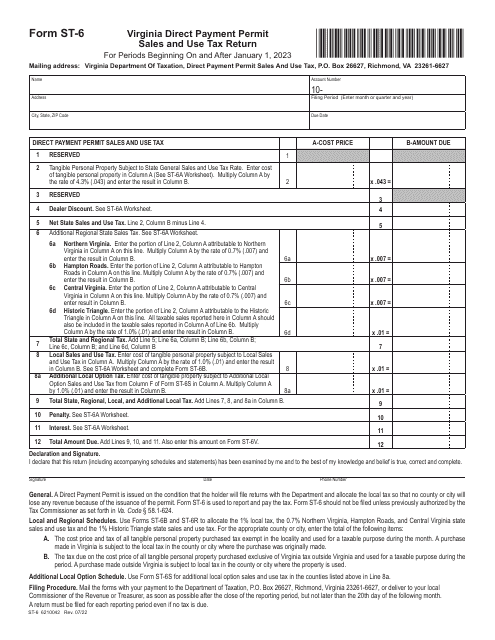

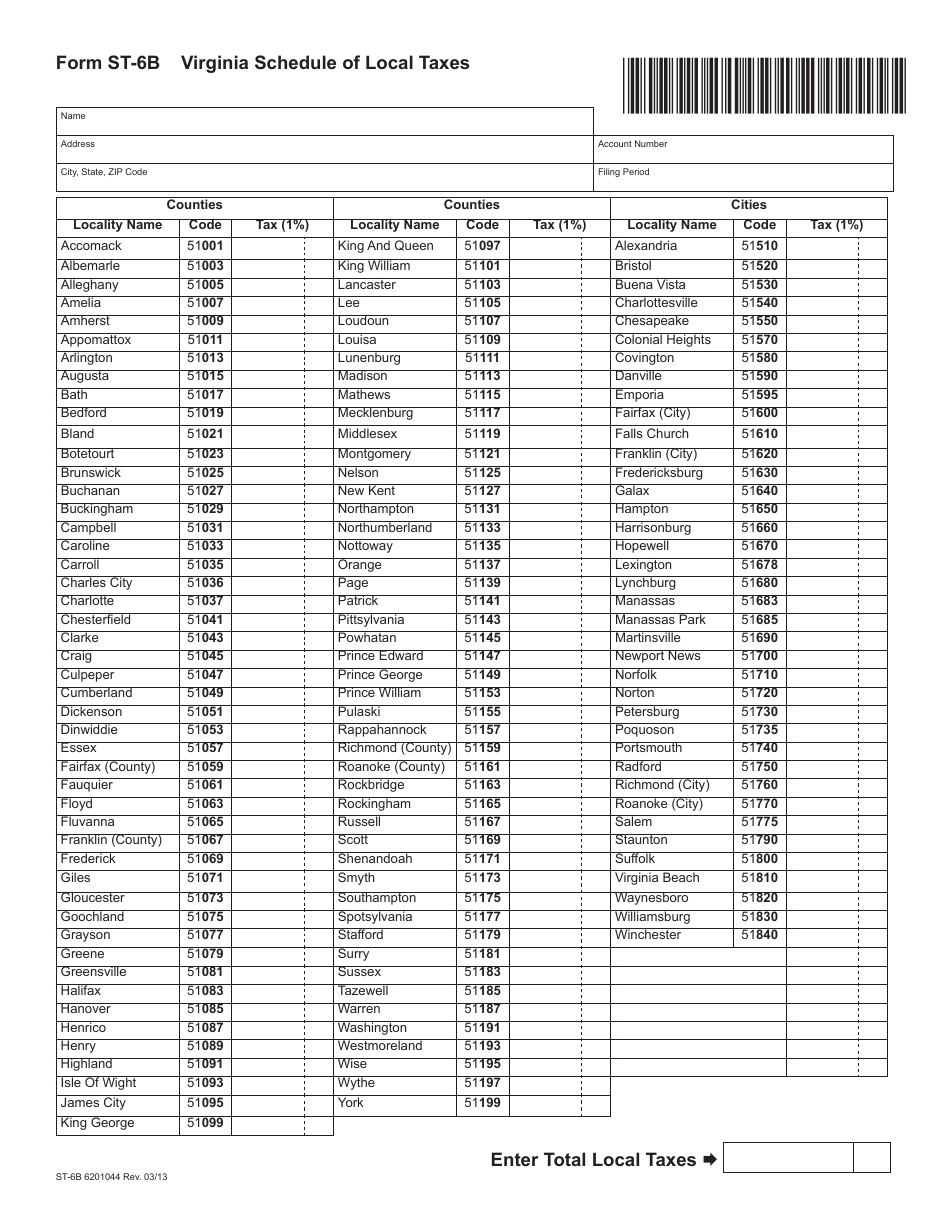

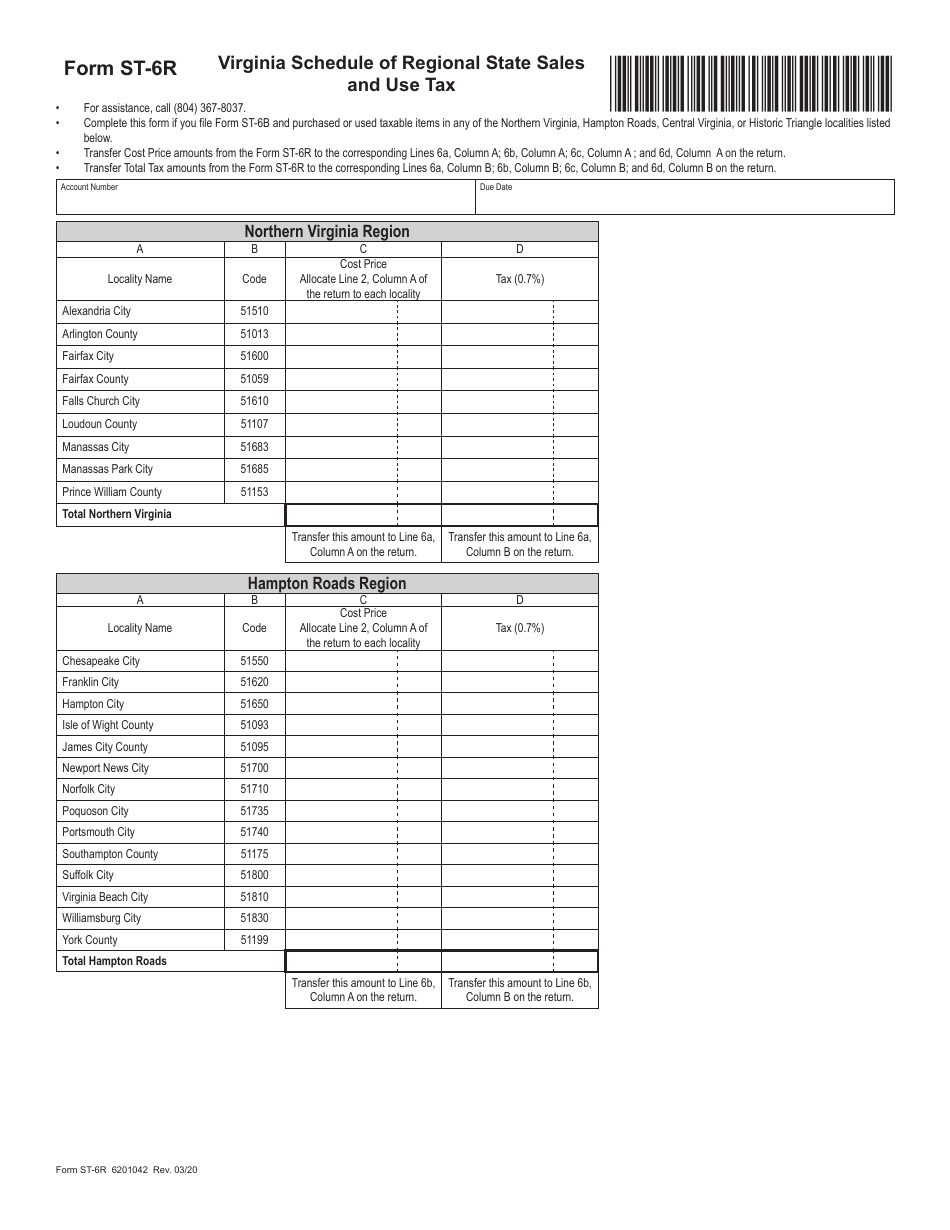

