This version of the form is not currently in use and is provided for reference only. Download this version of

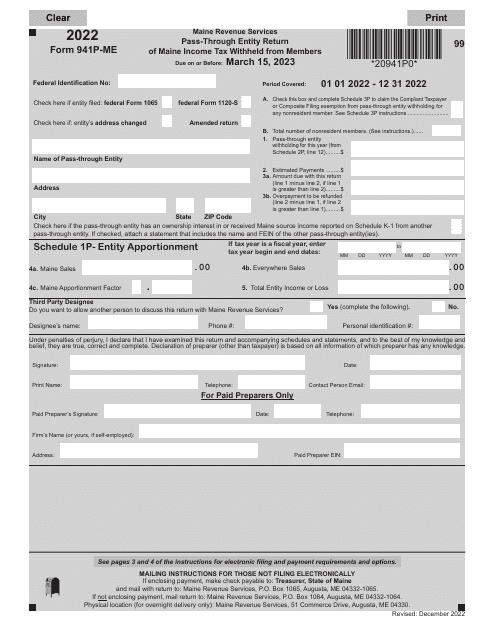

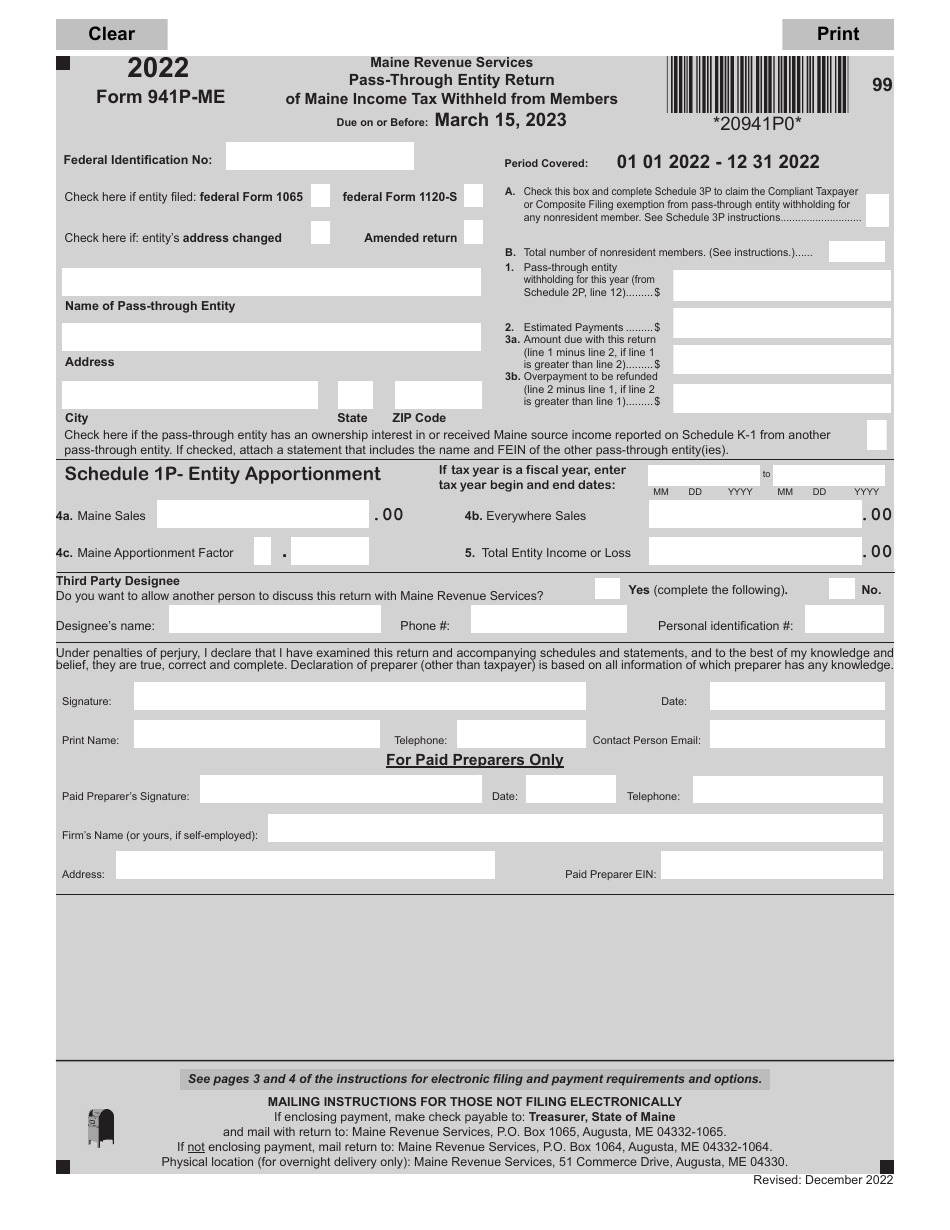

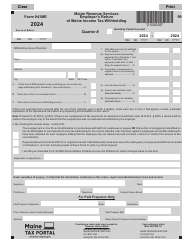

Form 941P-ME

for the current year.

Form 941P-ME Pass-Through Entity Return of Maine Income Tax Withheld From Members - Maine

What Is Form 941P-ME?

This is a legal form that was released by the Maine Revenue Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 941P-ME?

A: Form 941P-ME is the Pass-Through Entity Return of Maine Income Tax Withheld From Members in Maine.

Q: Who should file Form 941P-ME?

A: Pass-through entities in Maine should file Form 941P-ME.

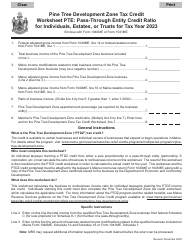

Q: What is a pass-through entity?

A: A pass-through entity is a business entity that does not pay income tax itself, but passes income and deductions to its owners or members.

Q: What is the purpose of Form 941P-ME?

A: Form 941P-ME is used to report and remit income tax withheld from members of a pass-through entity in Maine.

Q: When is Form 941P-ME due?

A: Form 941P-ME is due on or before the 15th day of the 4th month following the close of the tax year, which is generally April 15th.

Q: Are there any penalties for late filing of Form 941P-ME?

A: Yes, there may be penalties for late filing or failing to file Form 941P-ME, so it is important to file it on time.

Q: Is Form 941P-ME only for individuals?

A: No, Form 941P-ME is for pass-through entities, which can include partnerships, S corporations, and limited liability companies.

Q: What information is required on Form 941P-ME?

A: Form 941P-ME requires information such as the pass-through entity's federal identification number, names and addresses of members, and income tax withheld from members.

Form Details:

- Released on December 1, 2022;

- The latest edition provided by the Maine Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 941P-ME by clicking the link below or browse more documents and templates provided by the Maine Revenue Services.