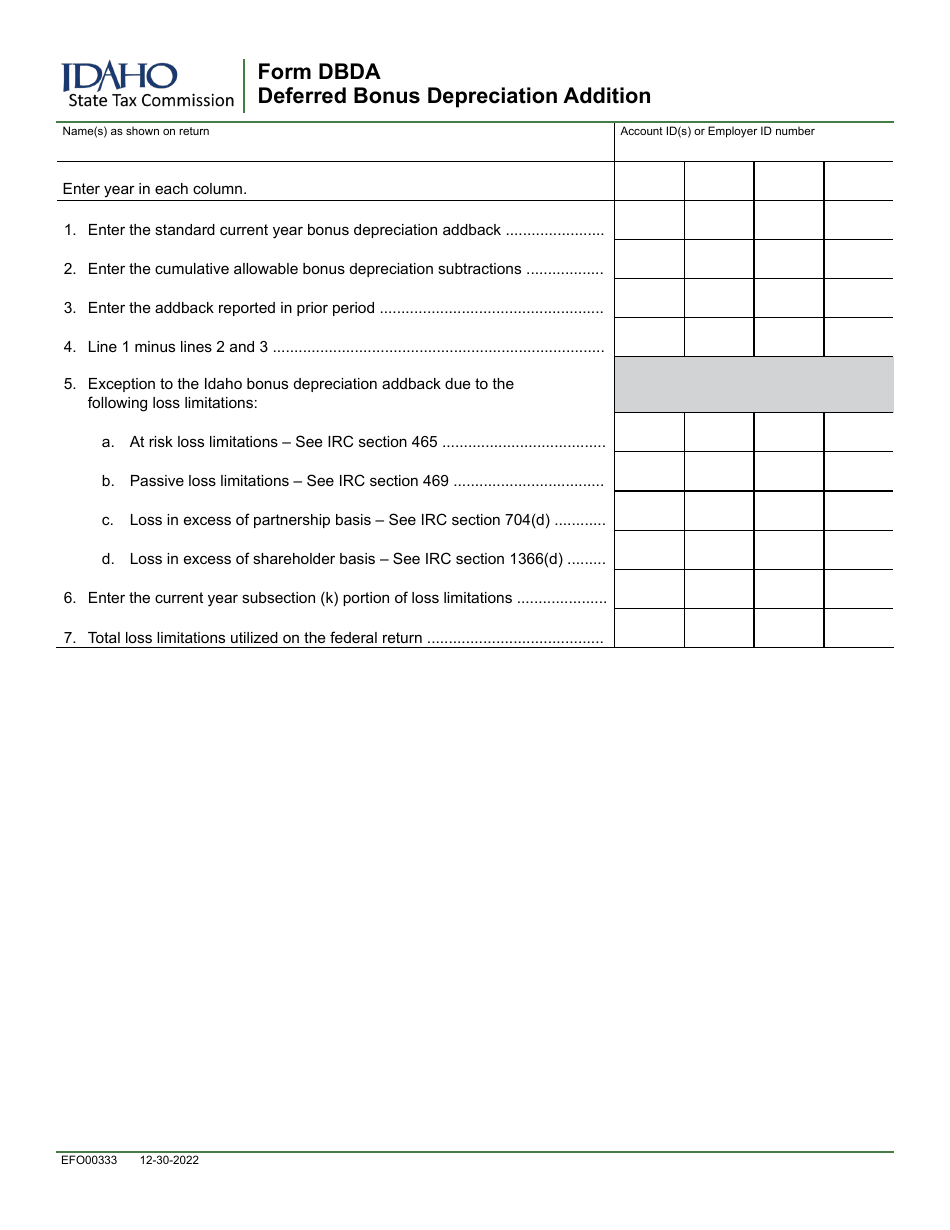

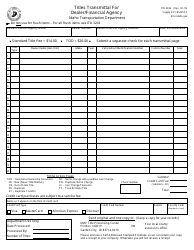

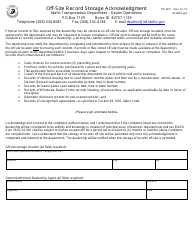

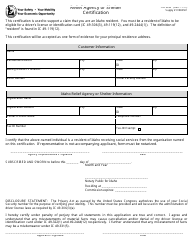

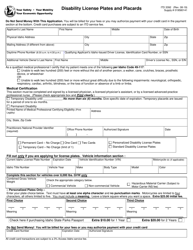

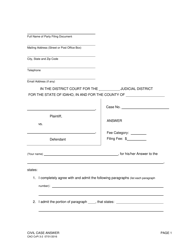

Form DBDA (EFO00333) Deferred Bonus Depreciation Addition - Idaho

What Is Form DBDA (EFO00333)?

This is a legal form that was released by the Idaho State Tax Commission - a government authority operating within Idaho. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is DBDA?

