This version of the form is not currently in use and is provided for reference only. Download this version of

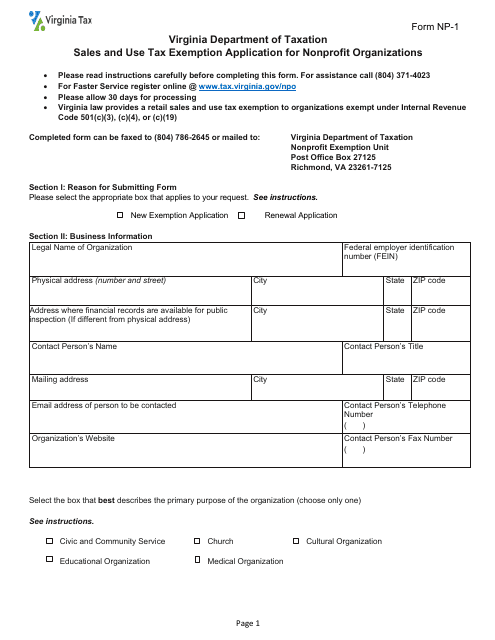

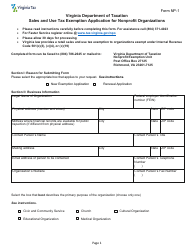

Form NP-1

for the current year.

