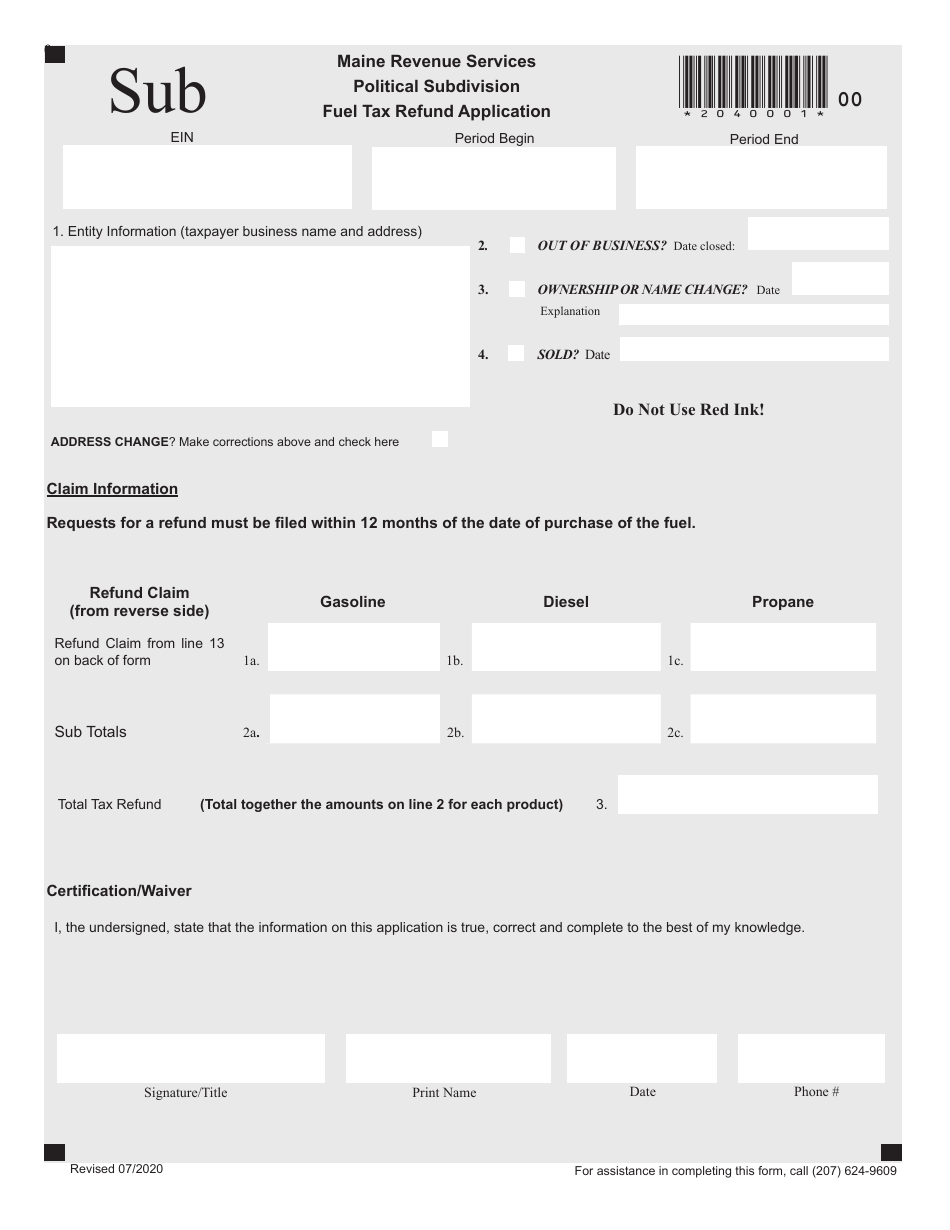

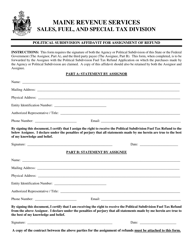

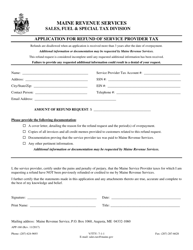

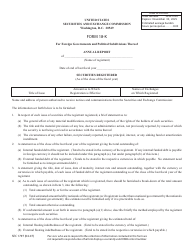

Political Subdivision Fuel Tax Refund Application - Maine

Political Subdivision Fuel Tax Refund Application is a legal document that was released by the Maine Revenue Services - a government authority operating within Maine.

FAQ

Q: What is a Political Subdivision Fuel Tax Refund Application?

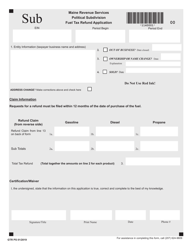

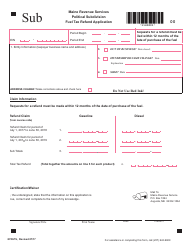

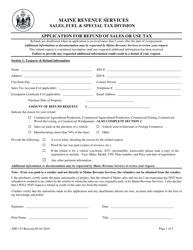

A: A Political Subdivision Fuel Tax Refund Application is a form that allows political subdivisions in Maine to request a refund of fuel taxes paid on certain vehicles.

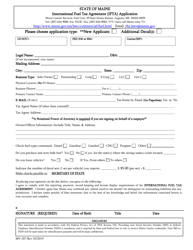

Q: Who can apply for a Political Subdivision Fuel Tax Refund?

