This version of the form is not currently in use and is provided for reference only. Download this version of

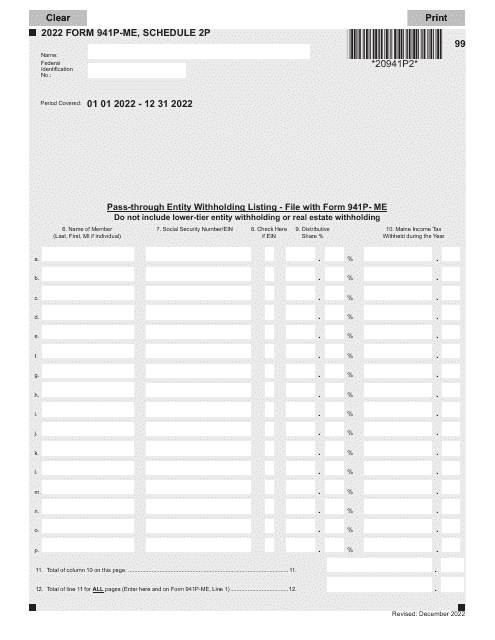

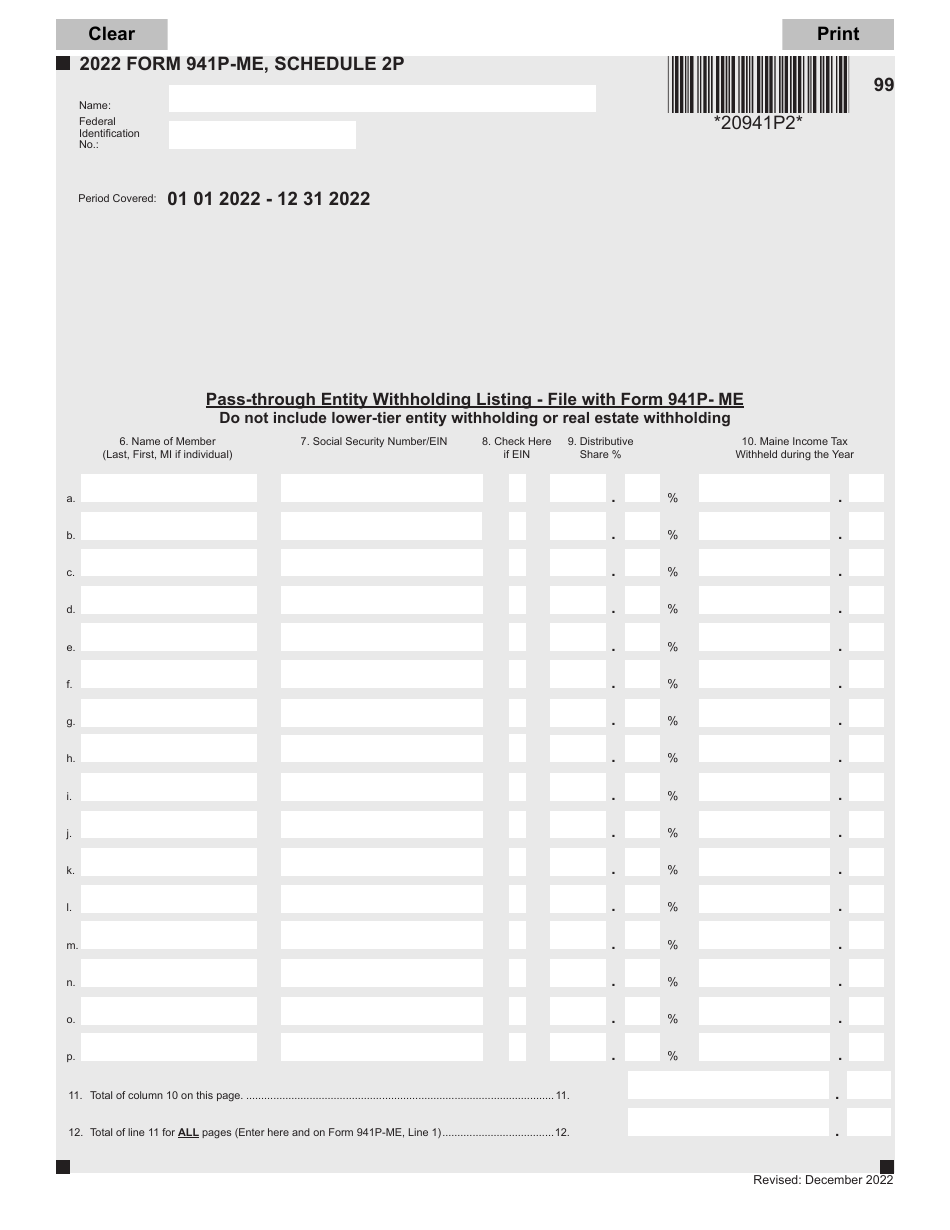

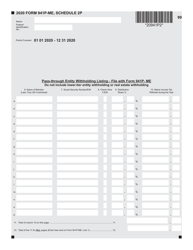

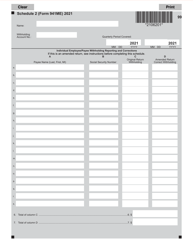

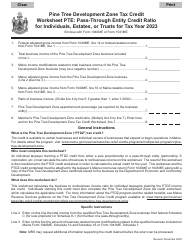

Form 941P-ME Schedule 2P

for the current year.

Form 941P-ME Schedule 2P Pass-Through Entity Withholding Listing - Maine

What Is Form 941P-ME Schedule 2P?

This is a legal form that was released by the Maine Revenue Services - a government authority operating within Maine.The document is a supplement to Form 941P-ME, Pass-Through Entity Return of Maine Income Tax Withheld From Members. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 941P-ME Schedule 2P?

A: Form 941P-ME Schedule 2P is a document used in Maine for pass-through entity withholding listing.

Q: What is a pass-through entity?

A: A pass-through entity is a business entity that passes its income and deductions through to its owners, who then report the income and deductions on their individual tax returns.

Q: What is pass-through entity withholding?

A: Pass-through entity withholding is the process of withholding and remitting taxes on behalf of nonresident owners of a pass-through entity.

Q: Who needs to file Form 941P-ME Schedule 2P?

A: Maine pass-through entities that have nonresident owners need to file Form 941P-ME Schedule 2P.

Q: What information is required on Form 941P-ME Schedule 2P?

A: Form 941P-ME Schedule 2P requires information about the pass-through entity and its nonresident owners, including their names, addresses, and amounts withheld.

Q: When is the deadline to file Form 941P-ME Schedule 2P?

A: The deadline to file Form 941P-ME Schedule 2P is the same as the pass-through entity's income tax return due date, which is generally April 15th of the following year.

Q: Are there any penalties for late filing of Form 941P-ME Schedule 2P?

A: Yes, there may be penalties for late filing of Form 941P-ME Schedule 2P, including interest charges on any unpaid taxes.

Form Details:

- Released on December 1, 2022;

- The latest edition provided by the Maine Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 941P-ME Schedule 2P by clicking the link below or browse more documents and templates provided by the Maine Revenue Services.