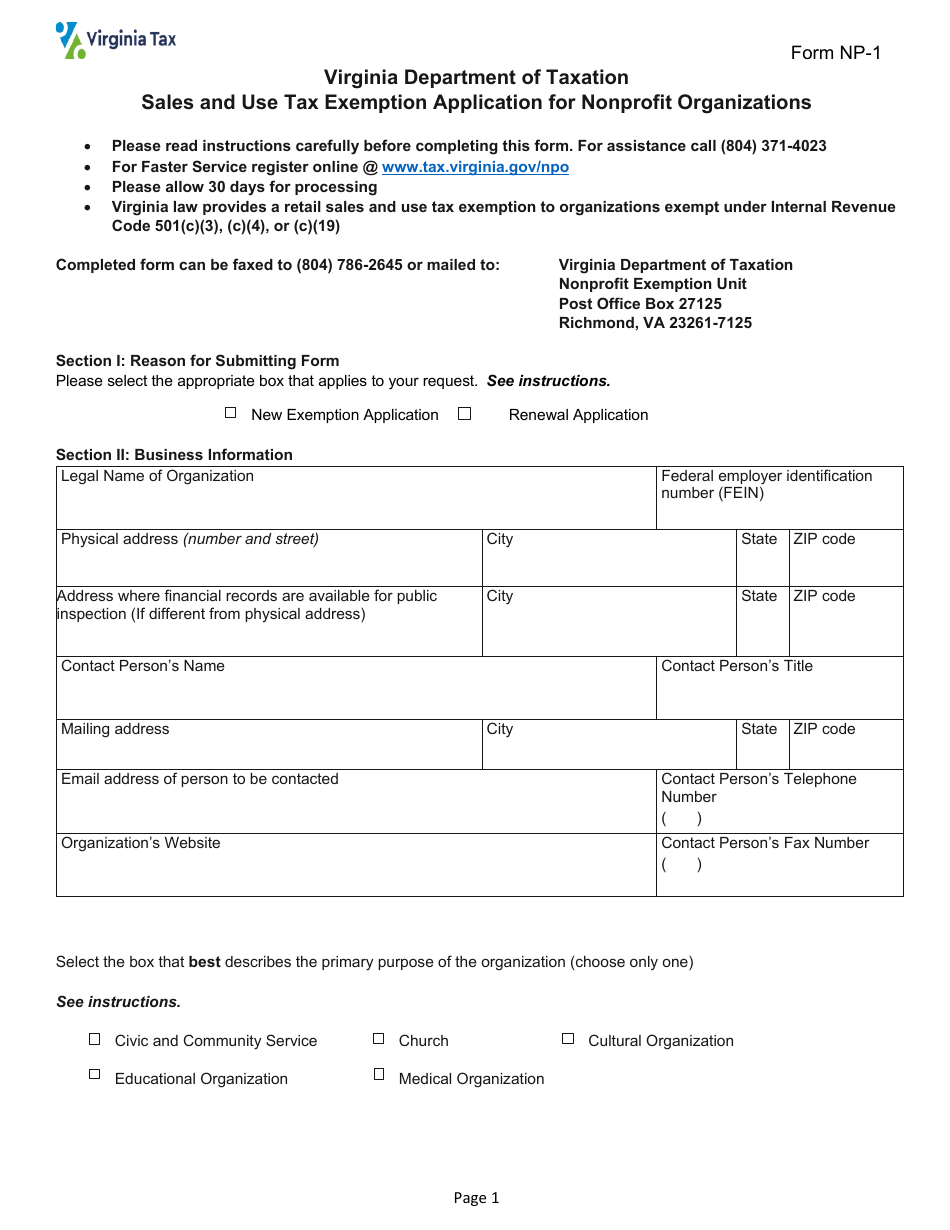

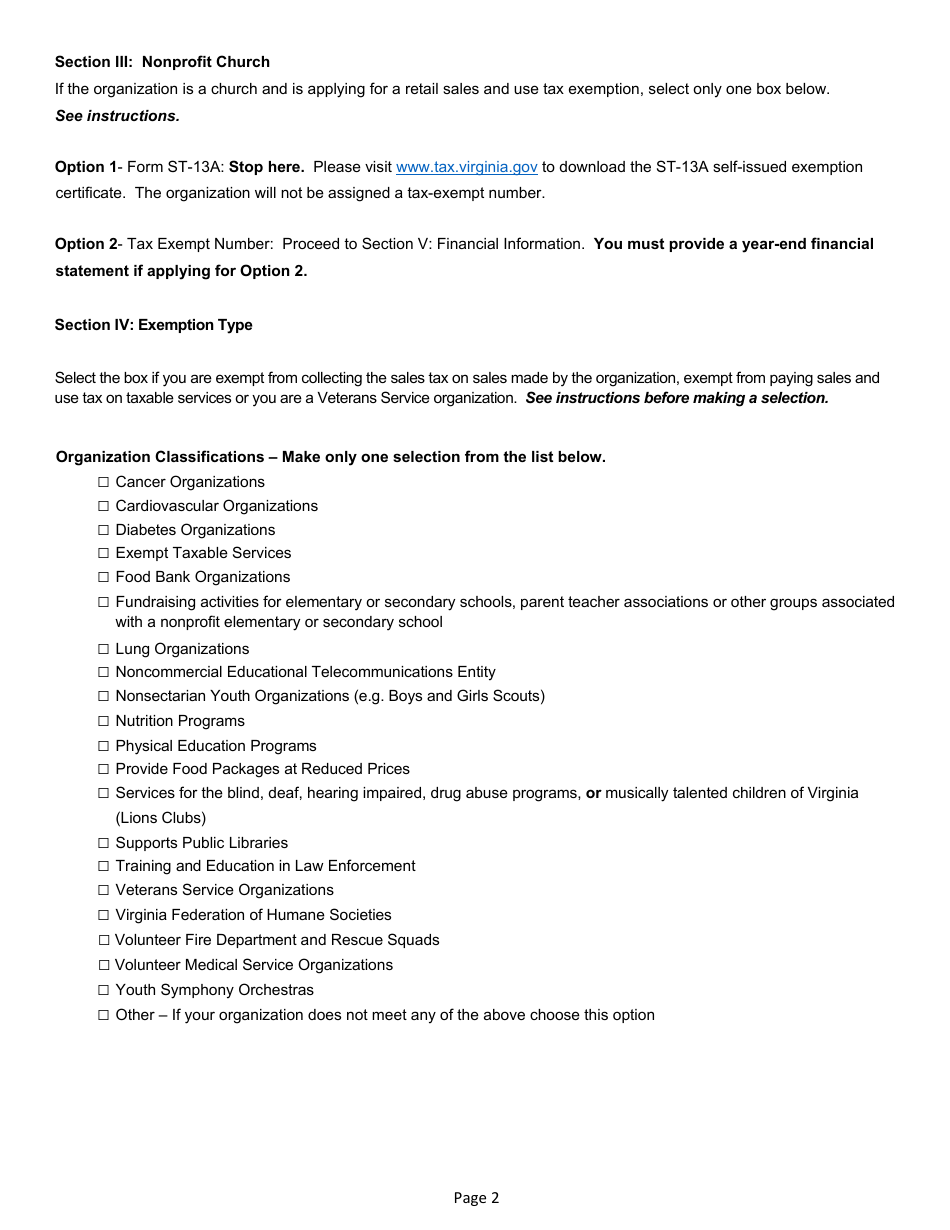

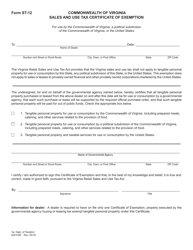

Form NP-1 Sales and Use Tax Exemption Application for Nonprofit Organizations - Virginia

What Is Form NP-1?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. Check the official instructions before completing and submitting the form.

