This version of the form is not currently in use and is provided for reference only. Download this version of

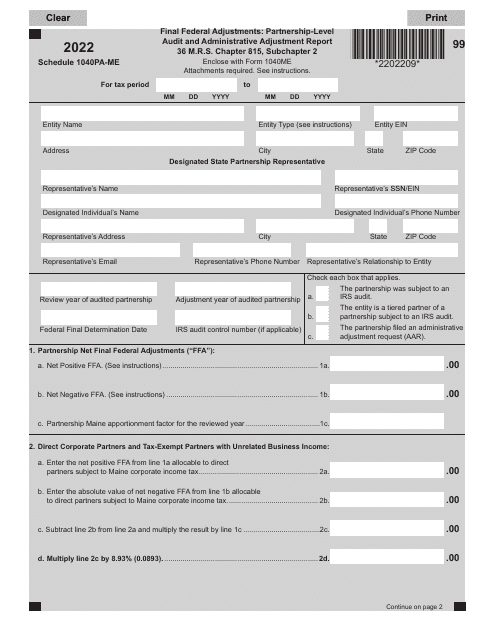

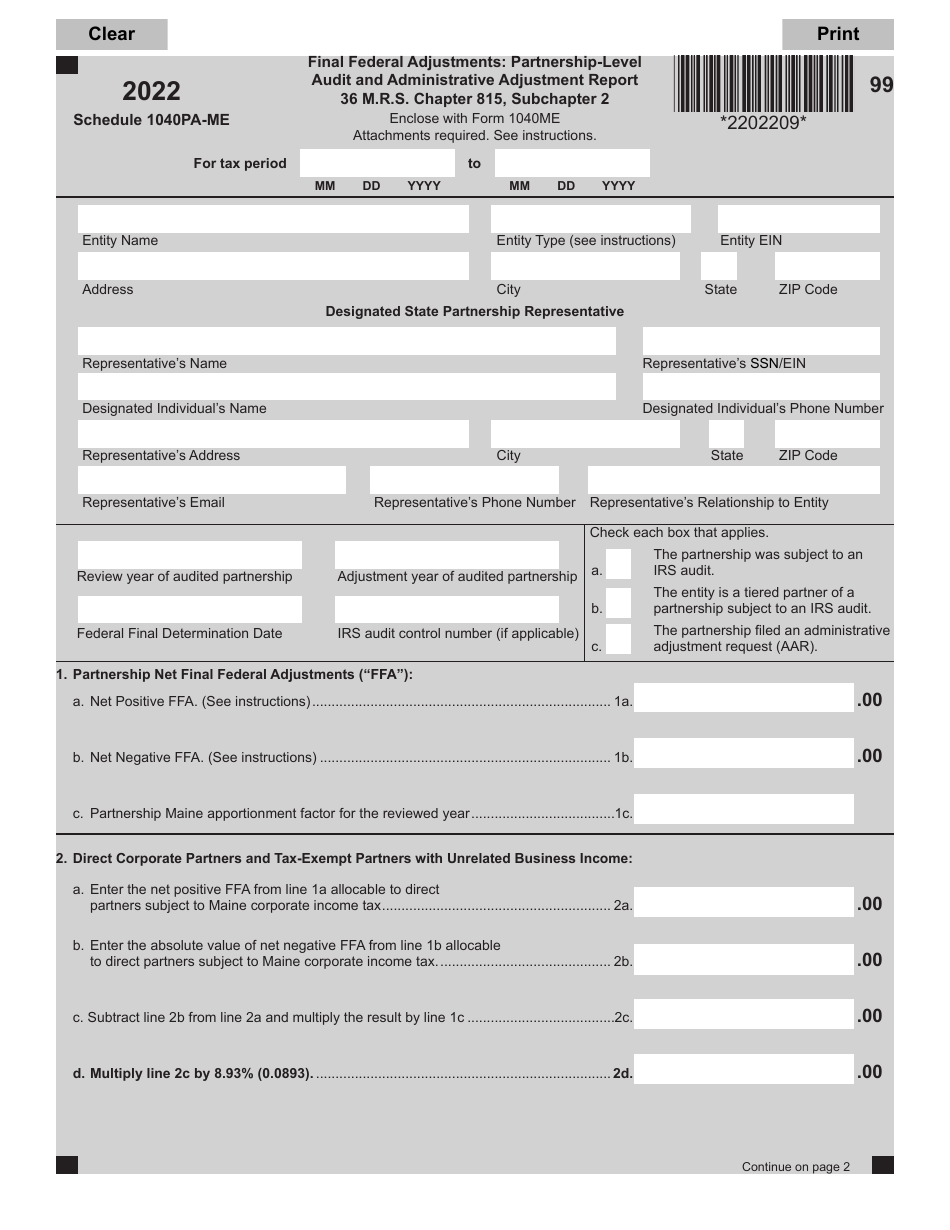

Schedule 1040PA-ME

for the current year.

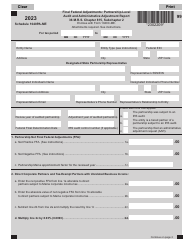

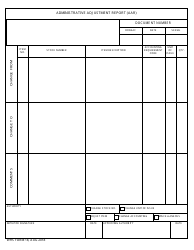

Schedule 1040PA-ME Final Federal Adjustments: Partnership-Level Audit and Administrative Adjustment Report - Maine

What Is Schedule 1040PA-ME?

This is a legal form that was released by the Maine Revenue Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule 1040PA-ME?

A: Schedule 1040PA-ME is a form used to report Partnership-Level Audit and Administrative Adjustment Report pertaining to federal adjustments in Maine.

Q: What are federal adjustments?

A: Federal adjustments refer to changes made by the Internal Revenue Service (IRS) to your federal tax return.

Q: What is a Partnership-Level Audit and Administrative Adjustment Report?

A: A Partnership-Level Audit and Administrative Adjustment Report is a report that details the adjustments made by the IRS to a partnership's federal tax return.

Q: When is Schedule 1040PA-ME needed?

A: Schedule 1040PA-ME is needed when a partnership has federal adjustments and wants to report them to the state of Maine.

Q: What is the purpose of Schedule 1040PA-ME?

A: The purpose of Schedule 1040PA-ME is to calculate the correct amount of state taxes owed or refunded based on the federal adjustments made to a partnership's tax return.

Q: Who needs to file Schedule 1040PA-ME?

A: Partnerships that have federal adjustments and are filing taxes in the state of Maine need to file Schedule 1040PA-ME.

Q: Is Schedule 1040PA-ME required for individual taxpayers?

A: No, Schedule 1040PA-ME is specific to partnerships and not required for individual taxpayers.

Q: What happens if I don't file Schedule 1040PA-ME?

A: If a partnership fails to file Schedule 1040PA-ME when required, it may result in inaccurate state tax calculations and potential penalties or fines.

Q: Do I need to attach Schedule 1040PA-ME to my federal tax return?

A: No, Schedule 1040PA-ME is a separate form that is filed with the state of Maine and does not need to be attached to your federal tax return.

Form Details:

- Released on December 1, 2022;

- The latest edition provided by the Maine Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule 1040PA-ME by clicking the link below or browse more documents and templates provided by the Maine Revenue Services.