This version of the form is not currently in use and is provided for reference only. Download this version of

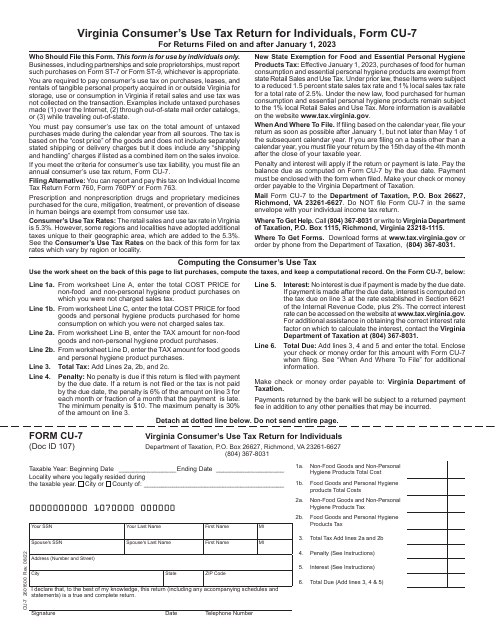

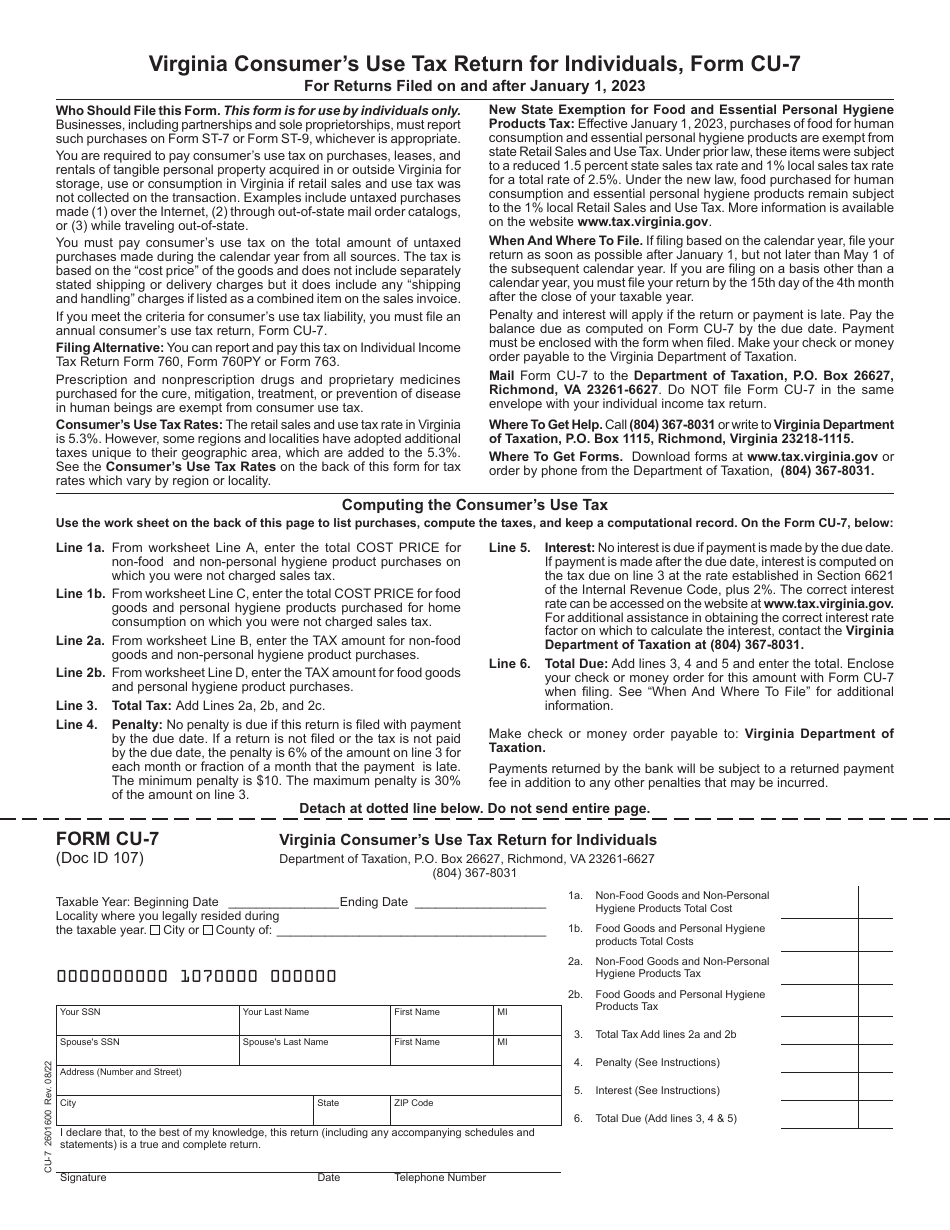

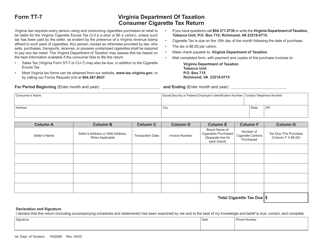

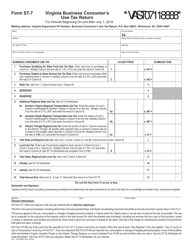

Form CU-7

for the current year.

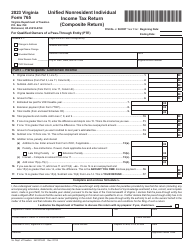

Form CU-7 Virginia Consumer's Use Tax Return for Individuals - Virginia

What Is Form CU-7?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CU-7?

A: Form CU-7 is the Virginia Consumer's Use Tax Return for Individuals.

Q: Who needs to fill out Form CU-7?

A: Virginia residents who have made out-of-state purchases without paying sales tax and owe use tax need to fill out Form CU-7.

Q: What is the purpose of Form CU-7?

A: The purpose of Form CU-7 is to report and pay the use tax owed on out-of-state purchases.

Q: When is Form CU-7 due?

A: Form CU-7 is due on or before the 20th day of the month following the end of the quarter in which the purchases were made.

Q: What happens if I don't file Form CU-7?

A: If you don't file Form CU-7 or pay the use tax owed, you may be subject to penalties and interest.

Q: Can I e-file Form CU-7?

A: No, Form CU-7 cannot be e-filed. It must be filed by mail.

Q: What supporting documents do I need to include with Form CU-7?

A: You need to include copies of invoices, receipts, and other proof of purchase that shows the amount of use tax owed.

Q: Are there any exemptions from paying use tax on out-of-state purchases?

A: Yes, certain items, such as food, medicine, and property used for business purposes, may be exempt from use tax.

Form Details:

- Released on August 1, 2022;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CU-7 by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.