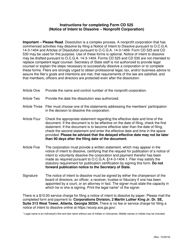

This version of the form is not currently in use and is provided for reference only. Download this version of

Appendix F

for the current year.

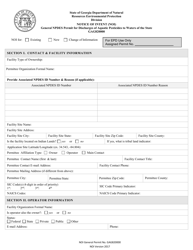

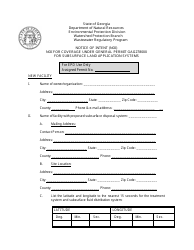

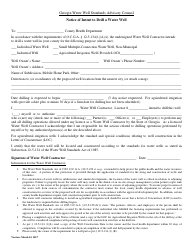

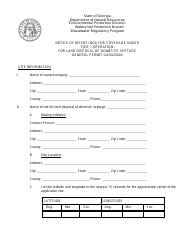

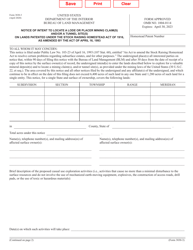

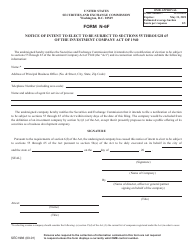

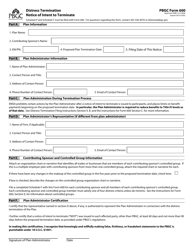

Appendix F Notice of Intent for Georgia Job Tax Credit - Georgia (United States)

What Is Appendix F?