FAQ

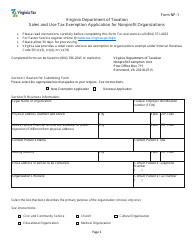

Q: What is the NP-1 form?

A: The NP-1 form is the Sales and Use Tax Exemption Application for Nonprofit Organizations in Virginia.

Q: Who is this form for?

A: This form is for nonprofit organizations in Virginia seeking sales and use tax exemption.

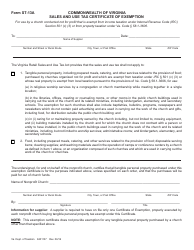

Q: What is the purpose of this form?

A: The purpose of this form is to apply for exemption from sales and use tax for qualified nonprofit organizations.

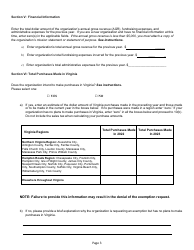

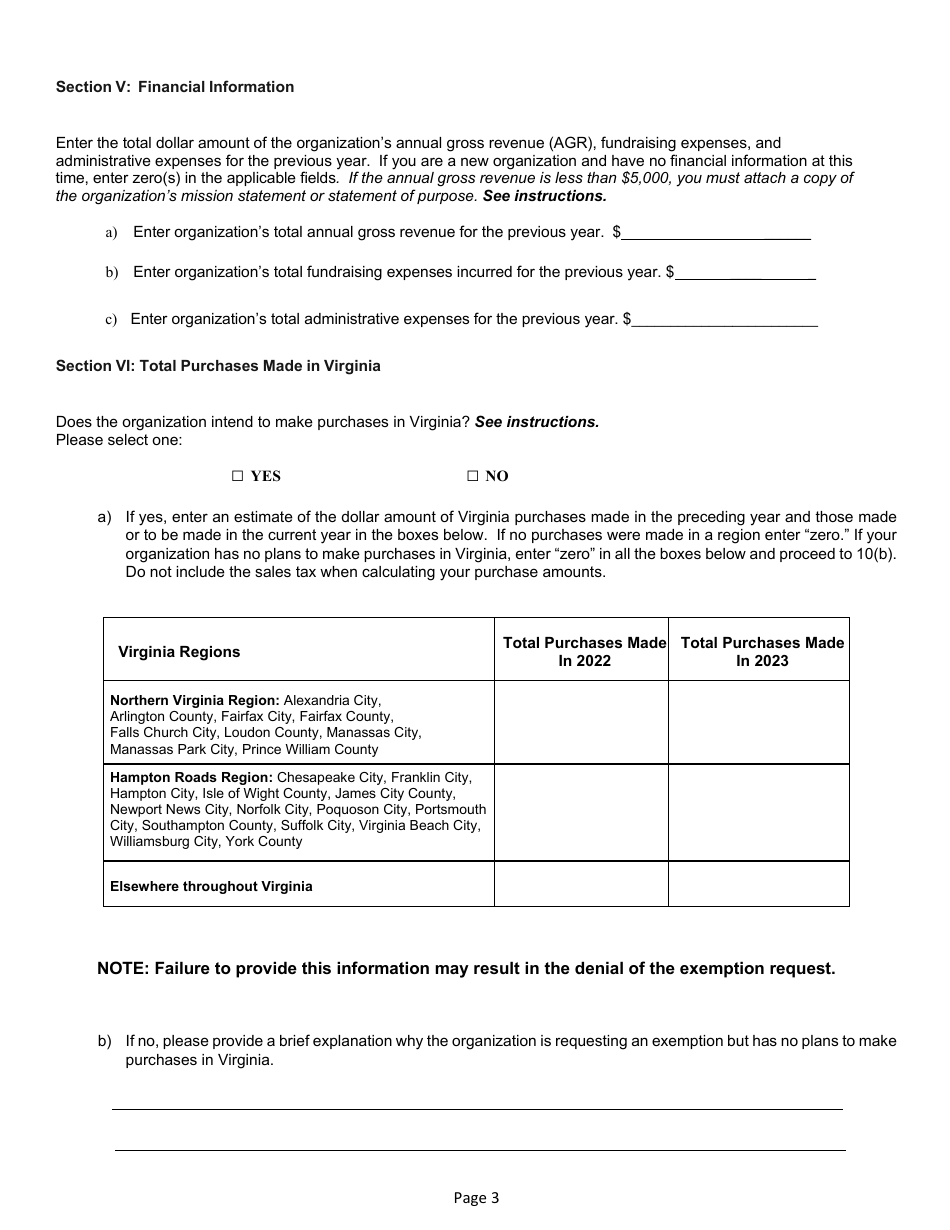

Q: What information do I need to provide on the NP-1 form?

