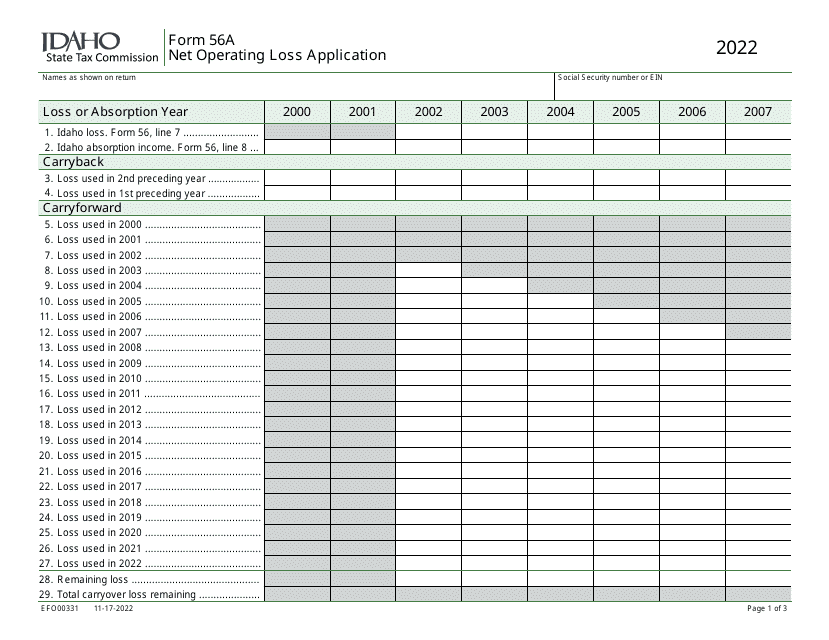

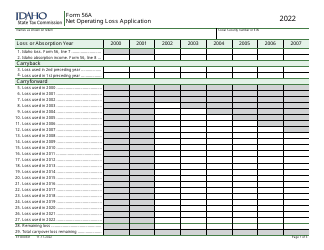

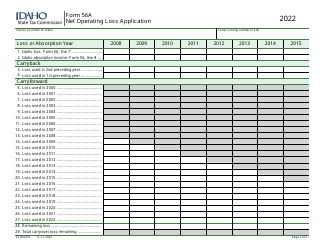

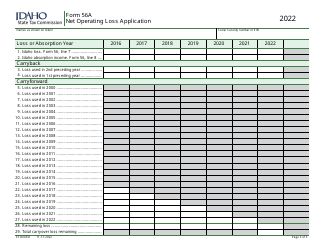

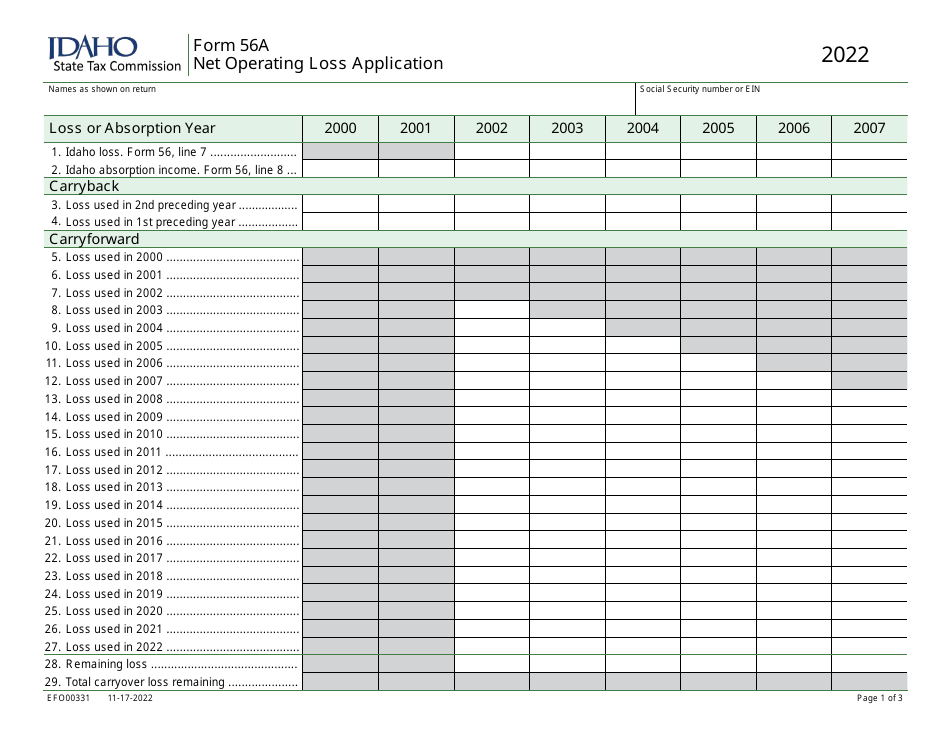

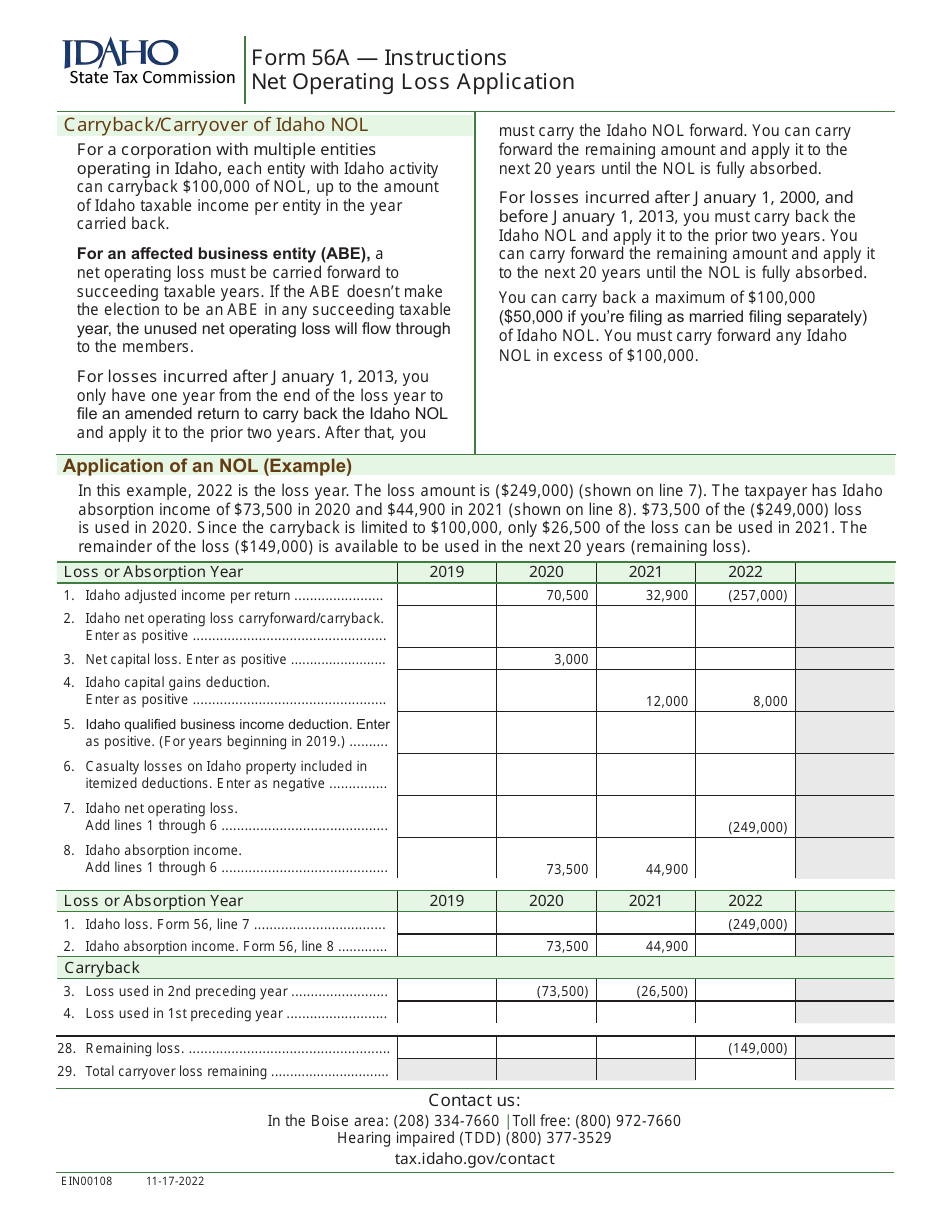

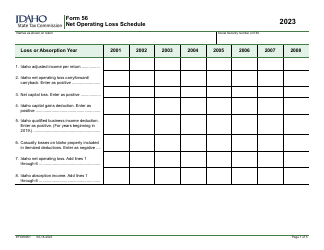

Form 56A (EFO00331) Net Operating Loss Application - Idaho

What Is Form 56A (EFO00331)?

This is a legal form that was released by the Idaho State Tax Commission - a government authority operating within Idaho. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 56A?

A: Form 56A is the Net Operating Loss Application form for Idaho.

Q: What is the purpose of Form 56A?

A: The purpose of Form 56A is to apply for a net operating loss deduction in Idaho.

Q: What is a net operating loss?

A: A net operating loss occurs when the deductions exceed the income of a business for a particular year.

Q: Who can use Form 56A?

A: Form 56A is used by businesses and individuals who have a net operating loss and want to apply it to future tax years.

Q: Are there any filing fees for Form 56A?

A: No, there are no filing fees for Form 56A.

Q: When should Form 56A be filed?

A: Form 56A should be filed within 18 months from the end of the tax year in which the net operating loss occurred.

Q: Can Form 56A be filed electronically?

A: Yes, Form 56A can be filed electronically if you are using the Idaho Taxpayer Access Point (TAP) system.

Form Details:

- Released on November 17, 2022;

- The latest edition provided by the Idaho State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 56A (EFO00331) by clicking the link below or browse more documents and templates provided by the Idaho State Tax Commission.