A: DBDA stands for Deferred Bonus Depreciation Addition.

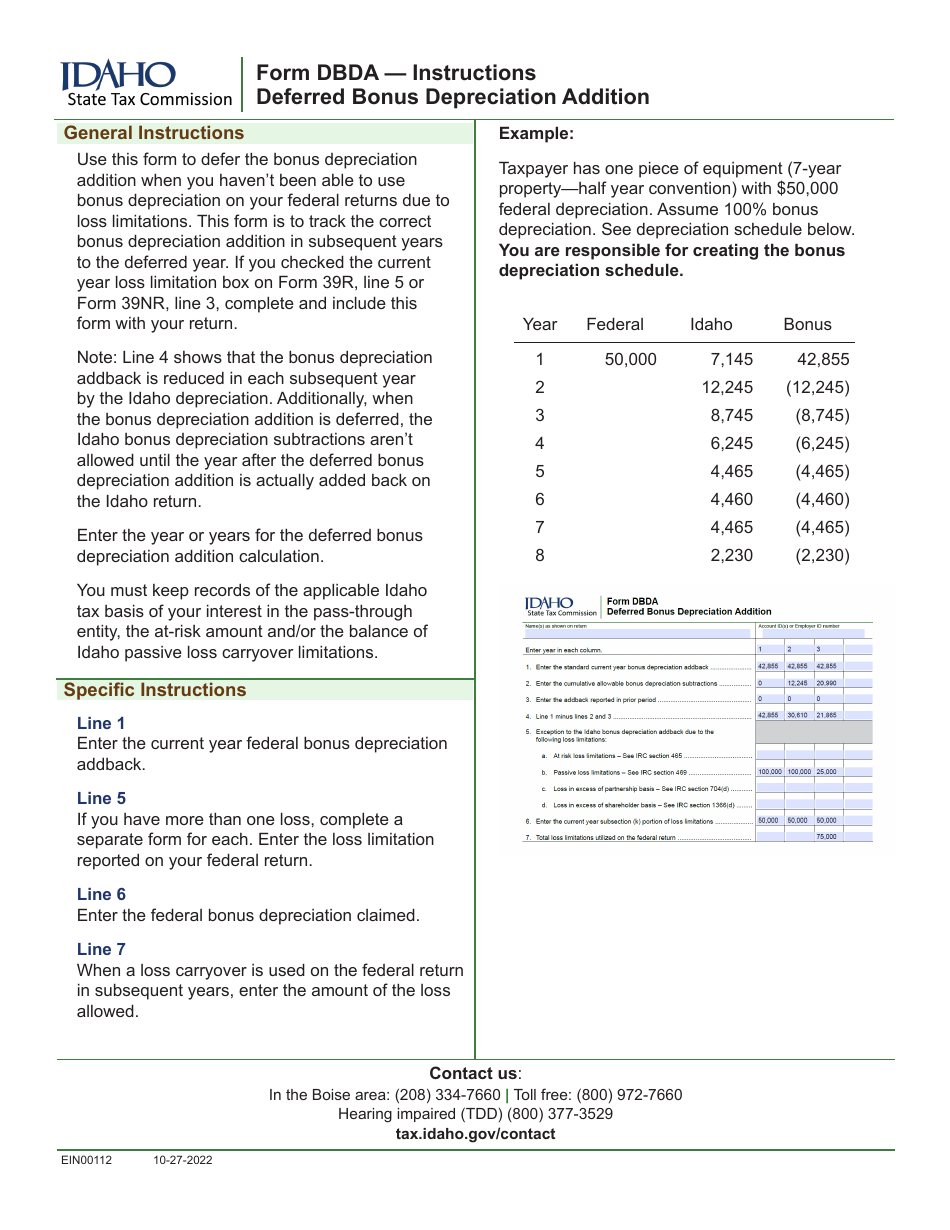

Q: What is the purpose of DBDA?

A: The purpose of DBDA is to allow businesses to claim additional depreciation deductions.

Q: What does EFO00333 refer to?

A: EFO00333 is the identifier for the form related to DBDA.

Q: What is Bonus Depreciation?

A: Bonus Depreciation is a tax incentive that allows businesses to deduct a larger portion of the cost of eligible assets in the year they are placed in service.

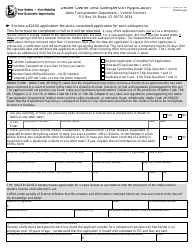

Q: How does DBDA work in Idaho?

A: In Idaho, DBDA is used to update the state-specific taxable income to reflect the federal bonus depreciation deduction.

Form Details:

- Released on December 30, 2022;

- The latest edition provided by the Idaho State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DBDA (EFO00333) by clicking the link below or browse more documents and templates provided by the Idaho State Tax Commission.