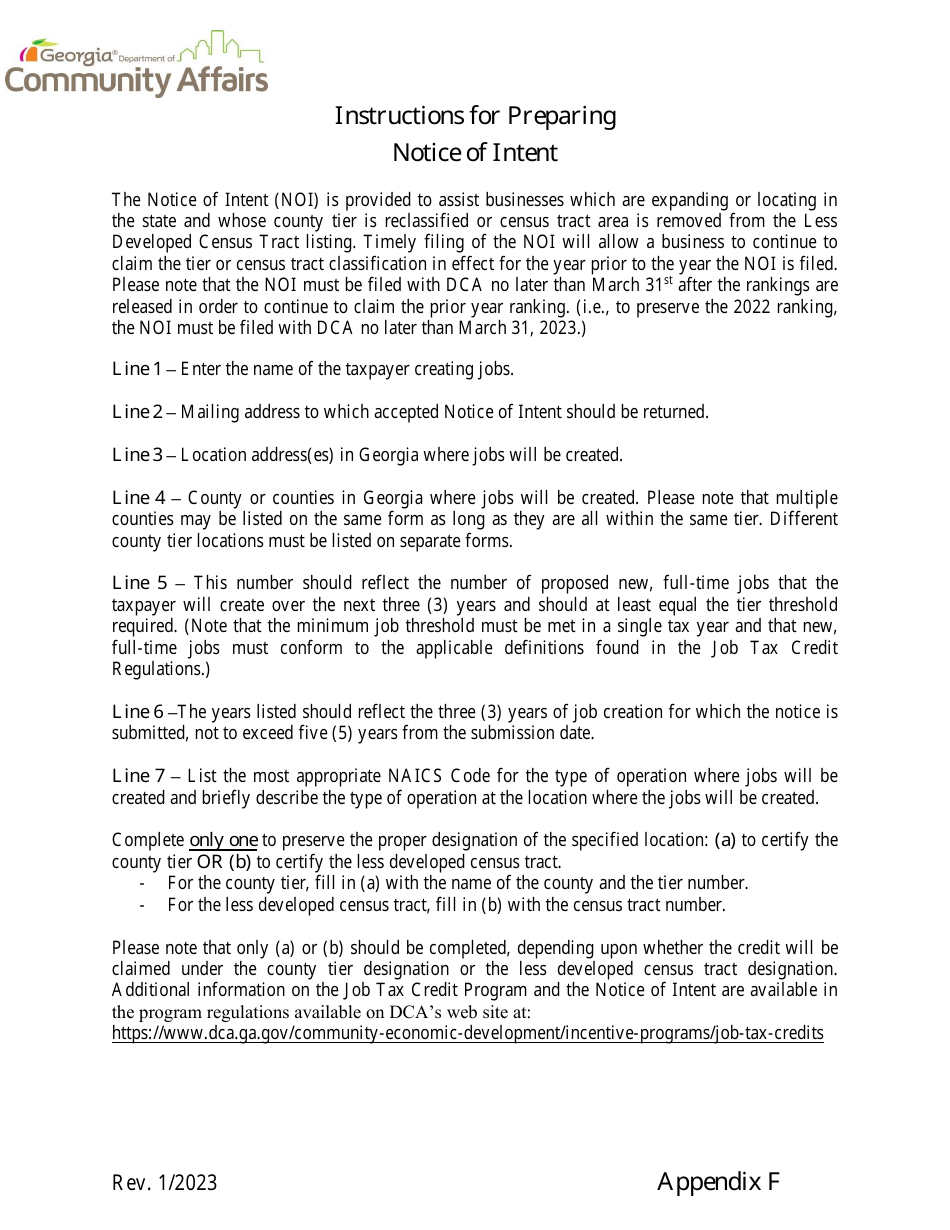

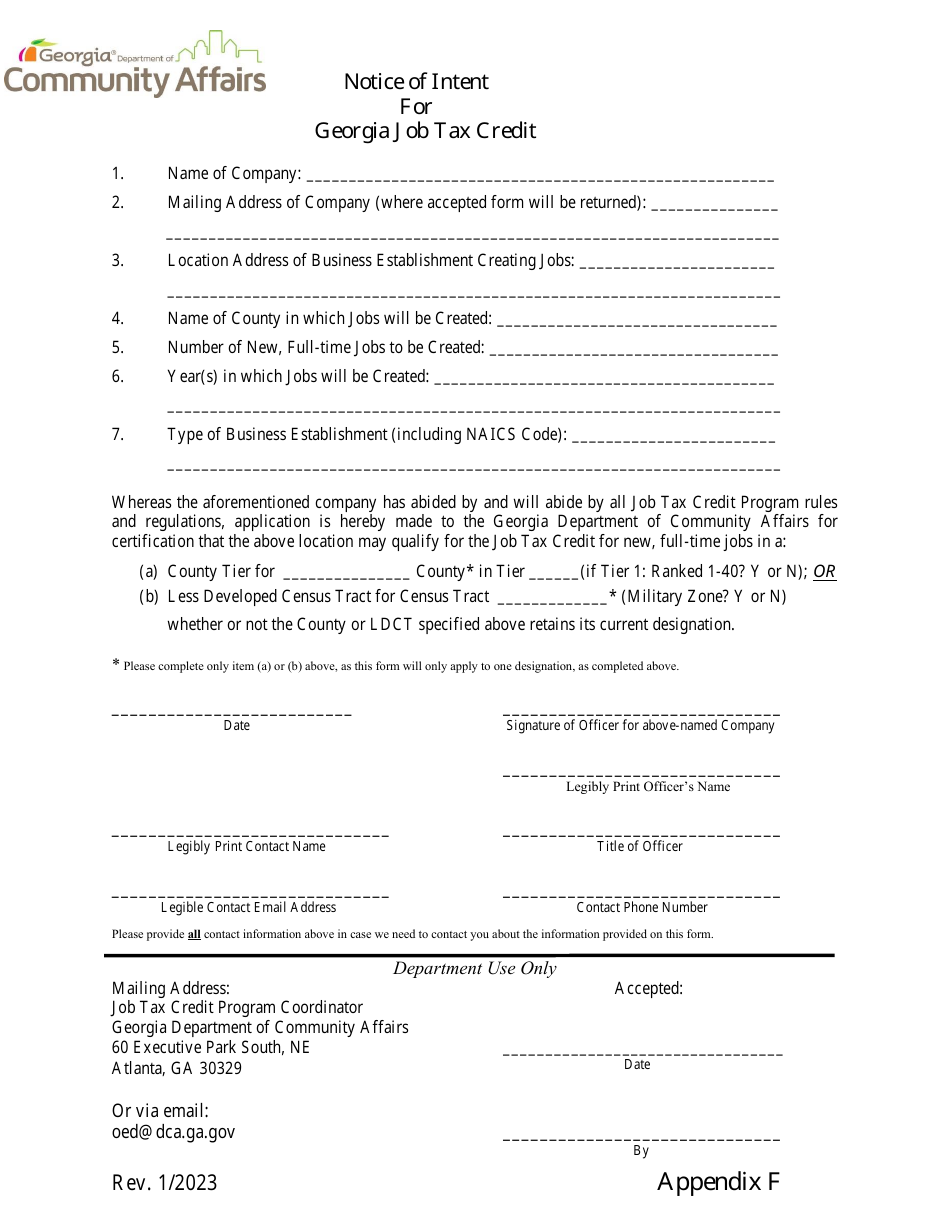

This is a legal form that was released by the Georgia Department of Community Affairs - a government authority operating within Georgia (United States). As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Appendix F Notice of Intent for Georgia Job Tax Credit?

A: Appendix F Notice of Intent for Georgia Job Tax Credit is a form used in the state of Georgia to apply for the Job Tax Credit.

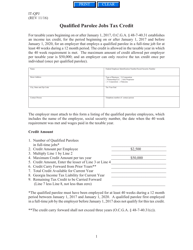

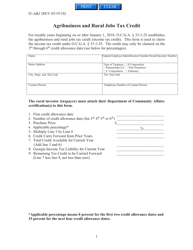

Q: What is the purpose of the Georgia Job Tax Credit?

A: The purpose of the Georgia Job Tax Credit is to incentivize businesses to create jobs in the state.

Q: How can I qualify for the Georgia Job Tax Credit?

A: To qualify for the Georgia Job Tax Credit, you must meet certain criteria, such as creating a certain number of jobs and paying wages that meet or exceed a set threshold.

Q: What are the benefits of the Georgia Job Tax Credit?

A: The benefits of the Georgia Job Tax Credit include a reduction in state income tax liability and the potential to receive a refund if the credit exceeds the tax liability.

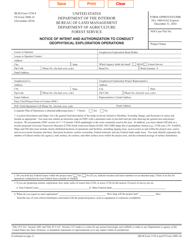

Form Details:

- Released on January 1, 2023;

- The latest edition provided by the Georgia Department of Community Affairs;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Appendix F by clicking the link below or browse more documents and templates provided by the Georgia Department of Community Affairs.