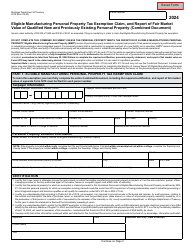

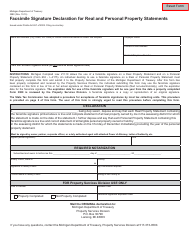

This version of the form is not currently in use and is provided for reference only. Download this version of

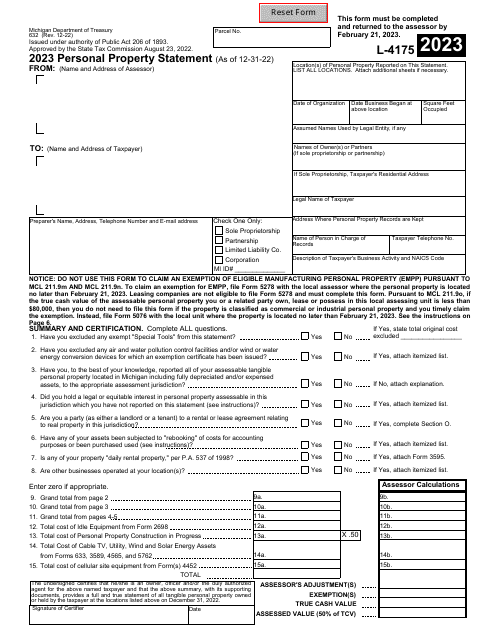

Form L-4175 (632)

for the current year.