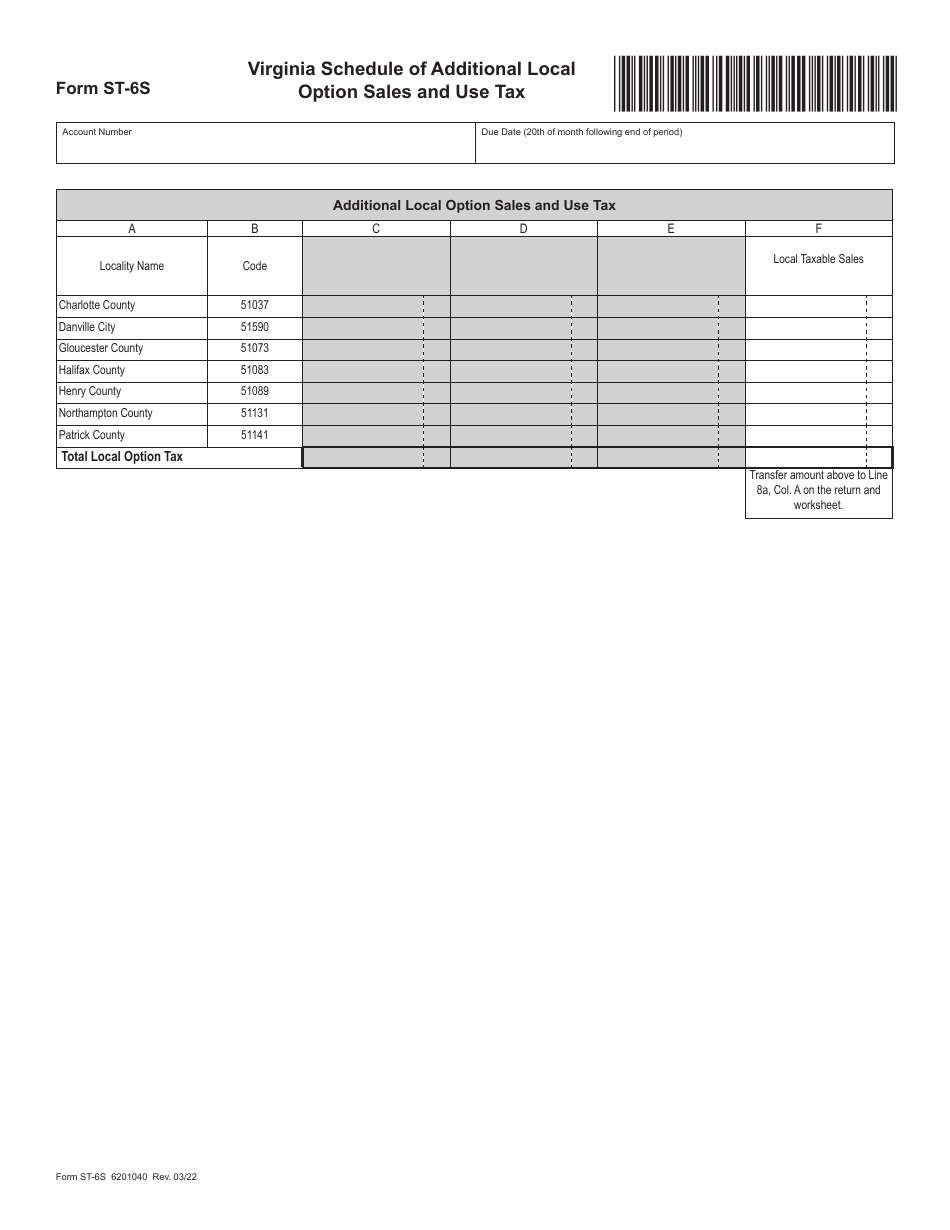

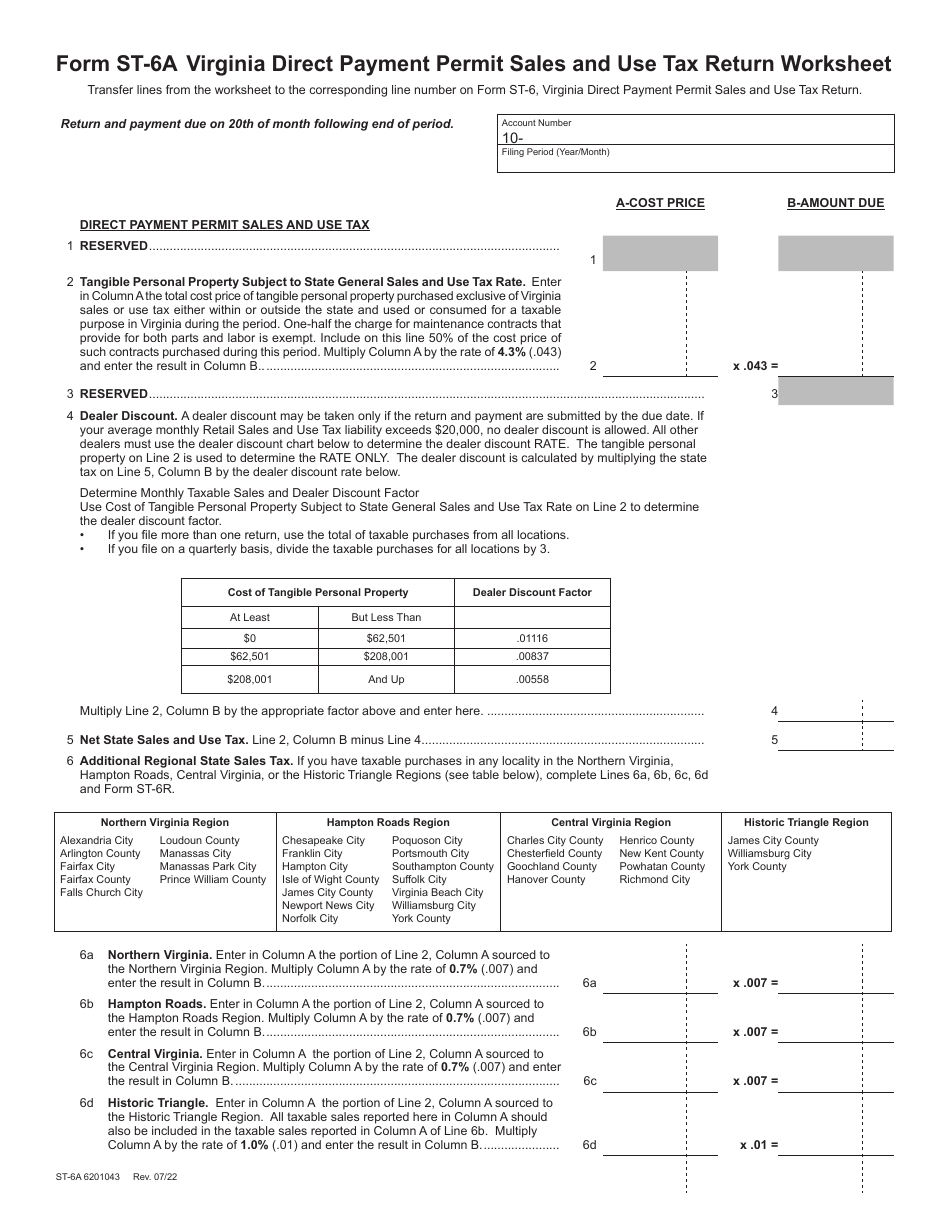

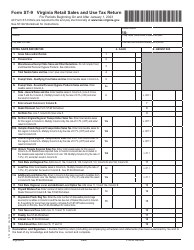

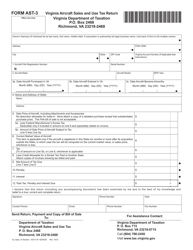

