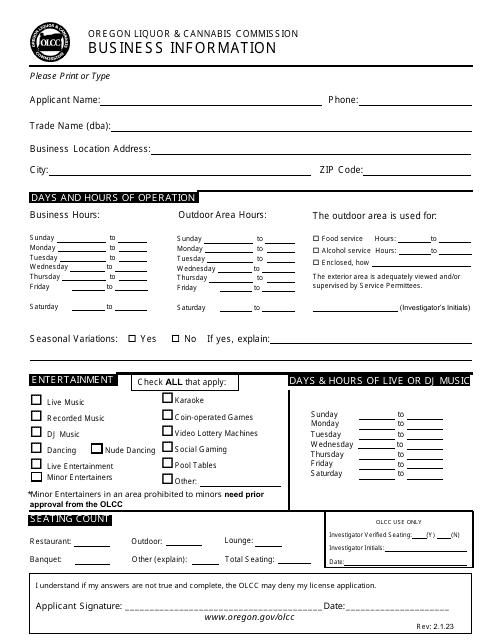

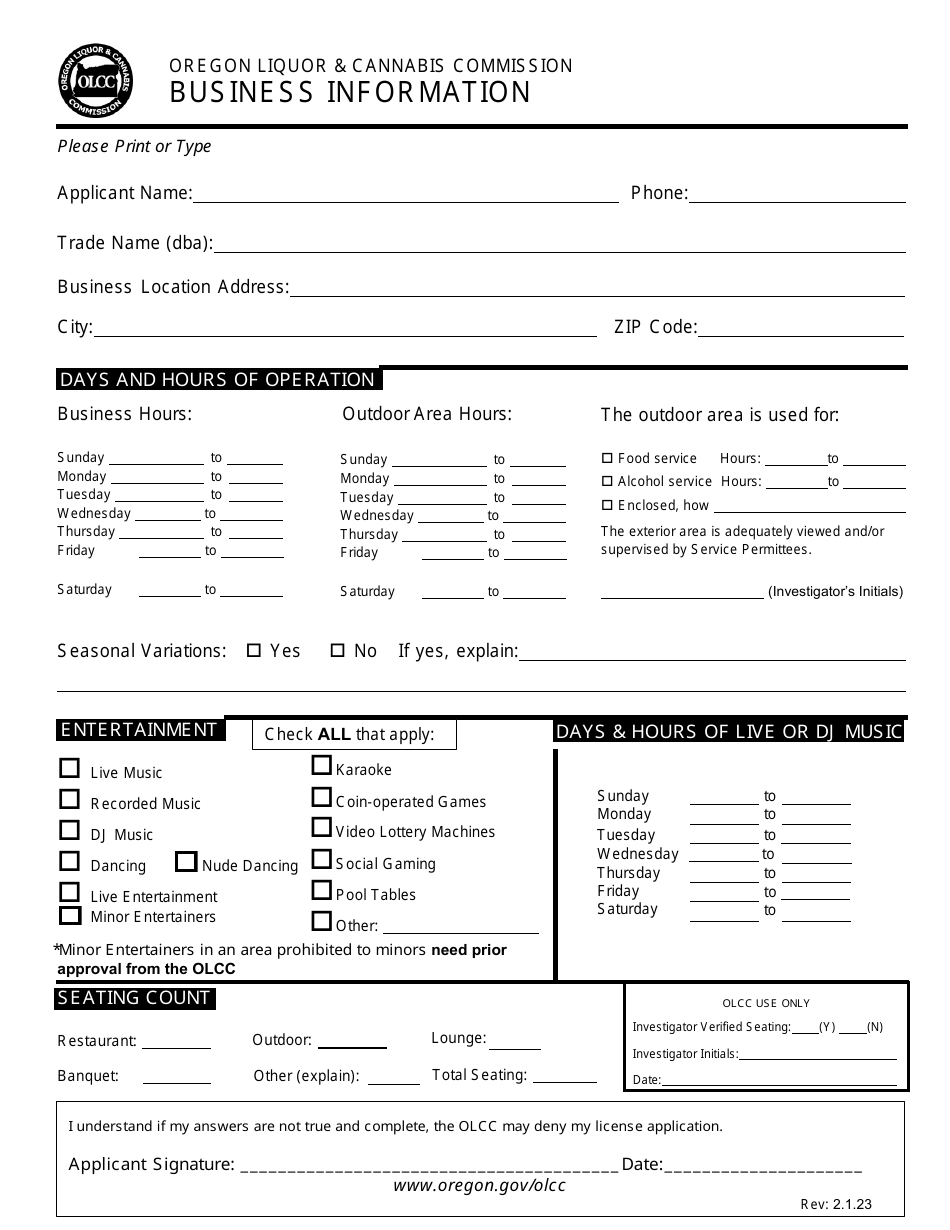

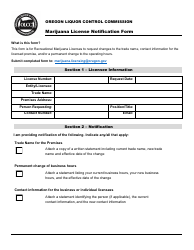

Business Information - Oregon

Business Information is a legal document that was released by the Oregon Liquor and Cannabis Commission - a government authority operating within Oregon.

FAQ

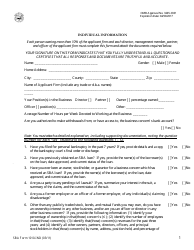

Q: What are the requirements for starting a business in Oregon?

A: To start a business in Oregon, you will need to choose a business name, register your business with the Oregon Secretary of State, obtain any necessary licenses or permits, and register for tax purposes.

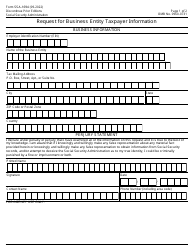

Q: How do I register my business in Oregon?

A: You can register your business in Oregon by filing the necessary forms and paying the required fees with the Oregon Secretary of State's office.

Q: What types of businesses are popular in Oregon?

A: Many popular businesses in Oregon include craft breweries, wineries, outdoor recreational businesses, technology companies, and sustainable or eco-friendly businesses.

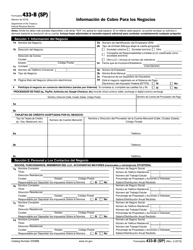

Q: What are the tax obligations for businesses in Oregon?

A: Businesses in Oregon are required to pay state income tax, unemployment insurance tax, and potentially other taxes depending on the nature of the business.

Q: Are there any incentives for businesses in Oregon?

A: Yes, Oregon offers various incentives for businesses, such as tax credits, grants, and loans, particularly for industries like renewable energy, film and television production, and research and development.

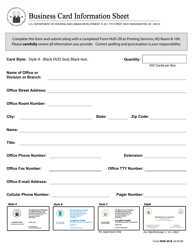

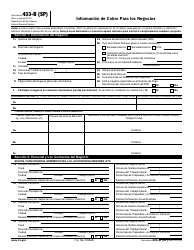

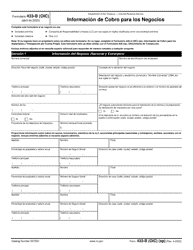

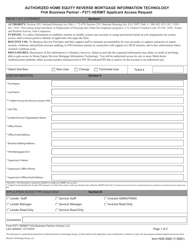

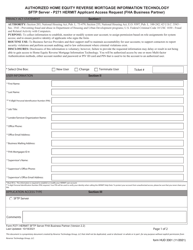

Form Details:

- Released on February 1, 2023;

- The latest edition currently provided by the Oregon Liquor and Cannabis Commission;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Oregon Liquor and Cannabis Commission.