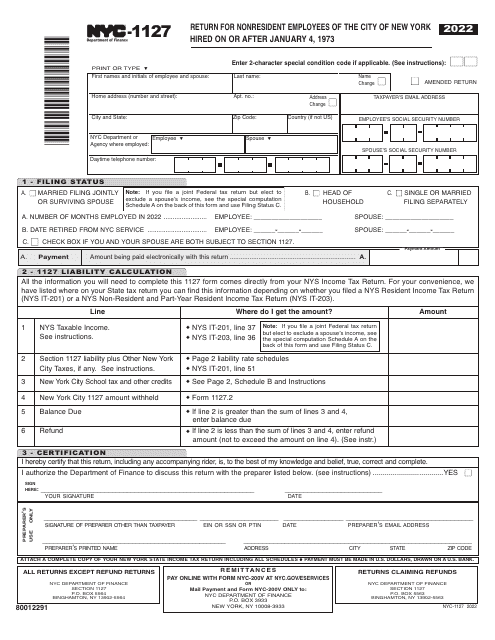

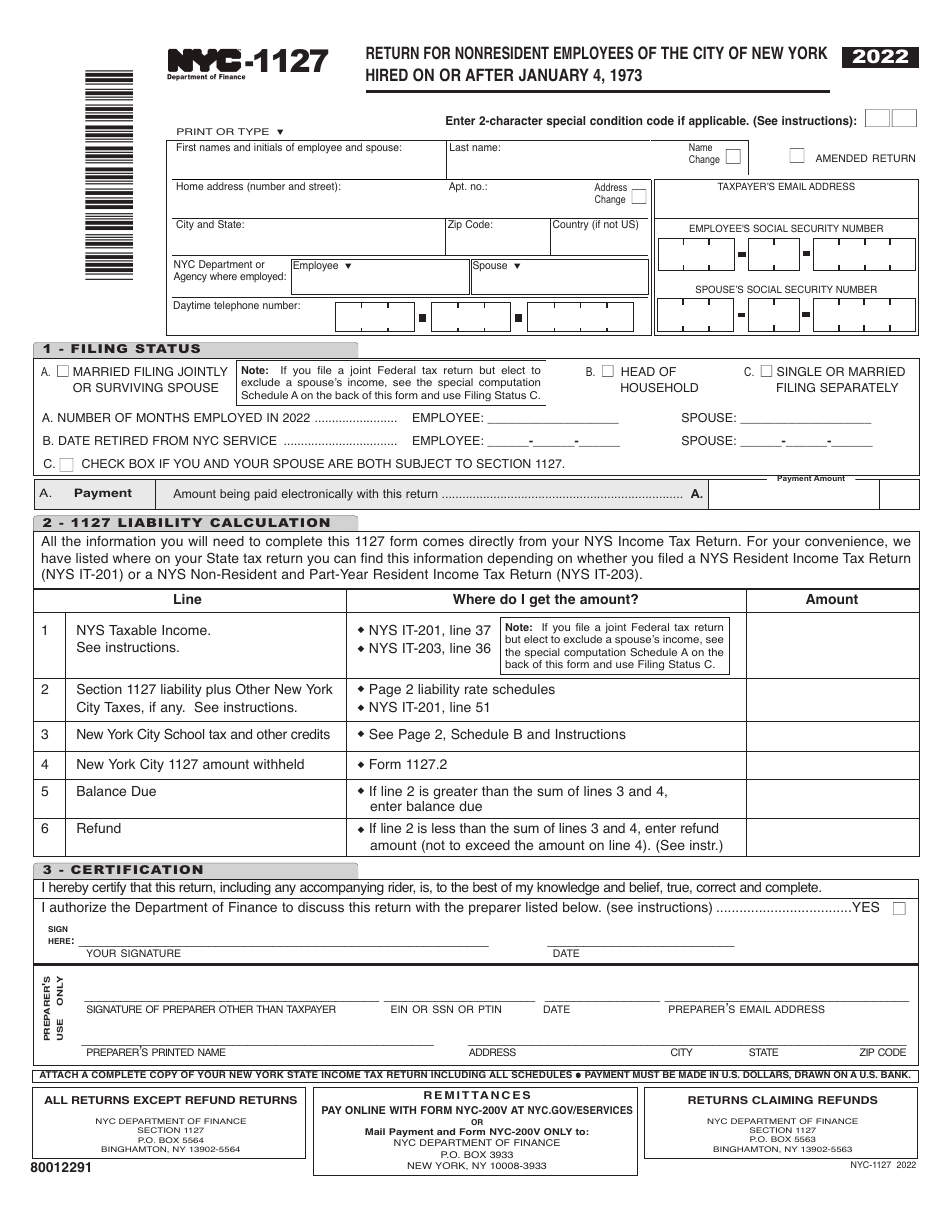

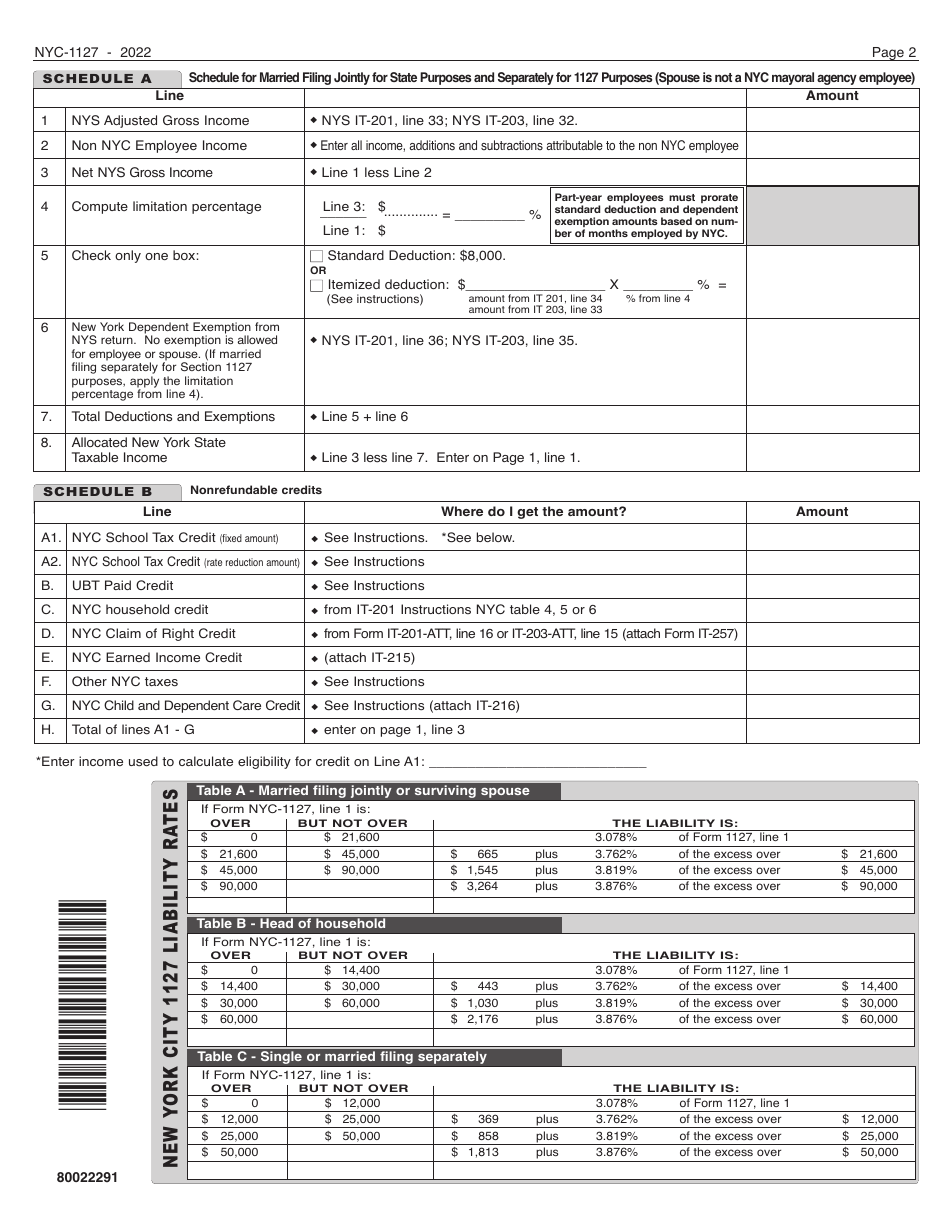

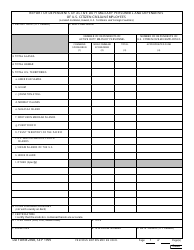

Form NYC-1127 Return for Nonresident Employees of the City of New York Hired on or After January 4, 1973 - New York City

What Is Form NYC-1127?

