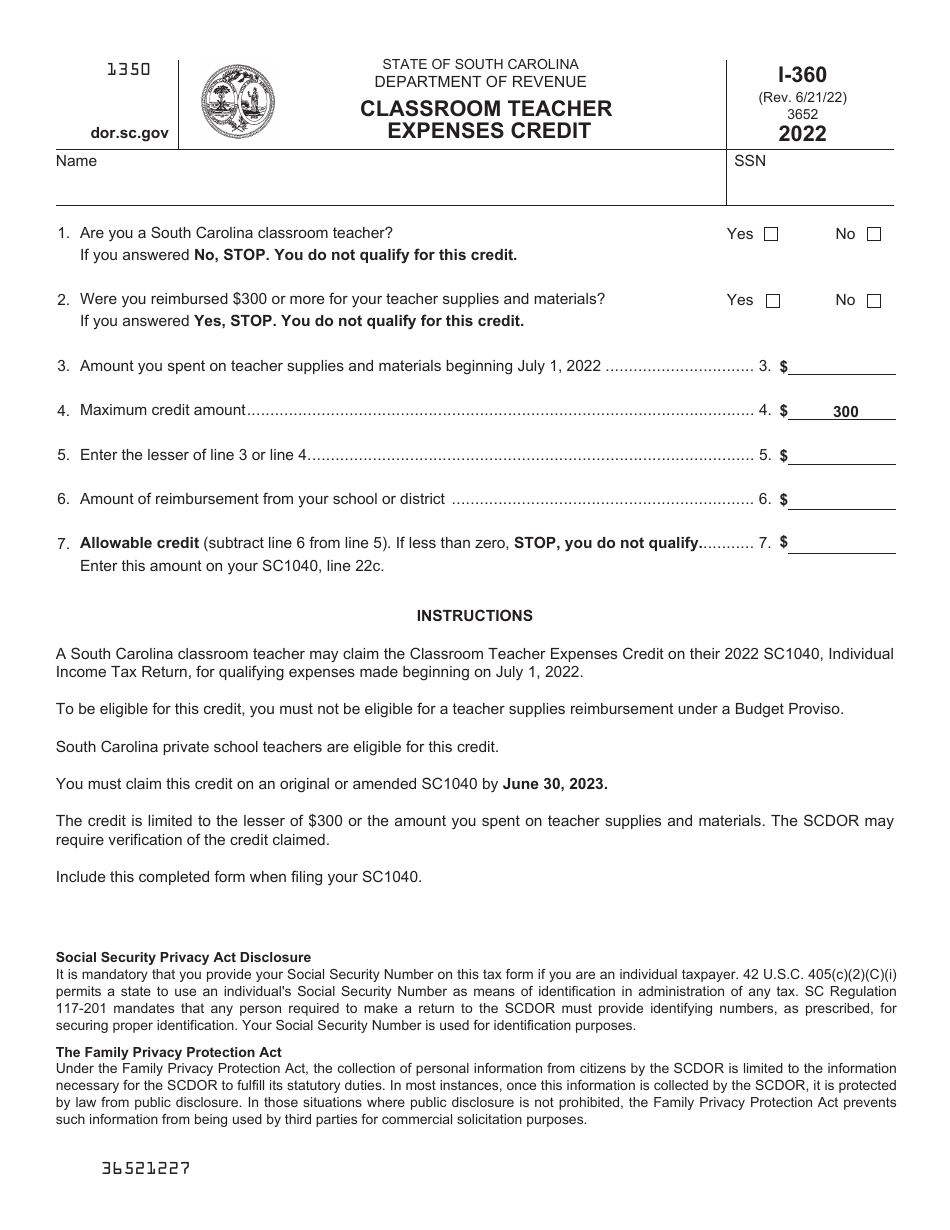

Form I-360

for the current year.

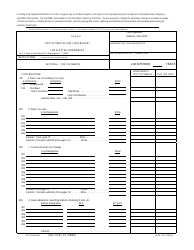

Form I-360 Classroom Teacher Expenses Credit - South Carolina

What Is Form I-360?

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form I-360 Classroom Teacher Expenses Credit?

A: Form I-360 Classroom Teacher Expenses Credit is a tax credit available to certified classroom teachers in South Carolina.

Q: Who is eligible for the Form I-360 Classroom Teacher Expenses Credit?

A: Certified classroom teachers in South Carolina who spend their personal money on classroom supplies and materials are eligible for the credit.

Q: How much is the tax credit?

A: The tax credit is up to $275 for certified classroom teachers.

Q: What expenses qualify for the Form I-360 Classroom Teacher Expenses Credit?

A: Expenses such as books, computers, software, classroom supplies, and other necessary materials for the classroom may qualify for the credit.

Q: How can teachers claim the Form I-360 Classroom Teacher Expenses Credit?

A: Teachers can claim the credit by completing Form I-360 and attaching it to their South Carolina tax return.

Q: Is there a deadline for claiming the Form I-360 Classroom Teacher Expenses Credit?

A: Yes, the credit must be claimed within three years from the date it was due or paid, whichever is later.

Form Details:

- Released on June 21, 2022;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form I-360 by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.