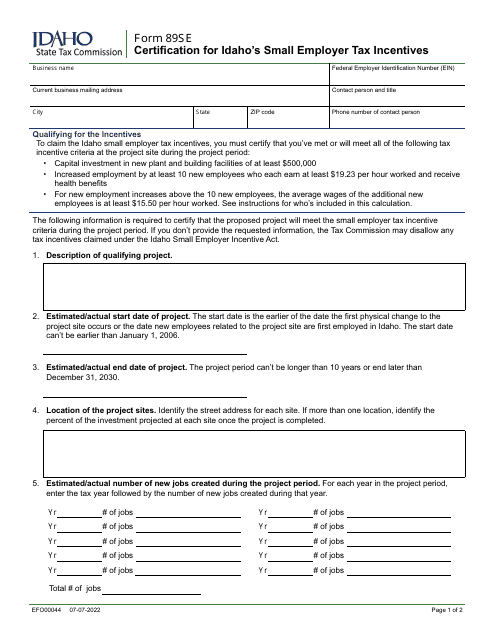

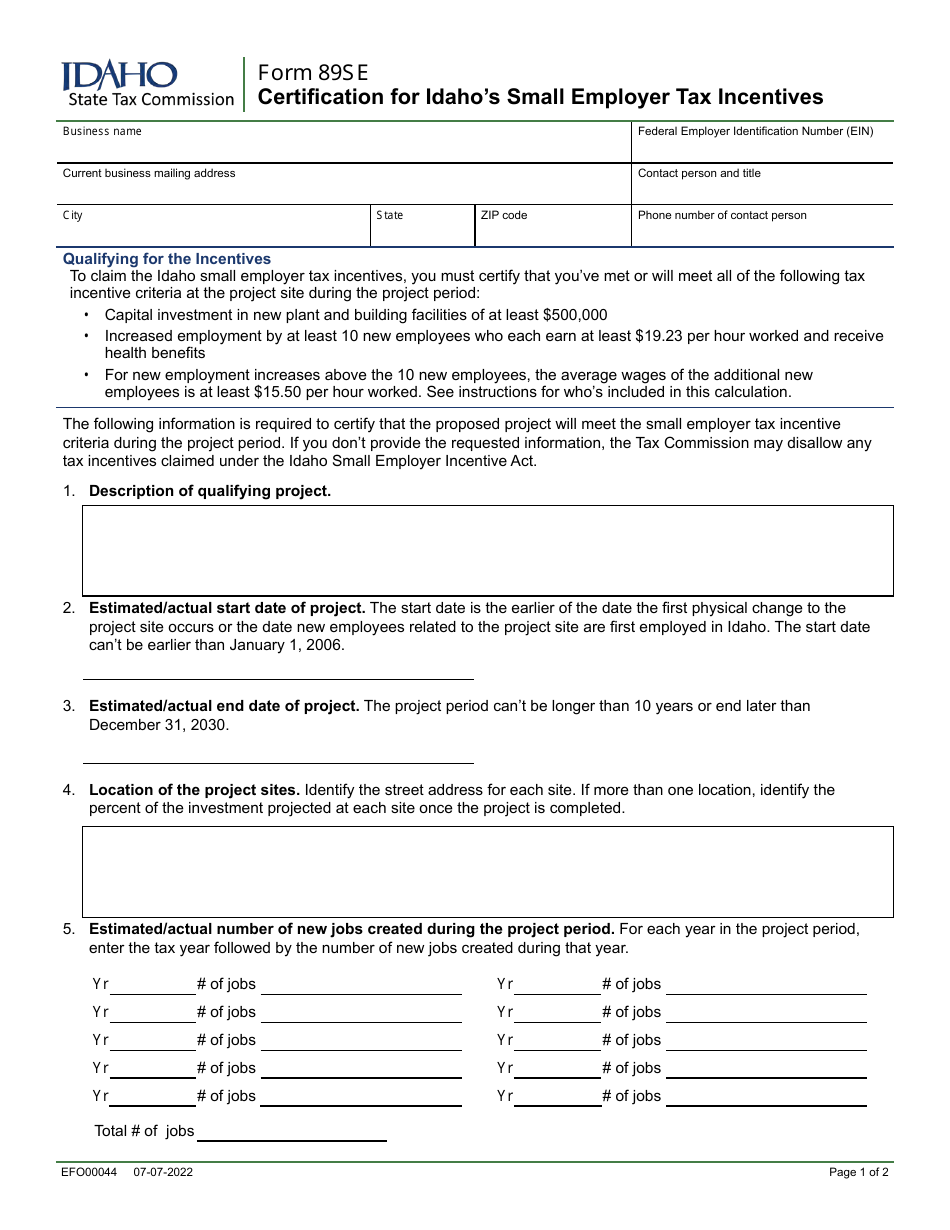

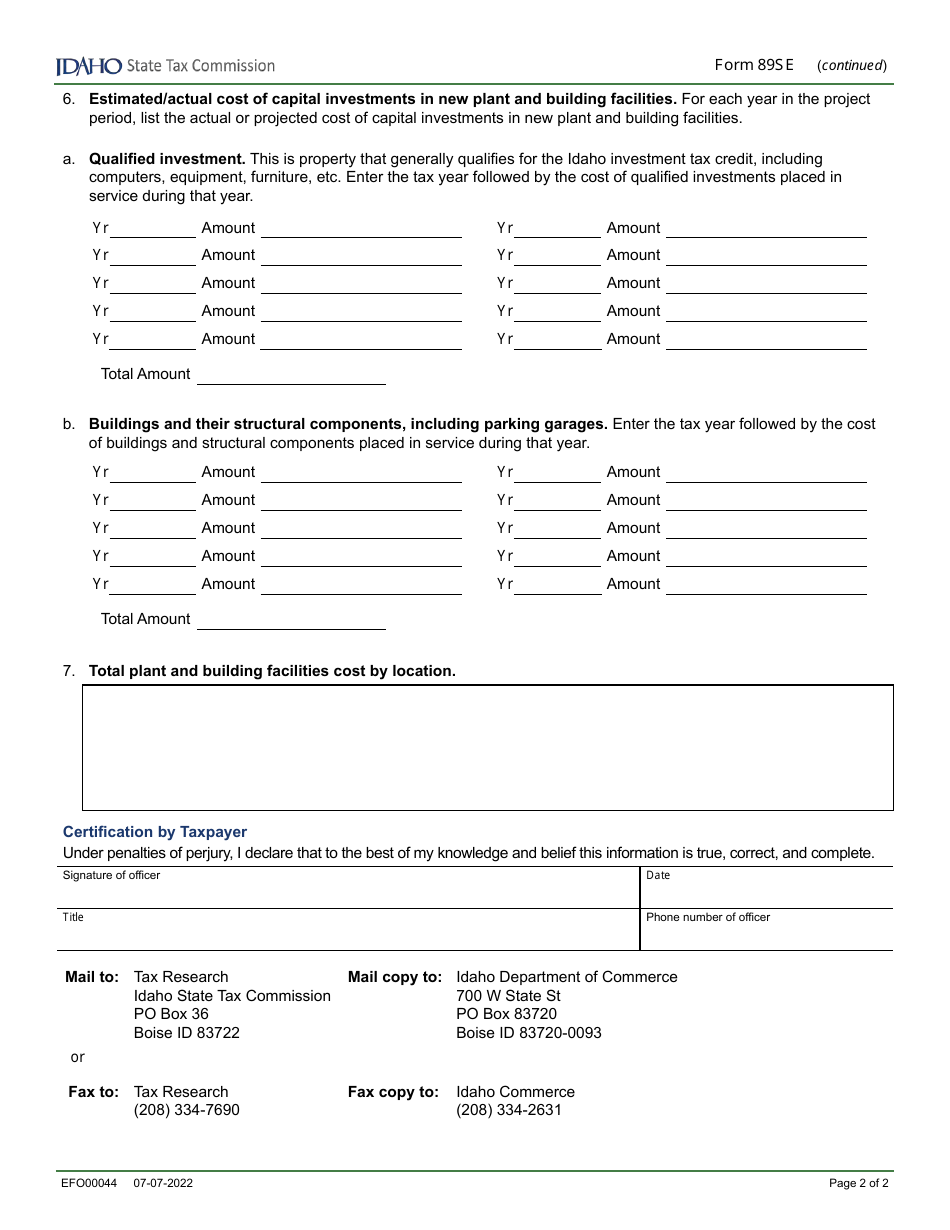

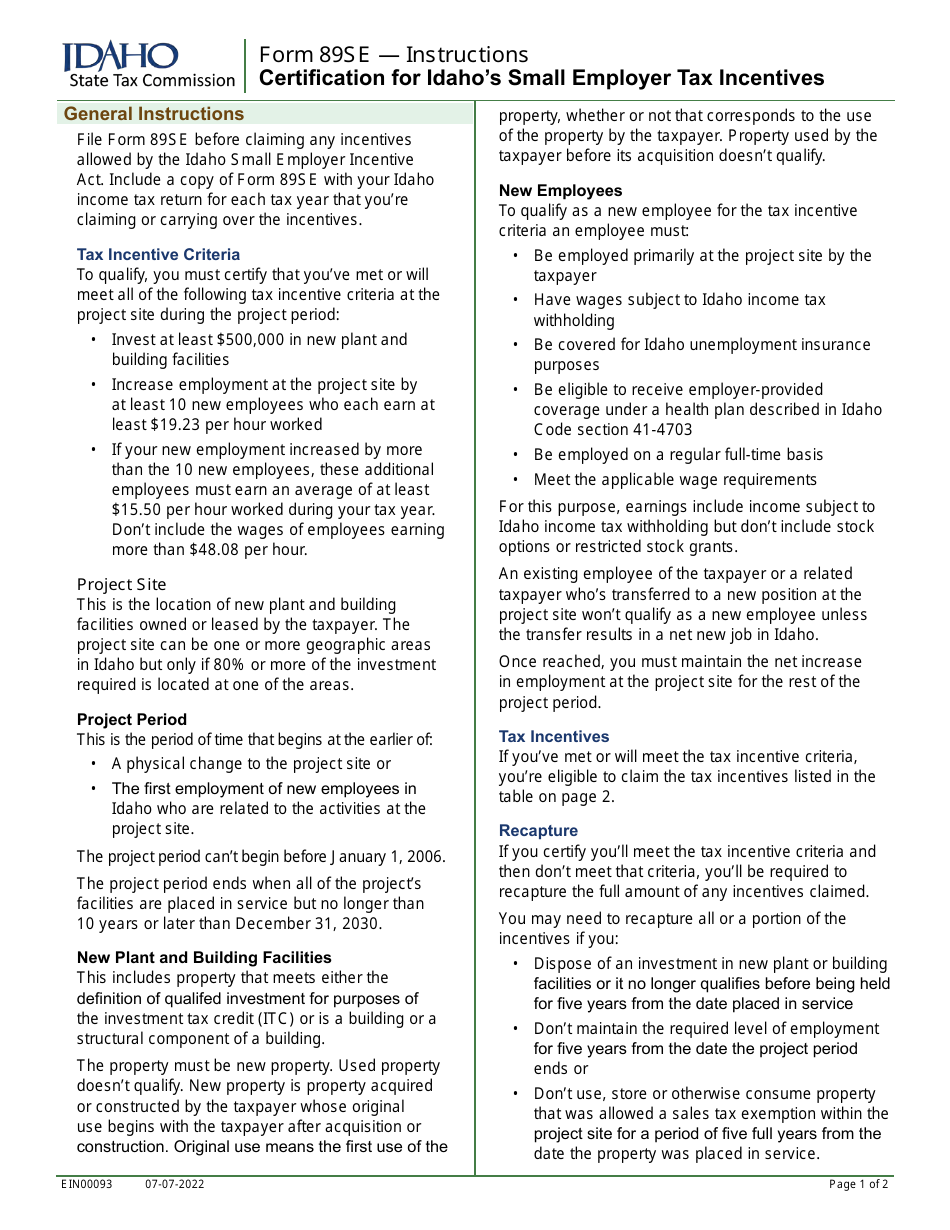

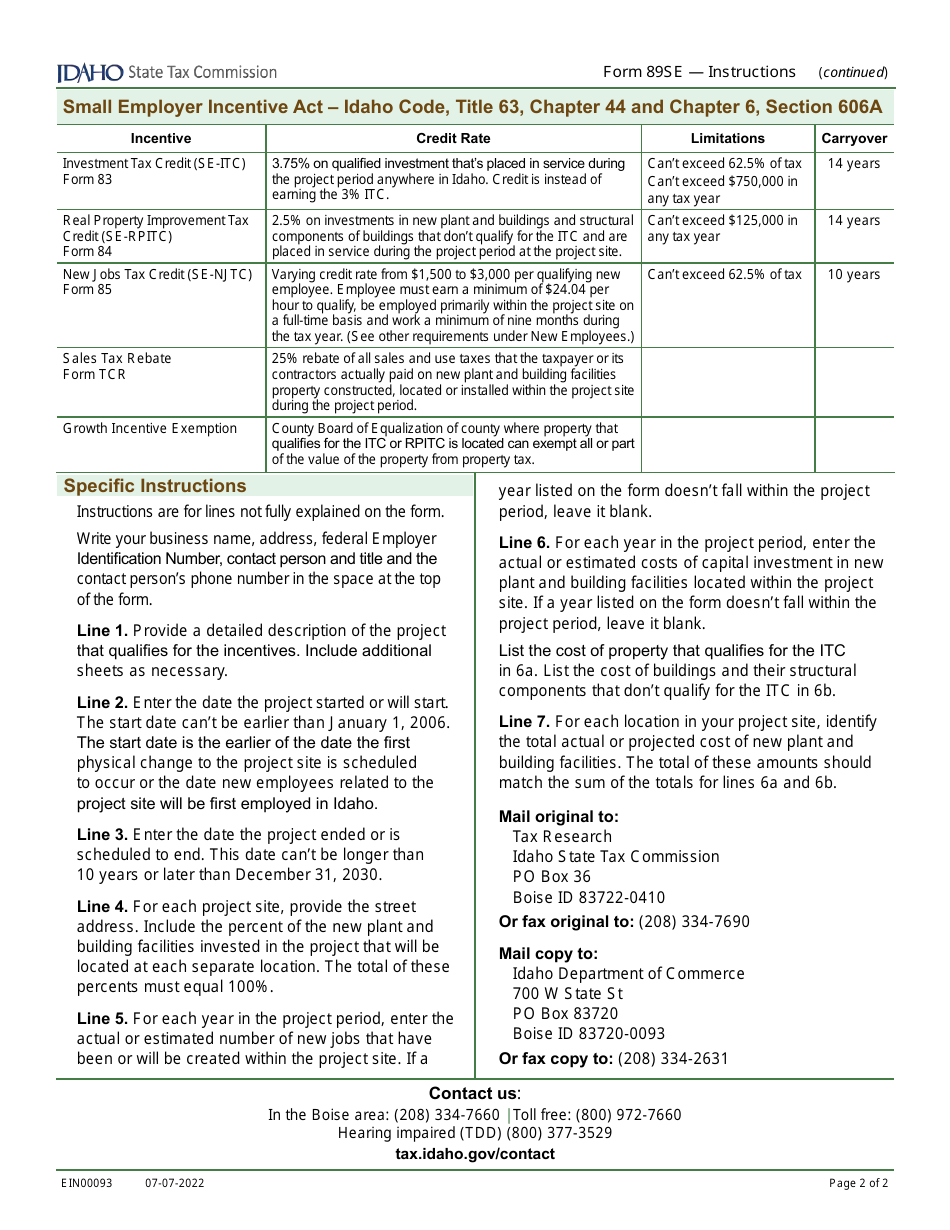

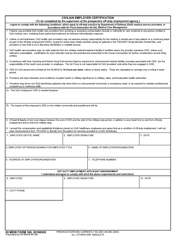

Form 89SE (EFO00044) Certification for Idaho's Small Employer Tax Incentives - Idaho

What Is Form 89SE (EFO00044)?

This is a legal form that was released by the Idaho State Tax Commission - a government authority operating within Idaho. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 89SE?