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the NYC-1127 form?

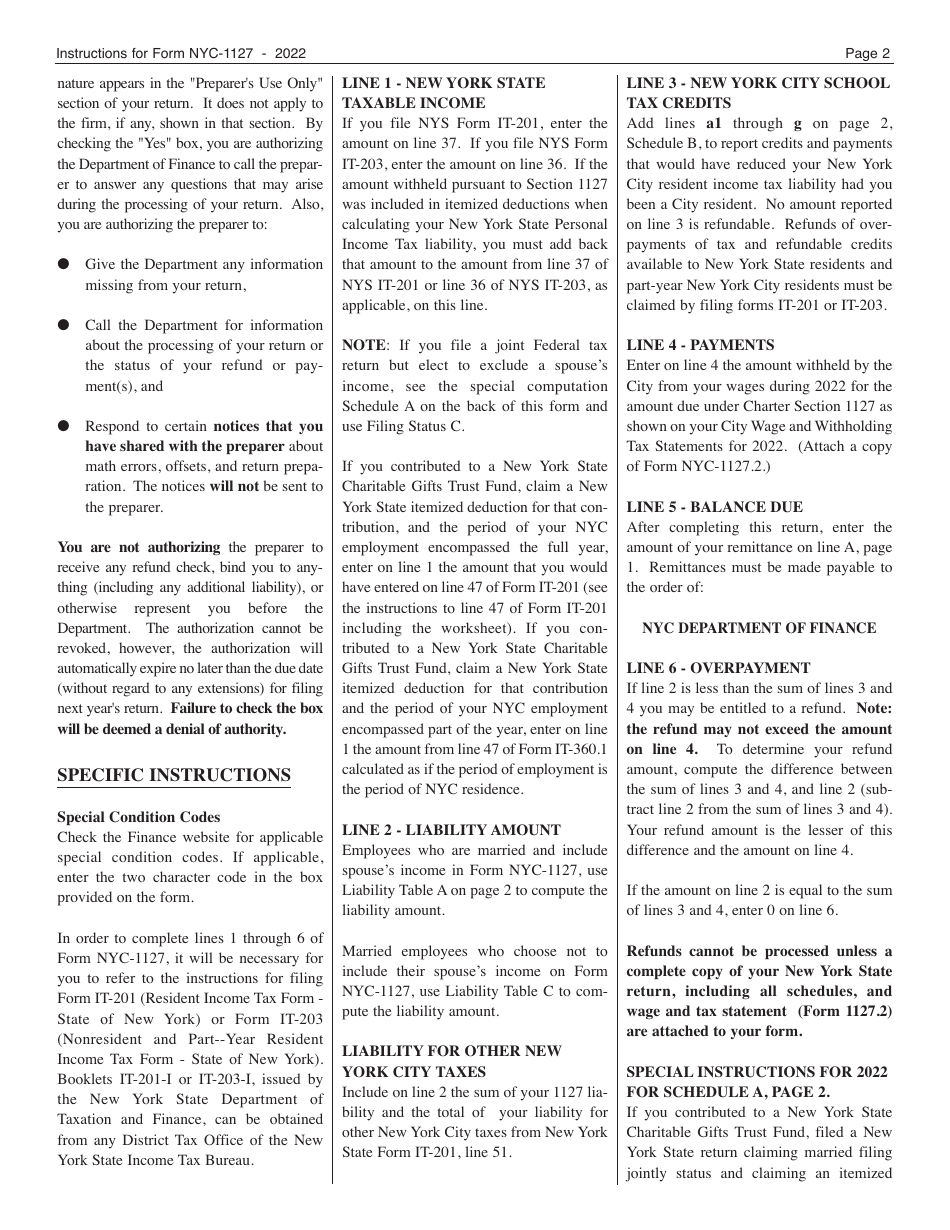

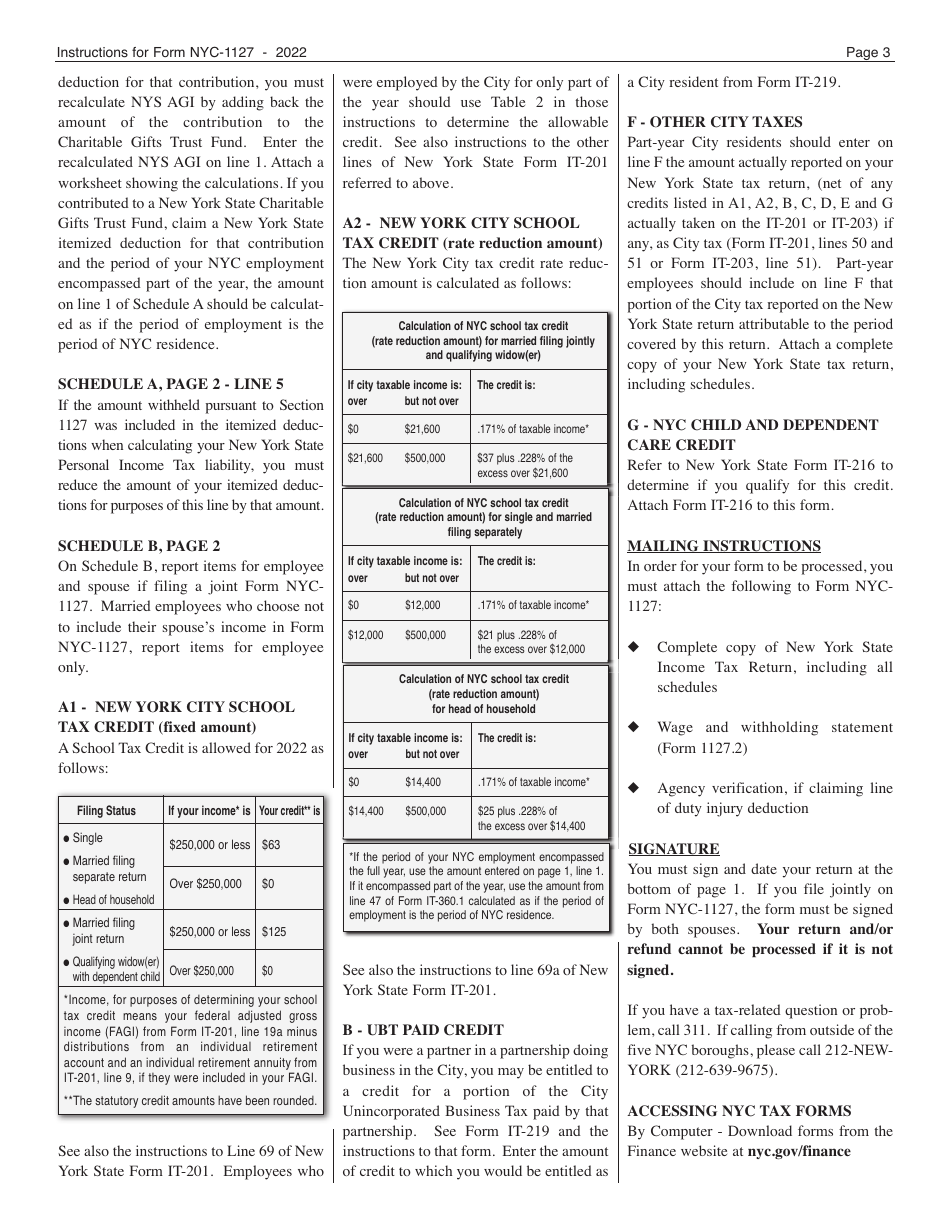

A: The NYC-1127 form is the tax return form for nonresident employees of the City of New York, hired on or after January 4, 1973.

Q: Who needs to file the NYC-1127 form?

A: Nonresident employees of the City of New York hired on or after January 4, 1973 must file the NYC-1127 form.

Q: When do I need to file the NYC-1127 form?

A: The NYC-1127 form must be filed annually by April 15th.

Q: What information do I need to complete the NYC-1127 form?

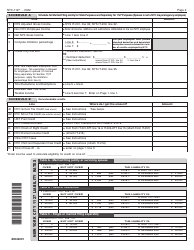

A: You will need to provide your personal and employment information, as well as details about your income and deductions.

Q: Are there any penalties for not filing the NYC-1127 form?

A: Yes, if you fail to file the NYC-1127 form, you may be subject to penalties and interest.

Form Details:

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYC-1127 by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.