A: Only political subdivisions in Maine, such as municipalities and school districts, can apply for a Political Subdivision Fuel Tax Refund.

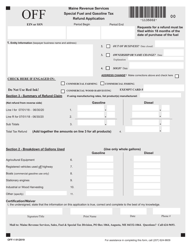

Q: What vehicles are eligible for the refund?

A: The refund is available for motor vehicles owned and operated by political subdivisions that are used exclusively for government purposes.

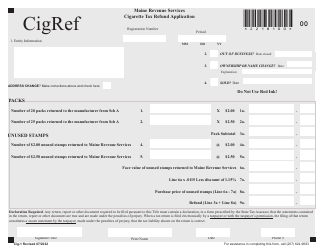

Q: How much can be refunded?

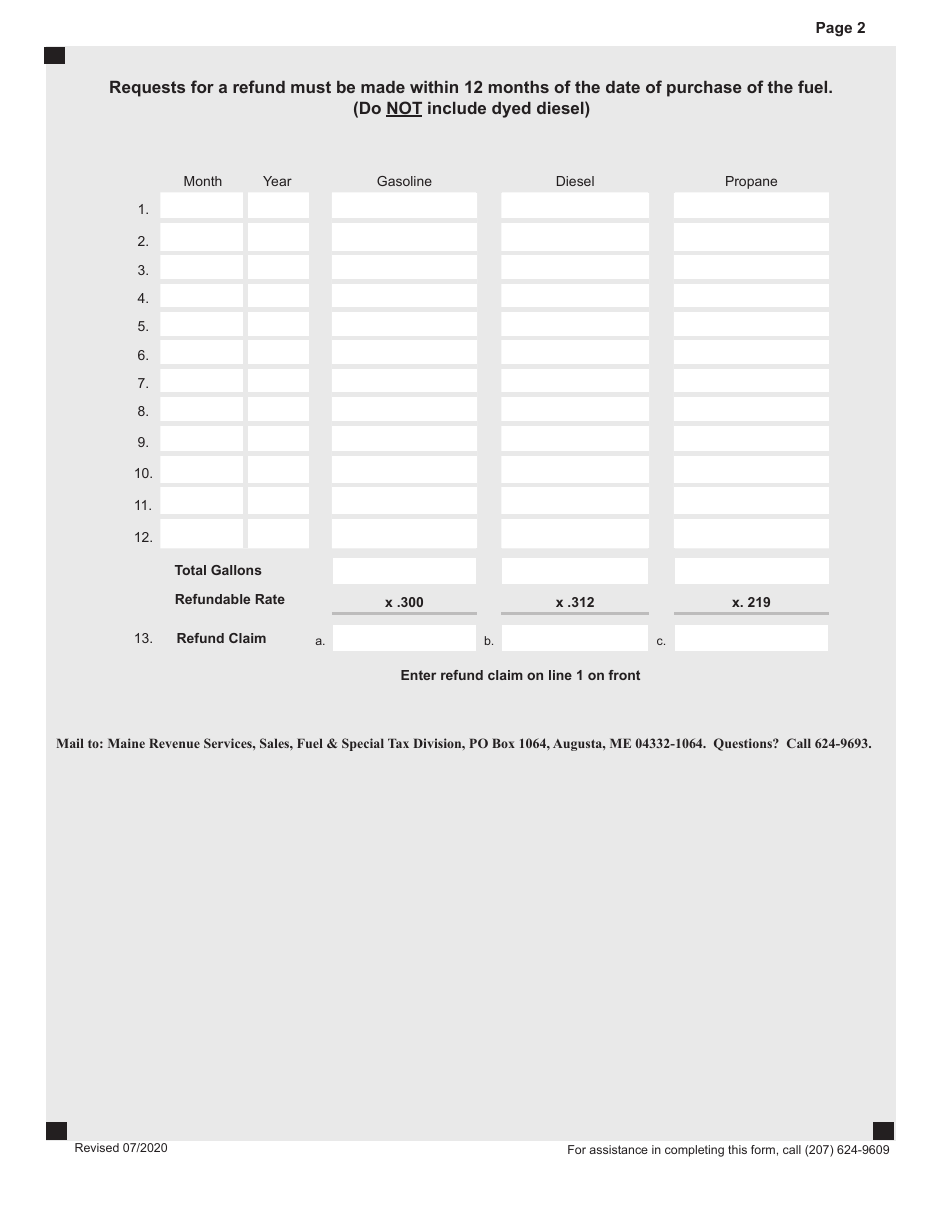

A: The amount of the refund depends on the type and quantity of fuel used, as well as the current fuel tax rate.

Q: How often can a political subdivision apply for a refund?

A: Political subdivisions can apply for a refund on a quarterly basis.

Q: What documentation is required for the application?

A: Applicants must provide detailed records of fuel purchases and usage, as well as copies of fuel invoices and receipts.

Q: Is there a deadline for submitting the application?

A: Yes, the application must be submitted within 60 days following the end of the quarter for which the refund is being requested.

Q: How long does it take to process the refund?

A: Once the application is submitted, it typically takes 6 to 8 weeks to process the refund.

Q: Are there any other requirements or restrictions for the refund?

A: Yes, applicants must meet certain criteria and comply with all applicable laws and regulations to be eligible for the refund.

Form Details:

- Released on July 1, 2020;

- The latest edition currently provided by the Maine Revenue Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Maine Revenue Services.