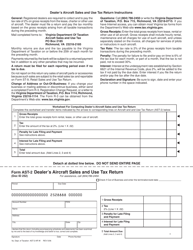

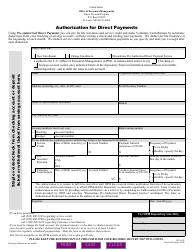

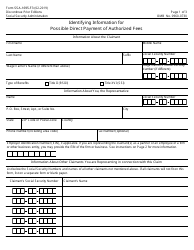

Form ST-6 Virginia Direct Payment Permit Sales and Use Tax Return - Virginia

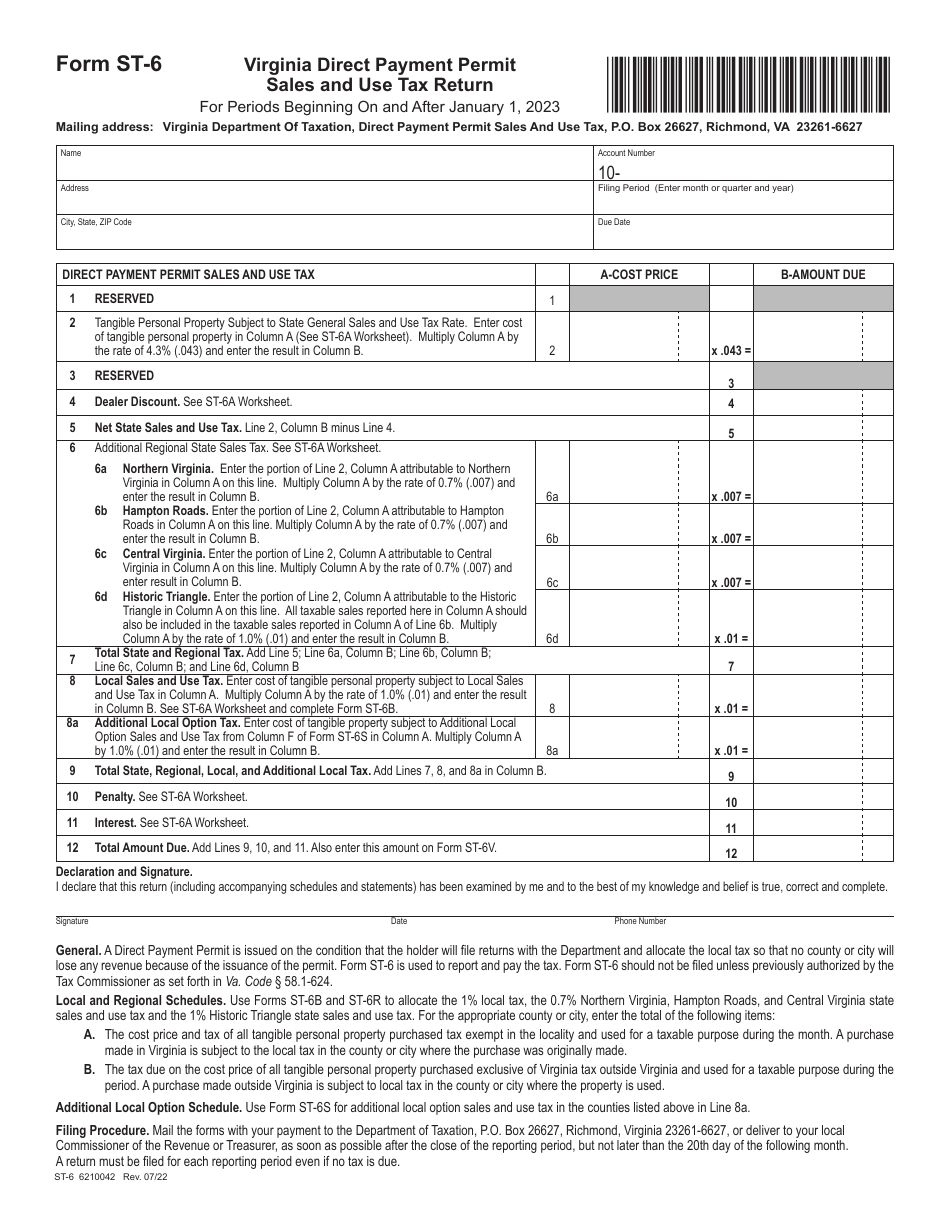

What Is Form ST-6?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ST-6?

A: Form ST-6 is the Virginia Direct Payment Permit Sales and Use Tax Return.

Q: Who needs to file Form ST-6?

