This version of the form is not currently in use and is provided for reference only. Download this version of

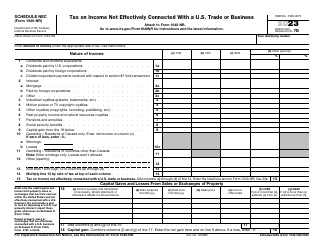

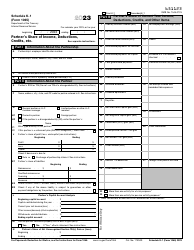

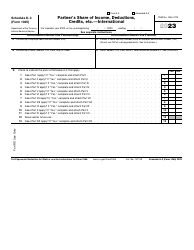

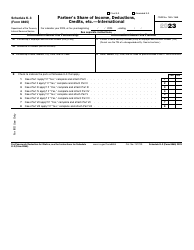

Instructions for IRS Form 1120-F Schedule H

for the current year.

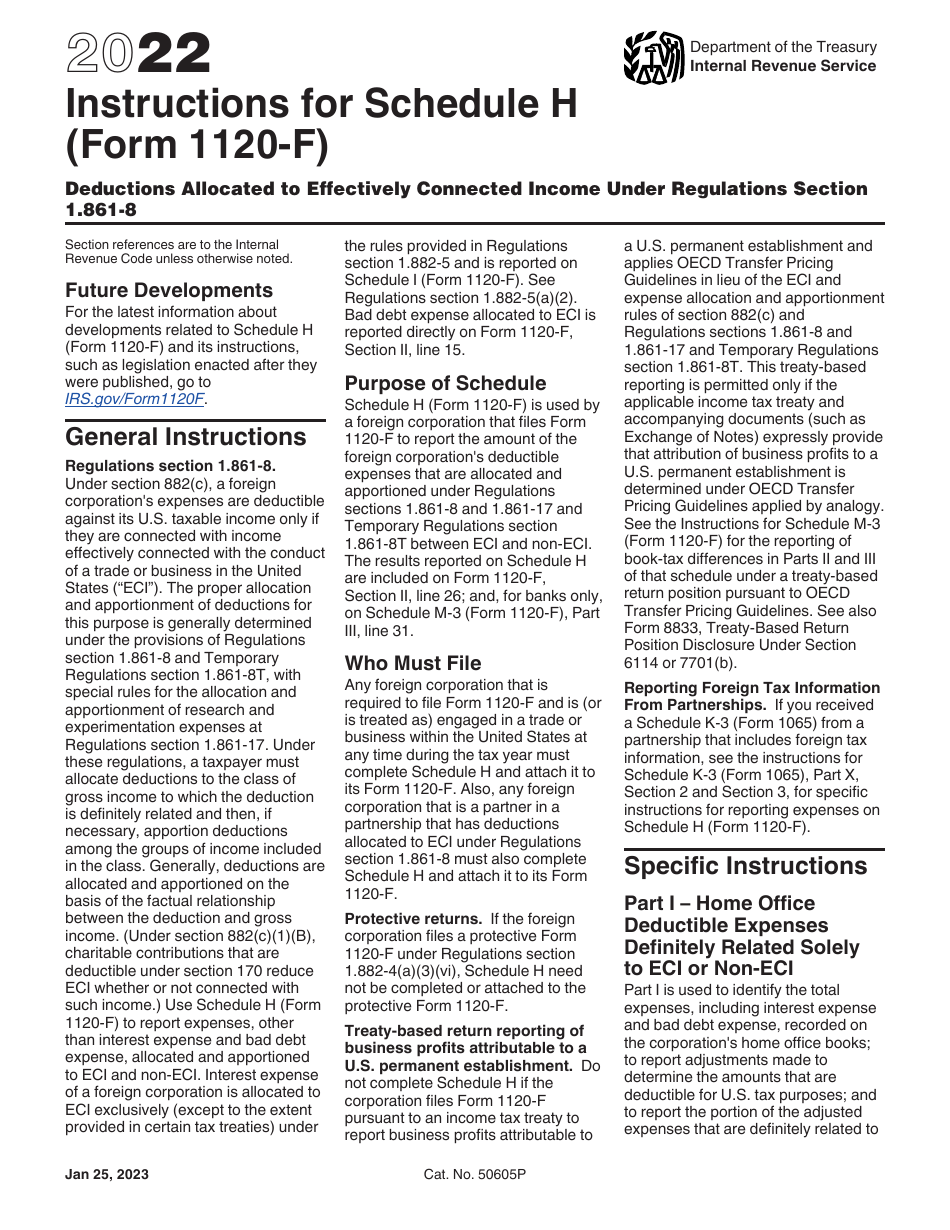

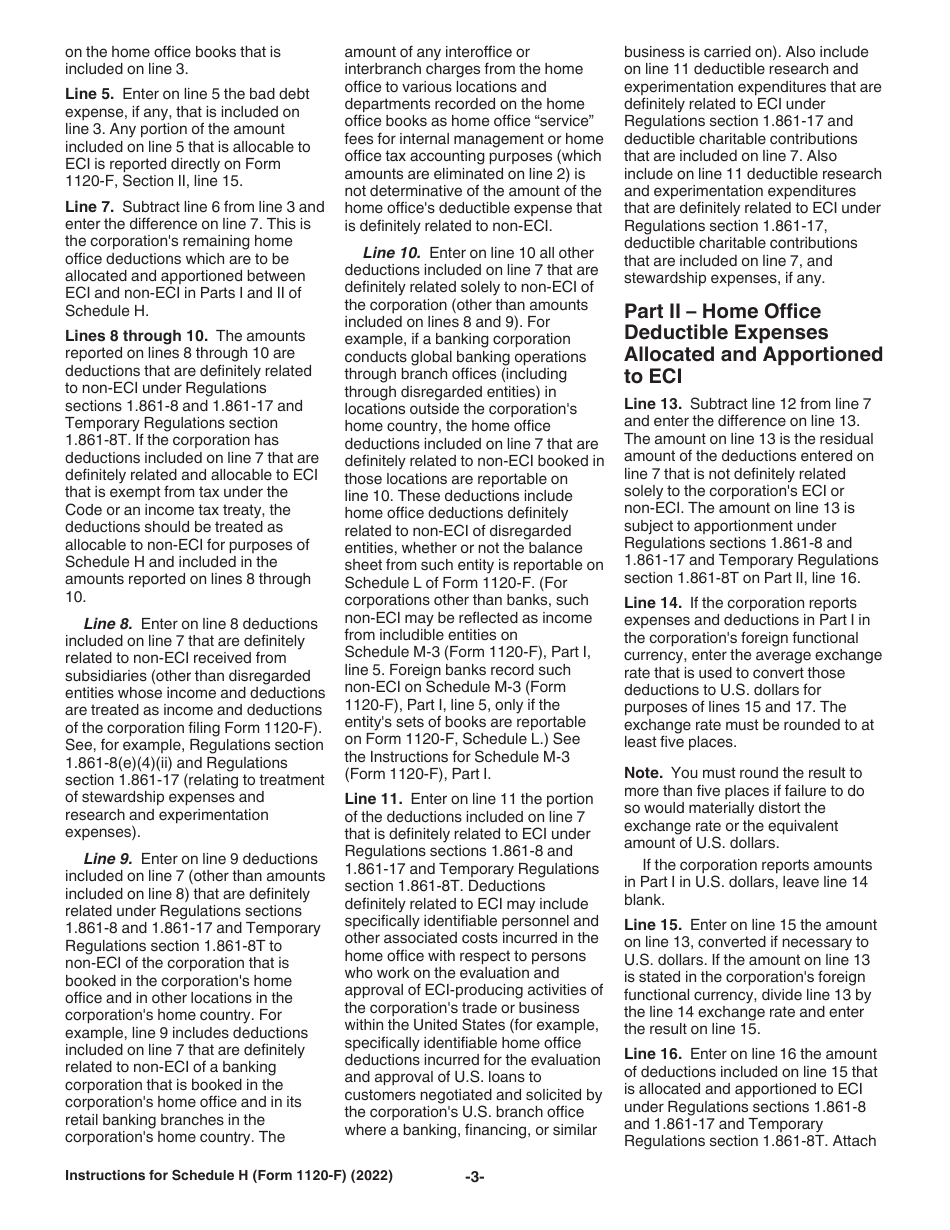

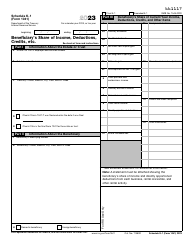

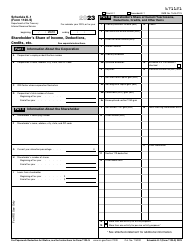

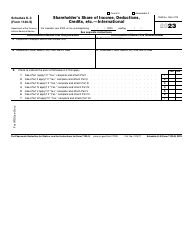

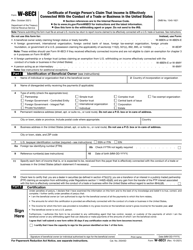

Instructions for IRS Form 1120-F Schedule H Deductions Allocated to Effectively Connected Income Under Regulations Section 1.861-8

This document contains official instructions for IRS Form 1120-F Schedule H, Deductions Allocated to Effectively Connected Income Under Regulations Section 1.861-8 - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1120-F Schedule H is available for download through this link.

FAQ

Q: What is IRS Form 1120-F Schedule H?

A: IRS Form 1120-F Schedule H is a form used to report deductions allocated to effectively connected income.

Q: What are deductions allocated to effectively connected income?

A: Deductions allocated to effectively connected income are expenses that can be deducted from income connected to the United States.

Q: What is Regulations Section 1.861-8?

A: Regulations Section 1.861-8 refers to a specific IRS regulation that provides guidance on how to allocate and apportion deductions to effectively connected income.

Q: Who needs to file IRS Form 1120-F Schedule H?

A: Taxpayers who are non-U.S. corporations and have effectively connected income in the United States may need to file IRS Form 1120-F Schedule H.

Q: What types of deductions can be allocated to effectively connected income?

A: Various deductions related to conducting business in the United States can be allocated to effectively connected income, such as salary and wages, rent, and interest expenses.

Instruction Details:

- This 7-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.