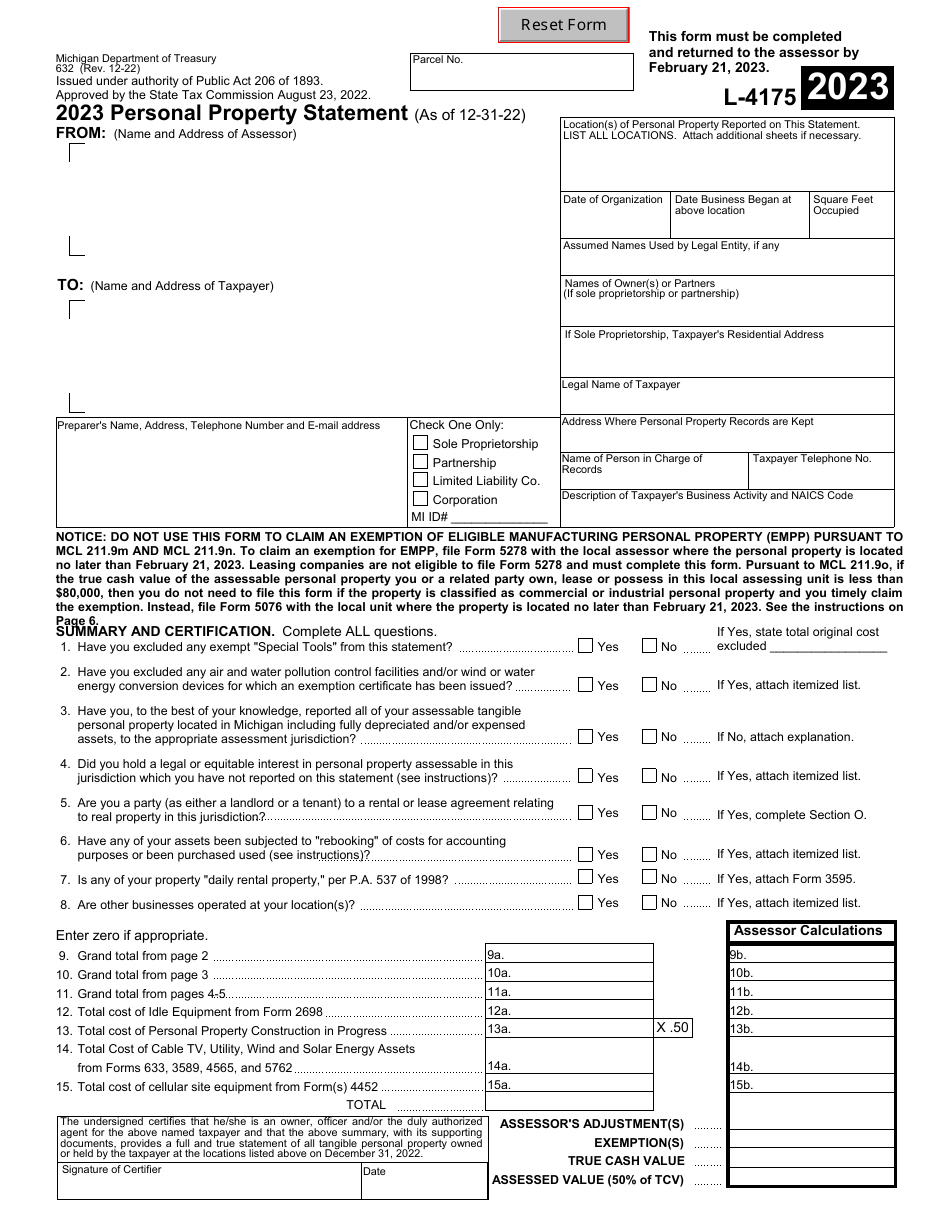

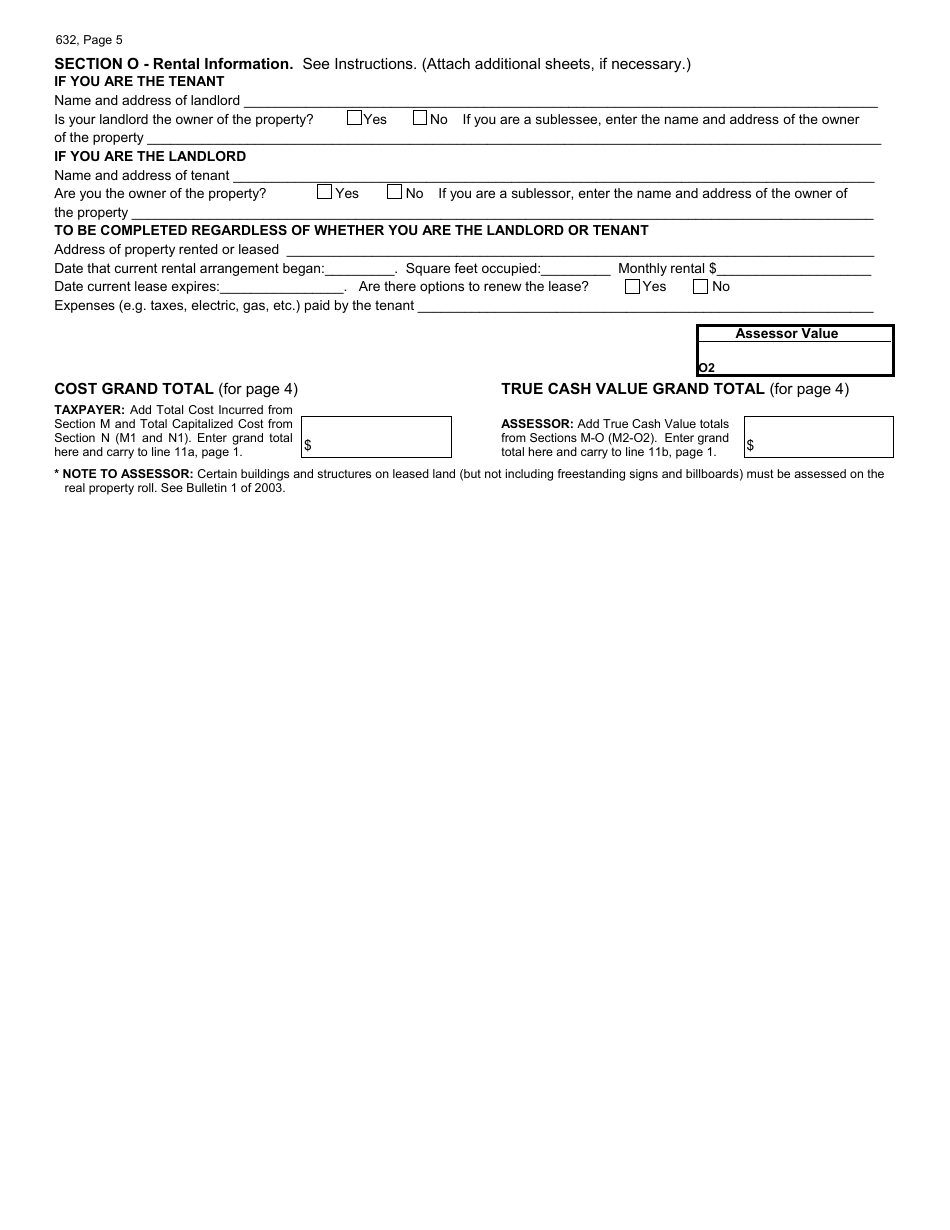

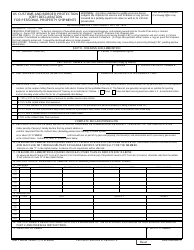

Form L-4175 (632) Personal Property Statement - Michigan

What Is Form L-4175 (632)?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

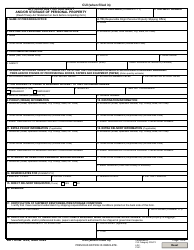

Q: What is Form L-4175?

