This version of the form is not currently in use and is provided for reference only. Download this version of

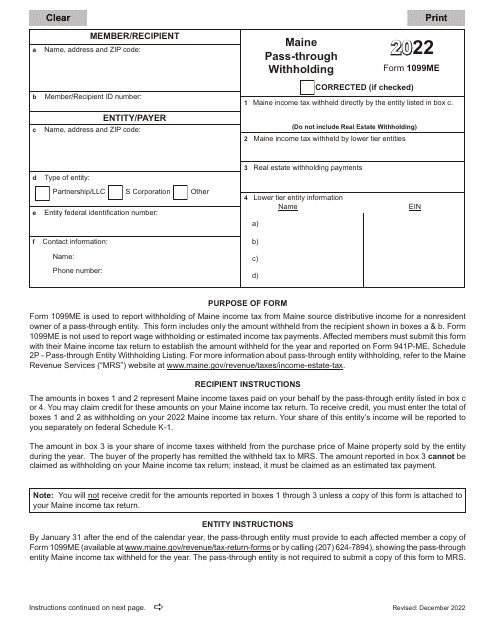

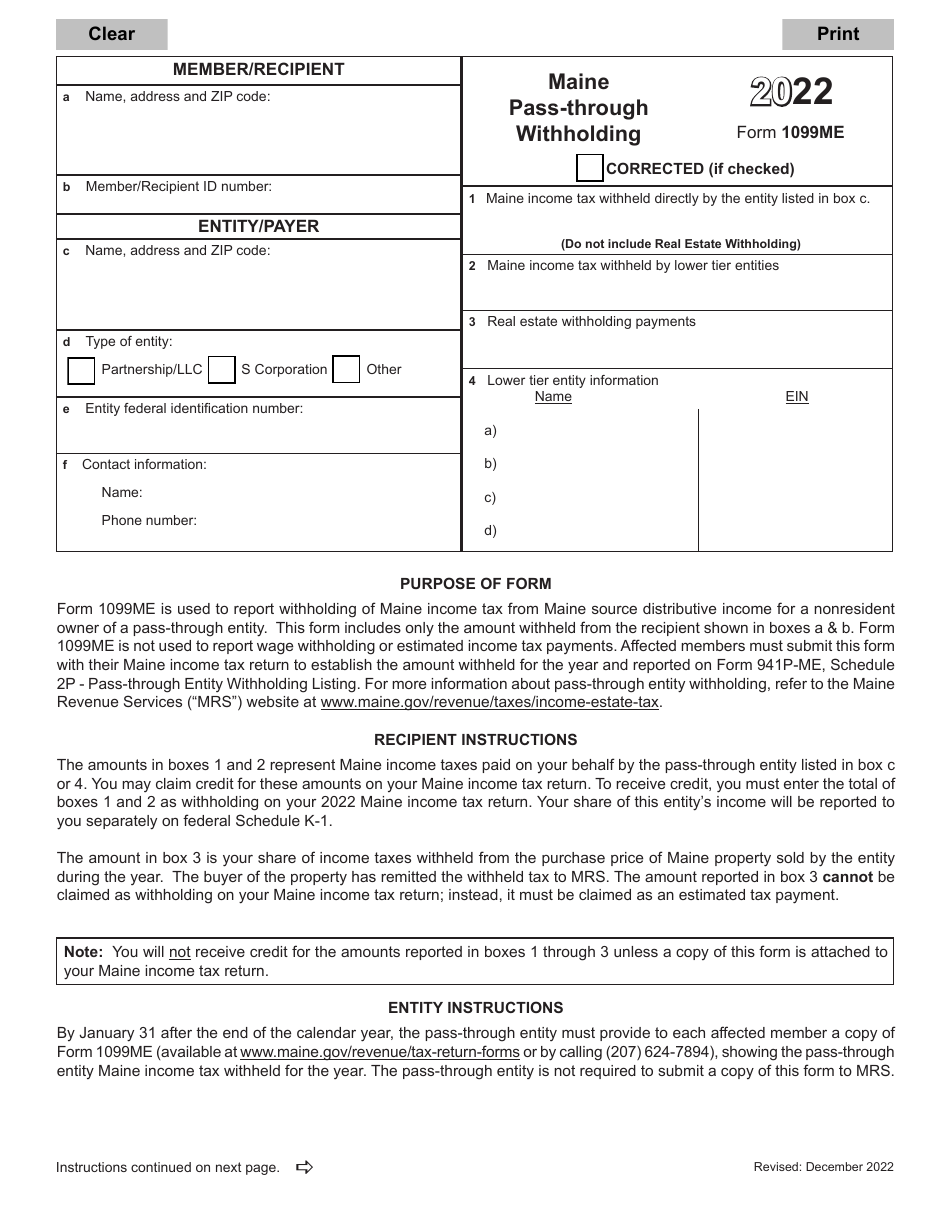

Form 1099ME

for the current year.

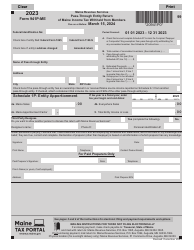

Form 1099ME Maine Pass-Through Withholding - Maine

What Is Form 1099ME?

This is a legal form that was released by the Maine Revenue Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1099-ME?

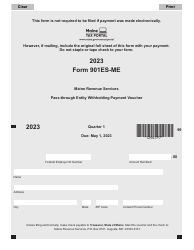

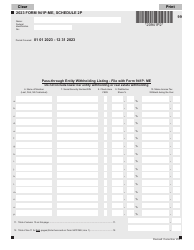

A: Form 1099-ME is a tax form used for reporting Maine Pass-Through Withholding.

Q: Who needs to file Form 1099-ME?

A: Any person or entity who withheld Maine income tax from a pass-through entity needs to file Form 1099-ME.

Q: What is Maine Pass-Through Withholding?

A: Maine Pass-Through Withholding is a tax on income distributed by pass-through entities, such as partnerships and S-corporations, to nonresident owners.

Q: When is Form 1099-ME due?

A: Form 1099-ME is generally due by January 31st, following the end of the tax year in which the withholding occurred.

Form Details:

- Released on December 1, 2022;

- The latest edition provided by the Maine Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1099ME by clicking the link below or browse more documents and templates provided by the Maine Revenue Services.