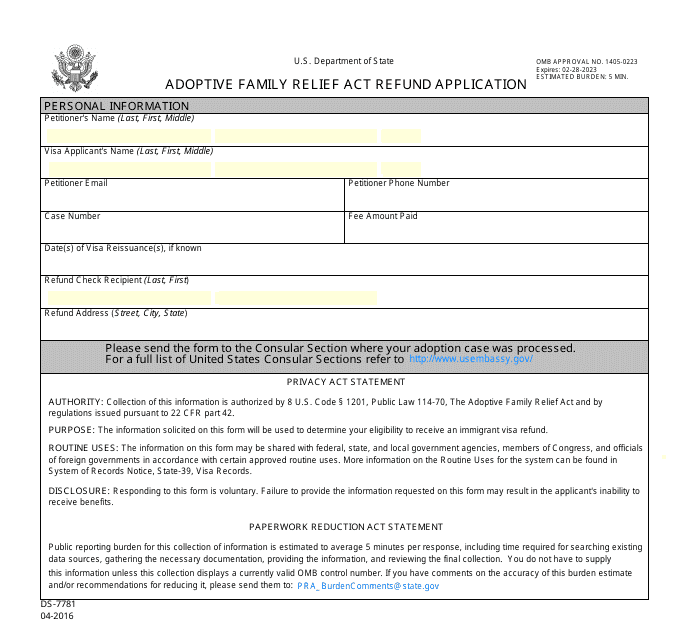

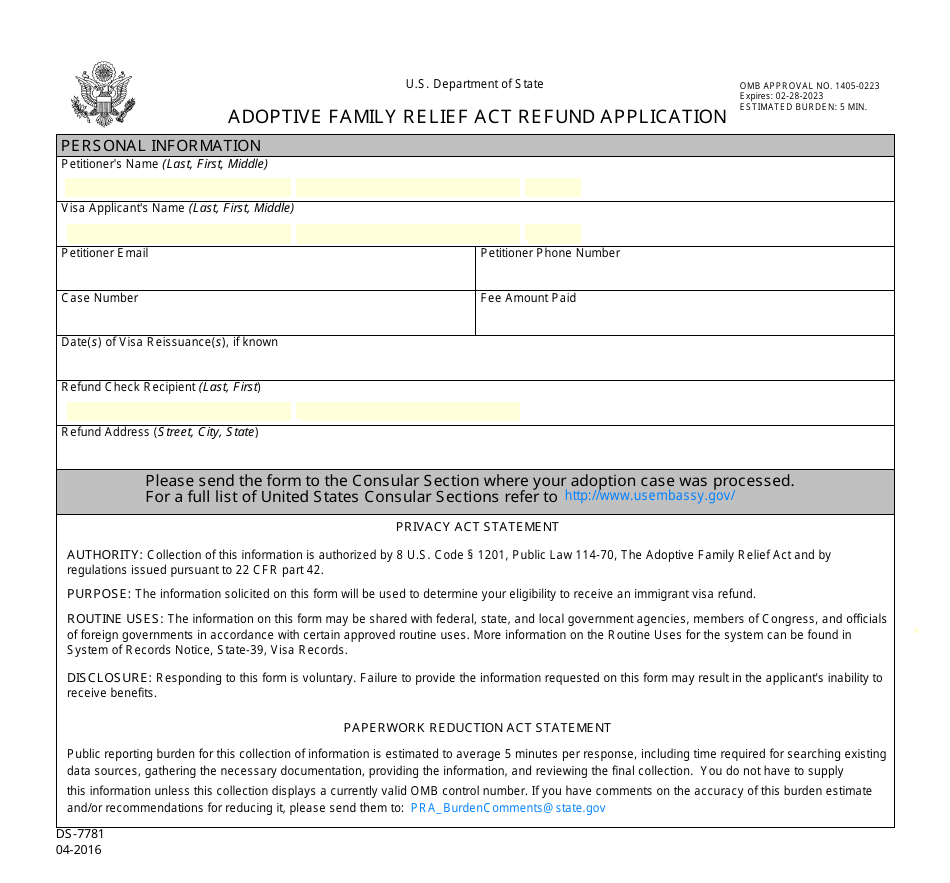

Form DS-7781 Adoptive Family Relief Act Refund Application

What Is Form DS-7781?

This is a legal form that was released by the U.S. Department of State on April 1, 2016 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DS-7781?

A: Form DS-7781 is the Adoptive Family Relief Act Refund Application.

Q: What is the Adoptive Family Relief Act?

A: The Adoptive Family Relief Act is a federal law that provides financial relief to adoptive families.

Q: Who can apply for the refund?

A: Adoptive families who meet the eligibility criteria can apply for the refund.

Q: What is the purpose of the refund?

A: The refund is intended to help adoptive families with the expenses associated with the adoption process.

Q: What information is required on the application?

A: The application will require personal and financial information, as well as documentation related to the adoption.

Q: Is there a deadline to submit the application?

A: Yes, there is a deadline to submit the application. It is important to check the instructions for the specific deadline.

Q: How long does it take to receive the refund?

A: The processing time for the refund application may vary. It is advisable to contact the relevant authorities for more information.

Q: Are there any eligibility requirements for the refund?

A: Yes, there are eligibility requirements that adoptive families must meet to qualify for the refund. These requirements may include income limits and other criteria.

Q: Can I apply for the refund if my adoption is not finalized?

A: In most cases, the adoption must be finalized for families to be eligible for the refund. It is recommended to review the specific eligibility criteria.

Q: Is the refund taxable?

A: The taxability of the refund may vary depending on individual circumstances. It is recommended to consult with a tax professional for personalized advice.

Form Details:

- Released on April 1, 2016;

- The latest available edition released by the U.S. Department of State;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DS-7781 by clicking the link below or browse more documents and templates provided by the U.S. Department of State.