A: Form L-4175 is the Personal Property Statement used in Michigan.

Q: Who needs to fill out Form L-4175?

A: Businesses in Michigan that own personal property exceeding $80,000 in true cash value need to fill out this form.

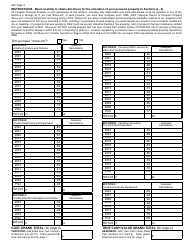

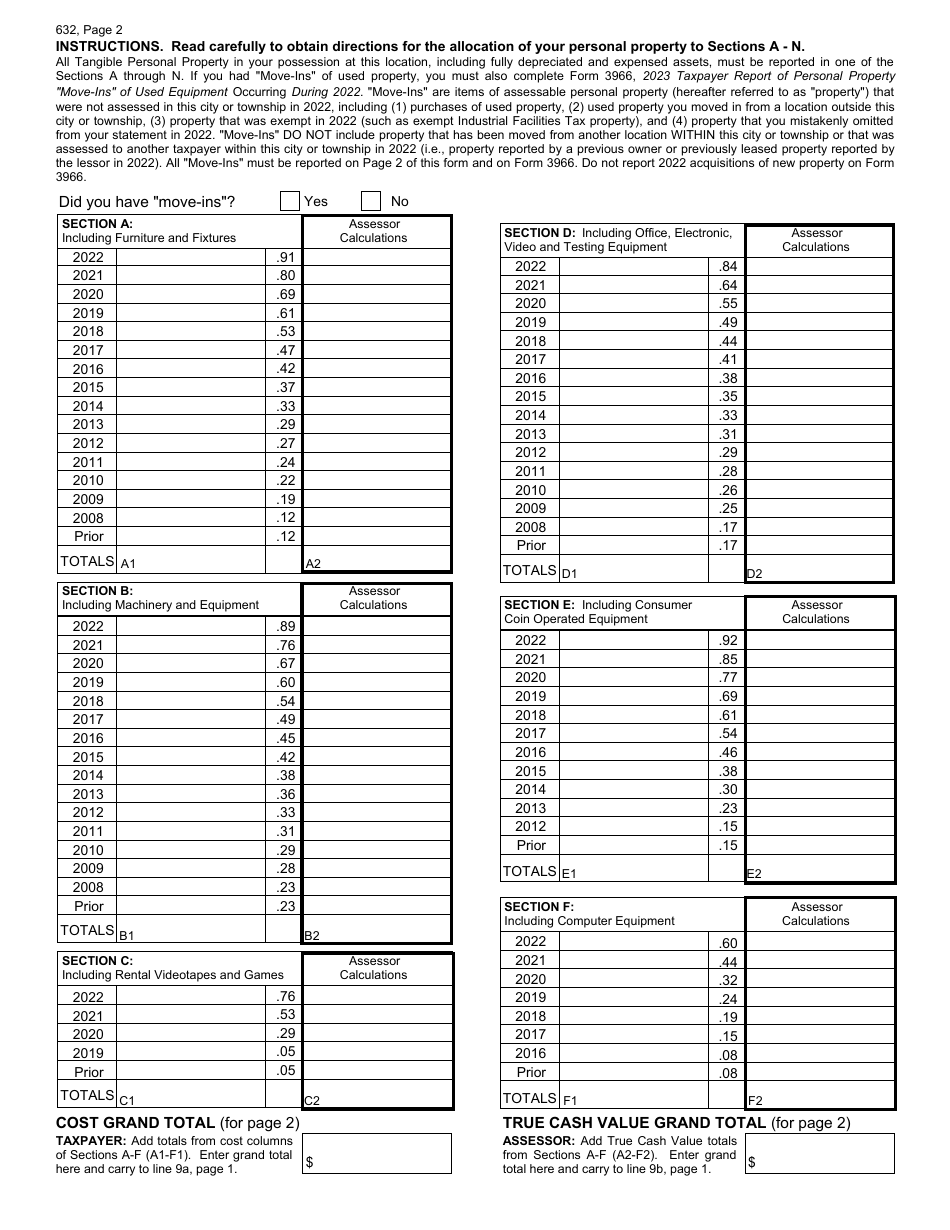

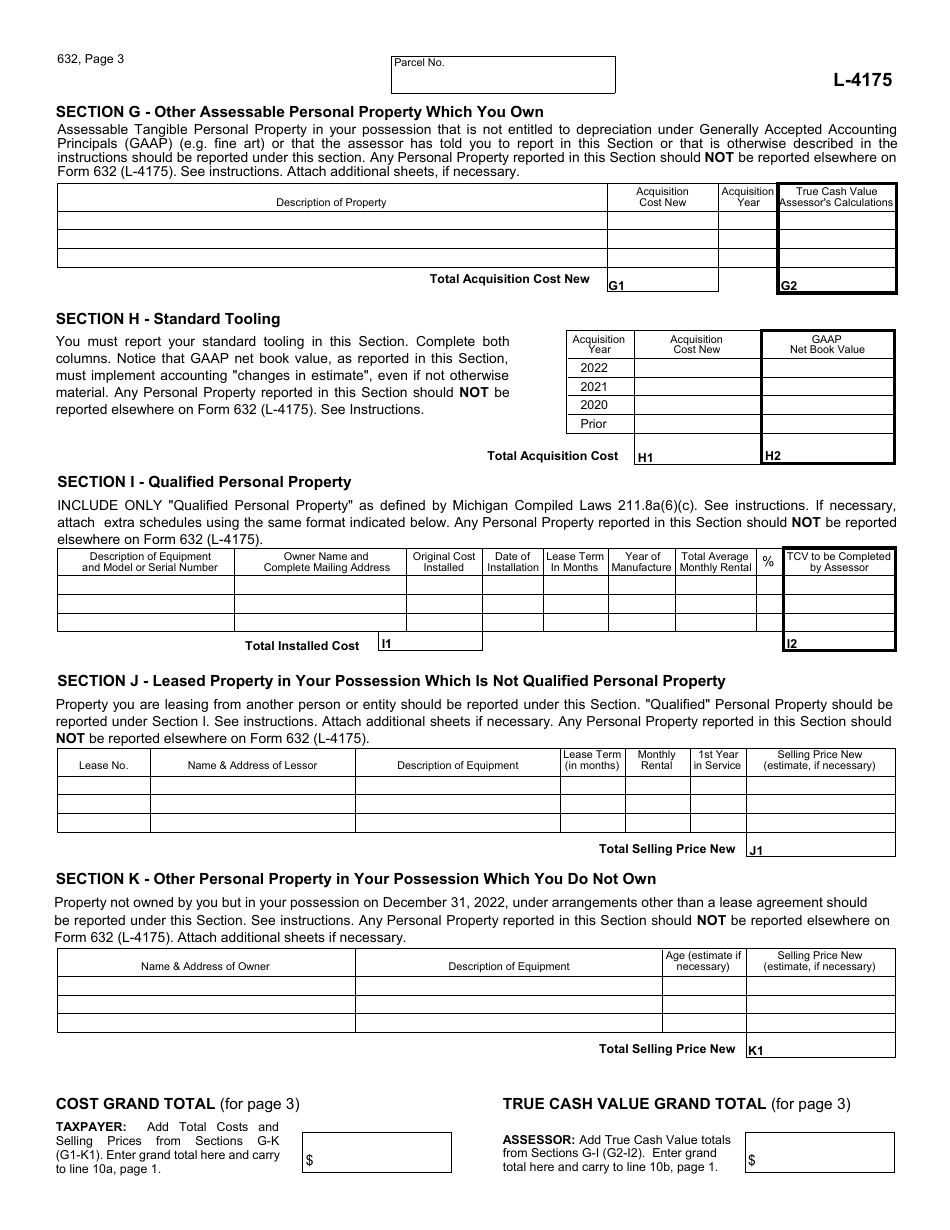

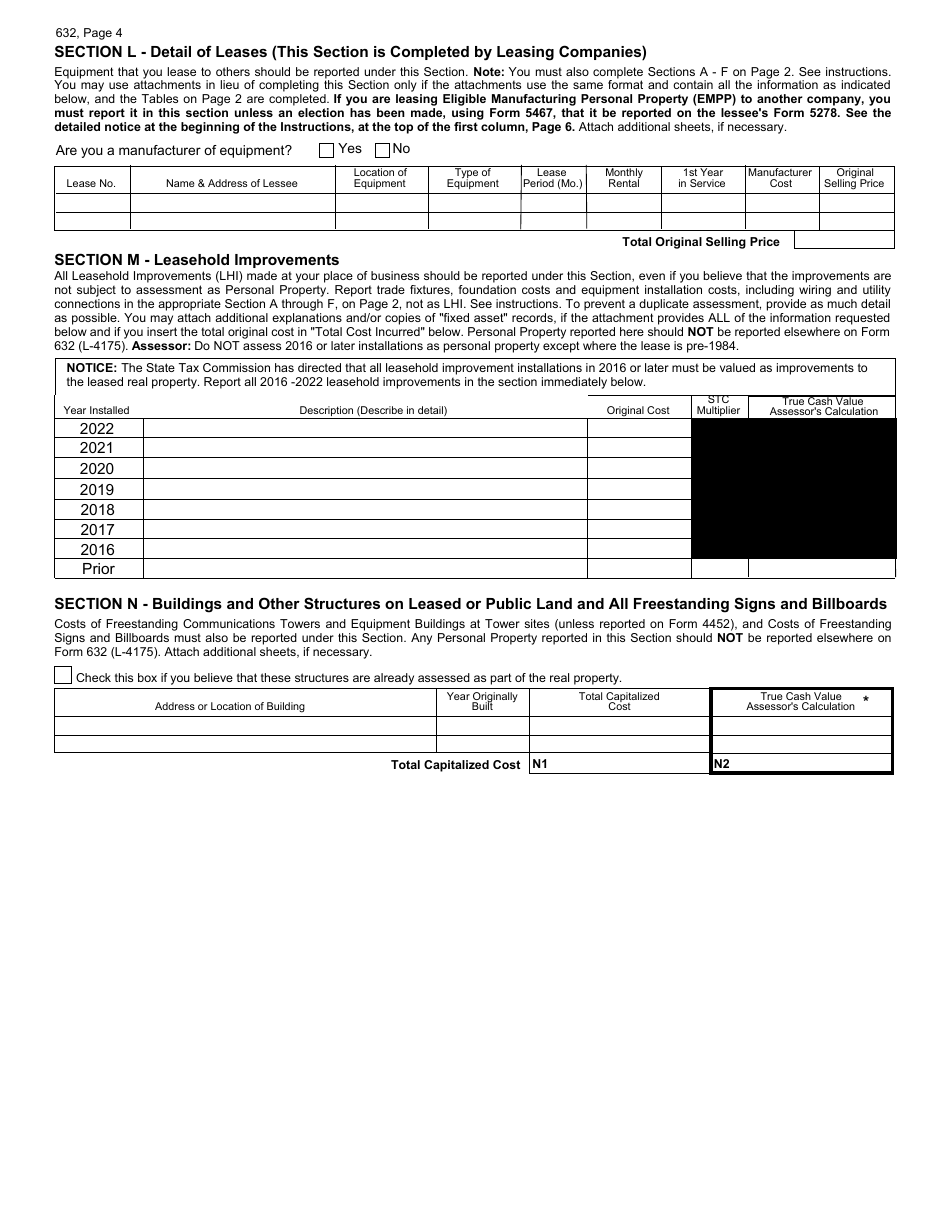

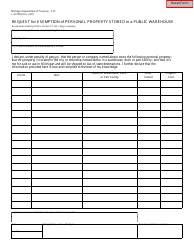

Q: What is personal property?

A: Personal property includes items such as furniture, equipment, machinery, fixtures, and leasehold improvements.