A: Form 89SE is the Certification for Idaho's Small EmployerTax Incentives.

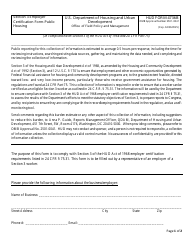

Q: What is the purpose of Form 89SE?

A: The purpose of Form 89SE is to certify a small employer's eligibility for tax incentives in Idaho.

Q: Who is eligible for Idaho's Small Employer Tax Incentives?

A: Small employers in Idaho who meet certain criteria are eligible for these tax incentives.

Q: What are the benefits of Idaho's Small Employer Tax Incentives?

A: The tax incentives include credits and deductions that can reduce the tax liability of eligible small employers.

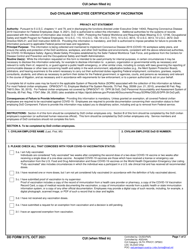

Q: What information is required on Form 89SE?

A: Form 89SE requires information about the small employer's business and the number of employees.

Q: When is the deadline to submit Form 89SE?

A: Form 89SE must be submitted annually by the due date of the employer's Idaho income tax return.

Q: Are there any fees associated with submitting Form 89SE?

A: No, there are no fees associated with submitting Form 89SE.

Q: What happens after submitting Form 89SE?

A: The Idaho State Tax Commission will review the form and determine the small employer's eligibility for tax incentives.

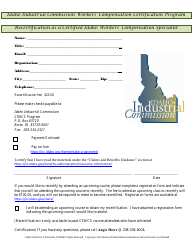

Form Details:

- Released on July 7, 2022;

- The latest edition provided by the Idaho State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 89SE (EFO00044) by clicking the link below or browse more documents and templates provided by the Idaho State Tax Commission.