This version of the form is not currently in use and is provided for reference only. Download this version of

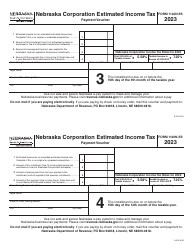

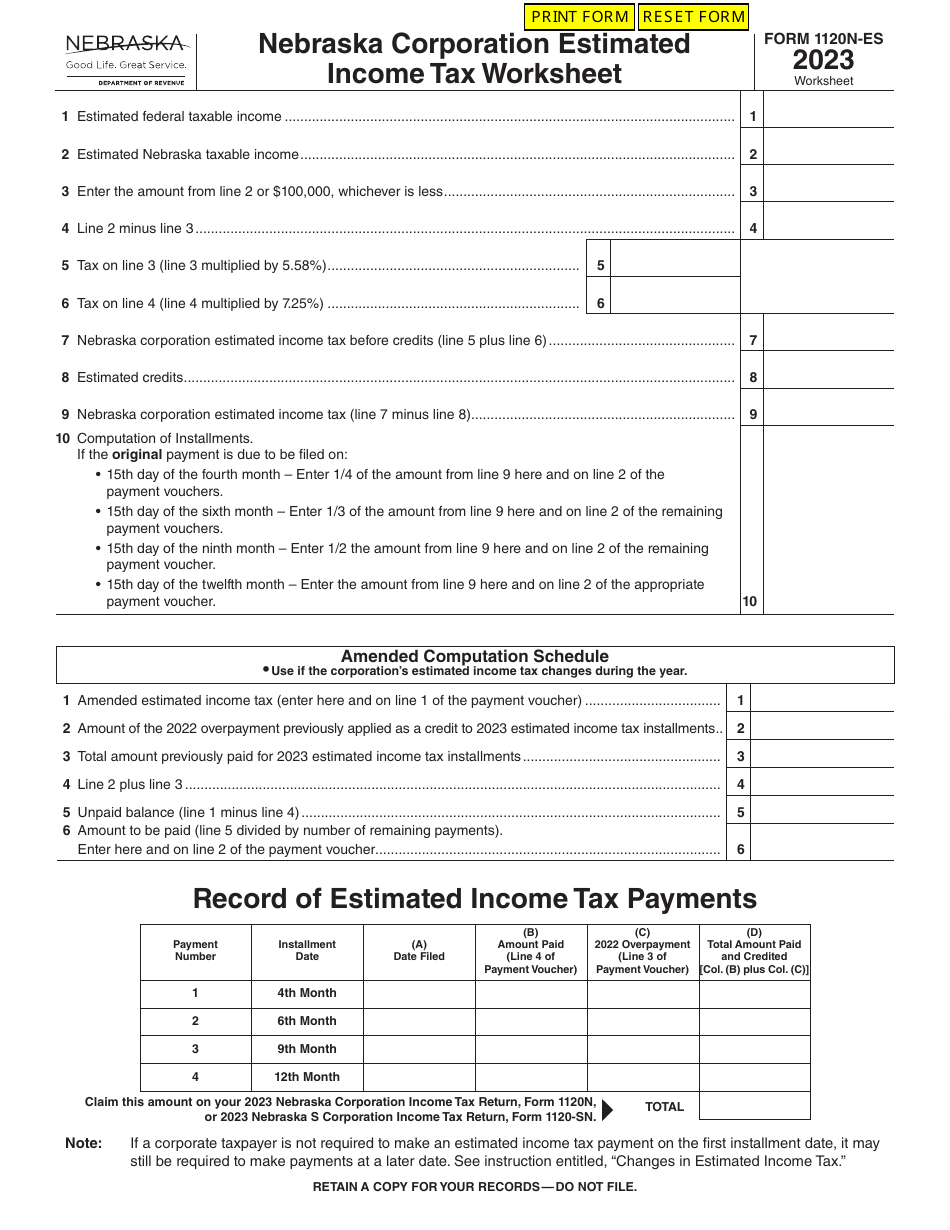

Form 1120N-ES

for the current year.

Form 1120N-ES Nebraska Corporation Estimated Income Tax Payment Voucher - Nebraska

What Is Form 1120N-ES?

