This version of the form is not currently in use and is provided for reference only. Download this version of

Form 762

for the current year.

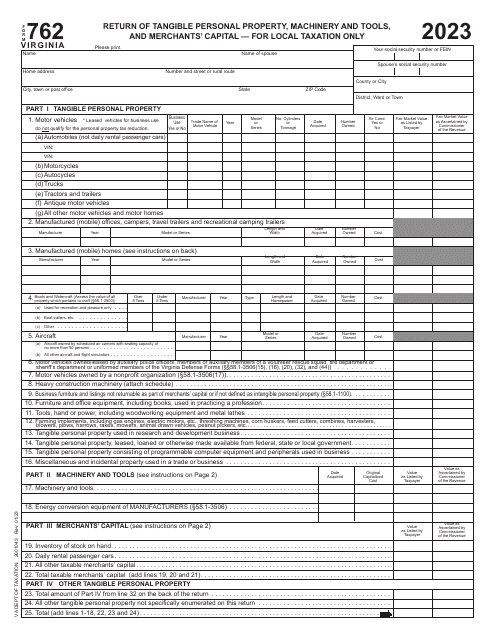

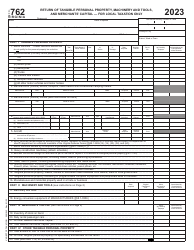

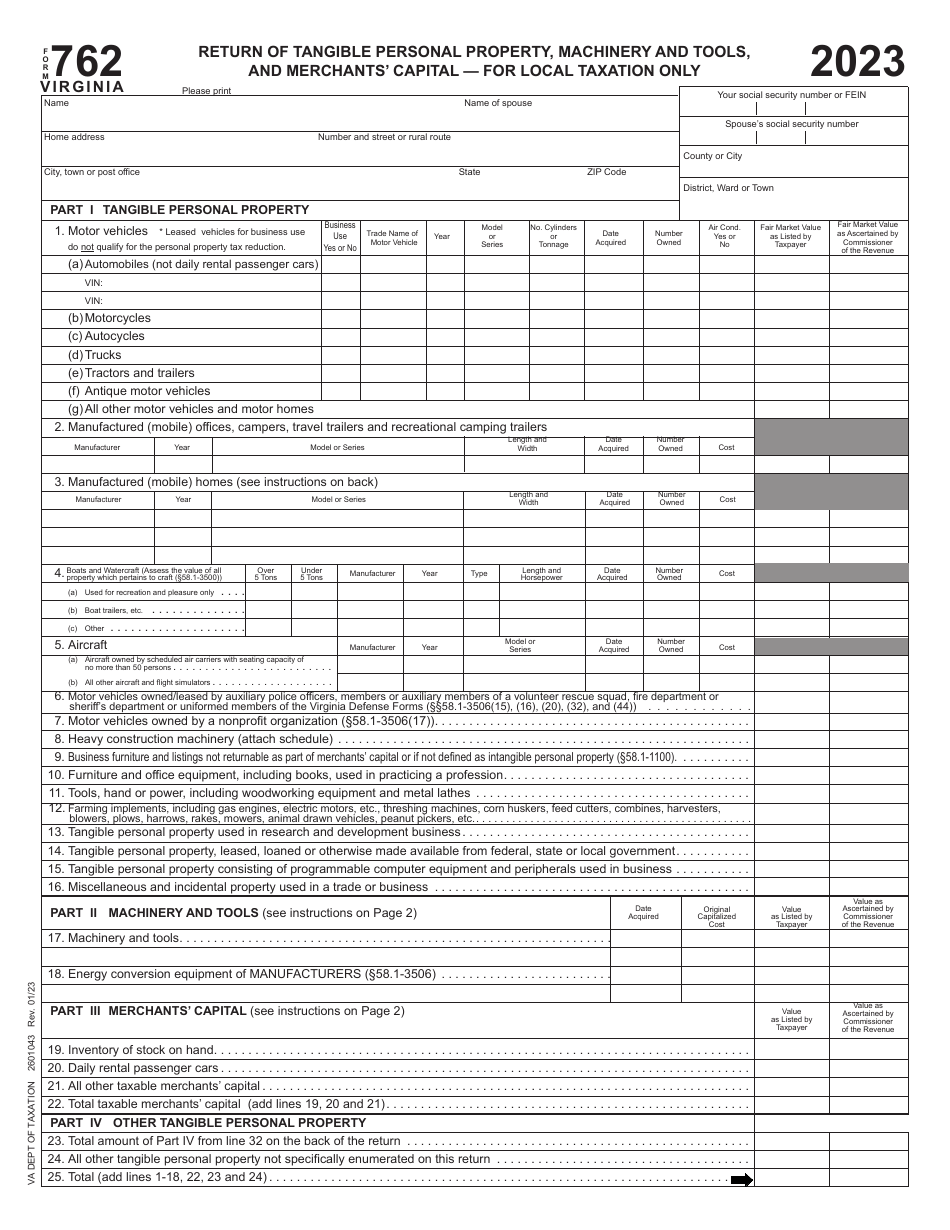

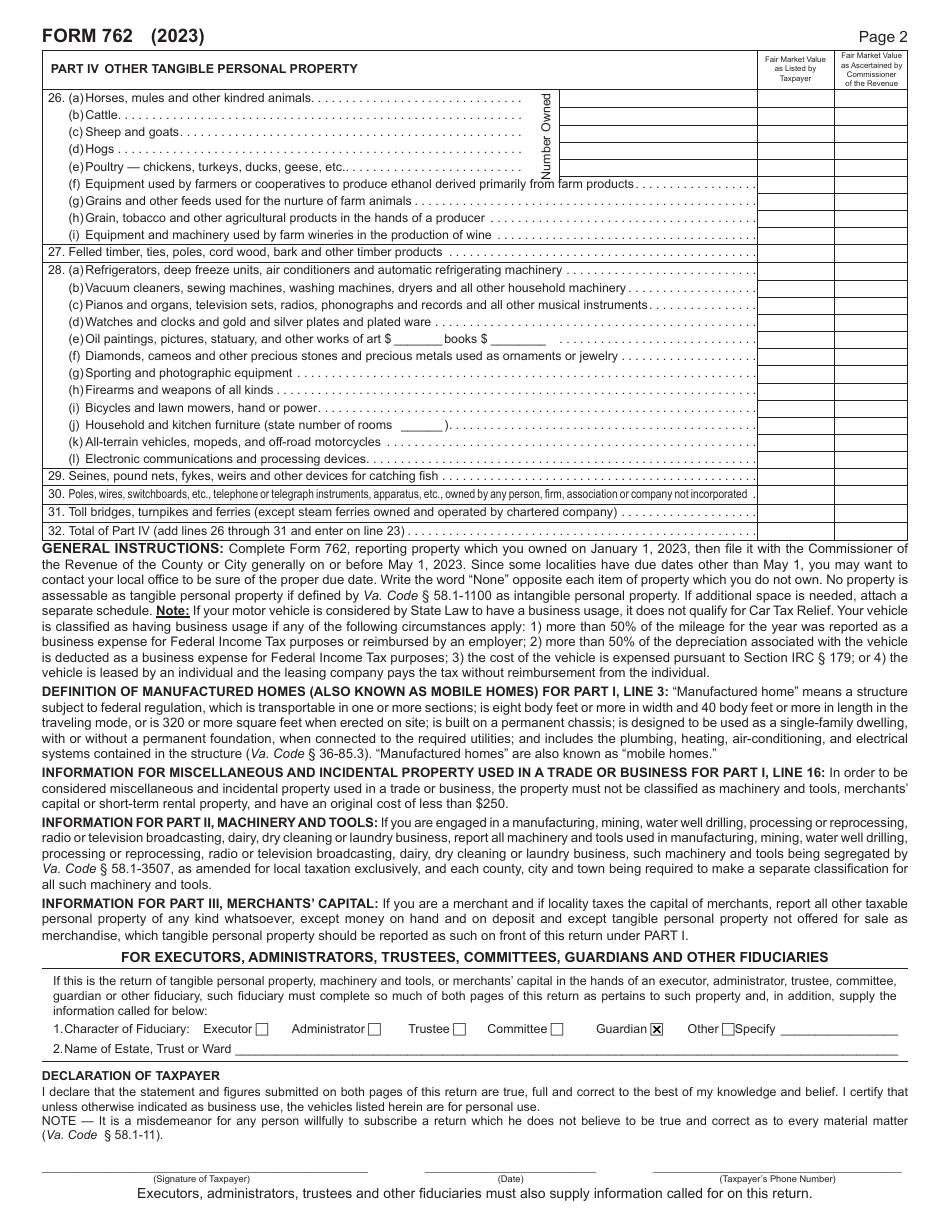

Form 762 Return of Tangible Personal Property, Machinery and Tools, and Merchants' Capital - for Local Taxation Only - Virginia

What Is Form 762?

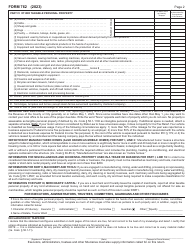

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form 762 used for?

A: Form 762 is used for reporting and paying taxes on tangible personal property, machinery and tools, and merchants' capital in Virginia.

Q: What types of property are included in form 762?

A: Form 762 includes tangible personal property, machinery and tools, and merchants' capital.

Q: Is form 762 used for local taxation only?

A: Yes, form 762 is specifically for local taxation in Virginia.

Q: Who needs to file form 762?

A: Anyone who owns or leases taxable tangible personal property, machinery and tools, or merchants' capital in Virginia may need to file form 762.

Q: When is form 762 due?

A: The due date for form 762 varies by locality, but it is generally due by May 1st of each year.

Q: How do I submit form 762?

A: Form 762 can be submitted by mail or electronically, depending on the instructions provided by your local government.

Q: What happens if I don't file form 762?

A: Failure to file form 762 or pay the required taxes may result in penalties and interest.

Q: Are there any exemptions or deductions for form 762?

A: Yes, there are certain exemptions and deductions available for qualifying property. You should consult the instructions for form 762 or seek professional advice for more information.

Form Details:

- Released on January 1, 2023;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 762 by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.