A: You will need to provide information about your nonprofit organization, including its name, address, and tax identification number.

Q: Are there any fees associated with filing the NP-1 form?

A: There are no fees associated with filing the NP-1 form.

Q: How long does it take to process the NP-1 form?

A: The processing time for the NP-1 form varies, but it is typically within a few weeks.

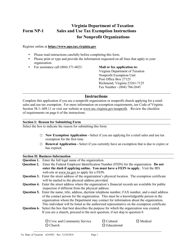

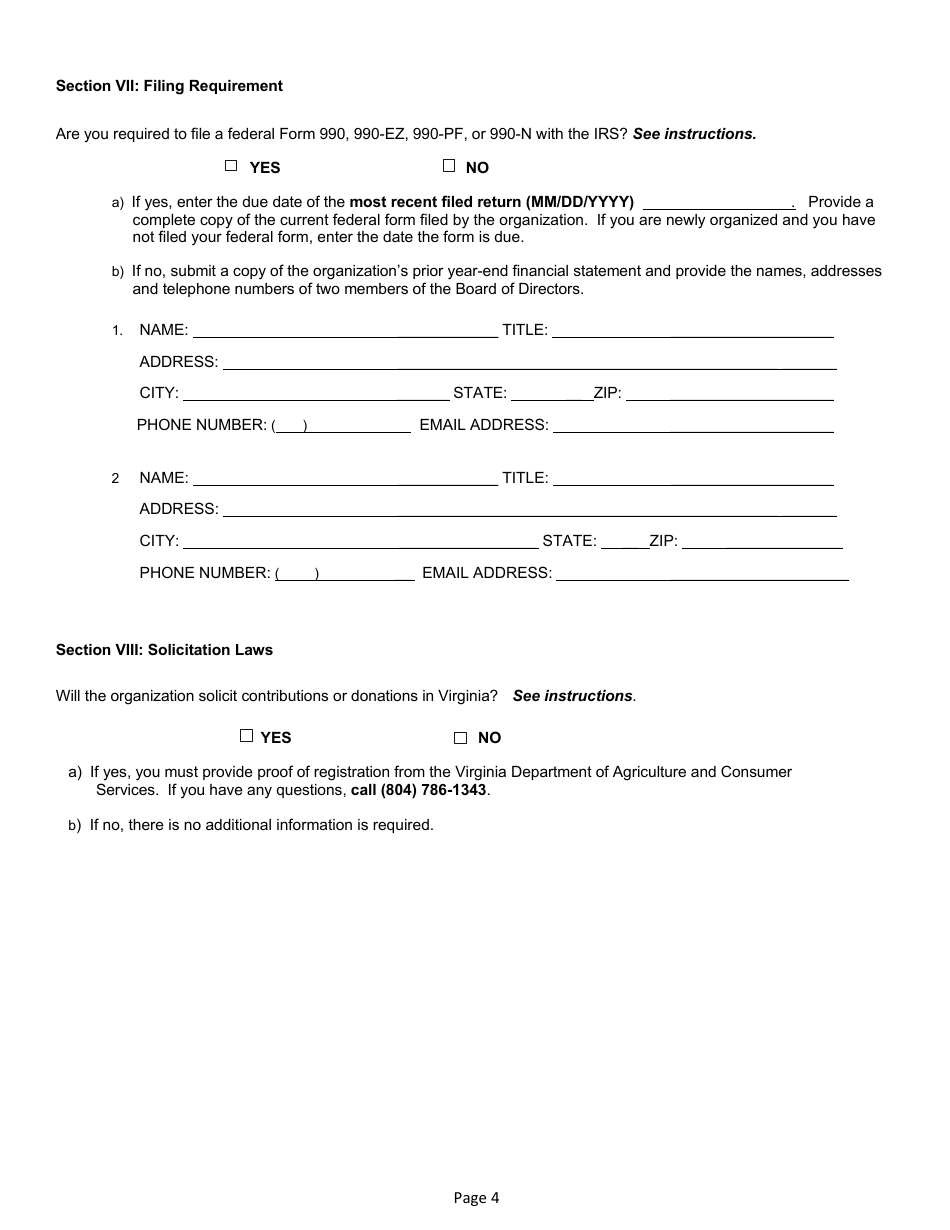

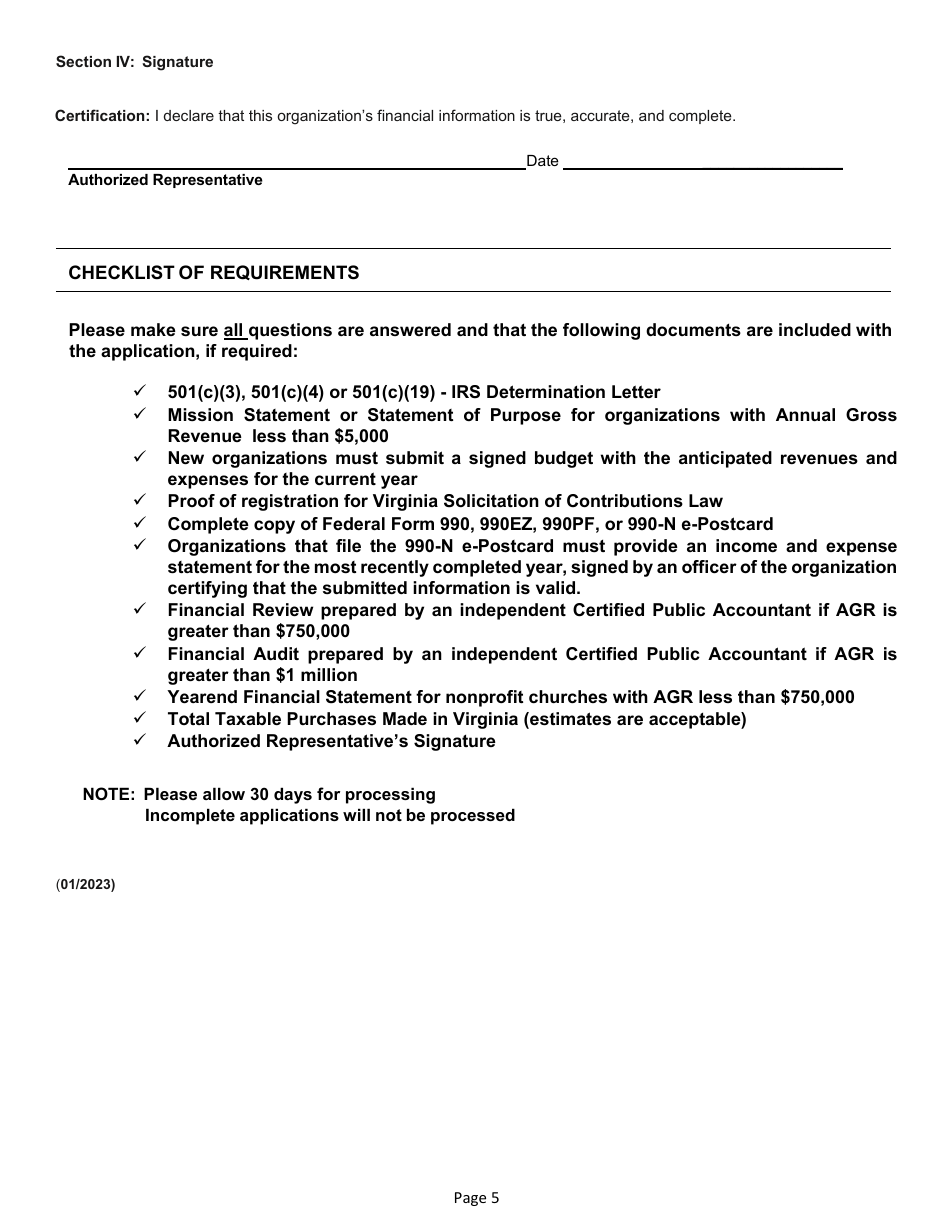

Q: What documentation do I need to include with the NP-1 form?

A: You will need to include supporting documentation, such as copies of your organization's articles of incorporation, bylaws, and IRS determination letter.

Q: Can I apply for retroactive exemption using the NP-1 form?

A: Yes, you can request retroactive exemption for up to three years prior to the date of application with the NP-1 form.

Q: Who can I contact for more information about the NP-1 form?

A: For more information about the NP-1 form, you can contact the Virginia Department of Taxation.

Form Details:

- Released on January 1, 2023;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NP-1 by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.