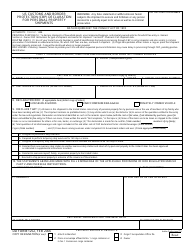

Q: What is true cash value?

A: True cash value is the usual selling price at the place where the property to which the term is applied is at the time of assessment.

Q: When is Form L-4175 due?

A: Form L-4175 is due by February 20th each year.

Q: Are there any penalties for late filing?

A: Yes, there are late filing penalties, which can be up to 25% of the taxes attributable to the personal property reported.

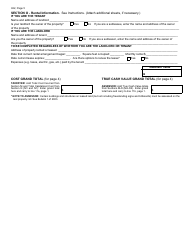

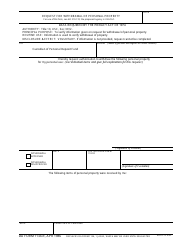

Q: What if there are changes to the personal property during the year?

A: Any changes to the personal property during the year should be reported promptly to the assessing officer using Form L-4175-V, the Personal Property Statement Change Report.

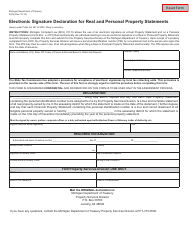

Q: Can Form L-4175 be filed electronically?

A: Yes, Form L-4175 can be filed electronically through the Michigan Department of Treasury's e-Registration system.

Form Details:

- Released on December 1, 2022;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form L-4175 (632) by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.