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

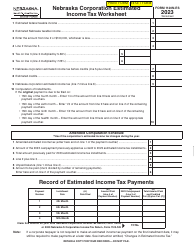

Q: What is Form 1120N-ES?

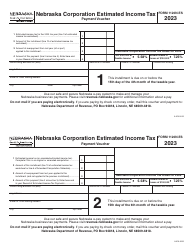

A: Form 1120N-ES is a Nebraska Corporation Estimated Income Tax Payment Voucher.

Q: Who needs to file Form 1120N-ES?

A: Nebraska corporations that need to make estimated income tax payments.

Q: What is the purpose of Form 1120N-ES?

A: The purpose of Form 1120N-ES is to make estimated income tax payments for Nebraska corporations.

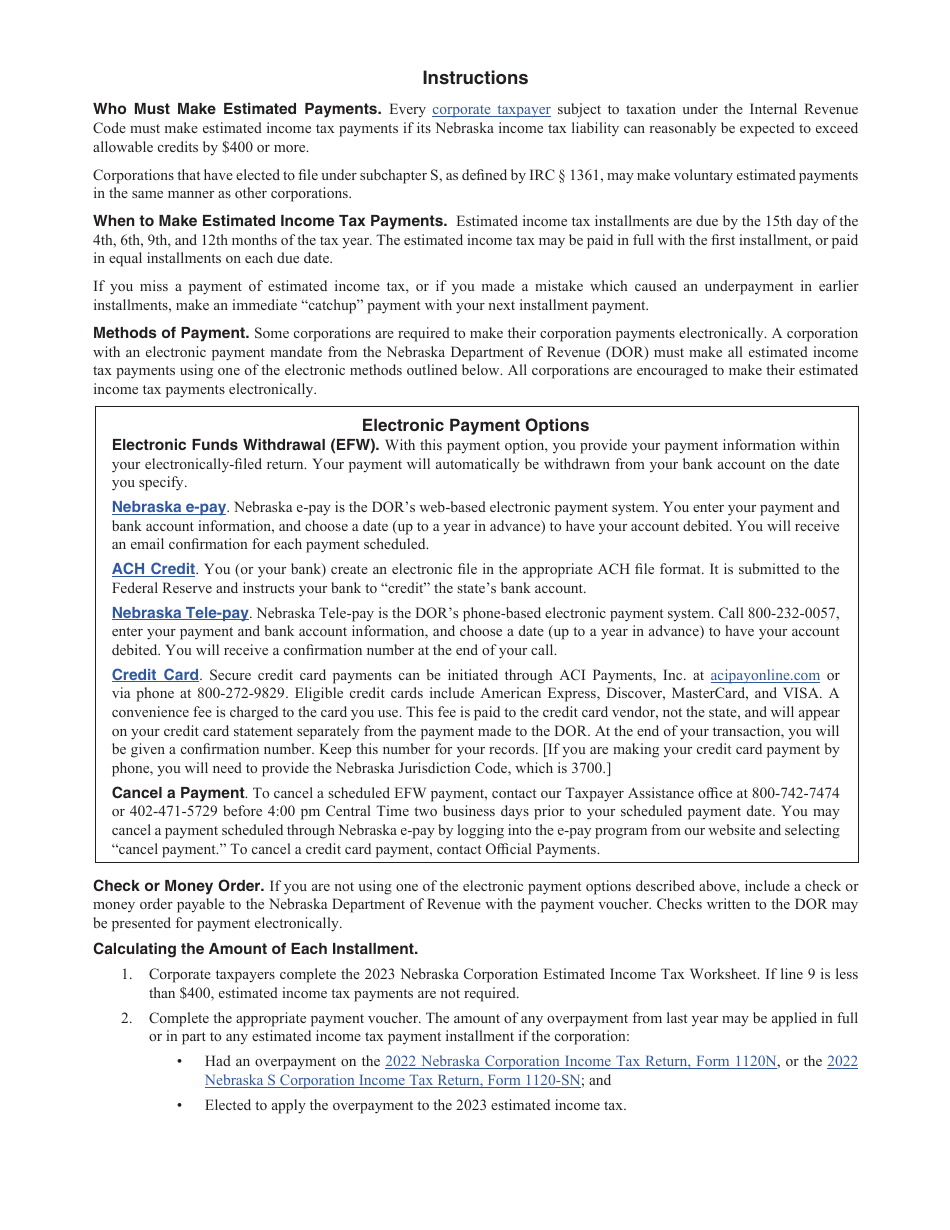

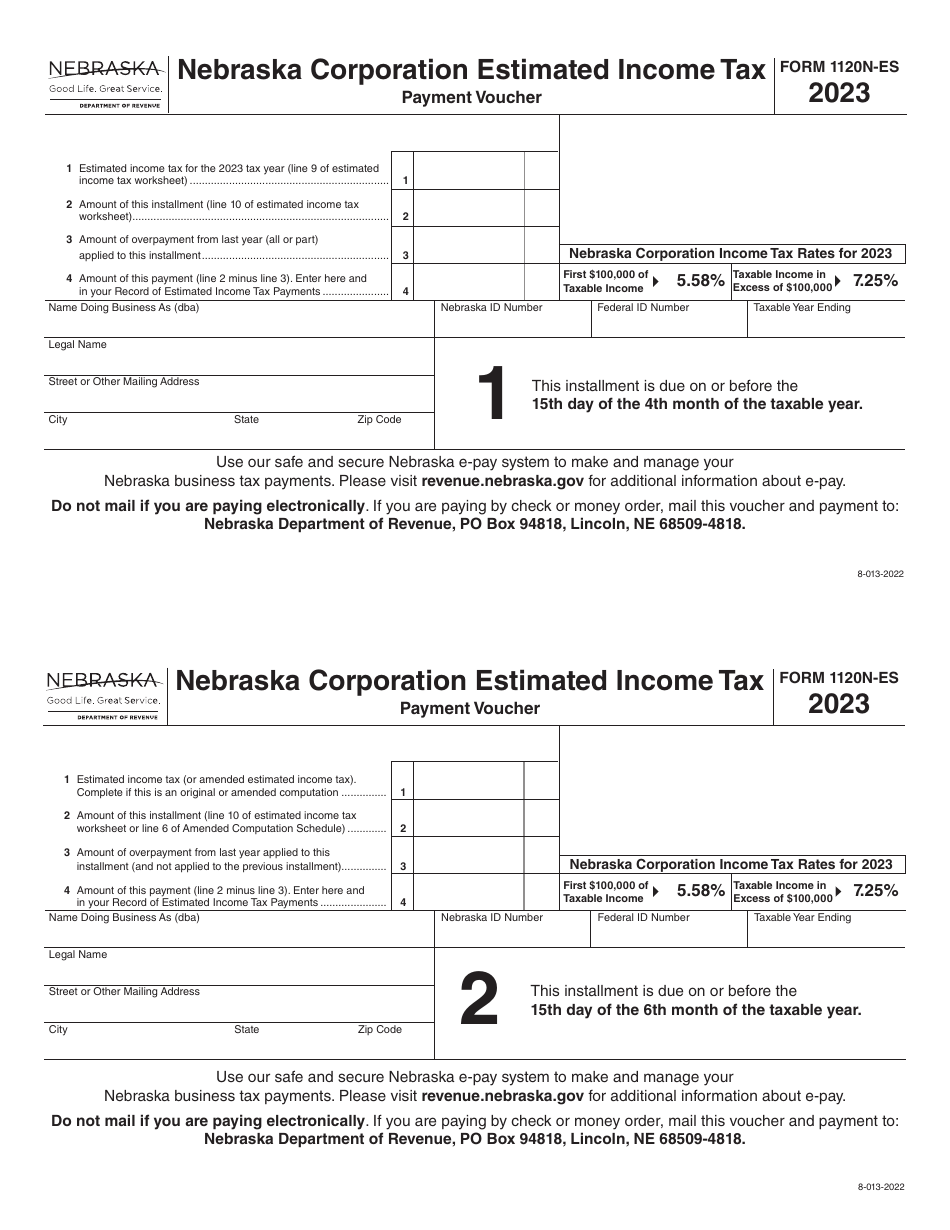

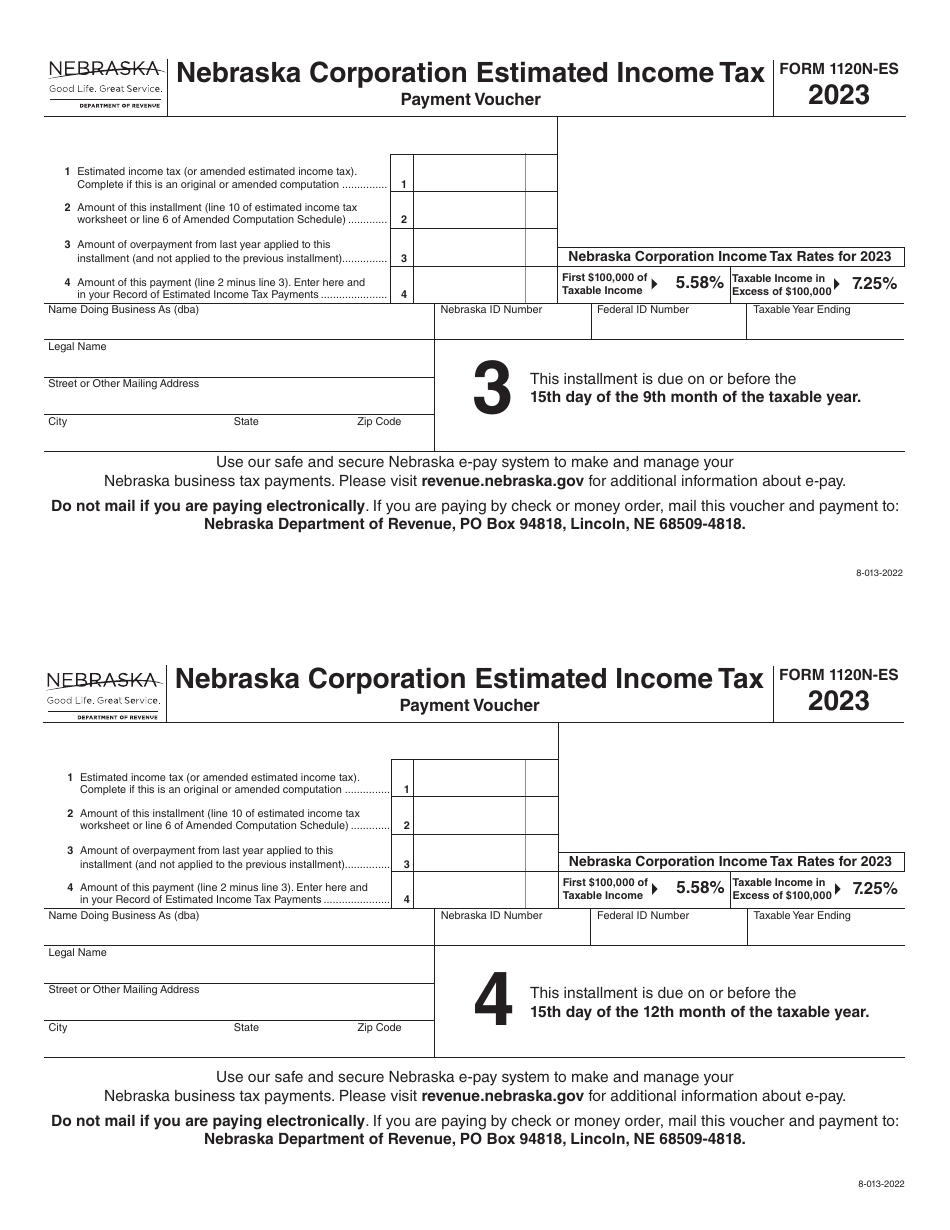

Q: When is Form 1120N-ES due?

A: Form 1120N-ES is due on a quarterly basis. The due dates are April 15th, June 15th, September 15th, and December 15th.

Q: Are there any penalties for not filing Form 1120N-ES?

A: Yes, there may be penalties for not filing or underestimating your estimated income tax payments using Form 1120N-ES. It is important to file and pay on time to avoid penalties.

Q: Can I e-file Form 1120N-ES?

A: No, at the time of this document, e-filing is not available for Form 1120N-ES. It must be filed by mail.

Form Details:

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1120N-ES by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.