A: Businesses that hold a Virginia Direct Payment Permit and are subject to sales and use tax must file Form ST-6.

Q: What is the purpose of Form ST-6?

A: The purpose of Form ST-6 is to report and pay sales and use tax directly to the Virginia Department of Taxation.

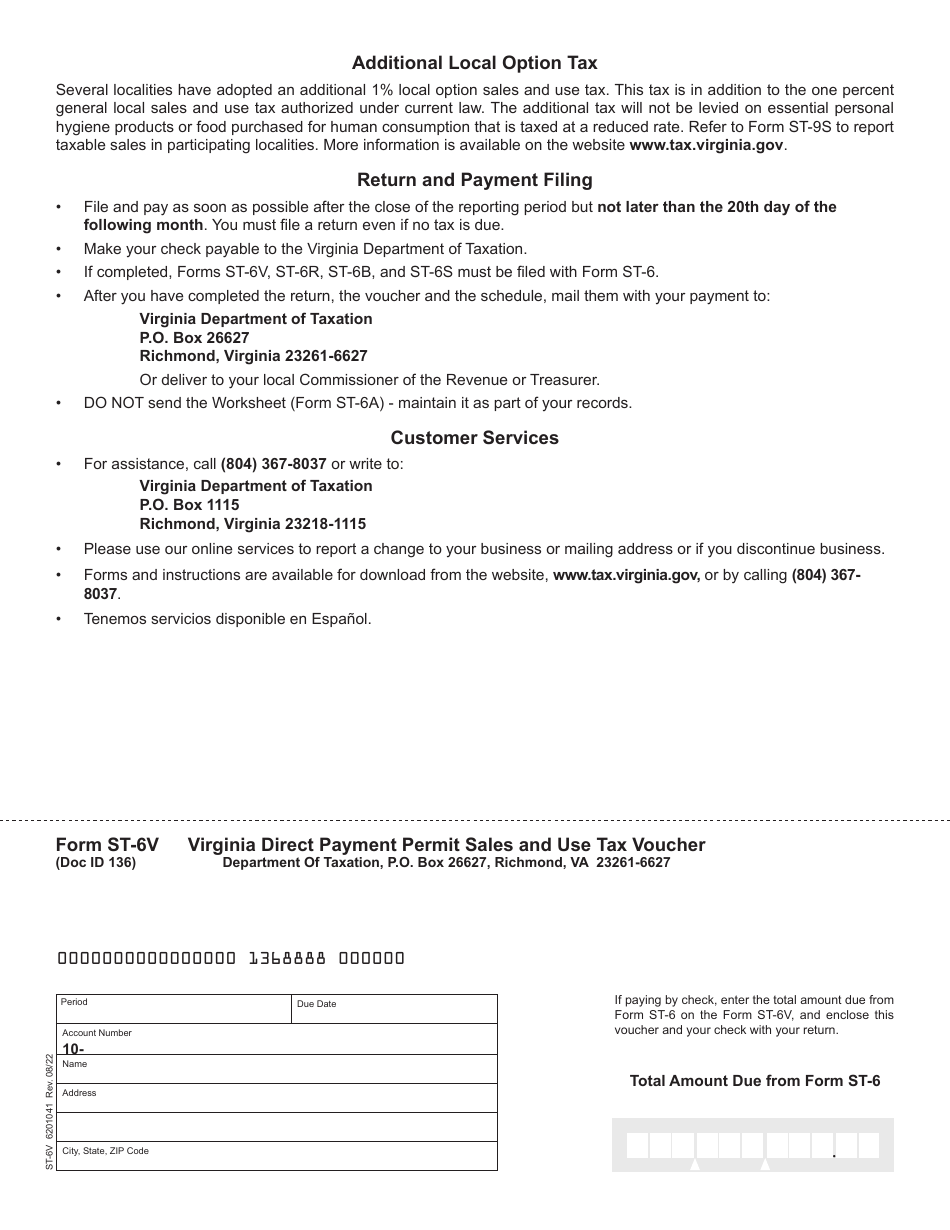

Q: When is Form ST-6 due?

A: Form ST-6 is due on the 20th day of the month following the end of the reporting period.

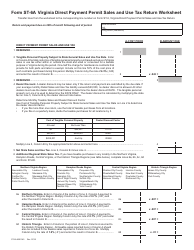

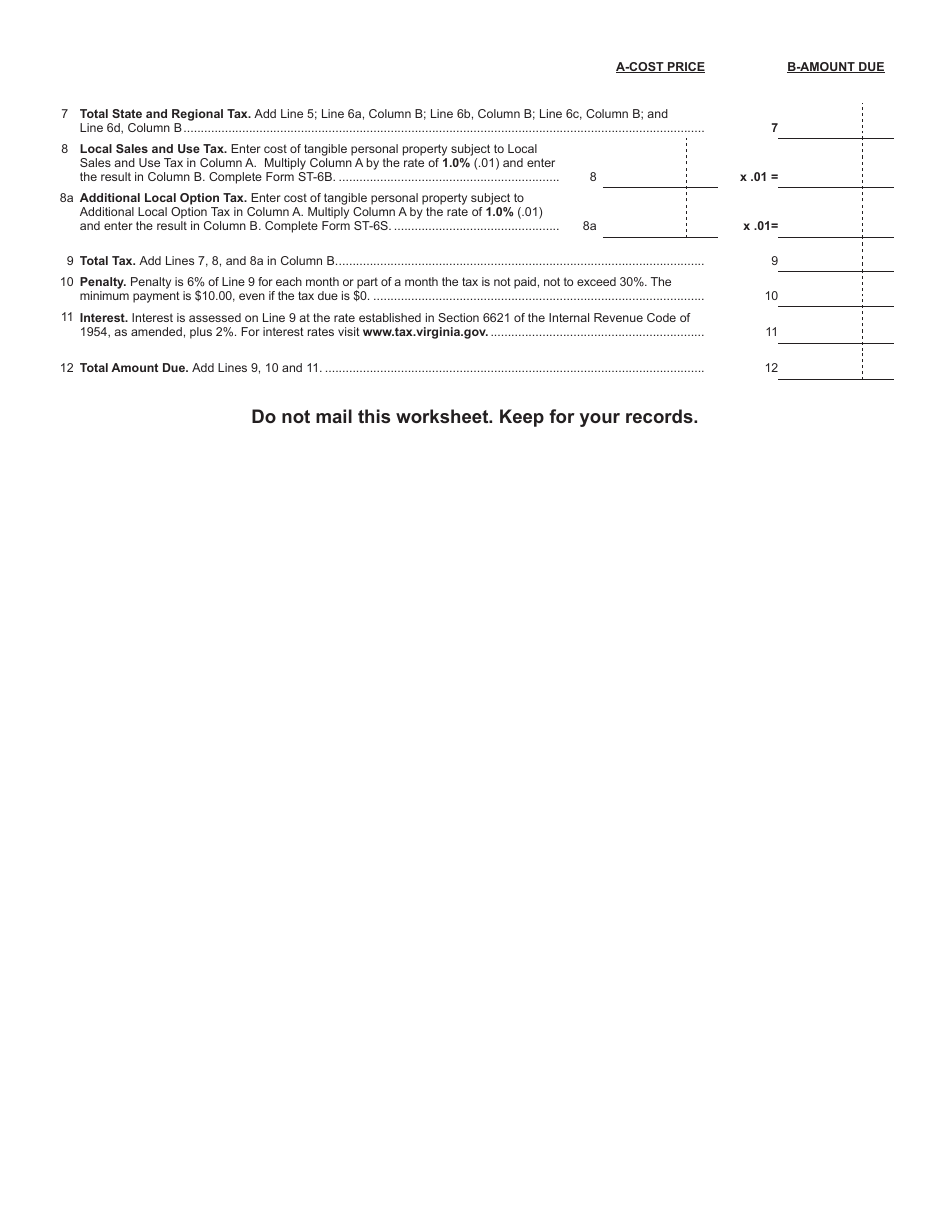

Q: What information is required on Form ST-6?

A: Form ST-6 requires the reporting of total sales and use tax due, as well as any allowable deductions and credits.

Q: Are there any penalties for late filing of Form ST-6?

A: Yes, there are penalties for late filing of Form ST-6. It is important to file and pay on time to avoid these penalties.

Form Details:

- Released on July 1, 2022;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST-6 by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.